Ecoinometrics - What to do when you are a few quarters away from a recession?

The most dangerous phase of any rate hike cycle is now.

Up until now the Federal Reserve is following a clear path: tighten the financial conditions by raising rates to slow down the US economy and get inflation under control.

The issue is that there is always a delay between the monetary policy actions and the effects they have on the economy.

How far has this monetary policy shift made its way into the US economy matters a lot to assess how close we are from a recession.

The closer we are from a recession the less risk you should take, the more dry powder you should secure and the more ready you need to be to jump on the occasion to buy your favourite assets on the cheap.

So let’s review what was said in the FOMC minutes of the July meeting and see how that squares with the state of the US economy.

The Ecoinometrics newsletter gives you insights from crypto and macro data to help you make better investment decisions.

We spend hours every day gathering data, creating metrics and bringing them to life with data visualizations that allow you to quickly get to the heart of things.

We then distill all that knowledge in each issue of the newsletter with less words and more charts so that you get insights, direct to the point, in five minutes or less.

Join more than 20,000 investors here:

Done? Thanks! That’s great! Now let’s dive in.

P.S. Checkout our latest tracker of MicroStrategy Bitcoin holdings at https://www.ecoinometrics.com/microstrategy-bitcoin-holdings-with-charts/.

What to do when you are a few quarters away from a recession?

The takeaway

Changes in monetary policy from the Federal Reserve never affect the real economy immediately. The levers the Federal Reserve is pulling are too far remove from it.

The monetary policy actions make their way into the US economy step by step:

The FOMC decide of some change.

This change affects the bond market and bank liquidity first.

The banks respond to the rate changes by changing their loan standards.

Businesses and individuals find it easier or tougher to finance themselves with loans.

This change in access to debt impacts the economy by making it

Easier or harder to expand and survive for businesses.

Easier or harder to consume for individuals.

Right now we are at the step where the rubber meet the road. The monetary policy changes have created much tougher loan conditions for everyone:

Commercial and industrial loans for large and middle-market firms: more than 51% of banks tightened their standards in Q2 2023.

Commercial and industrial loans for small firms: more than 49% of banks tightened their standards in Q2 2023.

Commercial real estate loans: more than 72% of banks tightened their standards in Q2 2023.

Credit card loans: more than 36% of banks tightened their standards in Q2 2023.

Given that the Federal Reserve has no plan to ease in the immediate future those loan conditions have no reason to ease either. For an economy completely reliant on debt for growth this is greatly raising the chances of a recession in the next few quarters. Far from being a time to despair, this should be a time of great opportunities.

But to understand the timing, let’s look at the data.

Access to debt is hard and getting harder

Here is some interesting metric: the net percentage of US banks tightening standards for a given category of loans.

This metric represents the net percentage of US banks that have reported tightening their lending standards. Every quarter senior loan officers from US banks provide qualitative information on changes in the supply of and demand for bank loans to businesses and households over the past quarter.

Basically the senior loan officers can respond that they have tightened, not changed or eased the loan conditions. Then net percentage of tightening is calculated by taking the percentage of banks reporting a tightening and subtracting the percentage of banks reporting an easing of the conditions.

Example if 60% of banks report they have tightened the loan conditions and 10% report that they have eased the loan conditions then 60% - 10% = 50% net percentage tightening is reported by this metric.

A positive value of the net percentage of banks tightening indicates banks are becoming more bearish about the US economy.

A negative value of the net percentage of banks tightening indicates banks are pursuing a more aggressive strategy and that they are more confident in the US economy.

If we look at this metric applied to commercial loans to businesses and real estate then more than 50% of banks have signalled they are tightening standards. And credit card loans aren’t far away behind.

To give you a reference, this kind of signalling is pretty close to the level of tightening that happened when the US was battling the first wave of COVID in 2020.

So both businesses and consumers:

Are finding it harder and harder to get loans.

When they manage to get one they have to pay high interest rates.

Without a dramatic change in the monetary policy coming from the Federal Reserve there is no reason to see why loans standards should ease.

And without loan standards easing it is hard to see how the US economy which is so much dependent on debt to grow could continue expanding.

So is the Fed going to shake things up? I don’t think so. Not based on what we read in the FOMC minutes for the July meeting.

The Federal Reserve is likely to do nothing in the face of uncertainty

Currently there are two things that could lead the Federal Reserve to do something:

Inflation stars trending up again.

The US economy enters a recession.

In the first case they will certainly push rates higher. In the second case they would cut rates and we’d enter a new QE sequence.

In the absence of any clear data point showing we are in one of these scenarios the Federal Reserve will do nothing. The reason is that we have entered the phase of uncertainty in which:

It looks like your monetary policy is having the desired effect.

But you are not quite sure.

In that phase you don’t want to overdo it but you also don’t want to give the impression that the job is done. Which means the Federal Reserve is likely to do nothing in the next few months.

This is what transpires from the FOMC minutes for the July meeting. Running our usual keyword cluster analysis you can see that very little has changed:

Inflation is the main topic of the debates.

The job market is only mentioned to say it is strong.

The banking sector is discussed but is considered as doing well enough.

And the risks, specifically the risk of a recession is barely debated.

Said differently there won’t be any pivot until the economy forces their hand. And they are unlikely to tightened further as long as inflation is moving in the right direction.

That’s what they say and that’s also what the Fed Funds rate futures market thinks.

On the chart below you can see the probability that the Fed Funds rate will move to a given range at the FOMC meetings until January 2024. Those numbers are derived from the Fed Funds futures on the CME. The current range is 5.25% to 5.5%.

The market is pricing 2 chances out of 3 that the Fed Funds rate will stay in the same range unti the end of the year. In second place we have a 1 out of 4 chances that there is one more rate hike in store.

My point is that in the current phase, the prudent thing to do is to focus less on the Federal Reserve and more on monitoring the state of the US economy. That’s the forcing function for macro in the next quarters.

What to do when you are a few quarters away from a recession

Now as we have discussed numerous times in this newsletter, the current state of the US is not incompatible with a recession. The strength of the job market, or the good performance of the stock markets are never good indicators that a recession won’t happen.

