Tough Year For The Bitcoin Miners

Also Gold Standing Its Ground Against BTC and Financial Conditions Heading Looser

Welcome to the Friday edition of the Ecoinometrics newsletter.

Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets.

Today we'll cover:

Tough Year For The Bitcoin Miners

Gold Standing Its Ground Against BTC

Financial Conditions Heading Looser

Each topic comes with a small explanation and one big chart. So let’s dive in.

In case you missed it, here are the other topics we covered this week:

If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox:

Tough Year For The Bitcoin Miners

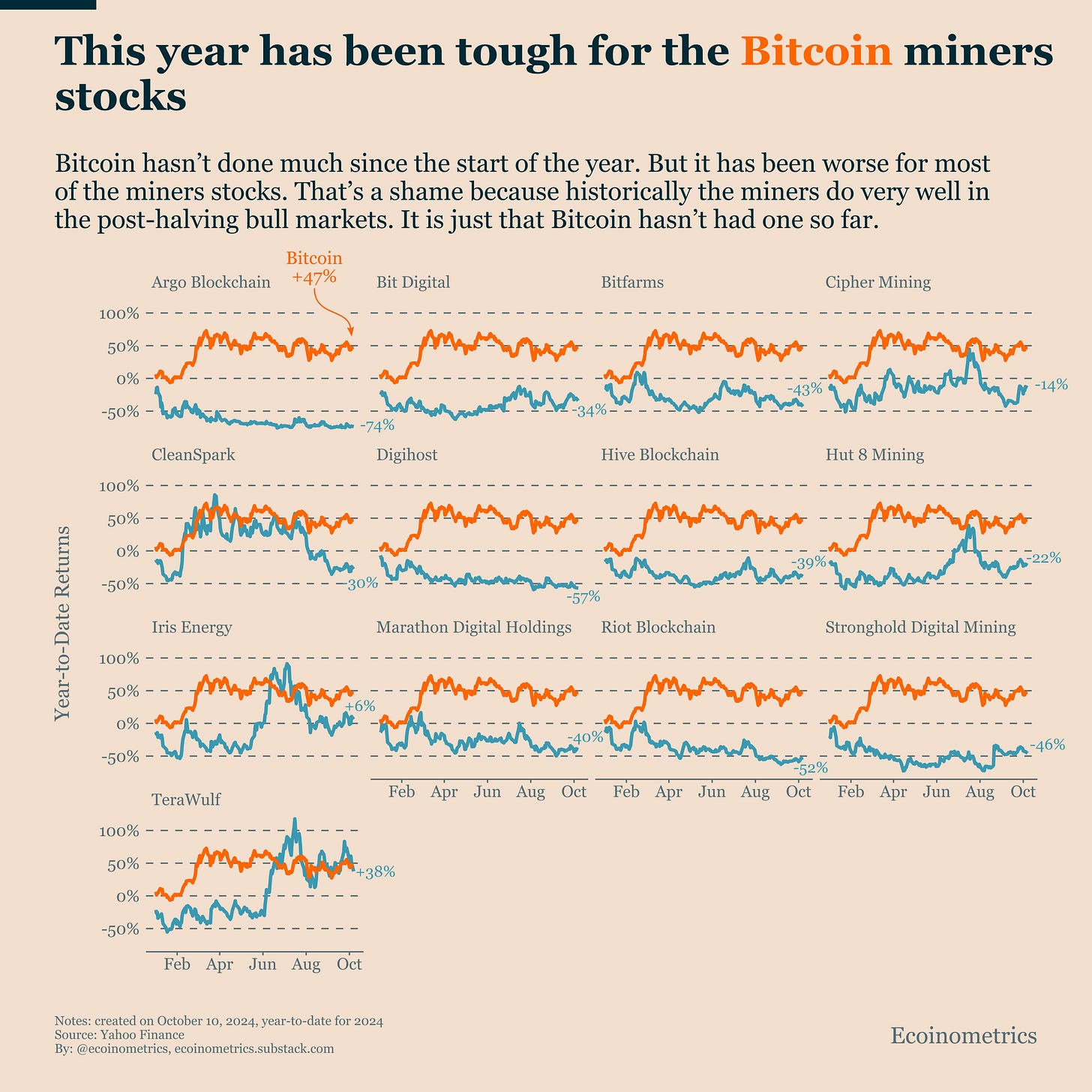

Bitcoin hasn't moved much since the start of the year. It's up about 50% year-to-date, but that's mostly due to the ETF launch. Since then, it's been flat or slowly trending down since March.

But things could be worse. Just look at Bitcoin miners. Their performance this year has been disappointing:

All are underperforming Bitcoin.

Most have negative returns.

This isn't what we expected when we started looking at miners' stocks as a buying opportunity for the next bull market.

Typically, miners do very well in post-halving bull markets. They often outperform Bitcoin significantly.

The issue? We haven't had a post-halving bull market yet.

So it's not that Bitcoin miners are bad stocks. We just haven't seen the right conditions for them to shine. If you can wait for the bull market to start (which isn't close right now), they could still be a good deal.

Even the largest of these stocks are exploring interesting ways to boost their long-term value.

Gold Is Standing Its Ground Against Bitcoin

Every four years since Bitcoin's launch, we've seen a pattern. Global liquidity expands rapidly, often aligning with Bitcoin halving events. This has led to Bitcoin's price exploding upward every four years.

Gold, the traditional store of value, doesn't follow this pattern. The chart shows how many ounces of gold one Bitcoin buys over time. It started at almost nothing, grew to one ounce, then 11 ounces, and peaked at 34 ounces during the COVID-19 monetary expansion in 2021/2022.

But progress has stalled since then. This year, Bitcoin has lost value relative to gold, dropping from 32 ounces per BTC to 24 ounces today.

Why? Bitcoin is stuck in a price range while gold has grown steadily for the past 12 months.

You might expect both gold and Bitcoin, as store-of-value assets, to react similarly to macro drivers. So why is only gold rising?

The past 12 months haven't seen increased global liquidity or a return to monetary expansion. This means Bitcoin's lack of growth isn't the anomaly, gold's steady rise is.

A big reason for gold's growth is China's buying spree. The People's Bank of China has been purchasing gold for almost two years. This fits the usual story of foreign central banks buying hard assets to reduce dependence on the US dollar.

Unsurprisingly, the PBoC isn't openly interested in buying Bitcoin. This explains the recent pattern we've seen.

We're still waiting for the return of global monetary expansion to boost Bitcoin.

Financial Conditions Are Heading Looser

The National Financial Conditions Index, which tracks the tightness or looseness of US financial conditions, has been ahead of the Fed for the past couple of years.

Financial conditions started to tighten long before the Federal Reserve began its rate hike sequence in 2022. Similarly, these conditions didn't wait for the Fed to start cutting rates before loosening again. By the time of the first rate cut in September 2024, financial conditions were already back to the pre-COVID range, which is considered historically loose.

This suggests the National Financial Conditions Index is leading US monetary policy by a significant margin. We should pay attention to it as a predictor of financial market conditions in the coming months.

So what’s the trend for the financial conditions?

Currently, the answer is: loose and getting looser. The rate of decline has slowed in 2024, but the US is now approaching the bottom of the pre-COVID range of financial conditions.

If this loosening happens slowly, it won't necessarily boost Bitcoin. But as long as the conditions don’t go the other way, that’s supportive of a potential bull market. We are just missing a catalyst.

That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts.

Cheers,

Nick

P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below.