Ecoinometrics - Volatility squeeze

July 14, 2021

These days Bitcoin price is going nowhere. Some call it boring. Technically minded people call it a volatility squeeze.

So what can you expect when a volatility squeeze happens?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Volatility squeeze

First thing first, is it really the case that the volatility is low?

I mean, it does feel like nothing is happening, but historically speaking is it more quiet than usual?

The one month realized volatility is trending down. That much is true. The eventful month of May has faded away and BTC is now stabilizing around $30k.

But if the trend is down, the actual level itself isn’t particularly low. A 78% score puts us just above the average volatility.

As a matter of fact Bitcoin seems to become less and less volatile after each halving. To be fair we are only 1 year into this 4 years cycle, but so far volatility has remained concentrated. There has been no right tail of volatility flare.

Hmmm.... alright, so no volatility squeeze then?

Hold up! The volatility squeeze that people are talking about is there. Just on a shorter time frame than the ones I usually consider.

Let’s look at a chart of the price action.

Okay, so the proper time frame for this squeeze is two weeks. And actually I should change my metric of volatility a little bit.

Often when people are talking about a squeeze, it refers to the price range in which BTC is trading.

So a better way of expressing volatility is to look at the two-week range:

Look back over the last two weeks.

Identify the highest and the lowest price over that period.

The two-week range is the percent change from that lowest point to that highest point.

At the time of this writing over the last two weeks the highest print was around $36,700 and the lowest around $32,700. That means today’s value of the two-week range is about 12%.

And if you are looking at it this way then yes we are kinda squeezing the volatility from an historical perspective. The two-week range is not super low, but it is on the low side.

Nice, nice… but how useful is it to know that?

Well the usual thinking is that when volatility is squeezed something is about to break and we could see fast moving price action in the near future.

Is it actually true?

To answer the question we can do the following:

Take the two-week range on any given day.

Calculate the trading range in the two weeks that follow that day. Let’s call that the forward max range.

Plot the historical two-week range vs the forward max range and see what kind of distribution we get.

For any historical value of the two-week range then we’ll be able to see if the following two weeks have seen the trading range increase and, if it did, by how much.

Alright, so this is exactly what we have plotted below.

On the horizontal axis is the two-week range. On the vertical axis is the forward max range. Points that are above the red line represent occasions where the trading range did increase in the next two weeks. Points below the red line are cases of the range shrinking in the next two weeks.

Take a look.

First observation is that indeed when the volatility is as squeezed as it is now, the most likely place to go in the next two weeks is higher. On the low end of the two-week range the density of points seems higher above the red line than below it.

So when volatility is around 12% it usually moves higher. That’s not particularly surprising. The real question is by how much? How much wider does the range get from there?

At first sight I’d say that it can easily go from 12% to 30% or even 50%. That’s a 2.5x to 4x increase within two weeks. Not too bad.

It is a bit hard to read with all those points though.

Let’s simplify things. We break down the two-week range in 2% increments and for each of those bins we can compute the highest, lowest, mean and median forward max range.

This summary statistics removes a lot of points and gives a better picture of what’s actually going on.

See for yourself.

For each value of the two-week range think of the red dots as outliers. The current two-week range is at 12% and in the past it did happen that the trading range widened to 80% in the following two weeks.

Good to know, but that’s not what’s happening in most situations.

As you can see with the average (yellow) and the median points (light blue), based on the historical data, it is more likely than not we’ll see the trading range double in the next two weeks.

It basically says that on average in the next two weeks the trading range could widen to take us roughly from $32k to as low as $26k (if we fall straight down), as high as $40k (if we move straight up), or any 24% wide interval in between those two extremes.

This average case is nothing dramatic even though it is true that we can expect volatility to make a comeback soon.

My personal philosophy is that quiet/boring periods are great for building positions:

It is easy psychologically, there is no feeling that you need to time the market.

The longer it lasts the more you accumulate.

If it goes lower you just average at a lower value.

You are ready whenever the big macro trend restarts.

So regardless if we are going to get more volatility soon or not, now is a great time to dollar cost average.

