Ecoinometrics - Who is Hodling?

September 08, 2021

Since yesterday Bitcoin is legal tender in El Salvador. I don’t expect the US, the EU or China to follow suit any time soon.

But clearly something is going on and it is more likely than ever that Bitcoin will have a large impact on global finance.

So who is hodling and what does that tell us of where we are going?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Who is hodling?

It has been a little more than a year since Michael Saylor started to put the idea of hodling Bitcoin as a treasury asset on the map.

For MicroStrategy it started with BTC 20,000 purchased in August last year. Fast forward 13 months and MicroStrategy now holds over BTC 100,000 and a host of public companies (so far mostly small ones) have taken a part.

Plus now El Salvador has officially made Bitcoin legal tender and is currently hodling BTC 550. Probably nothing...

But of course Michael Saylor wasn’t the first one to stack sats on its balance sheet.

So who is hodling these days?

Well here is the breakdown thanks to BitcoinTreasuries.net data.

The number comes up at 7.9% of the total supply of Bitcoin held in treasuries. This is starting to be significant.

If we go category by category:

ETF-like products still dominate with 4.1% of the total supply.

Private companies are reporting to hold 1.6% of the total supply.

Governments are keeping 1.2% of the total supply.

Public companies are hodling 0.9% of the total supply.

Of course this is a lower bound for the amount of BTC in treasuries since the only two really reliable categories are ETF-like investment vehicles and public companies. Instruments in those two groups are required to report what they hold on their balance sheet.

But private companies don’t necessarily need to say anything about their Bitcoin hodlings publicly. An example would be SpaceX which we kind of know is hodling but we have no idea how much.

And reporting on what governments are really doing is even less transparent. I mean who knows what law enforcement agencies have seized in Bitcoin and held in their coffers all over the world.

So it isn’t a stretch to imagine that this 7.9% number is maybe 1%, 2% or 3% higher for the total of the categories listed above. Who knows?

And when you see that GBTC alone captures like 3% of the total supply you can only imagine what an actual Bitcoin ETF in the US would be able to achieve.

Now it is interesting to see how the situation develops for public companies. Take a look at the bottom of the chart (above). Some big circles and a lot of smaller ones.

MicroStrategy is a heavy weight in there. Actually you could argue that at this point, its place is more in the ETF-like category than with public companies. I’m assuming everyone who bought MSTR over the last year did it to get some indirect exposure to Bitcoin.

Second is Tesla. For sure Tesla’s main business has nothing to do with cryptocurrencies (contrary to what Elon Musk’s Twitter feed would let you think). So we can really say that they are using Bitcoin as a true reserve asset.

In third position you have Square. You can argue that they are partly in the cryptocurrency business. But for the most part it isn’t their main focus. So again they are a company doing their own thing and using Bitcoin as a true reserve asset.

After that if you go down the list on BitcoinTreasuries.net you’ll see that most of the other public companies are in the business of either hodling Bitcoin (as in they are holdings or fintech companies) or mining it.

Some people will see that as a failure.

One year after Michael Saylor started to advertise the benefits of Bitcoin as a reserve asset, few public companies that are not in the fintech business have adopted it.

But that brings to mind a quote from Bill Gates:

“Most people overestimate what they can do in one year and underestimate what they can do in ten years.”

I think it is a bit early to consider that a failure. Clearly small companies or the ones that are already tuned in the Bitcoin space will be the first to put some on their balance sheet.

For everyone else it will take more time.

So I’d say we need to revisit this topic on a regular basis before making any conclusion.

But if you had invested on those public companies that are hodling Bitcoin when Micheal Saylor started making noise about it you’d be doing pretty well by now.

