Bitcoin ETF Inflows Are Gaining Momentum Again

Also Finding a Strong Bitcoin Proxy Stock Is a Challenge & The Federal Reserve Isn’t Offering Any Guidance

Welcome to the Friday edition of the Ecoinometrics newsletter.

Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets.

Today we'll cover:

Bitcoin ETF Inflows Are Gaining Momentum Again

Finding a Strong Bitcoin Proxy Stock Is a Challenge

The Federal Reserve Isn’t Offering Any Guidance

Each topic comes with a small explanation and one big chart. So let’s dive in.

In case you missed it, here are the other topics we covered this week:

Checkout the Bitcoin Market Monitor to understand what’s driving the market in just five charts:

Read the Bitcoin Market Forecast for the probabilities of key scenarios and the essential risk metrics to manage your portfolio:

If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox:

Bitcoin ETF Inflows Are Gaining Momentum Again

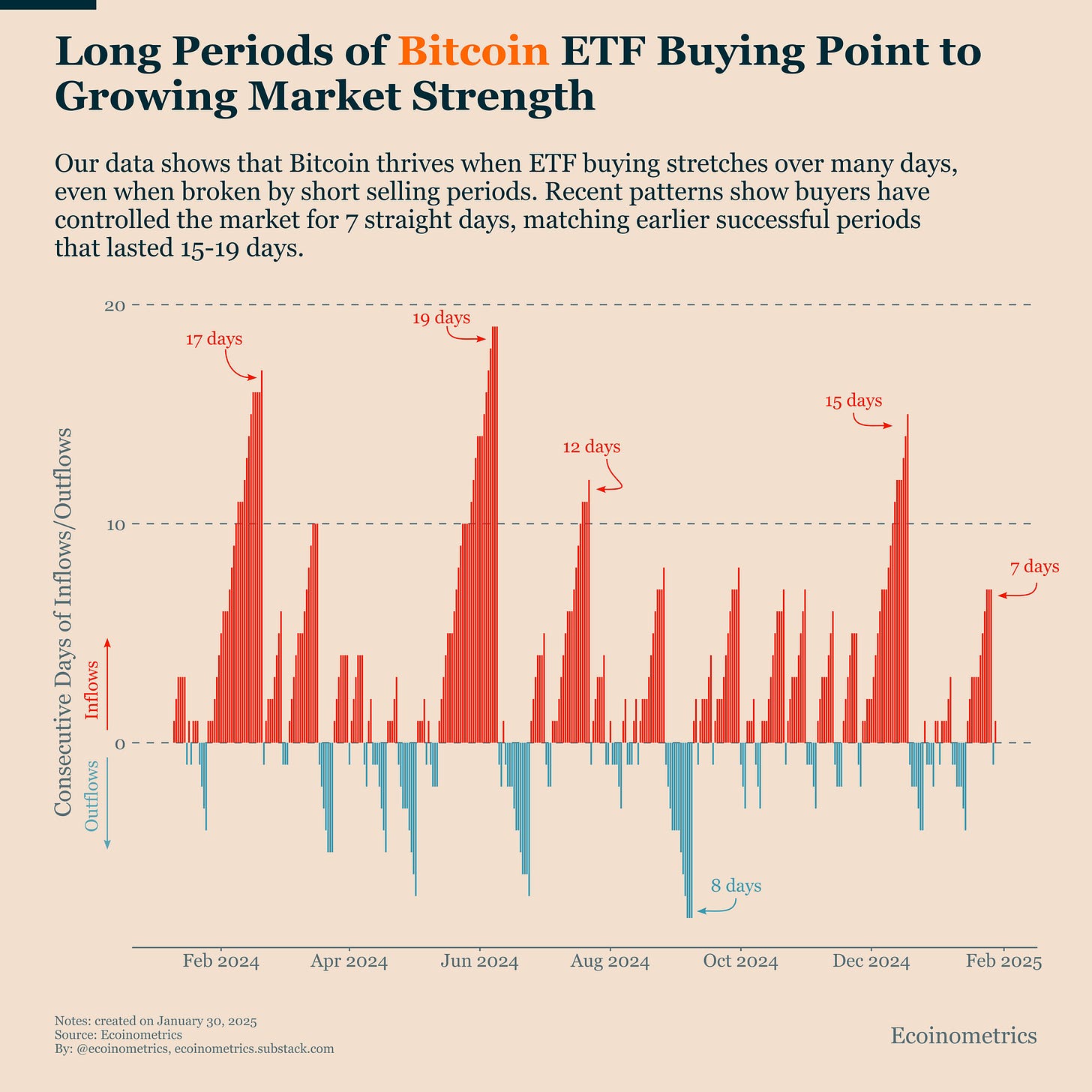

Here's what we've observed since the launch of Bitcoin ETFs:

We've seen several long streaks of inflows, lasting up to 19 consecutive days, which suggests strong institutional interest and systematic buying behavior.

When outflow periods stay short (three days or less), Bitcoin's price tends to gain positive momentum.

Extended periods of outflows create the strongest downward pressure on Bitcoin's price.

Notably, outflow periods have remained relatively brief (maximum 8 days) compared to inflow streaks (up to 19 days), suggesting institutional investors are using dips as buying opportunities rather than showing a fundamental shift in sentiment.

These observations may seem straightforward, but they highlight an important point: momentum in ETF inflows carries a premium. Longer inflow streaks correlate with better price performance. We studied this pattern earlier (you can read it here), and additional data has reinforced our findings.

ETF activity in December and early January was dominated by outflows. However, last week brought a seven-day streak of inflows, interrupted by just one day of outflow.

This pattern suggests the start of a new positive trend. While the FOMC meeting didn't provide much clarity about the Fed's next moves (more on that in our last chart), it notably didn't unsettle the market.

Given these conditions, we expect to see inflows resume their upward trend.

Finding a Strong Bitcoin Proxy Stock Is a Challenge

Say you cannot invest in Bitcoin directly. Maybe your investment charter doesn't allow it. Maybe you don't want to deal with custody issues. Maybe your investment platform restricts crypto trading, or perhaps you need to stick to traditional securities for tax or compliance reasons.

So you're looking for a Bitcoin proxy, an asset that both correlates with Bitcoin and matches its performance.

Turns out that's a tall order.

Other cryptocurrencies don't work well as proxies. Yes, they generally move with Bitcoin, but their relative performance is erratic. Just look at Ethereum for an example.

Bitcoin mining stocks aren't great options either. While they correlate with Bitcoin, they're inconsistent. The best performers might occasionally outpace Bitcoin, but on average, most struggle to keep up.

What about adjacent stocks? Take Coinbase, shown in the chart below. The logic seems sound: when Bitcoin does well, the whole crypto market benefits, which should boost Coinbase's business. And while Coinbase does follow Bitcoin's movements, it significantly underperforms over time. So not a great choice either.

MicroStrategy stands as the only truly effective proxy. They maintain high correlation and consistently match or exceed Bitcoin's performance.

But here's the catch: they achieved this by essentially becoming a Bitcoin holding company, a pseudo Bitcoin ETF.

The bottom line? Unless you absolutely cannot access Bitcoin directly, you're better off using a Bitcoin ETF to track its performance.

The Federal Reserve Isn’t Offering Any Guidance

The FOMC meeting came and went. As expected, rates stayed unchanged. As we discussed on Monday, the rate decision wasn't the main focus of this meeting.

What mattered was Jerome Powell and the committee members' assessment of the U.S. economic situation and their outlook on future rates.

And Powell offered nothing new:

Inflation remains too high

The labor market is too strong

The U.S. economy continues to grow well

Given these conditions, there's no reason to cut rates now

So when will they cut rates? Powell's answer: It will take as long as it takes.

This vagueness isn't just uncertainty, it's likely strategic. By keeping markets guessing, the Fed can prevent premature reactions to potential policy changes. After all, clear guidance now could trigger market moves that complicate their decision-making later.

But did Powell's tone during the press conference reveal anything? We ran our quantitative text analysis and calculated the Fed Communication Index (FCI) for this press conference and the result is Jerome Powell actually moderated its hawkish tone compared to the last two meetings.

This press conference still scores hawkish, but it scores hawkish below the trend line. That might explain in part why there was no over-reaction after this meeting.

But as long as core inflation is still a problem, uncertainties remain.

That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts.

Cheers,

Nick

P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below.