CME Bitcoin Derivatives

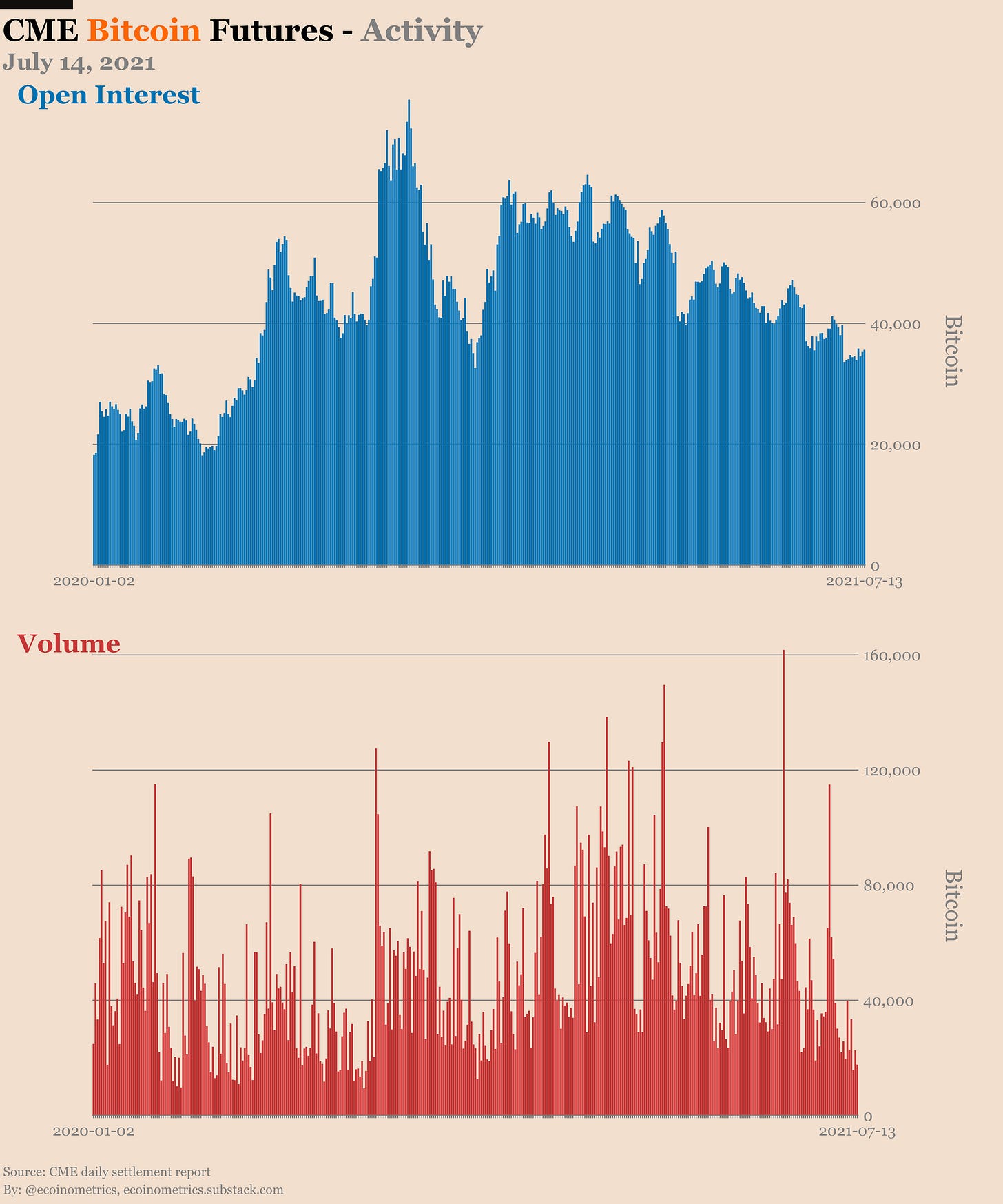

Talking about volatility squeeze, it looks like this did squeeze the life out of the CME Bitcoin derivatives market.

The open interest isn’t doing much and the daily traded volume is falling to levels last seen more than a year ago.

Result: there is very little to say about the trading activity over here.

Whether it is retail traders or the smart money, they have made very little change to their positions.

It is like there has been a reset here too.

Meanwhile the options market is practically dead. The few transactions that did happen over last week mainly involved traders buying puts. Nothing to see here.

Maybe a return of volatility will bring back some life to this market. Let’s see.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

P.S. For daily updates follow Ecoinometrics on Twitter.

Then, we are now in the Dollar cost average time….. do you think the unlock from 550 M USD from Grayscale on Sunday the 18th of July will drop the BTC value?