Bitcoin and Gold are the Winners of 2024

Also ETH Vs BTC, a Reversal in Correlations & Central Banks Liquidity is Catching Up

Welcome to the Friday edition of the Ecoinometrics newsletter.

Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets.

Today we'll cover:

Bitcoin and Gold are the Winners of 2024

ETH Vs BTC, a Reversal in Correlations

Central Banks Liquidity is Catching Up

Each topic comes with a small explanation and one big chart. So let’s dive in.

In case you missed it, here are the other topics we covered this week:

Checkout the Bitcoin Market Monitor to understand what’s driving the market in just five charts:

Read the Bitcoin Market Forecast for the probabilities of key scenarios and the essential risk metrics to manage your portfolio:

If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox:

Bitcoin and Gold are the Winners of 2024

What winning investment strategy of 2024 is also likely to win in 2025?

My bet is on store of value assets.

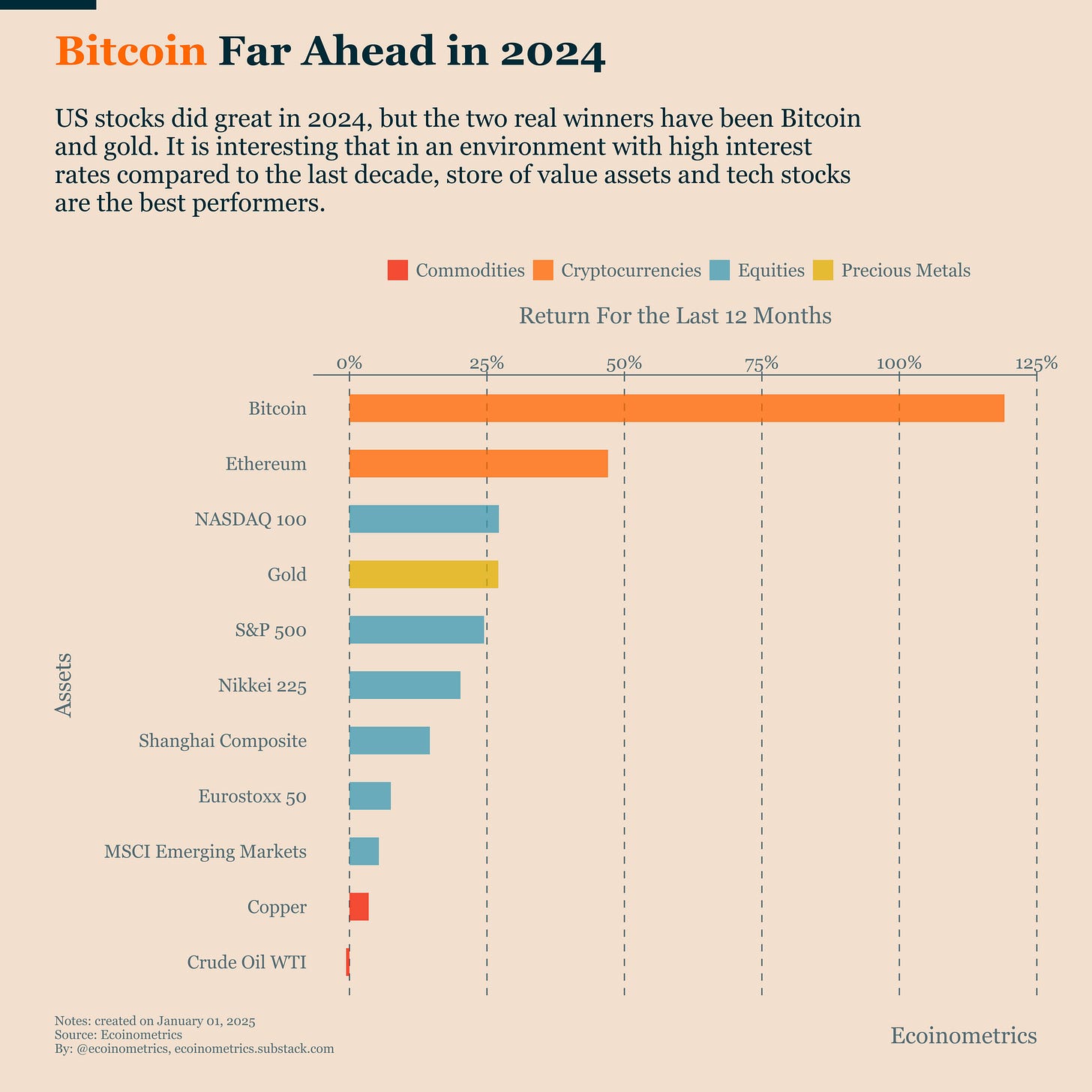

Looking at the 2024 total returns across different assets, two stand out clearly: gold and Bitcoin.

Gold had its strongest performance since 2010, matching the NASDAQ 100's returns, a remarkable achievement.

Bitcoin towers above everything else, with both BTC and gold showing superior risk-adjusted returns (which we discussed more in debt last Monday).

What's striking is that this happened while interest rates were at their highest levels since the Great Recession.

I believe what happened during COVID and the growing US debt are making investors nervous about potential rapid fiat currency debasement during extreme events.

This likely drove Bitcoin and gold's strong 2024 performance. Gold got an extra boost from central banks, including the PBoC, adding it to their reserves.

Looking ahead to 2025, we see:

An improving US regulatory environment for crypto

Lower interest rates (though limited by inflation risks)

Increasing central bank liquidity (as shown in our final chart)

Based on these macro conditions alone, I don't think Bitcoin has peaked. The conditions support an extended run in 2025.

ETH Vs BTC, a Reversal in Correlations

Bitcoin ETFs launched last year, and since then Ethereum began to break away from Bitcoin's pattern.

The decoupling wasn't complete, but the chart shows it was significant.

Ethereum shifted from being almost perfectly correlated with Bitcoin to showing only moderate correlation for several months.

Then December brought a change. The correlation stopped falling and started to climb again.

This pattern is familiar in crypto bull markets. Bitcoin leads the charge, then the rest of the crypto market follows.

Usually, this signals the start of an alt season, a period when alternative cryptocurrencies surge. We appear to be heading that way again.

But there's a catch this time. Alt coins lack a clear narrative.

Bitcoin's path is clear: ETFs and institutional adoption are already happening.

For alt coins, the future is less certain. We'll have to watch what themes emerge in 2025.

Central Banks Liquidity is Catching Up

The US dollar's debasement should return to pre-COVID levels in Q1 2025.

Back then, the US M2 money supply grew by 5% yearly. We're currently just under 4%.

A 5% expansion of the money supply doesn't guarantee Bitcoin's growth. But it does mean monetary policy won't be holding it back.

Since the Great Recession, Bitcoin's bull markets have followed the global four-year liquidity cycle.

With recession fears fading in the short term, the monetary situation gives no reason to be bearish on Bitcoin.

That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts.

Cheers,

Nick

P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below.