In 2025, if you’re a public company trying to boost your stock price, there are two playbooks:

Generate strong cash flow and return capital through share buybacks.

Or lean into financial engineering to accumulate as much Bitcoin as possible.

The second strategy is gaining traction and fast. That has two important consequences for investors:

It’s creating a new source of structural demand for Bitcoin.

It’s turning some public companies into leveraged Bitcoin proxies.

Let’s break that down.

Ecoinometrics delivers professional-grade crypto and macro analysis to help institutional investors and serious traders make data-driven decisions.

Our team conducts rigorous quantitative research, developing proprietary metrics and institutional-quality visualizations that cut through the noise to reveal key market dynamics.

Each newsletter provides clear, actionable insights backed by data, delivered in a concise format that respects your time, five minutes to absorb, but deep enough to inform your investment strategy.

Join over 32,000 professional investors and fund managers:

Ready? Let's dig into the data.

Why Some Public Companies Are Turning Into Bitcoin Funds

The Takeaway

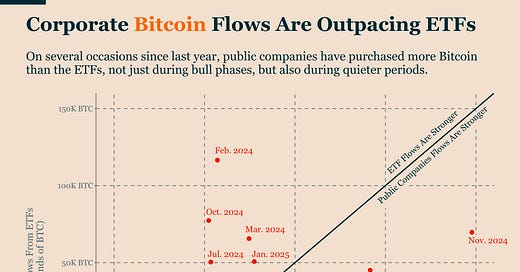

Public companies are turning Bitcoin treasuries into a core strategy. Their buying now rivals and sometimes exceeds ETF flows, creating a structural source of demand.

Keep reading with a 7-day free trial

Subscribe to Ecoinometrics to keep reading this post and get 7 days of free access to the full post archives.