Flows Point to $128K Fair Value for Bitcoin

Institutions Now Own 11% of Bitcoin Supply & Core Services Inflation Is the Real Problem

Welcome to Ecoinometrics' Friday edition.

Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis.

Today we'll cover:

Flows Point to $128K Fair Value for Bitcoin

Institutions Now Own 11% of Bitcoin Supply, That’s a Structural Shift

Core Services Inflation Is the Real Problem

We’re looking at a market where demand for Bitcoin is strong and increasingly institutional, yet the macro environment still has unresolved pressures.

Flows suggest Bitcoin is undervalued. Ownership trends point to a structural shift. But sticky inflation means the Fed is unlikely to pick up the pace.

In fact, it’s not so different from the setup we’ve seen for most of the year.

In case you missed it, here are the other topics we covered this week:

Essential Decision-Making Tools

Bitcoin Market Monitor - Key Drivers in Five Charts:

Bitcoin Market Forecast - Probability Scenarios & Risk Metrics:

Get these professional-grade insights delivered to your inbox:

Flows Point to $128K Fair Value for Bitcoin

It’s Friday, and Bitcoin has managed to stay near its all-time high for the entire week.

At $119K, taking a breather is normal. Price action got hot last week, with a string of strong daily inflows into the ETFs. Momentum built up fast. A pause lets things cool off a bit and resets the short-term indicators without changing the broader picture.

And that broader picture looks good.

