The Bitcoin Guide Every Financial Advisor Needs

Weekly data-driven insights to help you confidently advise on Bitcoin allocation

Bitcoin is no longer fringe, it’s a $2 trillion asset class with real institutional traction.

If your clients are asking about it, you need answers grounded in data, not hype, and framed for portfolio decisions.

✅ How Bitcoin fits into diversified portfolios across macro regimes

✅ Institutional-grade charts + commentary to use in client conversations

✅ Signals on ETF flows, volatility, and correlation to guide allocation timing

Trusted by 30,000+ investors, including RIAs, portfolio managers, and macro analysts.

Bitcoin’s Value Proposition

A Long-Term Hedge Against Fiat Debasement

In a world of expanding money supply, Bitcoin’s appeal lies in its fixed supply and resistance to monetary debasement.

It has consistently outperformed other asset classes during periods of monetary expansion. And the difference in performance with other assets is extremely significant.

Take the example of the post-COVID M2 money supply which increased by $6T. During that time window Bitcoin outperformed major asset classes during that window:

Bitcoin: +457%

NASDAQ: +84%

Gold: +15%

This is exactly what you can see on the chart below.

Bitcoin isn’t exactly an “inflation hedge” in the textbook sense. Instead, it thrives under financial asset inflation, the outcome of loose monetary policy and expanding liquidity.

In the current environment, tightening conditions and a cautious Fed, Bitcoin’s setup is more challenging.

Read more in our latest macro regime commentary.

Talking Points for Clients:

“Bitcoin is a bet against long-term fiat erosion.”

“It’s not about timing the market, it’s about preparing for monetary distortion.”

“Unlike fiat currencies, Bitcoin’s supply can’t be increased at will.”

