Welcome to Ecoinometrics Friday edition.

Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis.

Today we'll cover:

Institutional Bitcoin Flows Are Nearing the Trigger Point

Quiet Strength: Bitcoin Climbs as Volatility Fades

Dovish Tilt Returns After Four Years of Hawkish Messaging

Together, these signals point to a market environment where institutional demand for Bitcoin is firming, volatility is declining, and the Federal Reserve is shifting into a more cautious stance. It’s a setup that limits downside while creating room for further gains in Bitcoin and other risk assets.

In case you missed it, here are the other topics we covered this week:

Essential Decision-Making Tools

Bitcoin Market Monitor - Key Drivers in Five Charts (updated daily):

Bitcoin Market Forecast - Probability Scenarios & Risk Metrics (updated weekly):

Get these professional-grade insights delivered to your inbox:

Institutional Bitcoin Flows Are Nearing the Trigger Point

Bitcoin has reclaimed the $100K mark.

But is this just another speculative spike, or is there real momentum behind the move?

Let’s not waste time. Yes, this is a real move. Momentum is building, and there’s substance behind it.

Institutional investors are deploying capital into Bitcoin through ETFs. Over the last 30 days, net inflows have totalled around 50,000 BTC. That alone has helped lift the price significantly.

But here’s the key point: we’re just 10,000 BTC short (on a rolling 30-day basis) of a critical threshold. That’s the level where inflows start pulling enough BTC out of the liquid supply to trigger faster price appreciation.

And this dynamic isn’t just about price action, it’s a proxy for institutional conviction. Retail traders can drive short-term volatility, but ETF inflows represent allocation decisions made under fiduciary responsibility. When flows near key thresholds, it signals that capital is rotating into Bitcoin as part of a broader portfolio strategy.

If ETF inflows keep accelerating, Bitcoin has a clear path to move into the $100,000 to $125,000 range this month. Our Wednesday edition includes the full forecast from our ETF flows-to-price model.

This is the number one metric to watch right now.

Quiet Strength: Bitcoin Climbs as Volatility Fades

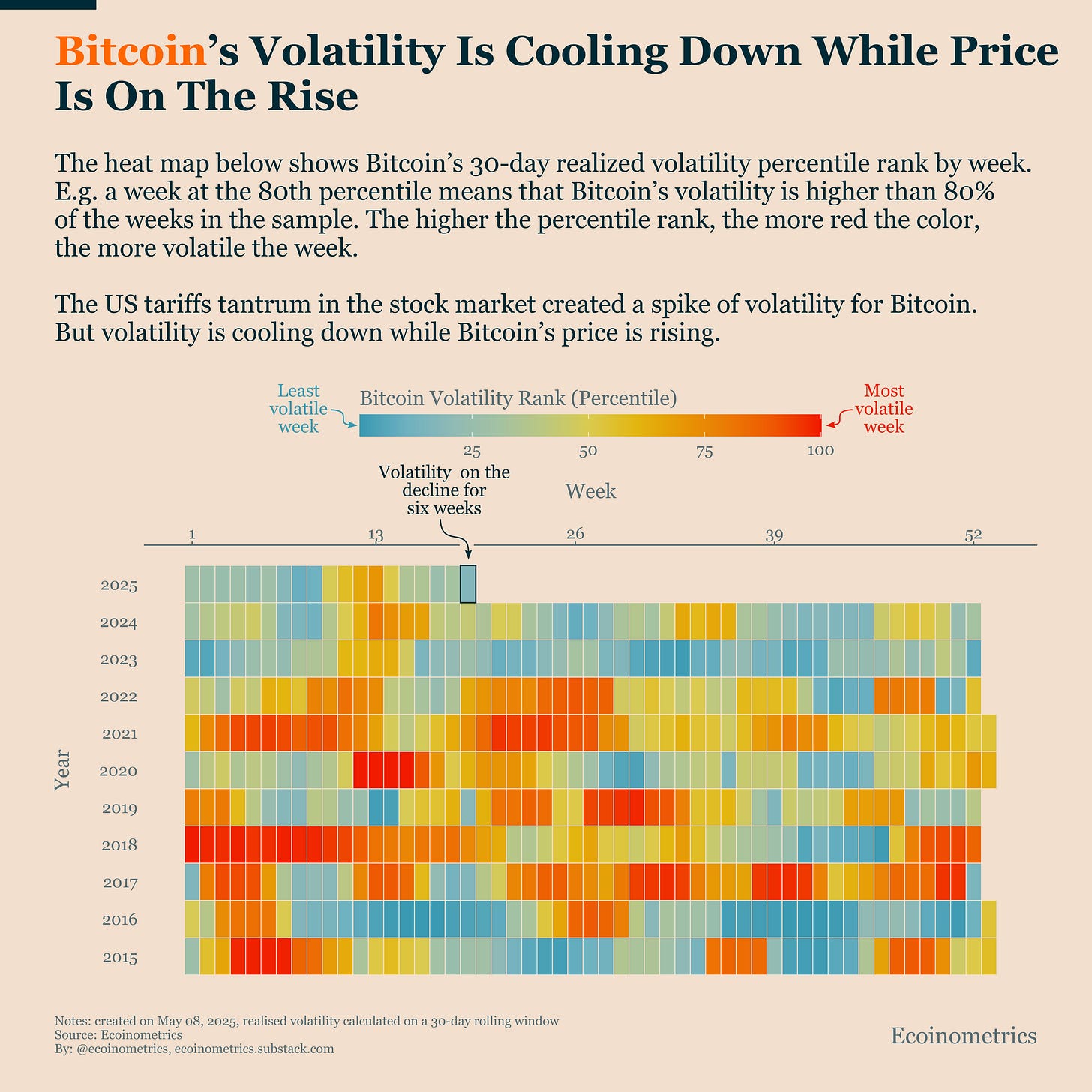

There’s another reason to have confidence in this rally: volatility.

Since the tariffs tantrum six weeks ago, which triggered a spike in volatility, Bitcoin’s volatility has been steadily declining.

It’s now down to one of the lowest percentile ranks we’ve seen this year. At the same time, the price is climbing. That’s the kind of steady growth we typically associate with gold, not Bitcoin (we did a comparison of gold vs Bitcoin in a 60/40 in Monday’s edition of the newsletter).

This matters. It signals that the rally isn’t driven by FOMO or retail speculation. It reflects a consistent shift in positioning, with institutional investors increasing their exposure to Bitcoin.

Periods like this, low volatility during a price rally, tend to increase Bitcoin’s appeal in portfolio construction. With volatility falling, risk-adjusted returns improve. That makes it easier to justify allocations under mandates sensitive to drawdowns or tracking error.

And the longer we stay in this low volatility regime while Bitcoin trends higher, the stronger the signal that institutional sentiment is solidifying.

This is a constructive setup. Of course, the Trump administration could still introduce new trade-related shocks that rattle markets. But for now, investors appear hopeful that the fallout from the trade war will remain contained.

Dovish Tilt Returns After Four Years of Hawkish Messaging

Someone a bit more cautious about the trajectory of the U.S. economy right now is Jerome Powell.

The Federal Reserve held rates steady at the May 7 FOMC meeting. That was fully expected, so it’s not particularly newsworthy.

What stands out instead is a shift in Powell’s tone.

For the first time since 2021, our Fed Communication Index (FCI), which scores Fed press conferences on a scale from hawkish (positive) to dovish (negative), has crossed back into dovish territory.

To be clear, this isn’t a deep dovish score. It’s just barely below zero, so we’d call it more of a neutral-dovish turn.

But the fact remains: we haven’t seen a press conference land in this zone for nearly four years. The broader trend of the FCI has been drifting lower for a while, but this marks a notable inflection.

What explains the shift? Powell didn’t lean as hard on inflation concerns as he has in past meetings. Instead, he emphasized risks to the U.S. economy, especially those tied to global trade tensions, more than he has in recent years.

This change in tone reflects growing caution. It’s not based on weakening core economic data, which remains solid, but on increased macro uncertainty.

To be clear, this doesn’t mean the Fed is about to pivot to rate cuts or QE. But it does suggest that any additional tightening is increasingly off the table.

That's it for today. Thanks for reading.

Cheers,

Nick

P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis.

Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions.

Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights.