Ecoinometrics - Who is the store of value?

October 27, 2021

Unless you live under a rock you must be well aware of the narrative which has been fuelling the rise of Bitcoin over the past few years: Bitcoin is digital gold.

This narrative hasn’t yet played out completely.

But these days Bitcoin is better at being gold than gold itself… Please be kind and do not share this newsletter with Peter Schiff.

The Ecoinometrics newsletter decrypts the place of Bitcoin and digital assets in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Who is the store of value?

Let me preface this review by saying that I don’t hate gold. I even have some arguments as to why you might want to own some.

The first one is that over long enough periods of time, gold has been holding up as a store of value. It is widely accepted as such pretty much everywhere in the world and has been for ages. So if you think the Lindy effect applies here, it is then likely that gold will continue to be perceived as a store of value in the foreseeable future.

The second argument in favour of gold is that it is something physical. I’m not talking about owning paper gold right here. I’m talking about owning gold bars, coins or jewelry. When you own physical gold, you are your own bank in the same way as when you self-custody Bitcoin.

The last argument of why you might want to own gold now, as a strategic play, is that central banks are stacking gold. That means it isn’t impossible that they will one day decide to pump the price of gold in order to undermine Bitcoin.

With all that you can argue that your portfolio deserves some allocation to gold.

But is gold the store of value of the future?

No.

Is it still the store of value of the present?

Well, when I look at the data I’m tempted to say that investors are already tilting towards Bitcoin as a replacement.

When it comes to the narrative, the number one reason people start buying gold is the real yield.

The real yield is the 10-year US Treasury yield minus the headline inflation. As the name indicates it is the actual yield you get on those ultra safe bonds when adjusted for inflation.

If the real yield is positive then you are getting paid for taking the risk of holding bonds. If the real yield is negative then you are paying for the privilege of taking someone’s risk…

Right now the real yield is at -4%... that’s the lowest it has been for more than a decade. So if you want to make positive real returns, there is literally no point in holding bonds.

Those times when the real yield dip into negative territory have historically been triggers for run ups in gold.

But this time… nothing. See for yourself.

As a prominent gold analyst commented:

Why?! Why?! Why?!

Peter Schiff

Well, either gold is being manipulated or maybe some other asset is stealing the inflow of money that would traditionally pump its price?

Maybe both.

But when it comes to stealing money inflows then there are reasons to think Bitcoin is doing exactly that.

