Ecoinometrics - Wen flippening?

August 25, 2021

Here is the question: under some reasonable assumptions, when can we expect Bitcoin to become more valuable than any publicly traded company?

Let’s do some back of the envelope estimations...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Wen flippening?

In some post that I wrote at the beginning of the year, we introduced this idea of a Bitcoin ABZ:

(A) Where are we now?

(B) What’s the next step?

(Z) What’s the end game?

The point is that once you know what is your current state (A) and what is the direction you’d like to pursue (Z) then you only need to worry about what’s your next move.

That’s a good framework to stay focused on what matters the most at a given point in time.

Sometimes I write about Bitcoin gaining grounds on gold or what it would mean for Bitcoin to grow to the scale of say a fraction of the bonds market. But the truth is that at its current valuation BTC is the size of a large cap stock…

Nothing to sneeze about for sure, yet there is a lot more road ahead.

So while it is nice to think about gold, real estate or the bond market as long term goals, there are definitely some lower hanging fruits that would make a good step B.

Now Bitcoin is the equivalent of something like the 6th largest company by market cap. Depending on the day it sits somewhere below Facebook and above Tesla.

What do you think would be a reasonable goal that would have great significance then?

Imho getting out of this large cap range and becoming more valuable than any public company would be THE next move:

First it is reasonable. After all, the market cap of Apple is only about 3x away from where we are now.

Then from a symbolic perspective, it would become really hard to dismiss Bitcoin if it managed to rise to that level.

Ok, so what would it take to achieve that?

Well in all honesty anything can happen. So maybe it is not worth spending too much time coming up with complicated price models or anything like that.

We might as well do some back of the envelope math, that only takes 5 minutes and it is good enough to give us a sense of scale.

Alright, so here are the hypothesis:

Apple is a moving target. But we’ll assume it moves at a constant rate. Over the last 5 years its market cap has been growing at an annualized rate of 22%. We’ll assume this is going to continue over the next five years.

For Bitcoin we can consider a range of scenarios...

…Bitcoin continues to grow at the same annualized rate over the next 5 years i.e. 118% annualized.

…Bitcoin grows 25% slower over the next 5 years i.e. 89% annualized.

…Bitcoin grows 50% slower over the next 5 years i.e. 59% annualized.

Now full disclosure, I’m not completely sold on the idea of diminishing returns for Bitcoin.

We explored the possibility a few weeks ago and found out that there is no evidence that the large cap/growth/tech stocks have experience diminishing returns as their market cap grew.

So there is no reason to think that Bitcoin will be automatically plagued by this phenomenon.

Still, diminishing returns are a possibility and that’s why I’ve included the two scenarios of slower growth.

Ok so if you run the numbers on the different scenarios (apply the compounded rate to the starting market cap) you’ll get the following projections (note that the vertical axis is using a log2 scale).

With the current growth rate Bitcoin will flip Apple somewhere in 2023. At 75% of the speed the flippening would happen in 2024. And worst case scenario, at half the speed this would happen in 2026!

Right so I think we can survive those diminishing returns without too much trouble…

Now of course this is just some estimation. Historically Bitcoin has been pretty volatile so the flippening might happen sometime earlier if we get a parabolic move or a bit later if we have some bear phase.

But unless something totally unexpected happens, Bitcoin is on track to move on to the next weight category sooner than many expect.

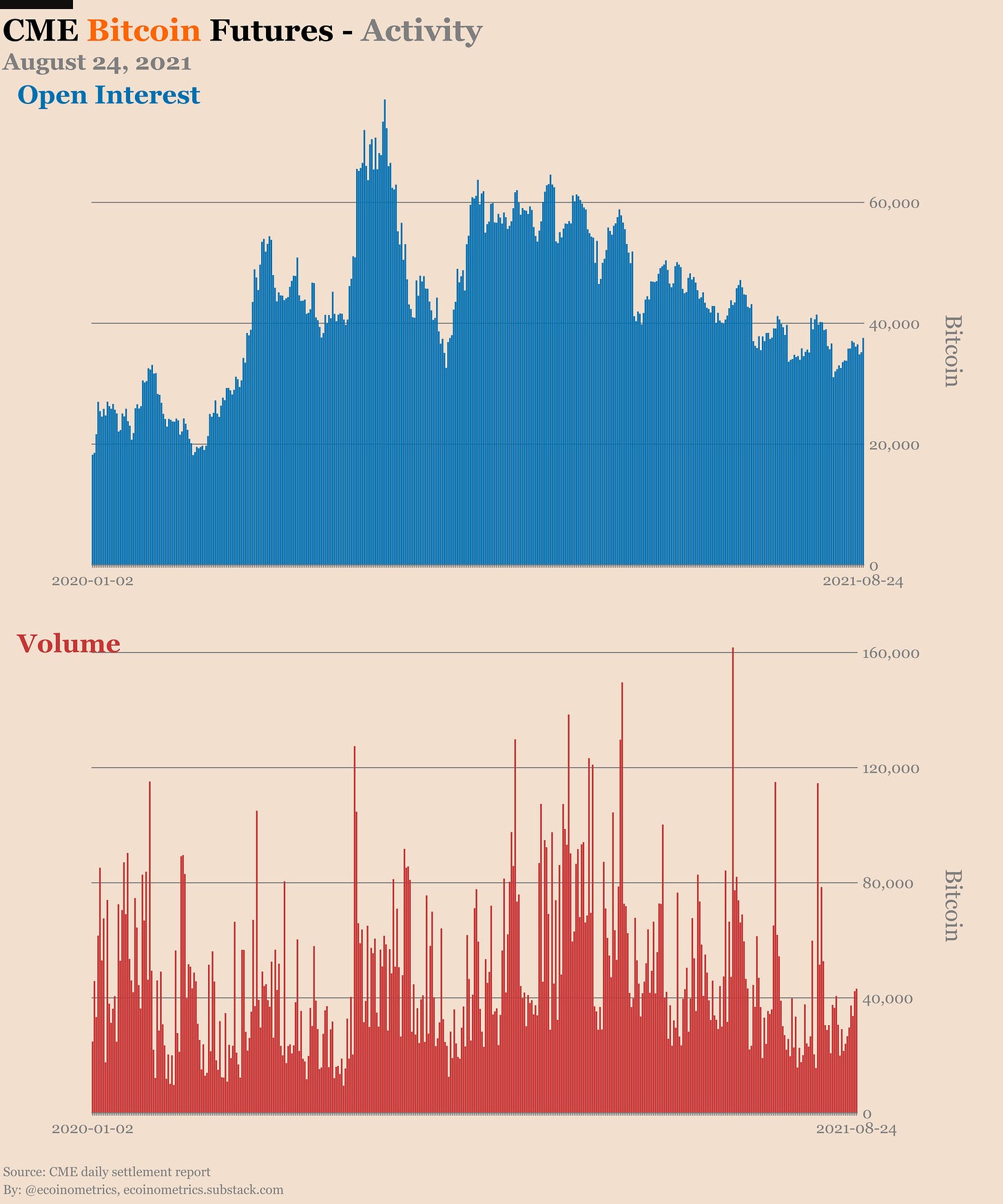

CME Bitcoin Derivatives

Not much new on the CME Bitcoin derivatives market. The traded volume is on the rise but that’s most likely due to the fact that the August contract expires on Friday.

Interestingly, despite the price being on the uptrend people have been adding to their puts so much so that we are back at a 3 puts for every 2 calls ratio.

There is a good amount of those puts at $40k as well as in the $45k to $48k range. Seems that traders are still cautious about the breakout.

The Commitment of Traders data shows that the retail crowd is turning more bullish but that’s pretty timid.

Meanwhile the smart money hasn’t really changed anything.

Let’s see how that plays out.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick