Wall Street is waking up to the inflation problem, but is it enough to turn the trend around

Financial conditions vs the Federal Reserve

The first FOMC meeting of the year is next week. The odds of a rate cut happening there are basically zero.

But despite the Fed Funds rate being the highest in 2007 years the real financial conditions continue to ease. That’s because Wall Street doesn’t believe in higher rates for longer and it also doesn’t believe in a recession in a short term.

But the way inflation is going, the financial markets might have to adjust. So where are the macro winds blowing?

The Ecoinometrics newsletter gives you insights from crypto and macro data to help you make better investment decisions.

We spend hours every day gathering data, creating metrics and bringing them to life with data visualizations that allow you to quickly get to the heart of things.

We then distill all that knowledge in each issue of the newsletter with less words and more charts so that you get insights, direct to the point, in five minutes or less.

Join more than 21,000 investors here:

Done? Thanks! That’s great! Now let’s dive in.

P.S. if you want more charts checkout Ecoinometrics.com, we update it with new crypto and macro charts several times a week.

Wall Street is waking up to the inflation problem, but is it enough to turn the trend around

The takeaway

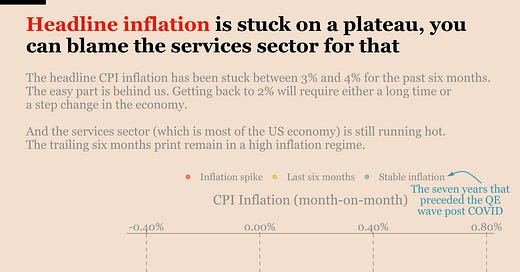

Inflation, lead by the services sector, is not going back to its pre-COVID regime.

More effort needs to be made or a lot more time needs to pass to get to the "good old 2% regime".

The financial markets are waking up to that fact by slowly correcting their expectations for aggressive rate cuts in 2024.

But financial conditions are now looser than before the Federal Reserve started this rate hike sequence. And those conditions are getting even looser.

That's good for Bitcoin and risk assets in general but you need to be cautious about a reversal of the financial conditions.

Such a change could signal that the market is sniffing a recession or a systemic issue with inflation.

That's something we'll be tracking week on week.

Inflation is not going away

Keep reading with a 7-day free trial

Subscribe to Ecoinometrics to keep reading this post and get 7 days of free access to the full post archives.