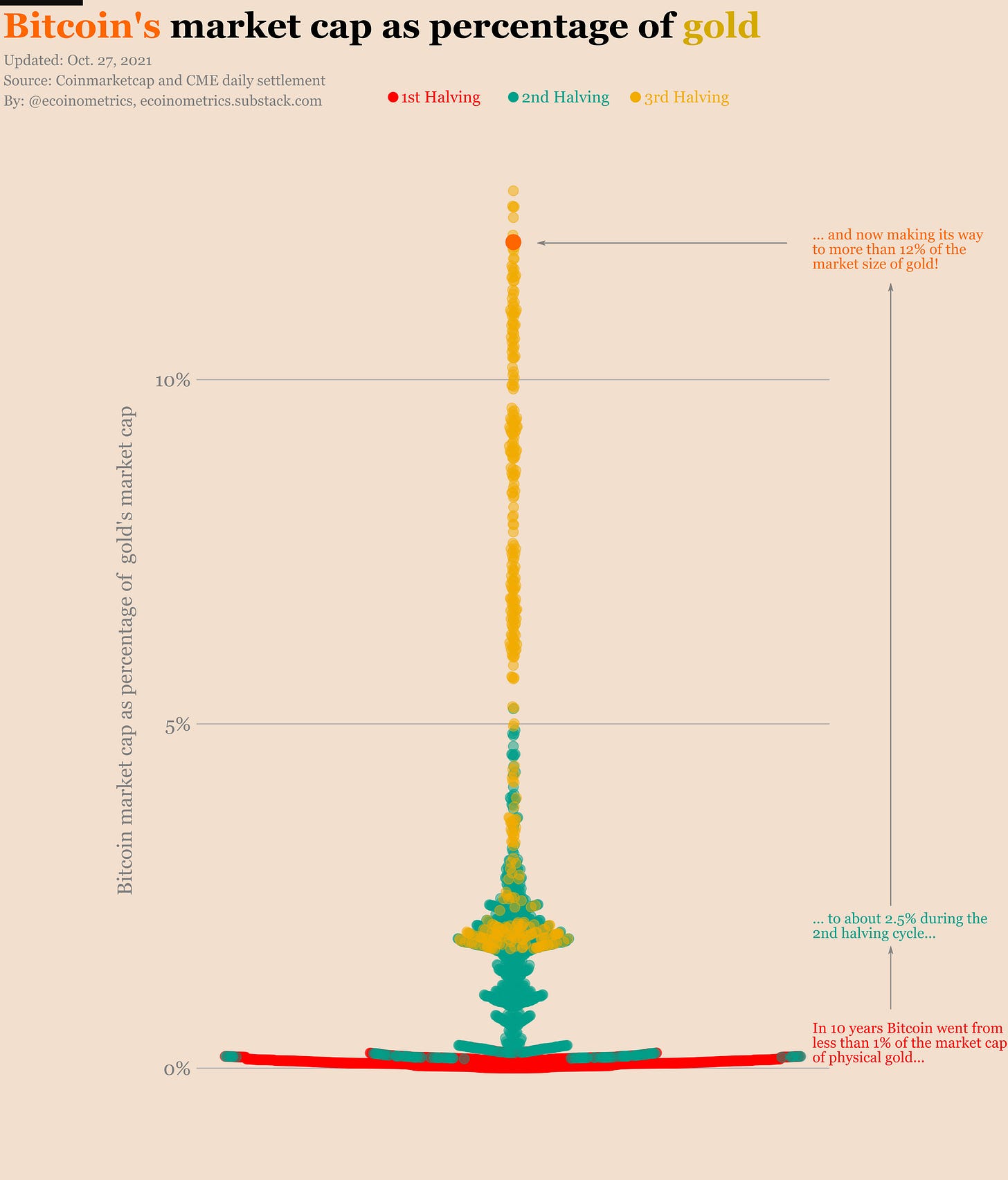

I mean just look at the evolution of the market cap of Bitcoin expressed as a percentage of the market size of physical gold:

Each point represents the ratio of BTC market cap to gold market cap at the end of a trading day.

The days are colour coded by halving cycles.

The orange dot is where we stand now.

This is basically a picture of the Bitcoin rocket taking off towards the moon. Maybe I should sell this one as an NFT...

Jokes aside, digital gold went from less than 1% of the market size of gold to 2.5% four years later and now 12%.

If you think of gold and Bitcoin as competing assets it is reasonable to guess that now that BTC is large enough it must cannibalize gold to grow larger.

At the moment it is probably just stealing some cash that would traditionally go to gold. But soon we could see some gold outflow feeding the growth of Bitcoin.

I guess we are going to have to switch to sats per ounce of gold for this chart.

I have argued in the past that the real test to gauge the adoption of Bitcoin as an institutional store of value is its correlation to the real yield. For the past 10 years BTC has stayed uncorrelated to the real yield.

It is too early to say definitively if that’s the case or not (given that there isn’t enough data). But maybe something is happening before our eyes.

CME Bitcoin Derivatives

I’ve been wrong in the past when trying to predict what was going to happen on the CME Bitcoin markets. But for once I got it right.

To be fair now that we have a bunch of Bitcoin futures ETFs things are getting simpler.

How so?

Well those ETFs need to buy futures contracts on the CME. The result is a rise in the open interest, a larger premium of the futures over spot BTC and bigger spreads.

There you have it:

All time high 85,000 Bitcoin equivalent of open contracts on the CME.

The smart money is at record high net short positions since they sell the futures while buying spot to pocket the big premium.

No big surprise after all.

All that isn’t enough to wake up the CME Bitcoin options market though. Very little activity with the puts still dominating the calls 3 to 2. Honestly the size of this options market relative to the futures is making it more and more irrelevant.

Only a few days left on the October contract:

52% of the contracts are about to expire.

42% of the calls are in-the-money.

Less than 5% of the puts are in-the-money.

Let’s see if we’ll stay there by the end of the week.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

If you do decide to NFT your Bitcoin rocket chart I offer one ounce of gold 😉

Question 1: Perhaps Crypto is one half of the barbell strategy, and cash/gold is the other half, with S&P equivalents being in the middle and used sparingly. It is claimed that this radical form of stock-bond allocation can soften the blow of temporary volatility whilst gaining the best results for future crypto returns. Why is this statistically the case, that holding world currency baskets OR gold (as if it is a "value" asset) becomes a hedge against "growth" tech assets e.g. NASDAQ and Bitcoin? Gold has less industrial application than common metals, timber, fabric ingredients, and agricultural goods. https://newsletter.banklesshq.com/p/the-crypto-barbell-strategy https://convivium.substack.com/p/the-bitcoin-gold-barbell-strategy

Question 2: If the yin-yang is established as such, is momentum investing ("speculation", "shorting", and "day trading" seemed so dirty to say) generally harmful for both gold and Bitcoin and on the side of S&P and bonds? Yarvin noted "borrowing fiat against X" is generally a sign that fiat is still better, and that "crypto tourists" almost always loses, but will only beat HODLers (naked long) and no-coiners in the last moments before Bitcoin gaining maximum market dominance. https://www.youtube.com/watch?v=rK0Tf9DX-9s https://www.youtube.com/watch?v=1S0BVPYoCFk https://graymirror.substack.com/p/degenerate-cryptofinance https://graymirror.substack.com/p/on-the-crypto-blizzard https://graymirror.substack.com/p/varoufakis-and-bitcoin-maximalism https://graymirror.substack.com/p/bitzion-how-bitcoin-becomes-a-state