In case you haven’t noticed yet the CME Bitcoin derivatives are crushing it. The open interest is reaching new all time highs and it is dominating the US market with Bakkt making very little progress since it launched last year.

And you know what? This is just getting started!

Looking at the Futures is a weekly newsletter where we are making sense of the Bitcoin derivatives market. Emphasis is put on the CME products as they dominate the field for institutional investors. But we’ll occasionally look at other venues too.

Subscribe now and don’t miss anything!

Why am I saying that we are just getting started? Well the data suggests that very little institutional money has any exposure to Bitcoin. This is true for actual coins. And it is also true for the cash settled futures offered by the CME.

It makes sense that institutions haven’t bought Bitcoin directly. If you are an individual then you manage your keys and the coins are yours. But institutions need custodial services. They need to deal with compliance. They need to deal with regulations. To summarize, it is a pain for them. Solutions are coming though but it will take time.

But cash settled products are another beast. You don’t need to deal with the keys. You are just tracking against a reference price like an index so everything is simple.

So it makes sense that big institutional money will get its exposure first through cash settled futures.

Cue Paul Tudor Jones announcing that he is long Bitcoin. When you look at the details, what it really means is that Paul Tudor Jones has a hedge fund and this fund is buying cash settled Bitcoin futures at the CME. How much? I don’t have exact number but let’s make some back of the envelope calculation.

The fund he is running has about $200 million of assets under management. From Paul Tudor Jones mouth we know he’d consider putting a “low single digit” allocation of his portfolio to long Bitcoin positions. Let’s say that low single digit is 1% to 5%. That means $2 million to $10 million. At the current rate that is going to buy you 200 to 1,000 Bitcoins. Honestly that’s not huge but a good start.

One contract of the Bitcoin futures on the CME holds for 5 BTC. That means Paul Tudor Jones would be long 40 to 200 contracts. That’s not earth shattering.

The point is that it is good for the narrative. If more funds and institutions see Bitcoin as a hedge against inflation then it is good for the cause. You can’t expect that much coming from one fund but as a group there is a lot of institutional money waiting to be injected in the market.

That is if they can justify it with the proper narrative. Because in terms of performance everything is already there. They just need to tell a good story about it.

That’s for the headlines. You read that Paul Tudor Jones is long. You read that Renaissance Technologies is going to trade BTC futures. But in practice are we seeing a change in sentiment for the smart money?

Let’s look at the recent sequence of events to see what’s actually going on.

On March 13 the stock market crashed hard and everything with it. Including Bitcoin. That’s typical. That’s expected. When everyone and their dogs is getting hit by margin calls only cash is king. So you’ll sell all your assets, including Bitcoin, to meet your margin calls.

But after that Bitcoin completely recovered in just two months. That’s a good sign. It goes hand in hand with the narrative of Bitcoin as a safe haven and as a hedge against inflation. Already Bitcoin has a gold like behaviour with just a fraction of the market cap.

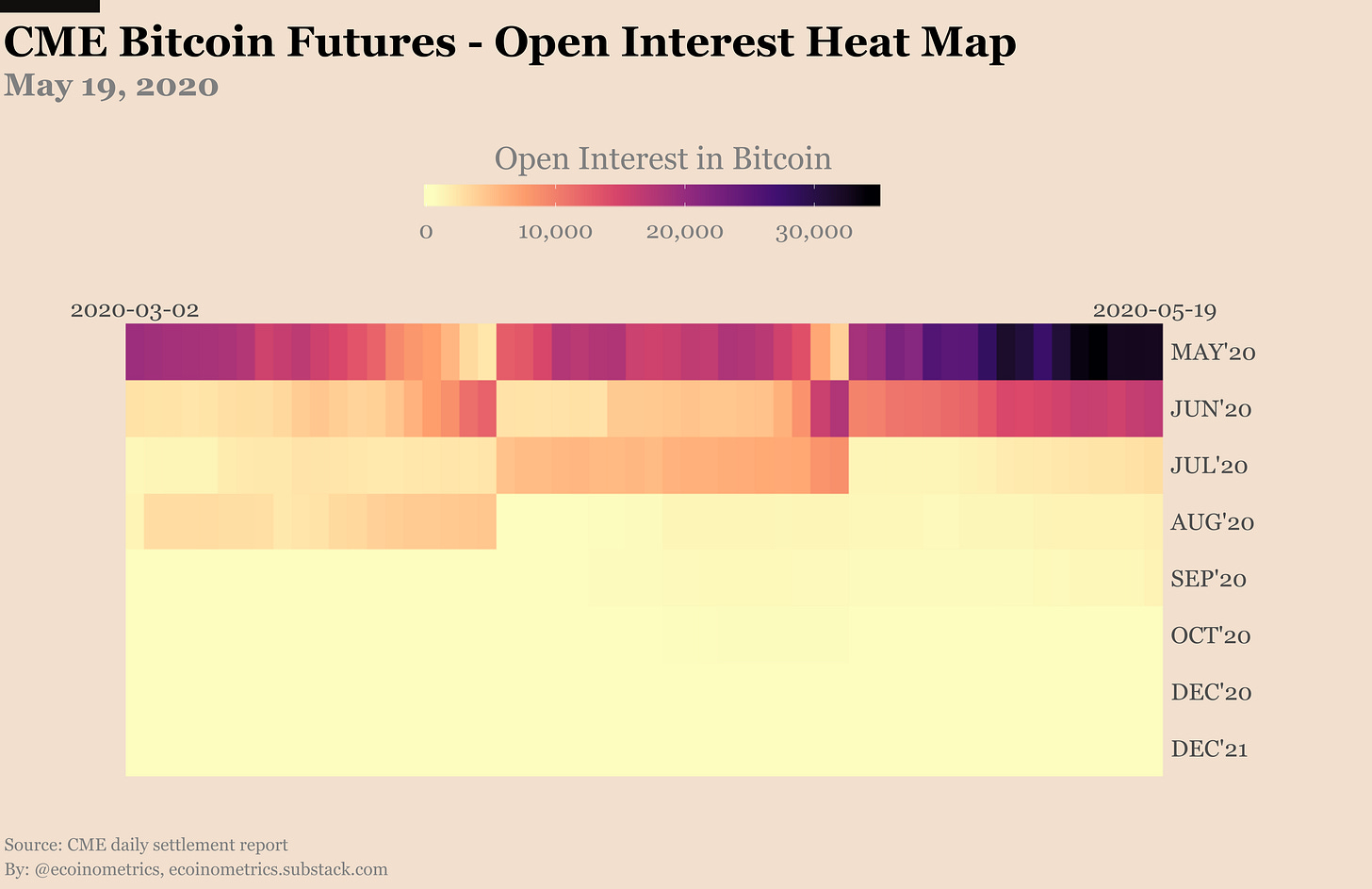

The price recovery is accompanied by a rise in open interest on the CME futures. Bitcoin doubled in value from the low of March and so did open interest!

With each future contract holding for 5 BTC we now have more than 50,000 BTC worth of open positions on the CME futures. This is an all time high.

But an interesting detail is that at the same time as open interest is rising, the average daily traded volume remains in the same range. That’s actually consistent with the idea that this new activity is the result of new traders getting exposure.

So that’s a pretty dramatic rise in new positions. The CME options market probably saw that and went:

“Hold my beer! You want to see growth? I’ll show you growth!”

The CME Bitcoin options market was launched in January. And until recently it was doing fine. But in the past few weeks the number of open positions has exploded! Just check out the evolution of the open interest. It has grown 30x in no time.

And the calls are leading the way. The puts to calls ratio is a mind boggling 20 calls for every 1 put!

Did anyone say bullish?

Most of these new positions are bullish bets on Bitcoin clearing the $10k strike within 10 to 40 days.

When you look at the structure of those positions you can see that they are cautiously bullish. Mostly bull calls with a target range of $10k to $13k. That’s like +10% to +30% from the current price.

In a Bitcoin bull market this is totally reasonable.

This is where we are right now.

So back to my original question. What is the smart money doing?

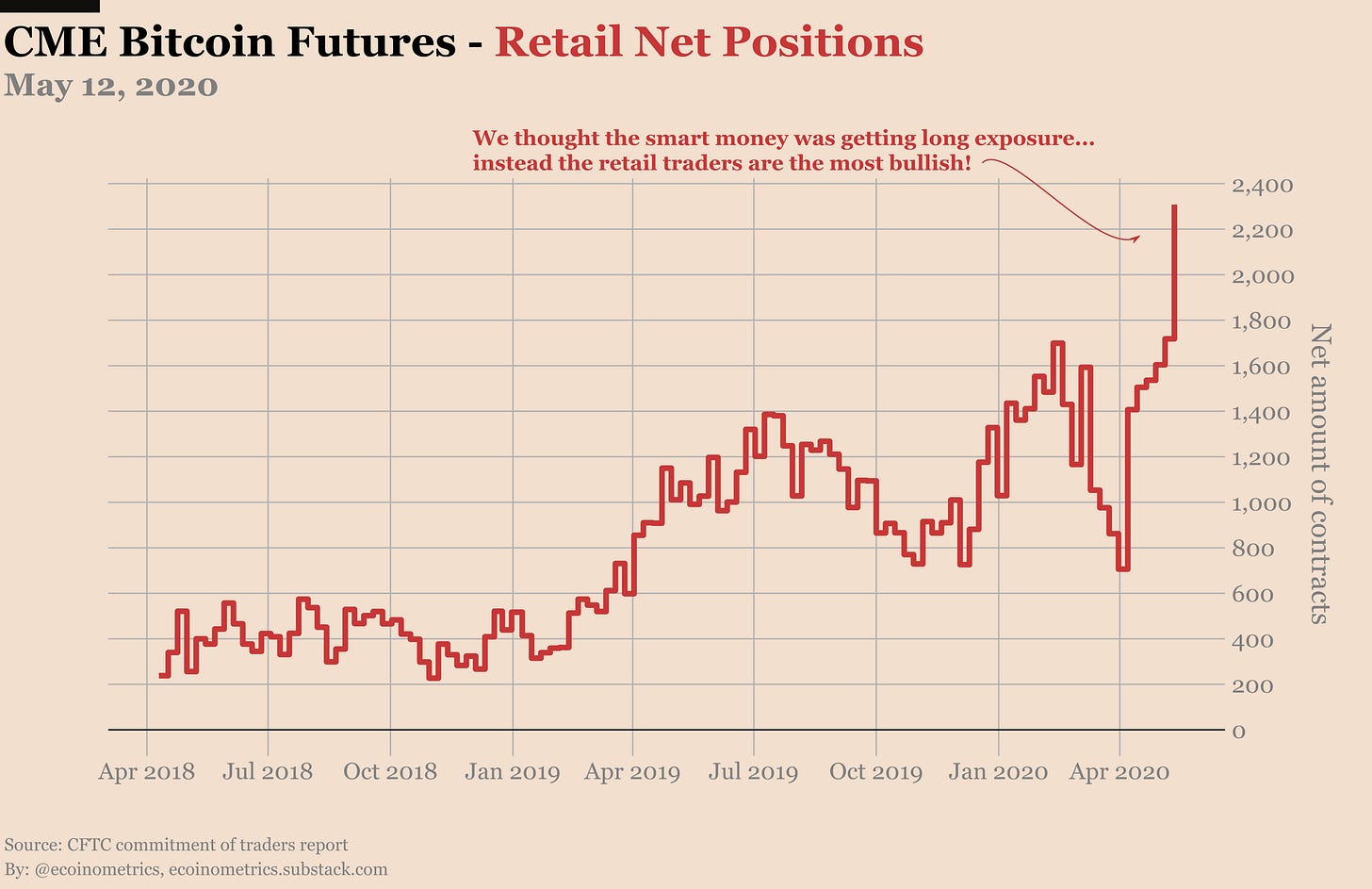

Well we have some idea by looking at the CFTC commitment of traders report for the CME Bitcoin futures and options. Note that the data from this report is always lagging by a week. The last report was on May 12, 2020 but it is always useful to look at it to see trends.

And what is the trend? The long positions of the smart money have increased. In fact they have recently doubled.

But when you look at the net positions of the smart money, that is the long positions minus the short positions, you see that… drum roll… the sentiment hasn’t changed. In aggregate the smart money is still short Bitcoin.

But you know who is record high net long Bitcoin? Retail investors of course.

So what does this all mean? It means that for institutional money the market is still small and the sentiment hasn’t changed. We are early and probably Paul Tudor Jones has the right of it when he says that Bitcoin now is gold in the 70s.

My take on this is:

There is a lot of room for growth.

Institutional money won’t flow in at scale until they have a compelling narrative.

Let’s keep an eye on that and see how it plays out.

If you liked this article please share and subscribe to help the Ecoinometrics newsletter grow!