Ecoinometrics - Waiting for an ETF

September 22, 2021

This fall the SEC will, once more, examine the prospect of approving a Bitcoin ETF in the US. Investors hope that an approval will give a big boost to BTC.

But this is not guaranteed.

So let’s think about that a little.

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Waiting for an ETF

Before we think about the future, it is informative to look at something in the past.

Seventeen years ago the first gold ETF backed by physical gold was launched in the US. This is the GLD ETF which now has about $57 billion in assets under management. That makes it the 20th largest ETF in the world.

Before GLD you had no “easy” way of investing in gold. Buying and storing physical gold was and still is a cumbersome process. Trading futures expose you to roll over costs. And while gold miners give you some exposure they do not track directly the value of gold.

So when GLD was introduced it was a real game changer. You could track physical gold with the ease of buying a stock.

The success was immediate and GLD came to control over 1,000 tonnes of gold to back its value. And since that is some actual physical supply of gold locked in the ETF people have speculated that some part of the move that saw gold go from $300 per ounce to $1,600 between 2004 and 2010 was driven by the physical gold ETFs ramping up.

However when the price of gold started stalling in 2012 the growth of GLD stopped and it has been pretty much keeping the same size for the past 10 years.

So whatever initial impact it had on gold’s value, it was limited in time.

And for gold that kind of makes sense.

The logic for GLD pushing up gold’s price is the following:

Buying shares of an ETF is easy.

So GLD provides an easy way of “buying” gold.

But GLD is backed by physical gold, which means this new demand puts pressure on the gold supply.

When the supply gets soaked up by the ETF it drives gold’s value higher.

But the thing is, gold is not Bitcoin. When the demand increases and the price is at a sufficiently high level, miners can produce more and more and more… up to the point where some equilibrium between supply and demand is met.

You can track the evolution of the physical gold captured by GLD vs the cumulative gold production by miners since the launch of the ETF.

The chart speaks by itself.

That’s more than 2,000 tonnes of gold produced every year by miners.

Actually, according to the Gold Council, there is about 200k tonnes of gold above ground as of last year:

46% of it is held in the form of jewellery

22% is kept in the form of gold bars and coins for investments

17% is held by central banks

So the 1,000 tonnes held by GLD aren’t having a big impact.

That’s the big difference when compared with Bitcoin. For BTC, the mining schedule is fixed by the protocol and the total supply is finite.

So any kind of additional demand pressure is bound to have outsized effects on the price.