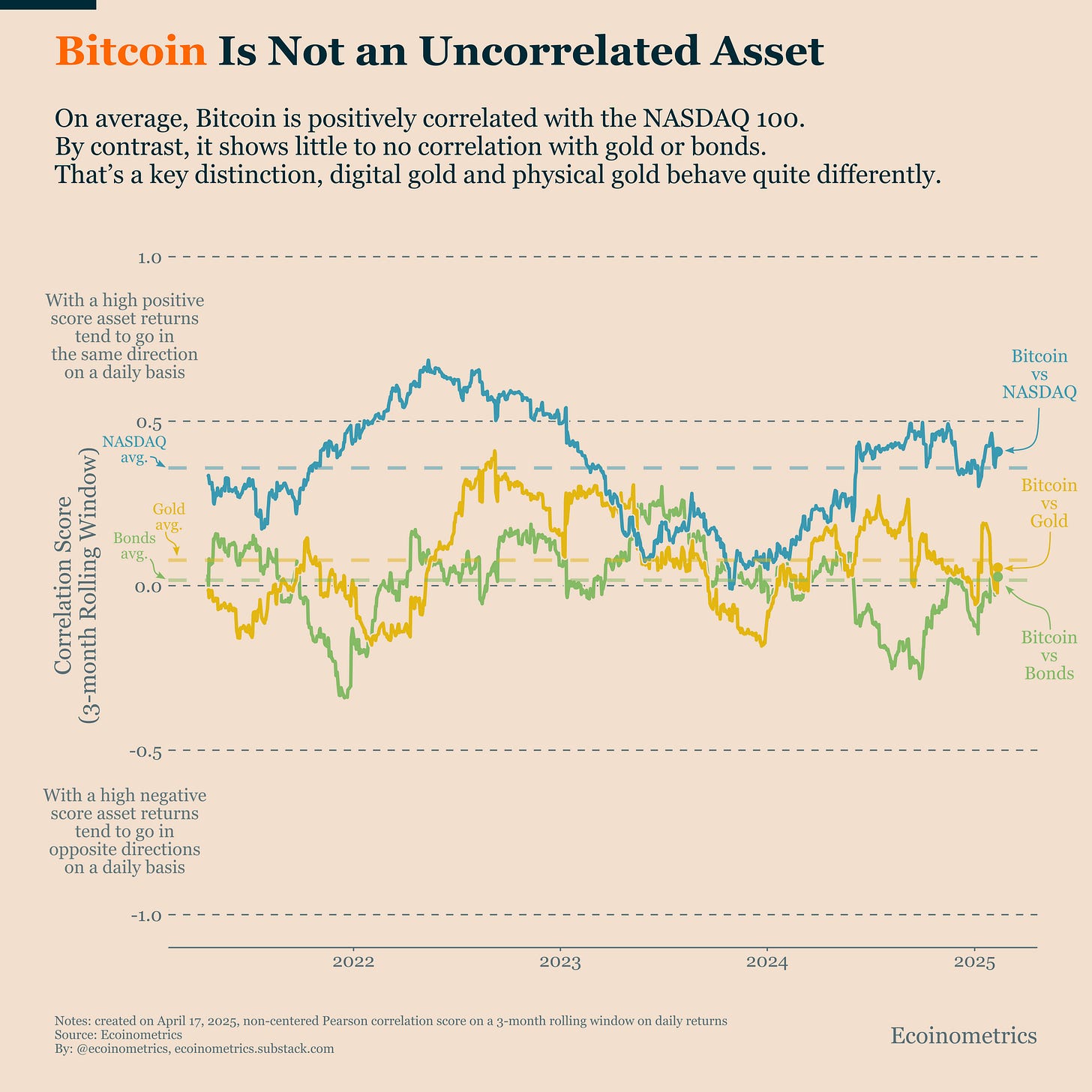

Bitcoin Is Not an Uncorrelated Asset

It Behaves Like a High-Growth Tech Stock

Despite early comparisons to gold, Bitcoin often moves in sync with tech-heavy indices like the NASDAQ 100. During risk-on and risk-off cycles, correlation spikes, especially in macro-driven environments.

If you look at the last five years, the average correlation score of Bitcoin over a 3-month rolling window is:

0.08 versus gold

0.36 versus the nasdaq

0.02 versus treasury bond prices

In today’s environment, the correlation with tech is even stronger, Bitcoin trades like a high-beta extension of the Nasdaq.

Talking Points for Clients:

“Bitcoin is a growth asset, not a safe haven.”

“It doesn’t diversify portfolios like bonds, but it has a different kind of upside.”

“Think of it like tech with a harder monetary profile.”

Want a weekly insight like this delivered to your inbox? Join thousands of other financial professionals for free.

No spam, unsubscribe anytime.

Risk-Adjusted Returns

Volatile, Yes, But Historically Worth It

Over longer timeframes, Bitcoin has delivered strong risk-adjusted returns. While short-term volatility is high, the Sortino ratios often outshine traditional assets.

2024 was a good year for growth and gold. Yet Bitcoin still outperformed across both absolute returns and Sortino ratio.

Historically, when macro tailwinds favour growth assets, Bitcoin amplifies those returns. It doesn’t just keep up, it leads.

Talking Points for Clients:

“Risk-adjusted, Bitcoin has outperformed most asset classes.”

“A small allocation improves the overall return-to-risk tradeoff.”

“We’re not betting big, just tilting the odds.”

Portfolio Allocation Impact

Adding Hard Assets to a 60/40 Portfolio: Gold vs. Bitcoin

Take a look at the next chart, it compares the performance of three portfolios over a 12-month period ending in April 2025:

A standard 60/40 portfolio using SPY (equities) and TLT (long-duration Treasuries), with dividends reinvested and no rebalancing.

A 60/30/10 portfolio where 10% of the bond exposure is shifted to GLD (gold ETF).

A 60/30/10 portfolio with that same 10% allocated to Bitcoin.

This period includes three distinct macro regimes: moderate growth, a post-election rally, and a policy-driven correction. Both hard asset allocations outperformed the traditional 60/40 in total and risk-adjusted returns:

Gold reduced drawdowns more effectively.

Bitcoin delivered stronger upside during bullish phases.

Sharpe ratios for the gold and Bitcoin portfolios were nearly identical (~0.78), suggesting that the choice depends on the macro outlook and your client’s tolerance for volatility.

More details with respect to the current outlook for Bitcoin in this edition of the newsletter.

Talking Points for Clients:

“Bitcoin and gold both improved a 60/40 portfolio over the last year.”

“Gold gave more downside protection. Bitcoin delivered more upside.”

“The right choice depends on the macro backdrop and your risk tolerance.”

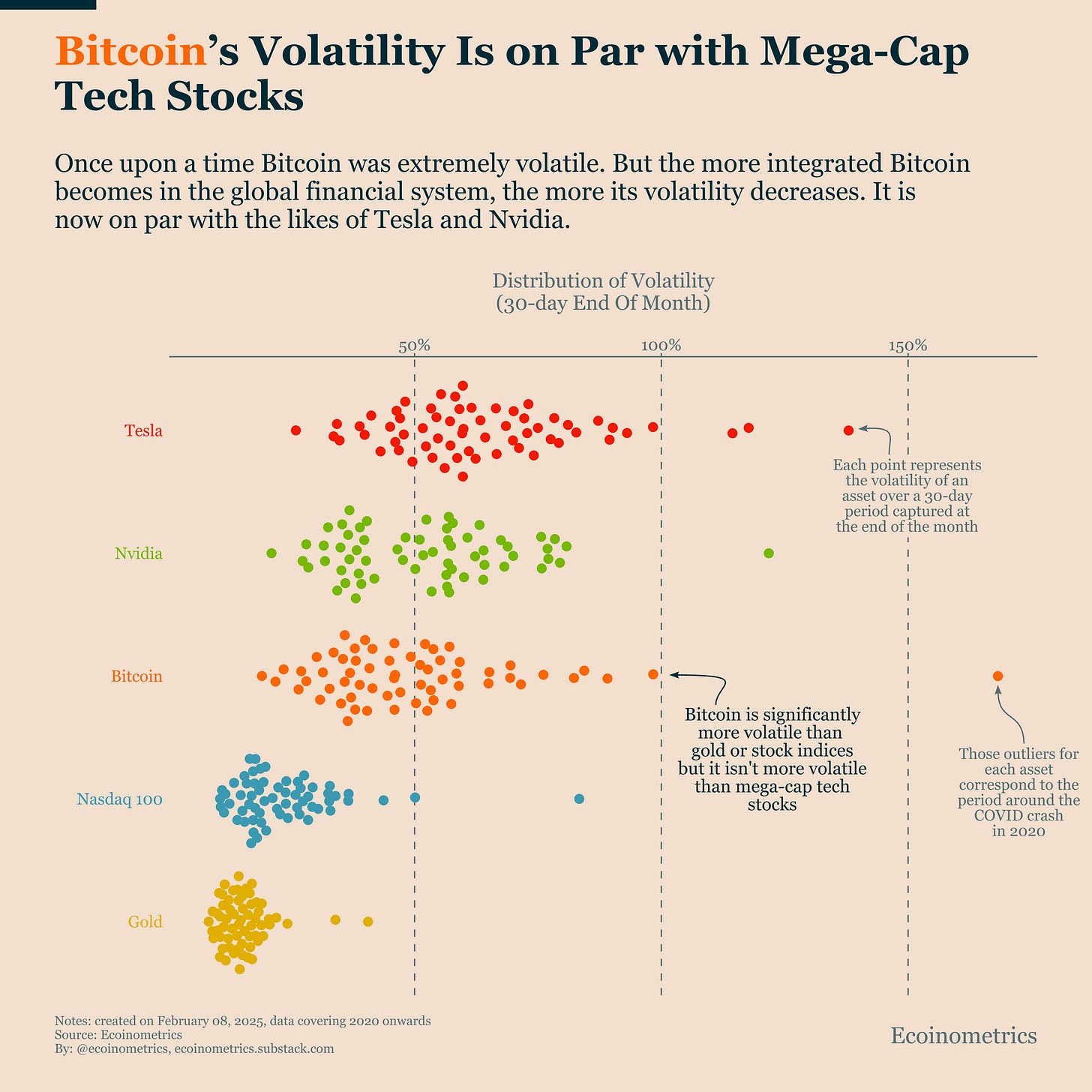

Volatility in Perspective

High, But Not an Outlier in Growth Portfolios

Bitcoin’s volatility is real, but not unique. It compares to assets like Tesla or Nvidia in terms of 30-day realized volatility. Volatility should be framed in the context of growth, not instability.

For advisors, the takeaway is simple: Volatility is not disqualifying, it’s manageable, especially with allocation sizing.

Talking Points for Clients:

“Volatility isn’t inherently bad, tech stocks are volatile too.”

“Volatility creates opportunity. That’s why we size Bitcoin allocations modestly.”

“We use the same framework here as with other growth assets.”

Bitcoin as a Mainstream Asset

$2 Trillion Market Cap. $40B+ in ETF Inflows.

Bitcoin is no longer fringe. With a market cap around $2T and Bitcoin spot ETFs pulling in over $40B in 2024, institutional adoption is real. The BlackRock Bitcoin ETF is nearly as large as GLD and it got there in one year.

This marks a massive shift: Bitcoin is no longer the domain of early adopters. It’s in institutional portfolios, and it’s shaping price action.

Our ETF Flows Model tracks this in real time and is one of our most referenced tools by professional readers.

Talking Points for Clients:

“Bitcoin isn’t a toy, it’s now a top-10 global asset.”

“Institutions are already here. We’re helping you follow, not lead.”

“This isn’t about speculation. It’s about strategic inclusion.”

Quick-Reference Checklist

Value Proposition: Hedge against fiat debasement. Fixed supply.

Correlation: Behaves like tech, not gold.

Returns: Strong Sortino ratios over time.

Portfolio: Bitcoin added to a classic portfolio improves risk-adjusted returns.

Volatility: High, but normal for growth-oriented assets.

Legitimacy: $2T cap, $40B ETF inflows, institutional traction.

Stay Ahead of the Curve

Bitcoin is evolving faster than any other macro asset. Advisors who stay informed—on macro trends, flows, volatility, and positioning—will lead the conversation and build trust with clients.

That’s what Ecoinometrics delivers.

What You Get When You Subscribe:

Weekly institutional-grade macro and Bitcoin reports

Proprietary data models and chart commentary

Clear, concise insights you can reuse with clients

No fluff. Just signal. Built for professionals.

Frequently Asked Questions

I already get macro insights from podcasts and Twitter. Why do I need Ecoinometrics for this?

Most free content is opinion. Ecoinometrics is built around original data models, like our Bitcoin ETF flows tracker and market regime framework, that help you make decisions and explain them to clients. You’ll stop guessing and start backing your opinions with numbers.

Will this help me in client conversations?

Yes. Every issue includes 3–5 actionable charts and clear commentary you can use to:

Answer client questions with confidence

Frame Bitcoin in terms of risk, return, and portfolio fit

Stay ahead of market narratives

Think of it as a weekly prep tool for client meetings.

Can I use the charts in client-facing materials?

Our content is for professional use only, but we know compliance matters. Each issue includes charts and language that many advisors adapt for:

Internal investment memos

Client discussions (with compliance review)

Strategy decks

We’re happy to provide compliance-safe summaries if needed.

Is this just for Bitcoin believers?

Not at all. Our focus is macro trends that affect Bitcoin (liquidity, flows, Fed policy) and how they connect to traditional assets like equities, gold, and bonds. Even if you’re just monitoring Bitcoin for now, this helps you understand how it fits in the bigger picture.

Is it really worth $300/year?

One client win or retention pays for the year many times over.

If you’re still unsure, subscribe for free now and redeem a free 7-day trial on any paywalled article to get access to everything. Try it and see the difference.