Strongest Bitcoin ETF Flows Since March

Also Coinbase As A Buying Opportunity And China With Less US Dollars But More Gold

Welcome to the Friday edition of the Ecoinometrics newsletter.

Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets.

Today we'll cover:

Strongest Bitcoin ETF Flows Since March

Coinbase As A Buying Opportunity

China: Less Dollars, More Gold, No Bitcoin

Each topic comes with a small explanation and one big chart. So let’s dive in.

In case you missed it, here are the other topics we covered this week:

If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox:

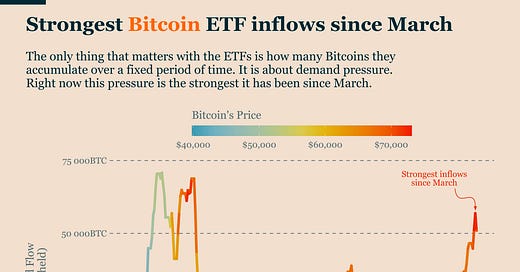

Strongest Bitcoin ETF Flows Since March

Bitcoin ETF flows are the only factor that consistently moves Bitcoin's price beyond daily noise. This has been clear since the ETFs launched earlier this year.

The scale of ETF activity dwarfs all other Bitcoin market movements. These flows provide a strong signal because they directly affect the supply and demand of actual Bitcoin.

The current push toward all-time highs follows this pattern. For months, ETF flows alternated between small outflows and modest inflows, which explains why Bitcoin's price moved sideways since March.

But things have changed. Over the past two weeks, ETFs have purchased about 3,500 Bitcoins per day. That’s the highest buying pressure since March. The impact on price is clear to see.

To understand where the trend is heading, keep watching those inflows.

Coinbase As A Buying Opportunity

Coinbase's stock price is lagging significantly behind Bitcoin's performance.

Coinbase went public right when Bitcoin hit its peak in the last bull market. Great timing for the venture capitalists who sold at IPO, not so great for later investors.

While COIN and Bitcoin prices move together, there's a growing gap between them. COIN is down about 40% since its IPO, while Bitcoin is up more than 10% in the same period. This gap grew mainly during Bitcoin rallies where COIN didn't keep up.

But this doesn't mean Coinbase is a bad investment. In fact, it might catch up to Bitcoin under the right conditions.

Coinbase makes most of its money from trading volume on its exchange. This makes its revenue highly seasonal, following crypto market booms and busts. If Bitcoin enters a new parabolic phase, trading volumes on Coinbase should increase. More importantly, this could revive the broader crypto ecosystem of altcoins and digital assets. Just one quarter of strong activity could dramatically improve Coinbase's financials - and its stock price would likely follow.

Will COIN outperform Bitcoin? That's hard to say. But if Bitcoin makes another push upward, COIN has clear room for growth.

China: Less Dollars, More Gold, No Bitcoin

Bitcoin isn't the only store of value performing well lately. Gold has shown strong returns over the past 12 months with minimal volatility.

A key driver behind gold's performance is the People's Bank of China's two-part strategy:

Selling US bonds

Buying gold

China's exit from US bonds isn't new. The value of US debt held by China has dropped by 40% over the past decade. What is new is their sustained gold buying over the last two years.

This clearly shows China's push to reduce its dependence on the US dollar.

Will China ever switch from gold to Bitcoin as a store of value? Probably not soon. Bitcoin's decentralized nature conflicts with China's vision of a controlled economy.

The dream of major central banks adopting Bitcoin remains just that, a dream.

Meanwhile, Europe's increased interest in US debt has largely offset China's withdrawal. So far, China's exit hasn't threatened the US dollar's position as the global reserve currency.

That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts.

Cheers,

Nick

P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below.

Useful data.

Great summary, thank you!!! ♥️☀️☮️🌈🏁