The ETH vs BTC cycle: what it means for rebalancing your portfolio

Exploring the Bitcoin vs Ethereum dynamic

If you are like me, you have both Bitcoin and Ethereum as part of your portfolio. Or maybe you are trading ETH/BTC pair on a regular basis.

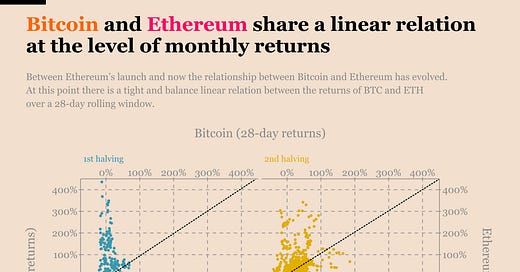

Regardless of the details we are dealing with two assets which are at the same time strongly correlated on a daily returns basis and following the same trend if you zoom out at the multi-months scale.

What that leaves us with is the relationship between Bitcoin and Ethereum over the scale of say one month. How tight is it? When is ETH outperforming BTC? And how can you use that to update the structure of your portfolio?

Note: Today's issue of the newsletter is inspired by a reader question, "should you try to be smart when rebalancing your crypto portfolio?" If you have questions don't hesitate to ask.

The Ecoinometrics newsletter gives you insights from crypto and macro data to help you make better investment decisions.

We spend hours every day gathering data, creating metrics and bringing them to life with data visualizations that allow you to quickly get to the heart of things.

We then distill all that knowledge in each issue of the newsletter with less words and more charts so that you get insights, direct to the point, in five minutes or less.

Join more than 20,000 investors here:

Done? Thanks! That’s great! Now let’s dive in.

P.S. Checkout our latest tracker of MicroStrategy Bitcoin holdings at https://www.ecoinometrics.com/microstrategy-bitcoin-holdings-with-charts/.

The ETH vs BTC cycle: what it means for rebalancing your portfolio

The takeaway

From looking at the dynamic between Bitcoin and Ethereum there are two smart things you can do to rebalance your portfolio of BTC and ETH holdings.

At the multi-year time scale scaling into Ethereum when the bull market gets going and out of it at the first sign of a correction will help grow your pie faster.

But at the monthly time scale there are also oscillations where BTC and ETH trade strength. Using those inflection points gives you opportunities to rebalance more often.

Now let’s look at the data to back it up.

Why rebalancing

Keep reading with a 7-day free trial

Subscribe to Ecoinometrics to keep reading this post and get 7 days of free access to the full post archives.