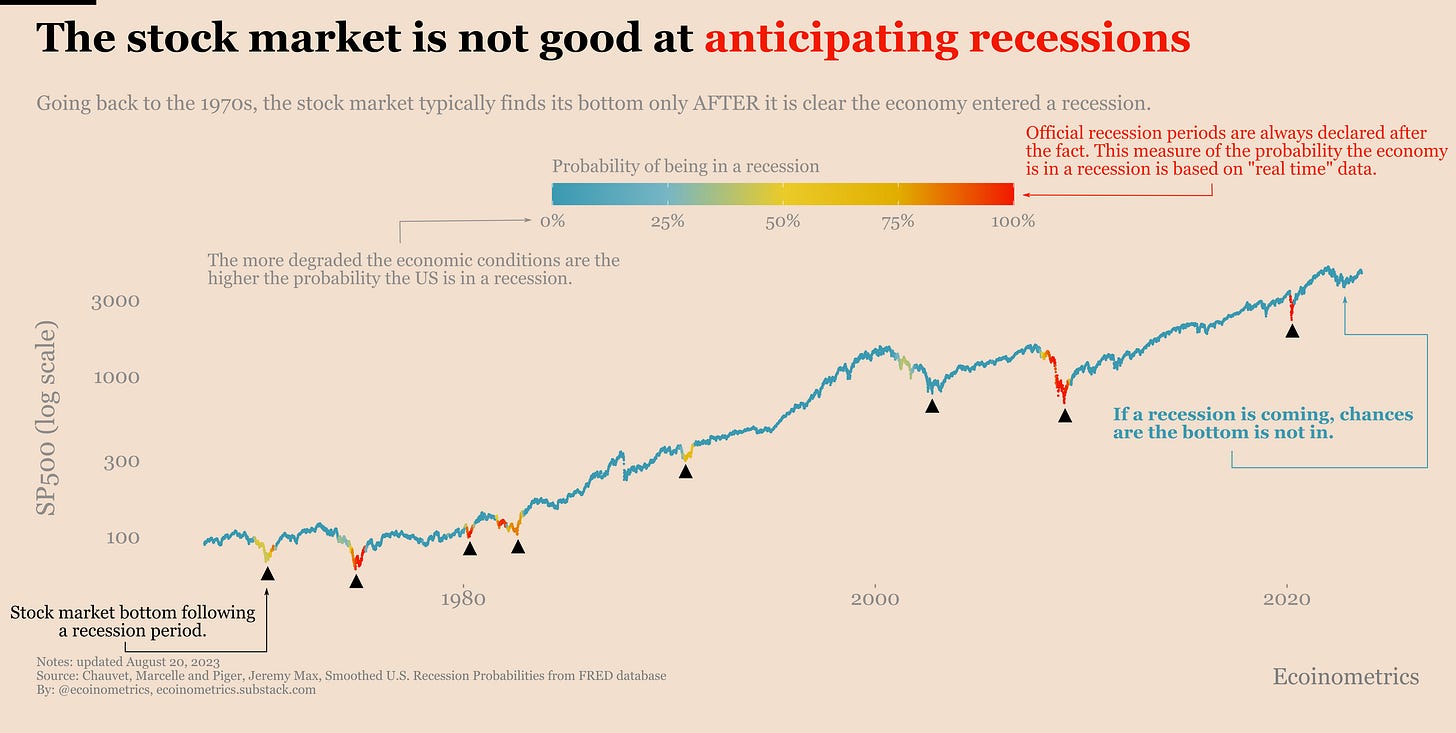

Take the SP500 as an example. Looking at all the recessions since the 1970s, the stock market does not find its bottom until after the US economy is seriously affected. So much for the forward looking aspect of the market.

But I’m not here to spread doom and gloom. There have been plenty of recessions. The economy will recover and so will the financial markets.

You don’t have to be a passive agent in this sequence though. If you are anticipating a significant market crisis then you can do two things:

Make sure you only have very liquid positions and monitor for early signs of an economic downturn. That will allow you to exit with minimal damage before everyone else panic.

Make sure you have some dry powder to buy assets at a discounted price. During a liquidity crisis all assets are on sale. That includes gold. That includes Bitcoin. As a result you can find great deals while everyone else panic.

My advice is to do your research now so that you aren’t surprised when there is blood in the street and so that you know at what discounted values you are ready to deploy your cash.

If you are looking to deploy this dry powder on crypto you might choose to simply load up on cheap BTC and ETH. That’s a solid fundamental.

But one sector I encourage you to explore if you are looking for more upside is the Bitcoin miners stocks:

They are tightly coupled to Bitcoin which means you are making the same directional bet.

But due to a size effect they are very likely to deliver multiples of the returns of BTC over the same period.

If you can buy them during a liquidity crisis those multiples could easily be upward of 30x~50x depending on how sever the correction is.

The Bitcoin miners sector is something we have been tracking for a while so if you want to read more about it go checkout:

That’s one of the most straightforward bet you can make that will surely get even more asymmetric if you get in during a recession.

If you want to stay within crypto there are certainly opportunities in the decentralized applications space on Ethereum, but those bets are much more complex to execute properly.

All in all, I encourage you to look at the potential for a big market correction as a time for opportunistic trades. Those don’t come around very often so better try to make the best of them.

That’s it for today. If you have any question don’t hesitate to reply to this email and I’ll get back to you.

If you have learned something please like and share to help the newsletter grow. Using the referral button you get rewarded for bringing in new subscribers:

Don’t forget to checkout other resources on the Ecoinometrics website such as:

A dollar cost averaging performance calculator for the stock market.

Which assets really hold up against inflation over the long run.

If you are already a free subscriber please consider upgrading to a paid tier to get the full access including:

All the issues of the newsletter (2 every week) including all the reports (Bitcoin miners, Bitcoin on-chain accumulation, Bitcoin correlations, macro liquidity, …)

A fast track to get your questions answer. Shoot me an email, if I don’t have an answer I’ll do the research and publish the result in an issue of the newsletter.

Cheers,

Nick

P.S. For hot takes and daily charts follow Ecoinometrics on Twitter, Instagram and on Threads @ecoinometrics.