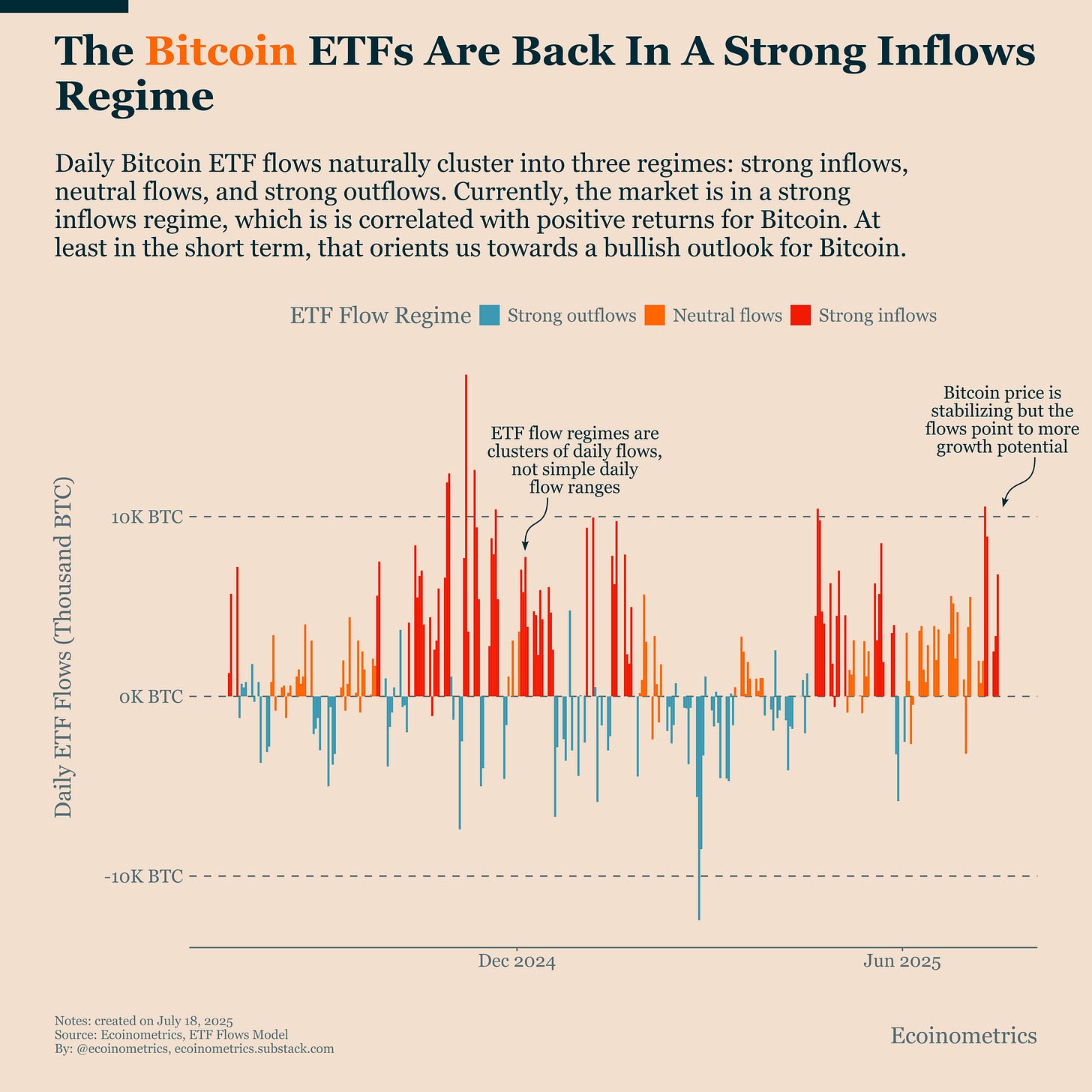

Under the surface, demand from the ETFs hasn’t slowed. Quite the opposite, flows have remained firmly in what we classify as a strong inflows regime.

That’s based on our ETF flows model, which sorts daily activity into three buckets:

Neutral flows: mixed and inconsistent.

Strong outflows: mostly negative days, often paired with negative returns.

Strong inflows: sustained buying pressure, typically associated with positive price momentum.

Since the breakout last week, we’ve been in strong inflows.

And at this level of demand, our ETF flows-to-price model implies Bitcoin's fair value is already around $128K (see the daily update here), slightly above the new all-time high.

That means even with price stalling, we’re not at equilibrium yet. The flows say there’s still more upside to price in.

So yes, Bitcoin is catching its breath. But demand is still strong and the flows point up.

Institutions Now Own 11% of Bitcoin Supply, That’s a Structural Shift

Here’s a stat that says a lot about how far Bitcoin has come.

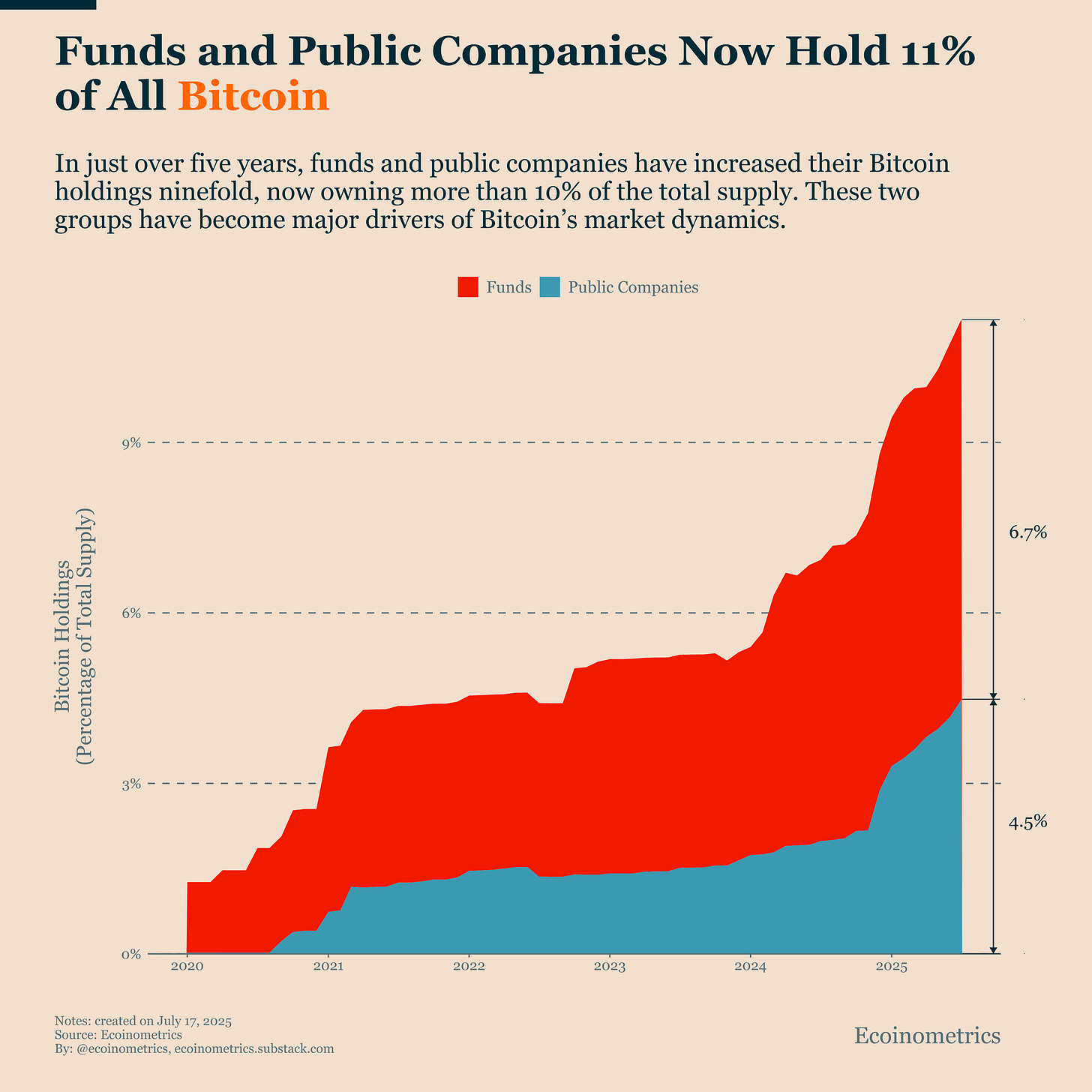

Back in 2020, funds and public companies held barely 1% of the total supply. Fast forward to July 2025, and that number has jumped to over 11%. That’s a ninefold increase in just over five years.

In other words, Bitcoin has gone from being mostly held by retail investors and whales to being partially absorbed into institutional balance sheets.

That shift matters because these new holders behave differently.

Their capital moves through structured vehicles. Their decisions are influenced by models, mandates, and fiduciary responsibilities. And as a result, their flows create different kinds of market pressures than what we saw in earlier cycles.

What’s even more striking is the trend is accelerating.

Take a look at the chart below. The steepest slope in holdings happened over the last 12 months. And while most of that growth came from ETFs, public companies have also picked up the pace in the last two quarters.

That’s why we believe that tracking institutional flows (through ETF inflows and public company treasuries) is no longer optional. It’s the single most important input for making tactical calls on Bitcoin.

