Reading the FOMC tea leaves: Wall Street is pushing its narrative too far

Is the market priced for perfection?

Is it me or are the financial markets getting ahead of themselves? I mean sure you expect the market to be forward looking to some extent. But is it looking forward to some realistic future?

The last FOMC meeting of 2023 is behind us and the Fed Fund rates is at a level last seen just before the Great Recession. Jerome Powell is still bent on following the data and he has not announced any specific date to start cutting rates.

Yet if you just looked at the market reactions to the FOMC press conference you’d think rate cuts have already happened. So what’s going on?

The Ecoinometrics newsletter gives you insights from crypto and macro data to help you make better investment decisions.

We spend hours every day gathering data, creating metrics and bringing them to life with data visualizations that allow you to quickly get to the heart of things.

We then distill all that knowledge in each issue of the newsletter with less words and more charts so that you get insights, direct to the point, in five minutes or less.

Join more than 21,000 investors here:

Done? Thanks! That’s great! Now let’s dive in.

P.S. Checkout our latest tracker of MicroStrategy Bitcoin holdings at https://www.ecoinometrics.com/microstrategy-bitcoin-holdings-with-charts/.

FOMC meeting aftermath: Wall Street is pushing its narrative too far

The takeaway

The financial markets are gripped by a bad case of irrational certainty about what’s going to happen in 2024:

Inflation is under control.

The economy is going to continue bussin.

The Fed is going to cut rates at least three times.

Meanwhile what comes out of the FOMC meeting is that:

Chairman Powell thinks the US economy has a non-zero probability of entering a recession in 2024.

Chairman Powell thinks inflation is not under control despite the decline.

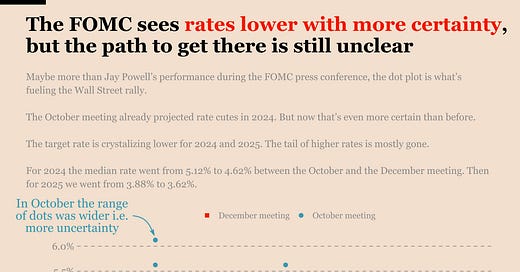

The projection materials are showing lower rates next year. But that’s not new. It is just more probable.

So we have this situation when on one side the message out of the Fed is “We are navigating by the stars under cloudy skies”. And on the other side the markets react with “got it boss, send it”.

That’s getting me worried that the markets are priced for perfection in 2024. Dangerous situation if anything goes wrong in those uncertain times.

Let’s recap.

The market is focusing on rate cuts

Keep reading with a 7-day free trial

Subscribe to Ecoinometrics to keep reading this post and get 7 days of free access to the full post archives.