The launch of spot Bitcoin ETFs in the US is the number one threat to the bull case for the miners.

We don't have any ETF yet. But Bitcoin's price action has been mostly driven by the ETF narrative in the past six weeks.

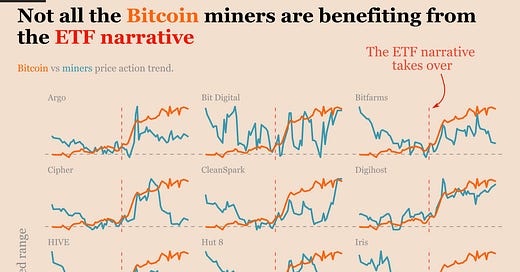

That's a great test for our Bitcoin miners thesis. We can see how the miners are reacting to an ETF narrative driven market. That's giving us a glimpse at the future.

The Ecoinometrics newsletter gives you insights from crypto and macro data to help you make better investment decisions.

We spend hours every day gathering data, creating metrics and bringing them to life with data visualizations that allow you to quickly get to the heart of things.

We then distill all that knowledge in each issue of the newsletter with less words and more charts so that you get insights, direct to the point, in five minutes or less.

Join more than 20,000 investors here:

Done? Thanks! That’s great! Now let’s dive in.

P.S. Checkout our latest tracker of MicroStrategy Bitcoin holdings at https://www.ecoinometrics.com/microstrategy-bitcoin-holdings-with-charts/.

Is the ETF narrative hurting the Bitcoin miners?

The Bitcoin miners stocks are tracking BTC pretty closely, with small market caps and a big pool of institutional buyers wanting exposure to Bitcoin. That makes them good asymmetric bets for when Bitcoin is on the rise. This is the investment thesis we track every month in the Bitcoin miners report.

The takeaway

Our bullish case for the Bitcoin miners relies on the expectation of money flowing to the miners stocks as a proxy for getting exposure to Bitcoin.

If investors have the possibility of get direct exposure to Bitcoin via a spot ETF, they have less incentives to buy the miners.

Now investors don't have this possibility yet. But Bitcoin's price action over the last six weeks has been mostly driven by expectations they will be able to in the bear future.

The result is that Bitcoin has found renewed strength, pushing to $38k as I write those lines. But only some of the miners have followed this move. And overall the difference between Bitcoin’s performance and that of the miners is shrinking.

From the point of view of our bull case that's a bit tricky to interpret. But there are at least two lessons to learn from this:

With the ETFs in the picture, it is less likely now that all the miners will benefit from the next bull run.

That lowers the expected value of the Bitcoin miners bet.

Now we only have a very small time window to judge this effect. But over this short period:

2 stocks are really following BTC.

2 stocks are kind of following BTC but without the kind of multiplier effect you’d hope to see.

9 stocks are no really following the BTC trend.

That doesn’t square well with our thesis.

Keep reading with a 7-day free trial

Subscribe to Ecoinometrics to keep reading this post and get 7 days of free access to the full post archives.