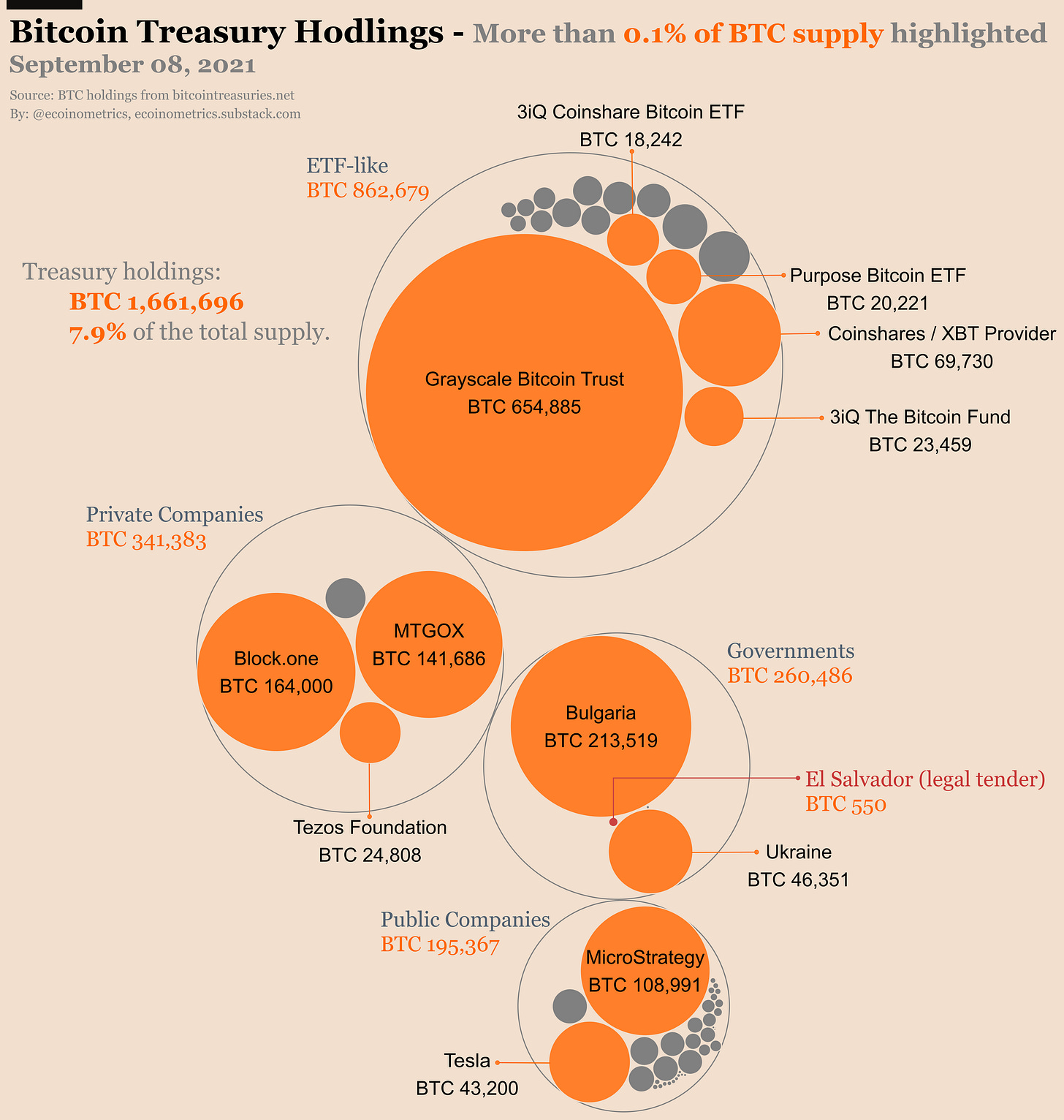

And already without a proper physically backed Bitcoin ETF in the US, the ETF-like investment vehicles capture 4% of the maximum supply. Another Bitcoin ETF could push that fraction to maybe 6% or even 8%.

However when you think about it a minute, it is not 100% guaranteed.

First you’d need the SEC to allow for a Bitcoin ETF that is backed by actual spot BTC.

Because a “safer” alternative for the SEC would be to approve an ETF that holds futures contracts. But that would be paper Bitcoin, very unlikely to have much impact.

Second you’d need to gauge how much actual extra demand is generated by that ETF.

Because as you can see above there are lots of ways of getting exposure to BTC already. Bitcoin is a digital asset which means it has a much lower barrier to entry than securing and storing physical gold.

You can already buy spot BTC on Coinbase or whatever exchange you fancy. You can buy futures and options even on the CME. You can also get your hands on shares of the Grayscale Bitcoin Trust or even hold some MicroStrategy stocks.

So while the necessity for a gold ETF was clear in 2004, the question is a bit more open when it comes to Bitcoin.

The advantage of a Bitcoin backed ETF is clear though. It simplifies a lot of things for institutional investors from a regulatory standpoint and it makes purchasing exposure to Bitcoin totally straightforward as part of an existing portfolio.

Which is why I’m hopeful that the approval of a true Bitcoin ETF can bring new people to the space and put some significant additional demand pressure.

But nothing has been won yet. Let’s see what the SEC will decide.

CME Bitcoin Derivatives

We have only a few days until the September contracts expire on the CME and all this volatility is driving a good amount of trading activity.

The puts to calls ratio is back at 8 puts for every 5 calls and is likely to move to 3 puts for every 2 calls after the September contracts expire.

In plain english that means the options market is still worried about the downside.

As of today:

56% of the contracts are set to expire at the end of the week.

4% of the calls are currently in-the-money.

19% of the puts are currently in-the-money.

That last number would spike dramatically if Bitcoin settles below $40k on Friday. So that’s really a level to watch.

The positions of traders haven't changed since last week so I’ll let you check the graph by yourself.

Despite the big red candles we have seen in September, it is important to note that the market hasn’t been particularly volatile over the past couple of months. So it could be we are ramping up to something for the fall.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick