Welcome to the Friday edition of the Ecoinometrics newsletter.

Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets.

Today we'll cover:

The Ethereum Curse

The MicroStrategy Risk

The Un-inverted Yield Curve

Each topic comes with a small explanation and one big chart. So let’s dive in.

In case you missed it, here are the other topics we covered this week:

Checkout the Bitcoin Market Monitor to understand what’s driving the market in just five charts:

Read the Bitcoin Market Forecast for the probabilities of key scenarios and the essential risk metrics to manage your portfolio:

If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox:

The Ethereum Curse

Ethereum hasn't caught a break in 2024. A clear pattern keeps repeating:

When Bitcoin rises, ETH rises too but much more slowly

When Bitcoin falls, ETH falls faster and harder

The chart shows the total returns of BTC and ETH since the 2022 bear market bottom. This pattern appears consistently throughout the period.

The situation got worse after the Bitcoin ETFs launched. Even the introduction of Ethereum ETFs failed to help ETH's performance.

The core issue? Ethereum's price movements now depend almost entirely on its correlation to Bitcoin.

There's no compelling narrative driving investors toward Ethereum on its own merits. The ecosystem is quiet: no return of the ICOs, no DeFi innovations, no NFT revival, and Web3 gaming remains dormant.

Without a strong independent narrative, ETH's best hope lies in the traditional alt coin season. This usually happens when crypto investors take profits from Bitcoin and move into riskier assets seeking higher returns.

We're not at that stage yet.

The MicroStrategy Risk

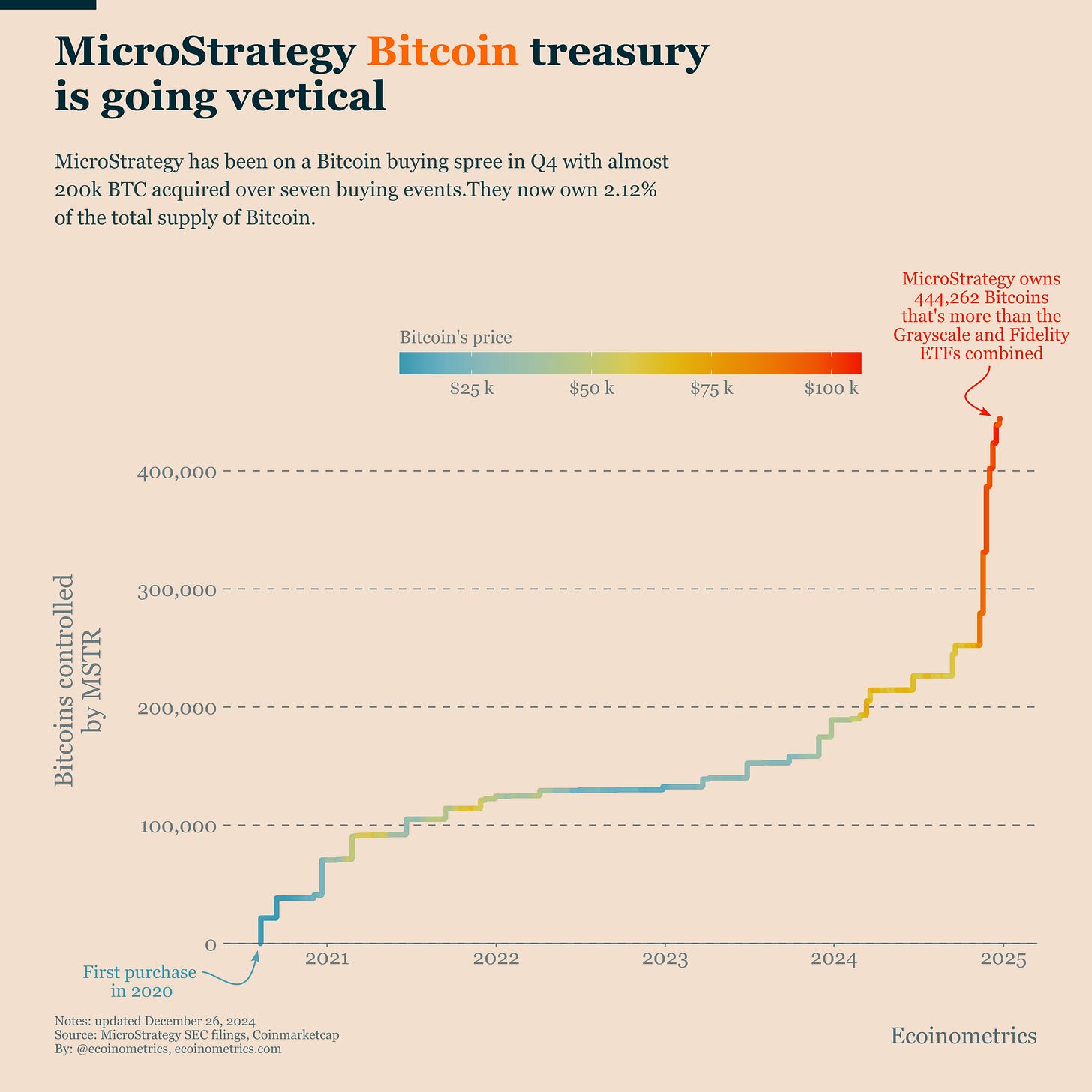

MicroStrategy went on a major Bitcoin buying spree in Q4.

They purchased almost 200,000 Bitcoins across seven buying events, and now control 2.12% of the total supply.

To put this in perspective: MicroStrategy holds more Bitcoin than the Grayscale and Fidelity ETFs combined.

While these coins are currently profitable for MicroStrategy, their debt-financed buying strategy raises concerns.

Various analysts have calculated different Bitcoin price points where MicroStrategy might need to sell coins to cover their debts.

With control of 2.12% of the supply, any forced selling would impact the market in two ways:

The measurable effect of large-scale selling

The psychological impact of seeing a major "diamond hands" holder forced to sell

Using our Bitcoin ETF flows model as a reference, if MicroStrategy sold just 10% of their holdings over 30 days, it could create an average -18% headwind for Bitcoin's price. While this estimate has large error margins since we haven't seen major ETF outflows yet, it shows the potential impact.

This selling pressure would likely coincide with an already declining market, after all, that's what would trigger MicroStrategy's need to sell in the first place.

MicroStrategy's size has become a genuine market risk. While everyone wants more Bitcoin, there's a point where aggressive accumulation might hurt both the company and the wider ecosystem.

The Yield Curve is Basically Un-inverted

The yield curve has finally returned to a normal state. After four years we are back to where we were before COVID hits, long-term yields are once again higher than short-term yields.

What's different this time? Current rates sit about 3 percentage points higher than before the COVID crisis.

Despite these higher rates, financial markets remain stable.

Historically, an inverted yield curve warns of an upcoming recession. But we've now gone well beyond the typical time gap between curve inversion and recession.

Even more striking: the period when the yield curve un-inverts typically carries the highest recession risk. Yet right now, we see few signs that the US economy is headed for trouble.

True, the Federal Reserve hasn't completely tamed inflation. But it is way down already and they have managed to avoid crashing the economy in the process.

While we should always watch for recession signals, the current outlook remains positive.

That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts.

Cheers,

Nick

P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below.

I really appreciate your work overall, but I gotta say that the section on MSTR is pretty weak. Given that over 80% of their debt is already slated to convert to stock the real risk is the dilution of the current shareholders and not the broader BTC market. The best analysis of the forced liquidation risk for the Microstrategy show that Bitcoin would have to drop below 20k for this to happen.

MicroStrategy would not be forced to sell its Bitcoin holdings due to its current financial structure. Unlike some past scenarios where its debt was secured by Bitcoin, MicroStrategy's recent debts are unsecured, meaning there's no direct collateralization of Bitcoin that would trigger automatic liquidation at a certain price point. However, the company could face pressure to sell if Bitcoin's price drops significantly, particularly if it needs to manage its debt obligations or if there's a severe economic downturn affecting its financial health.

Here are some key points:

- **Unsecured Debt**: MicroStrategy's current debt, as of late 2024, is largely unsecured, which means there are no conditions tied to Bitcoin's price that would force a sale of its holdings.

- **Debt Management**: While there isn't a specific liquidation price, a prolonged bear market could pressure MicroStrategy to sell Bitcoin to manage its approximately $7 billion in debt, which matures over several years. However, this would be a strategic choice rather than a forced liquidation at a specific price.

- **Market Perception**: If Bitcoin were to fall dramatically, say to levels like $16,500 as suggested by some analyses, market sentiment and investor confidence could lead to a situation where MicroStrategy might consider selling to stabilize its financial position or to avoid potential bankruptcy, although this is speculative and not based on any current debt covenant.

- **No Specific Trigger Price**: There is no exact price point at which MicroStrategy must sell its Bitcoin; it's more about broader financial strategy and market conditions.

It's important to note that these insights are based on available data and market analyses as of the last updates in 2024, and no specific price can be definitively stated as a "sell" threshold for MicroStrategy's Bitcoin holdings.[](https://protos.com/what-is-microstrategys-bitcoin-liquidation-price/)