No Rotation: Bitcoin Outflows Aren’t Boosting Gold

Also Ethereum Still Moves With Bitcoin & Fed’s Choice

Welcome to Ecoinometrics' Friday edition.

Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis.

Today we'll cover:

No Rotation: Bitcoin Outflows Aren’t Boosting Gold

Ethereum Still Moves With Bitcoin

Fed’s Choice: Inflation Risk Outweighs Labor Softness

Markets right now are stuck in a holding pattern. Bitcoin outflows haven’t rotated into gold, Ethereum’s rally is still tethered to Bitcoin, and the Fed is weighing inflation against a labor market that looks softer but not broken.

In other words, across assets and policy, the theme is the same: no clean break, just pauses and adjustments. That kind of environment tends to resolve quickly once a clear direction emerges, and when it does, Bitcoin will be right in the middle of it.

In case you missed it, here are the other topics we covered this week:

Essential Decision-Making Tools

Bitcoin Market Monitor - Key Drivers in Five Charts:

Bitcoin Market Forecast - Probability Scenarios & Risk Metrics:

Get these professional-grade insights delivered to your inbox:

No Rotation: Bitcoin Outflows Aren’t Boosting Gold

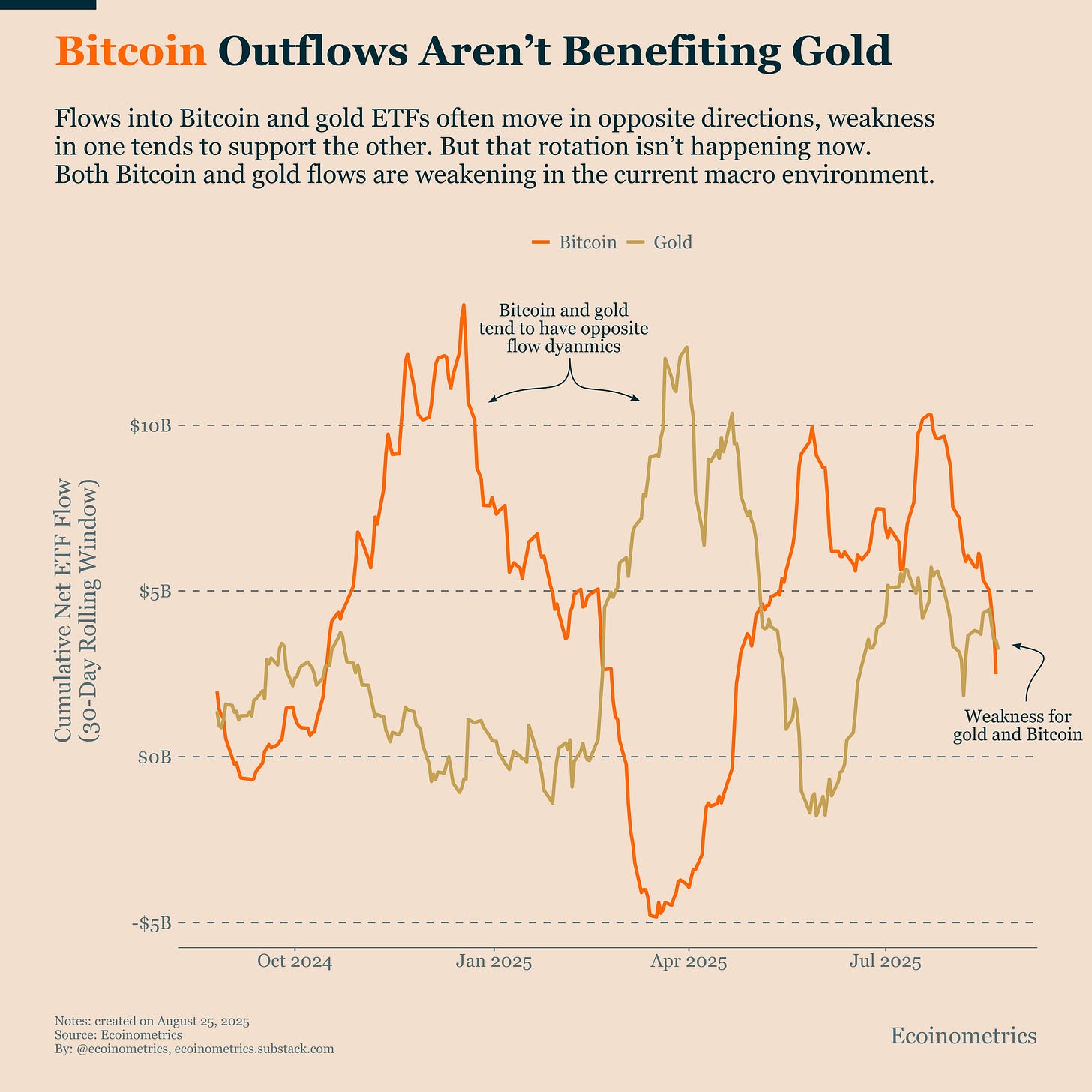

Bitcoin daily ETF flows are just coming out of a negative sequence, leaving demand pressure at weak levels. Historically, when flows are this soft, Bitcoin tends to do little more than hold its current price range, roughly $98K to $116K.

But the key difference this time is that we haven’t seen a rotation into gold. In past risk-off episodes, outflows from Bitcoin ETFs often came with inflows into gold ETFs. This time, both Bitcoin and gold flows are weakening together.

That distinction matters. A true rotation into gold would signal a broader risk-off move, which usually lasts longer. Instead, this looks more like a pause in risk appetite. Pauses without rotation tend to resolve faster, giving Bitcoin a chance to rebound quickly once the market regains direction.

As we showed on Wednesday, Bitcoin is trading only slightly below its fair value relative to the stock market which signals there is no dislocation for crypto.

So as the Fed provides more clarity on policy, we should expect the market to move out of this holding pattern. When that happens, Bitcoin is likely to respond with speed.

Ethereum Still Moves With Bitcoin

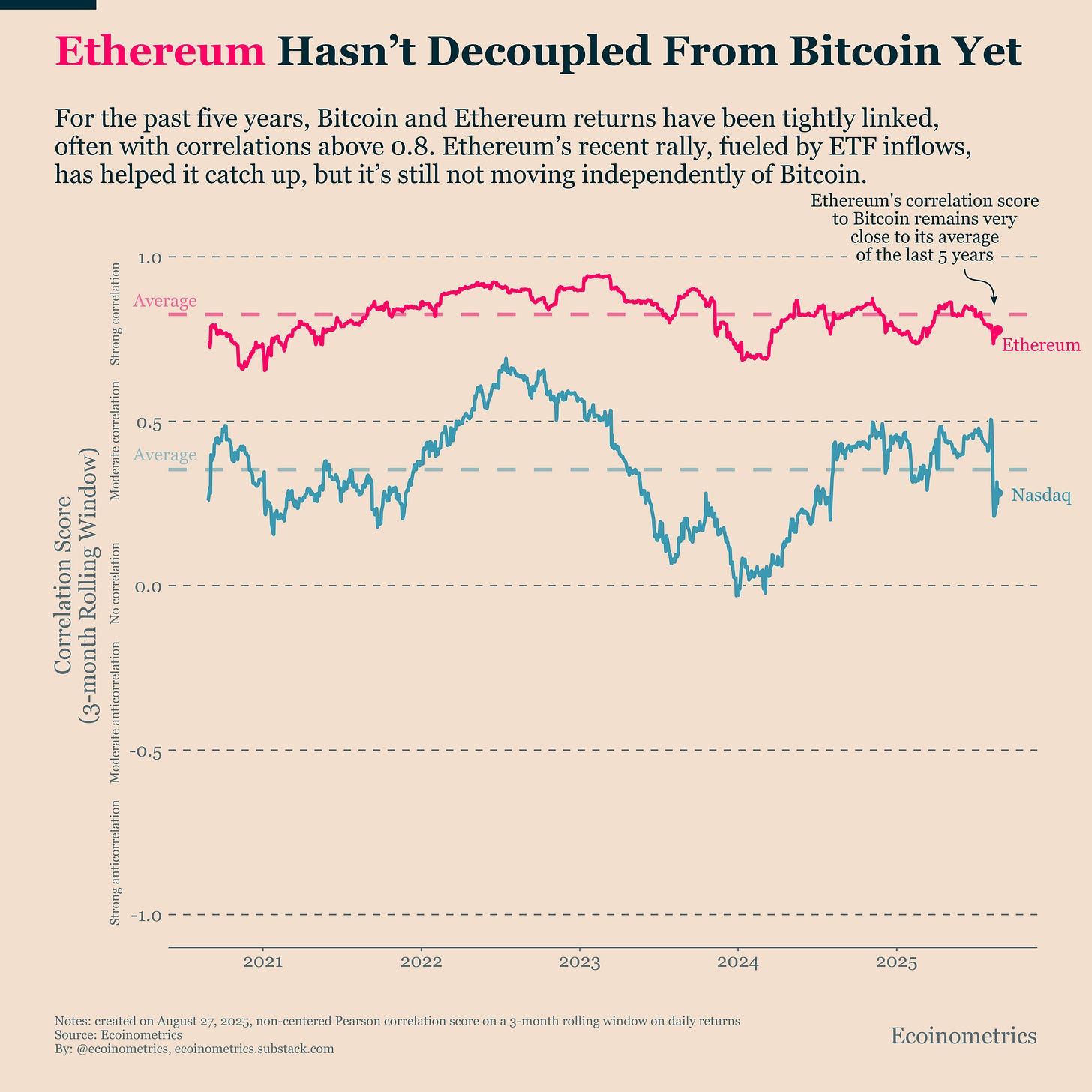

Ethereum has been on a strong run. It made new highs and attracted steady inflows into its ETFs, even while Bitcoin struggled. And the main driver is simple: Ethereum had been underpriced relative to Bitcoin, leaving room for a catch-up trade.

We laid out our case on Monday for why ETH is set up for a catch-up trade and how to measure when it’s nearing fair value.

But catching up doesn’t mean decoupling. Correlations tell the story. For the past five years, Ethereum’s returns have moved closely in line with Bitcoin’s, with correlations often above 0.8. That hasn’t changed. The recent rally hasn’t pulled ETH into independent territory, it’s still tracking Bitcoin’s direction, just with stronger momentum.

A true decoupling would show up as a sustained drop in correlation. Instead, correlations remain stable. That means Ethereum still doesn’t offer much diversification benefit in a portfolio. What’s really different this time is ETF inflows. They’ve given ETH more strength on the upside. But flows are a tactical driver, not a structural break from Bitcoin.

So for now, this move looks like a mean reversion trade. The gap with Bitcoin is still wide, suggesting some room to run. But once that spread closes, Ethereum may need a new narrative to keep outperforming.

Fed’s Choice: Inflation Risk Outweighs Labor Softness

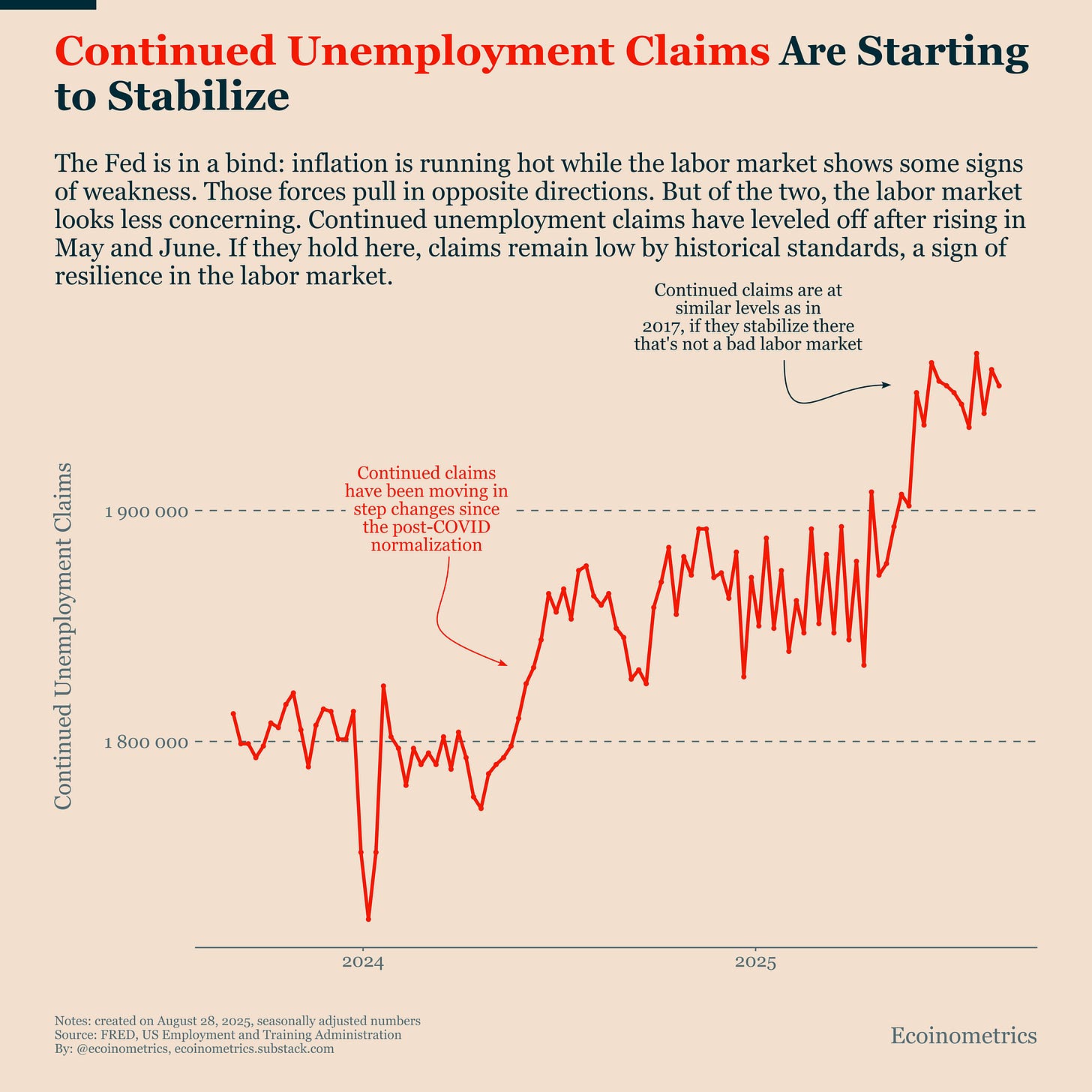

The Fed is in a bind:

Inflation is too high and sticky.

The labor market shows some signs of weakness.

One points to keeping rates high. The other argues for stimulus.

However, when you set aside the political pressure for faster cuts, the case for staying hawkish looks stronger.

The economy isn’t collapsing. Continued unemployment claims rose in May and June, but the increase looks more like a step change than a sustained trend. We’ve seen similar adjustments in 2023, 2024, and now in 2025.

At current levels, claims are still historically low, signalling resilience in the labor market.

Meanwhile, GDP is growing at a healthy 3.3%. That’s hardly an economy in need of emergency support.

Cutting too soon would risk a renewed inflation cycle and, with it, volatility across markets. Maintaining a hawkish stance, by contrast, preserves stability, and for risk assets like Bitcoin, stability is the better long-term outcome.

There’s also the issue of credibility. The Fed can’t afford to undermine its own fight against inflation. By staying patient and leaning hawkish, policymakers reinforce expectations that inflation won’t be allowed to spiral back.

When the market absorbs this reality, uncertainty will fade, and expectations for Fed policy will anchor more firmly. For Bitcoin, patience from the Fed is the least disruptive outcome.

That's it for today. Thanks for reading.

Cheers,

Nick

P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis.

Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions.

Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights.