Bitcoin Accumulation: Public Companies Are Catching Up to ETFs

Also Persistent Bitcoin ETF Inflows Signal Bullish Regime & Tariff-Driven Inflation Keeps the Fed on Alert

Welcome to Ecoinometrics' Friday edition.

Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis.

Today we'll cover:

Bitcoin Accumulation: Public Companies Are Catching Up to ETFs

Persistent Bitcoin ETF Inflows Signal Bullish Regime

Tariff-Driven Inflation Keeps the Fed on Alert

Together, these charts highlight a key dynamic: Bitcoin is benefiting from structural demand, both corporate and institutional, at the same time the macro backdrop remains uncertain. Understanding how these forces interact is critical for positioning in the weeks ahead.

In case you missed it, here are the other topics we covered this week:

Essential Decision-Making Tools

Bitcoin Market Monitor - Key Drivers in Five Charts:

Bitcoin Market Forecast - Probability Scenarios & Risk Metrics:

Get these professional-grade insights delivered to your inbox:

Bitcoin Accumulation: Public Companies Are Catching Up to ETFs

Public companies are starting to match, and even outpace, the Bitcoin ETFs in terms of accumulation.

Over the past three quarters, including the current one, public firms with active Bitcoin treasury strategies have collectively added more Bitcoin to their balance sheets than spot ETFs.

This group is less diverse than the ETF investor base. MicroStrategy still accounts for the lion’s share. But what’s new is that a growing number of companies, roughly a dozen, are now following the same playbook at their own scale.

It is also important to note that the dynamics behind corporate and ETF flows differ. ETFs are flow-driven by investor sentiment and portfolio rotations. Corporate treasuries, on the other hand, act more like programmatic buyers, less sensitive to short-term price moves (more on that here). But both sets of flows reduce liquid supply, and that has implications for price.

This is a relatively new trend which took off in Q4 2024. So the open question is whether public companies beyond MicroStrategy can continue accumulating Bitcoin at scale, and whether they do it with the same consistency.

Either way, the story has shifted. Compared to the previous years, corporate accumulation is no longer a one-company phenomenon.

For investors, this marks the emergence of a second structural demand channel. ETFs created an institutional wrapper. Corporates are now building long-duration positions that may be even less reactive to market volatility. That makes them important to monitor.

Persistent Bitcoin ETF Inflows Signal Bullish Regime

Bitcoin has pulled back from its all-time high, but the strong flow dynamics that helped drive it there haven’t disappeared.

True, the 30-day rolling net inflows are stagnating. But they remain above 60K BTC, a level our model associates with a high likelihood of continued price appreciation.

Equally important: over the past month, there have been only three days of outflows. The rest has been a steady streak of inflows, day after day. That’s the same kind of behaviour we saw in Q4 2024, when a wave of capital rotated into Bitcoin, especially following Trump’s election win.

That flow regime eventually broke down. First, the Fed started signaling a slower pace of rate cuts in late December. Then came the trade policy shocks that sparked the “tariff tantrum” earlier this year.

Now, if macro sentiment doesn’t deteriorate again, we could see this pattern of strong, persistent ETF demand continue and that’s the kind of setup that historically leads to a large upside.

This is a good time to watch the flows more than the headlines (flows are updated daily in the Bitcoin Market Monitor). If ETF inflows stay sticky, price pressure will likely follow. The playbook from Q4 2024 is still in motion.

Tariff-Driven Inflation Keeps the Fed on Alert

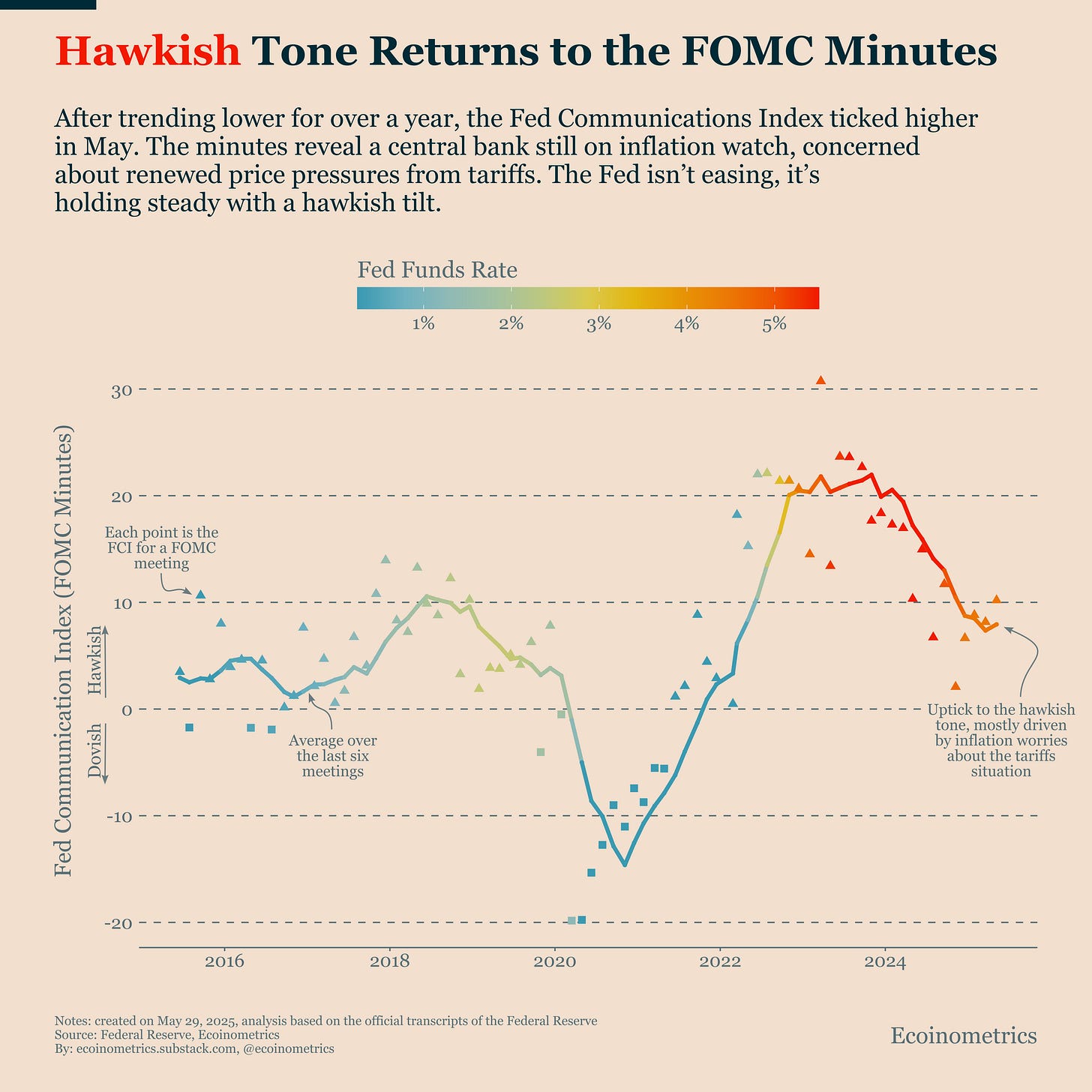

This week, we got the minutes from the May 7 FOMC meeting, and they offered a clearer, firmer message than what Jerome Powell delivered at the press conference.

At the time, Powell struck an unusually soft tone. When we ran that speech through our Fed Communications Index (FCI), the result came in slightly on the dovish side, neutral at best.

That tone was mainly due to two things:

Powell placed less emphasis than usual on inflation.

He highlighted the downside risks from tariffs and macro uncertainty.

But the actual FOMC minutes told a different story.

They reaffirmed that the Fed remains focused on inflation. The committee flagged new price pressures stemming from tariffs and noted that recent upside surprises in inflation data could keep expectations elevated. Multiple participants warned that if inflation stays sticky, they may have to keep policy tight for longer.

So when we ran the minutes through the FCI, the result was firmly hawkish, though not extreme. It suggests a Fed that’s holding steady with a clear inflation bias. In other words, they’re not looking to ease, but they’re not tightening either. It’s a “cautious hold” and the tone has stabilized there for now.

Just as importantly, this divergence between Powell and the full committee is a useful reminder: market sentiment can be overly swayed by the press conference narrative. But the minutes reflect the actual institutional stance that is going to lead to the real decision on the monetary policy of the United States.

For Bitcoin investors, this matters. A hawkish Fed, especially one watching inflation expectations, means risk assets won’t get much support from monetary policy unless macro conditions deteriorate meaningfully. That makes incoming inflation data and Fed speak critical to track.

But as we discussed on Monday, for now the positive dynamic is real.

That's it for today. Thanks for reading.

Cheers,

Nick

P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis.

Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions.

Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights.