The Federal Reserve has finally delivered the rate cuts the market expected. The 50bps cut is significant, and likely not the last one this year.

What can we expect for Bitcoin's price now that we've entered a new phase of monetary policy?

The Ecoinometrics newsletter gives you insights from crypto and macro data to help you make better investment decisions.

We spend hours every day gathering data, creating metrics and bringing them to life with data visualizations that allow you to quickly get to the heart of things.

We then distill all that knowledge in each issue of the newsletter with less words and more charts so that you get insights, direct to the point, in five minutes or less.

Join more than 24,000 investors here:

Done? Thanks! That’s great! Now let’s dive in.

What Does The FOMC Meeting Mean For Bitcoin?

The Takeaway

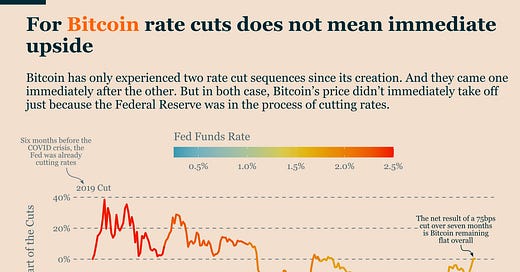

The Fed's 50bps rate cut signals a policy shift, with more cuts expected. While initially positive for Bitcoin, historical data urges caution.

The Fed aims for a 'new normal' of higher rates, not pre-COVID levels. This creates uncertainty for Bitcoin, which may continue rising short-term but faces potential economic headwinds. The Fed's balance between inflation control and recession avoidance will be key for Bitcoin's future.

In these complex conditions, investors should remain vigilant.

What Is The Federal Reserve Planning?

Keep reading with a 7-day free trial

Subscribe to Ecoinometrics to keep reading this post and get 7 days of free access to the full post archives.