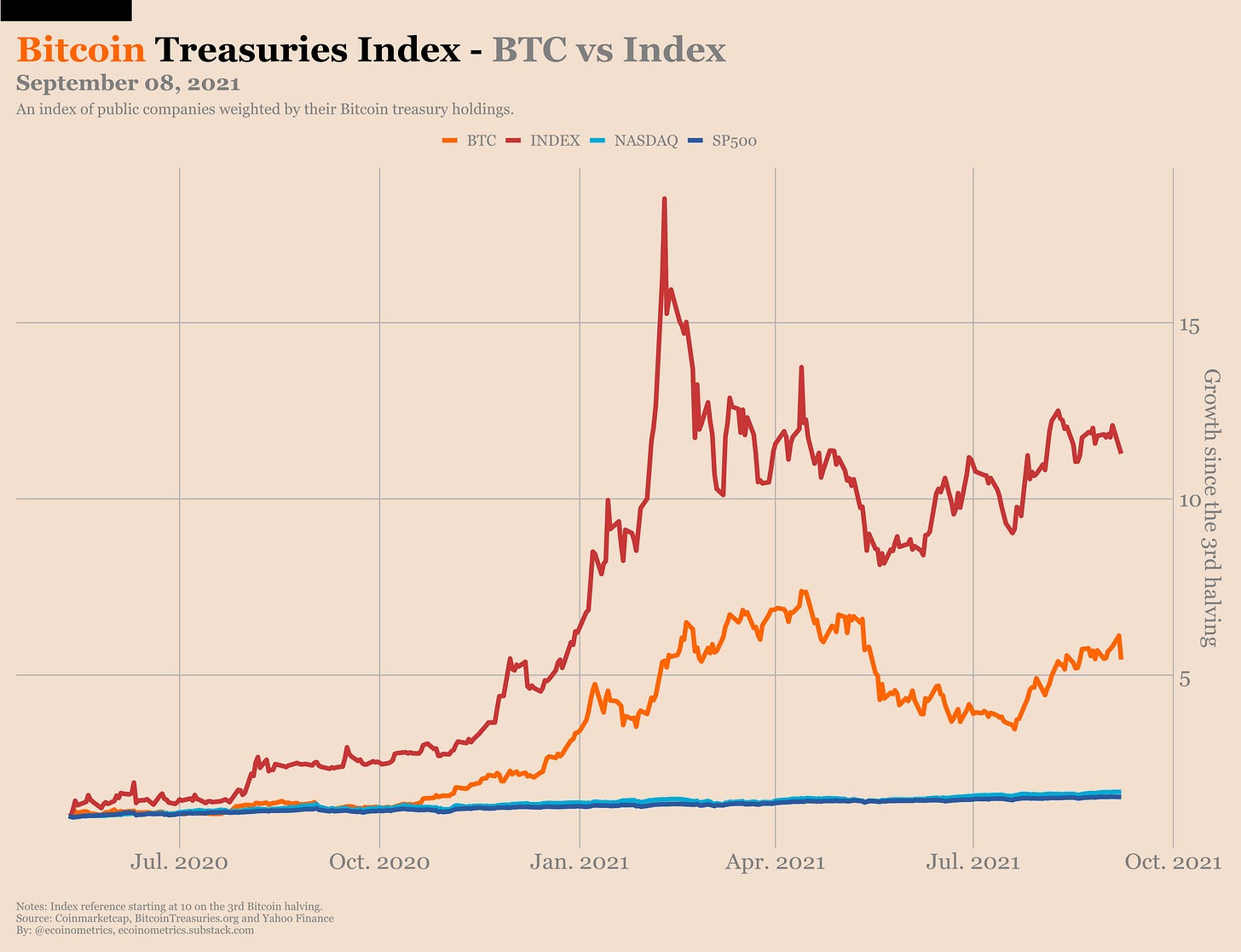

A while ago we had introduced the idea of a Bitcoin Treasuries Index which would include:

Public companies traded on a US exchange (liquidity criterion).

Owning at least 0.005% of the total Bitcoin supply (treasury criterion).

In this index each stock is weighted by the amount of Bitcoin they have on their treasury.

The current composition looks like that:

And if we take the 3rd Bitcoin halving as a reference this Bitcoin Treasuries Index is up twice as much as Bitcoin over the same period.

From up there the stock indices pretty much look like the horizontal axis…

And while MicroStrategy is obviously the main stock in the index, it is the miners who have performed the best:

Hut 8 did 2 times the returns of Bitcoin over the same period.

Marathon did 10 times the returns of Bitcoin over the same period.

For sure a big part of the gains came from the first parabolic move of Bitcoin which started slowly in October last year.

But you can see that miners have a life of their own. Again, in the absence of a Bitcoin ETF in the US I’m sure many investors are trying to gain as much indirect exposure to Bitcoin as they can.

Buying miners is one way of doing that given that their profits (in US$) is largely driven by the value of Bitcoin itself. But we’ll be diving more into the mining companies another time.

At the end of the day the picture that is painted is clear. More institutions are getting into Bitcoin. Sure the profile of the early adopters isn’t very diverse but at the same time it is what you’d expect.

If you see the glass half full it only means that there is more demand yet untapped. And judging by the attractiveness of the stocks that give some indirect exposure to Bitcoin, I’d say the demand is there.

So the tl;dr is: we are still early.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick