Ethereum ETFs Are Seeing Bitcoin-Scale Inflows

Also Bitcoin ETF Demand Holds Firm & No Real Progress on Inflation This Month

Welcome to Ecoinometrics' Friday edition.

Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis.

Today we'll cover:

Ethereum ETFs Are Seeing Bitcoin-Scale Inflows

Bitcoin ETF Demand Holds Firm

No Real Progress on Inflation This Month

Taken together, these signals paint a familiar but important picture: the demand side for crypto remains strong, macro headwinds aren’t getting worse, and capital is starting to move further out on the risk curve. That’s the kind of environment historically seen in the second half a crypto bull market.

In case you missed it, here are the other topics we covered this week:

Essential Decision-Making Tools

Bitcoin Market Monitor - Key Drivers in Five Charts:

Bitcoin Market Forecast - Probability Scenarios & Risk Metrics:

Get these professional-grade insights delivered to your inbox:

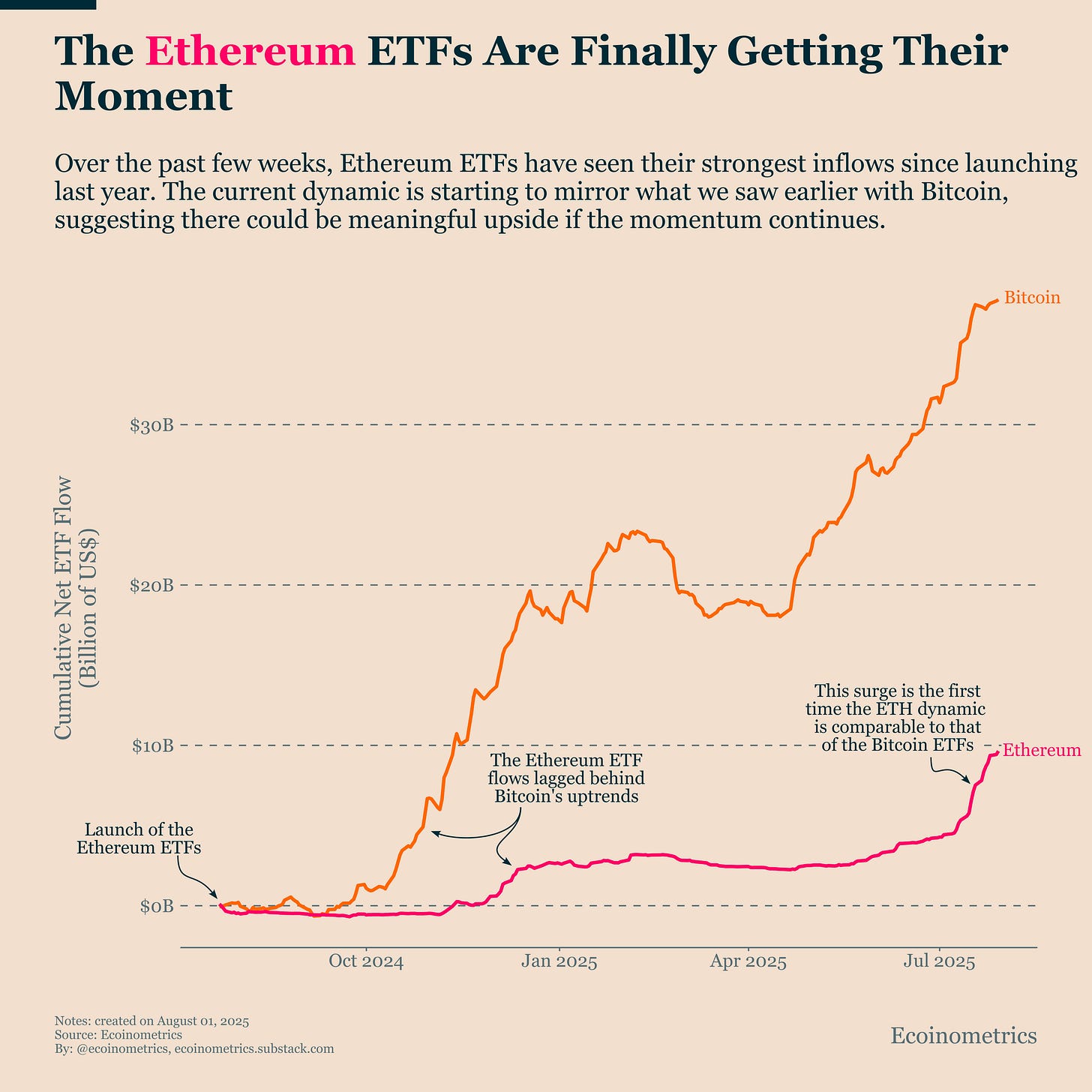

Ethereum ETFs Are Seeing Bitcoin-Scale Inflows

Most of the growth in Bitcoin over the past 18 months has been driven by inflows into spot ETFs.

Ethereum’s path has looked very different.

For most of the past year, ETH ETFs saw minimal inflows. Each attempt at momentum lagged behind Bitcoin and faded quickly. So it’s no surprise Ethereum is still stuck below the all-time high it set during the last cycle.

But now, that could be changing.

Last month marked the first time Ethereum ETFs showed a surge in net inflows that’s comparable in scale and intensity to what we saw with the Bitcoin ETFs.

Since both ETF products operate under the same structure, sustained inflows into ETH funds should eventually translate into upward price pressure just as they did for BTC.

If that trend continues, it opens the door for Ethereum to make new highs in the coming months. We’ll be able to start modeling the potential price effect once more data comes in.

More broadly, this shift hints at a new phase in the crypto bull market, one where capital starts moving further out on the risk curve. That’s typically when ETH and other large-cap altcoins outperform relative to Bitcoin.

But as we noted on Monday, this doesn’t come at Bitcoin’s expense. A rising tide in crypto risk assets often lifts Bitcoin too.

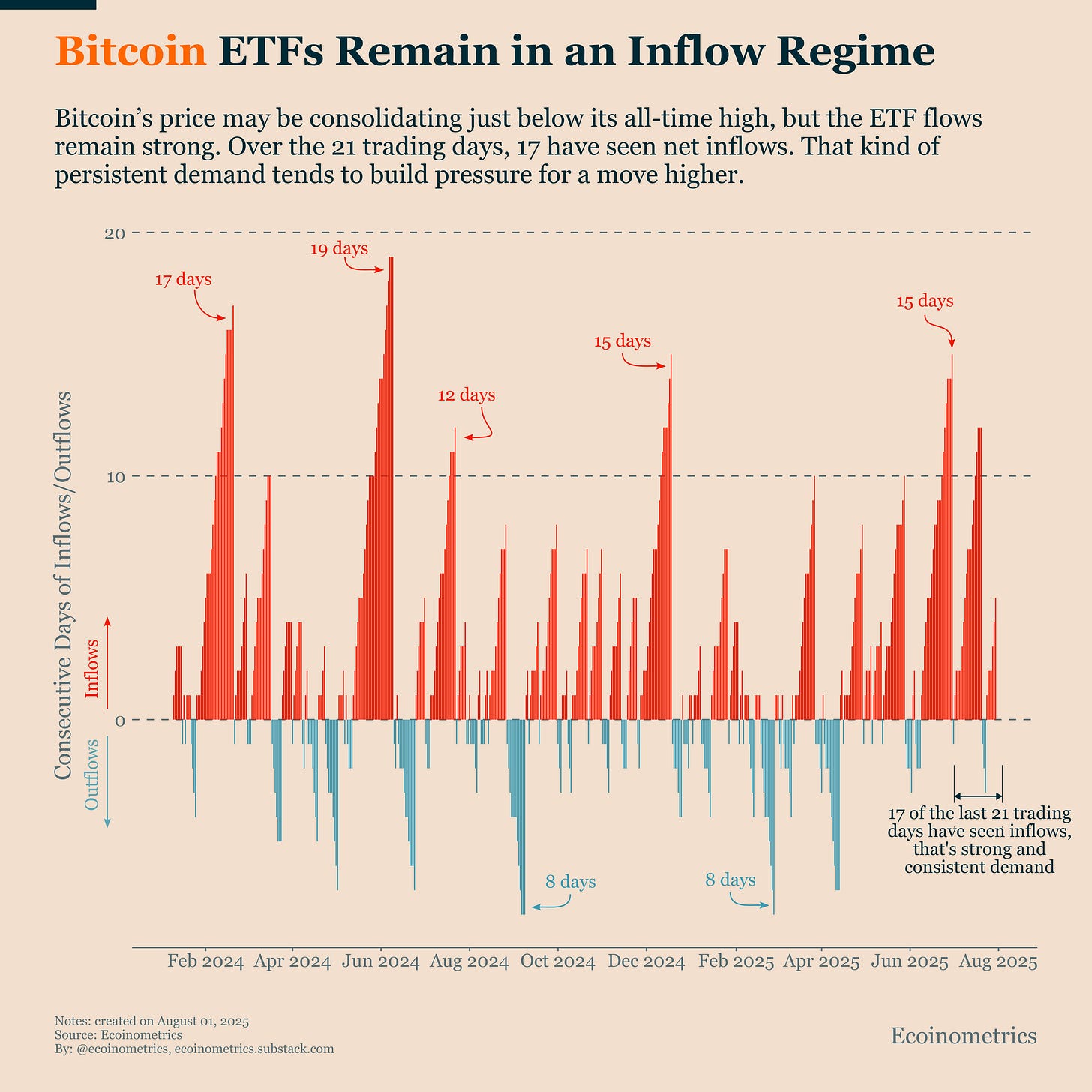

Bitcoin ETF Demand Holds Firm

As I’m writing this on Friday, there’s another knee-jerk move in risk assets following Trump’s latest tariff announcement.

Bitcoin and U.S. equities are seeing some mild selling pressure but nothing dramatic yet.

The bigger picture is that demand for Bitcoin remains strong.

In July, 17 out of 21 trading days saw net inflows into the ETFs. The only sustained outflow streak (just three days) came right after Bitcoin touched a new all-time high. That’s a textbook moment for some profit taking, not a shift in trend, so nothing surprising there.

Outside of that, we’ve seen steady activity on the ETF front all month. That tells us institutional demand is still there and that’s the kind of support that helps anchor price, even during consolidation.

It’s true that inflows have slowed in magnitude in recent days, which explains why Bitcoin has stalled just under its high. But this isn’t weakness, it’s a healthy pause.

When inflows remain positive while price moves sideways, it often builds pressure under the surface. If this dynamic continues, it could set the stage for a breakout once the next catalyst shows up.

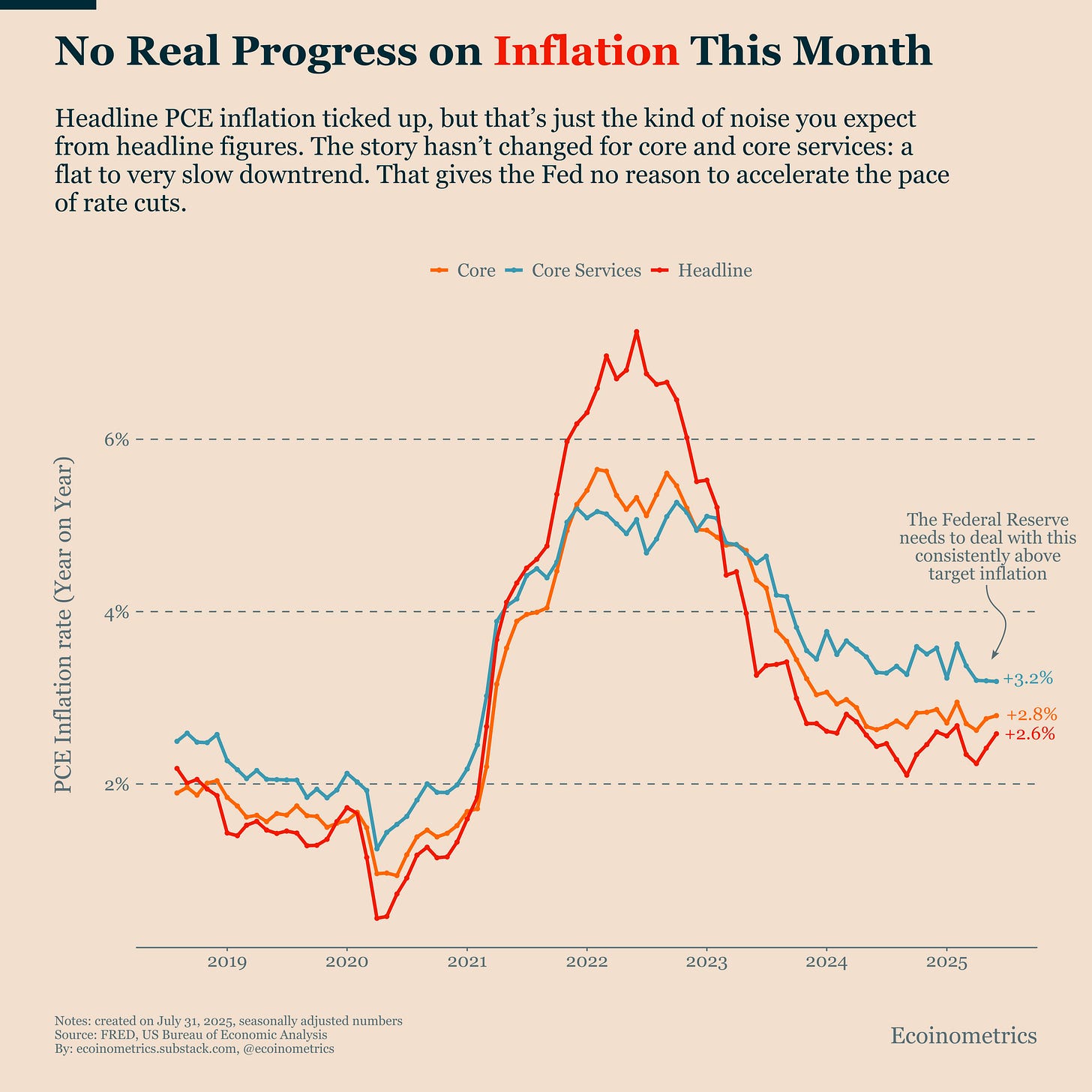

No Real Progress on Inflation This Month

Year-on-year PCE inflation currently stands at:

2.6% for headline (up slightly)

2.8% for core (up slightly)

3.2% for core services (down slightly)

All of these remain well above pre-COVID levels and above the Fed’s 2% target.

If you look at the chart, you could argue there’s a slow downtrend in core services, which matter most for wage-driven inflation. But realistically, the picture is flat. There’s been no real progress over the past 12 months.

As investors, the key risk here is whether the Fed could react to this by turning more hawkish.

But that doesn’t seem to be the case.

The FOMC meeting in July confirmed that the Fed intends to stay on its current path: very slow rate cuts, no urgency to accelerate, and no sign of hiking. That outcome was broadly expected by the market, so no surprise is good news for risk-on assets like Bitcoin.

Still, this is a dynamic worth watching closely because the risk is asymmetric.

If inflation data surprises to the downside, the Fed might speed up rate cuts: bullish for Bitcoin. But if inflation re-accelerates and forces a hawkish pivot, that would be a major headwind. Liquidity would dry up fast, and Bitcoin would feel the impact immediately.

For now, that scenario looks unlikely. The Trump camp is pushing for lower rates, and speculation is already building over Powell’s 2026 replacement. Unless the data really forces their hand, the Fed will likely keep policy loose enough to remain favourable for Bitcoin.

That's it for today. Thanks for reading.

Cheers,

Nick

P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis.

Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions.

Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights.