This is not a Bitcoin problem

Also the miners haven’t had their moment and how high are interest rates

Welcome to the Friday edition of the Ecoinometrics newsletter.

Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets.

Today we'll cover:

This is not a Bitcoin problem.

The Bitcoin miners haven’t had their moment yet.

How high are interest rates really?

Each topic comes with a small explanation and one big chart. So let’s dive in.

In case you missed it, here are the other topics we covered this week:

If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox:

This is not a Bitcoin problem

Bitcoin is boring.

If you have been hodling since 2016 of course a couple of months with no action is nothing. But I can understand why a lot of people are getting nervous. It is all about the contrast.

Thanks in big part to the ETFs Bitcoin had a very good start of the year. And since then nothing. So it feels natural to ask if there is a problem with Bitcoin.

The answer is no. This is not a Bitcoin problem. This is a risk assets problem.

If you are not convinced look at the price action of Bitcoin and the NASDAQ 100 side by side. Since March:

Bitcoin down -2.3%.

NASDAQ 100 down -1.1%.

Same range bound movements.

What are risk assets waiting for? The return of global liquidity.

When we get that Bitcoin will find a new reason to rally.

The Bitcoin miners haven’t had their moment yet

But enough talking about the performance of Bitcoin over the last couple of months.

Let’s zoom out and look at Bitcoin since the bottom of the bear market. It is up +290%. By comparison the average Bitcoin miner stock is up +200% over the same period.

That’s a bit disappointing.

During the previous bull markets the miners generates 10x, 20x and more times the returns of BTC. That was the result of a lot of cash chasing a small market of stocks that could give exposure to Bitcoin.

In 2024 the situation is not that different. The miners stocks still don’t have a very large market cap. And we still don’t have that many stocks that can give you exposure to Bitcoin. So we’d expect the miners to be a good bet again.

The only question is how much liquidity are the ETFs going to take away from the miners.

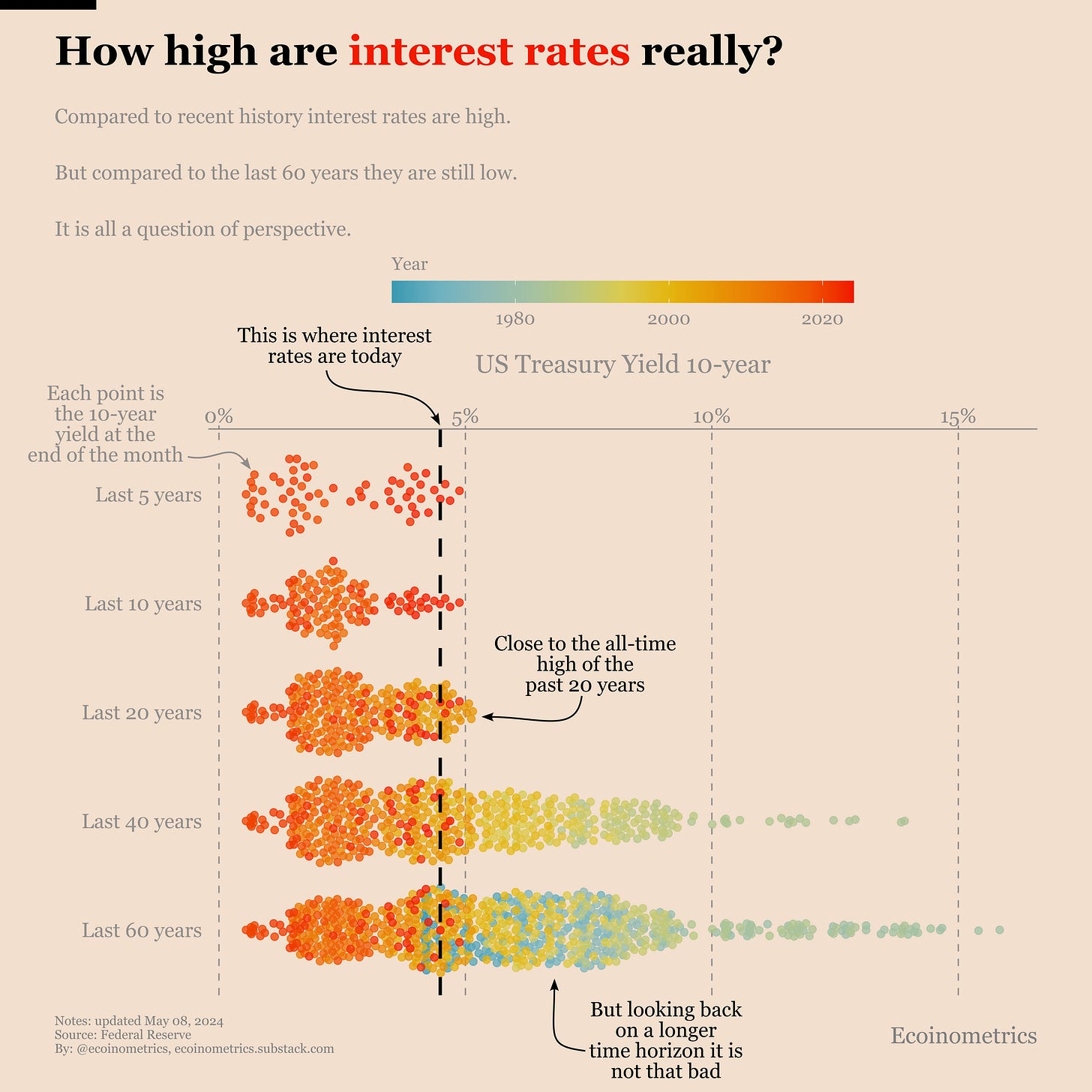

How high are interest rates really?

Since the Federal Reserve initiated the most aggressive rate hike sequence in history back in 2022 interest rates have been high.

But how high really? I mean historically speaking.

I only started my career after 2008. So I never experienced first hand a financial regime with interest rates higher than they are now.

But if you go back 40 years the current interest rates are actually pretty average. And if you extend the look back period to 60 years, interest are currently on the low end of the distribution.

So “high interest rates” is relative.

Now the economic situation in 2024 is not the same as 60 years ago. There is a lot more debt in the system which means that higher interest rates bites harder.

That’s especially true if you are the US government. When the debt grows exponentially and interest rates are climbing you end up spending a lot on interest payments.

That’s the number one reason why you can expect the debasement rate of the US$ to accelerate in the years to come.

That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts.

Cheers,

Nick

P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below.