Core Services Inflation Is the Real Problem

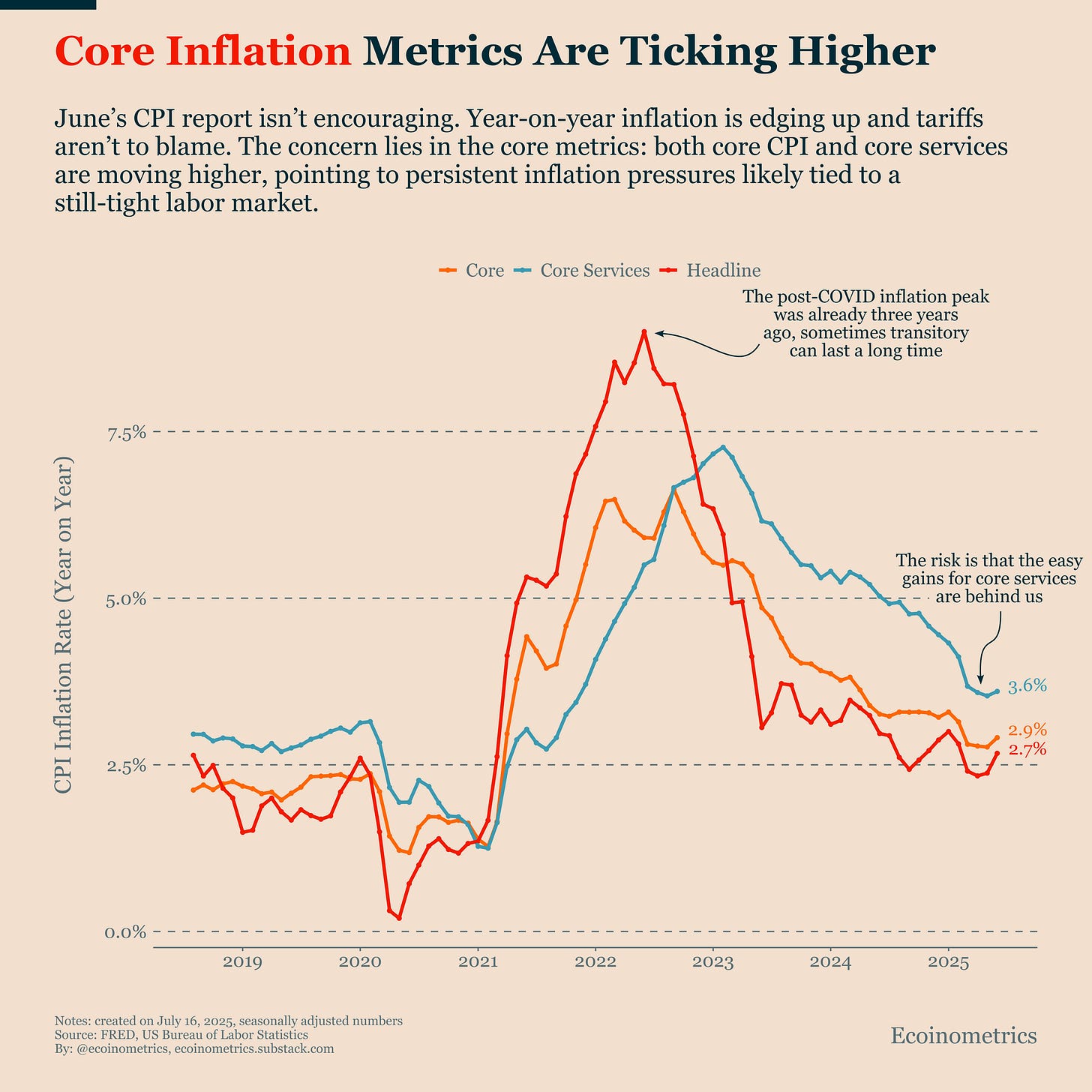

The CPI numbers for June are out, and a few things stand out.

Headline inflation ticked higher (year-on-year at 2.7%). Core inflation also moved up (year-on-year at 2.9%), not great. But what really jumps out is core services inflation: it climbed again (year-on-year at 3.6%). That’s the part that matters most, and it’s going the wrong way.

And what didn’t move? Durable goods.

Which is interesting, considering all the recent headlines about tariffs. If anything were going to react first, it would be durable goods. But those prices have stayed basically flat since March.

It’s possible that the tariffs won't have a meaningful impact, at least not right away. Remember that during the first round of tariffs (roughly 2018-2020) under Trump’s first mandate, durable goods prices also stayed pretty stable.

So if you're trying to read the inflation tea leaves, the tariff story isn’t the big concern in this data right now.

The real problem is the stickiness in core services.

Core services inflation is mostly a labor market issue. Wages are the largest input cost, and right now, the labor market still looks too tight to bring inflation all the way down to 2%.

That’s the bottleneck. And it’s likely the way the Fed sees it too. With data like this, there’s no reason for them to bring forward rate cuts.

But for Bitcoin, none of this matters unless it pushes the Fed into a meaningfully more hawkish stance. So far, that’s not happening and investors are still positioned for risk-on.

That's it for today. Thanks for reading.

Cheers,

Nick

P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis.

Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions.

Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights.

would love to see some analysis on BTC.D drop and forward returns. I think this has been a local top signal this cycle.

Flows? Since when “Flows” are a valuation tool? Maybe among apes.