Welcome to the Friday edition of the Ecoinometrics newsletter.

Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets.

Today we'll cover:

Bitcoin is building momentum.

Dangerous correlations between stocks and bonds.

The Bitcoin mining industry is small and what that tells you about the market.

Each topic comes with a small explanation and one big chart. So let’s dive in.

In case you missed it, here are the other topics we covered this week:

Bitcoin offers lots of opportunities, even without the volatility.

The Bitcoin miners are negatively affected by the ETF narrative.

If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox:

Bitcoin is building momentum

Do you know when was the last time Bitcoin got six consecutive months of green candles? That was during the bull run which started in October 2020.

We aren’t there yet. Only three consecutive months of positive returns so far. But already that’s pretty good. Happens about 12% of the time historically.

The flip side to this stat is that most likely it isn’t going to be only up and to the right between now and the halving. So manage your expectations.

Dangerous correlations between stocks and bonds

The 60/40 portfolio has been hugely popular for decades. The idea is that you split your allocation 60% towards stocks and 40% towards bonds. Stocks provide you growth. Bonds provide you with stability. And since those two asset classes are anti correlated mixing them up helps manage risk.

Now that’s the theory.

Because in practice bonds have been very volatile since 2020. And on top of that the correlation between stocks and bonds has changed from typically anti correlated to reaching a 20 years high in correlation.

It should be clear by now that the financial markets are not operating in their standard regime. The sequence of QE followed by inflation followed by QT with inflation has changed the deal.

Beware not to get stuck operating on old principles.

The Bitcoin mining industry is still very small

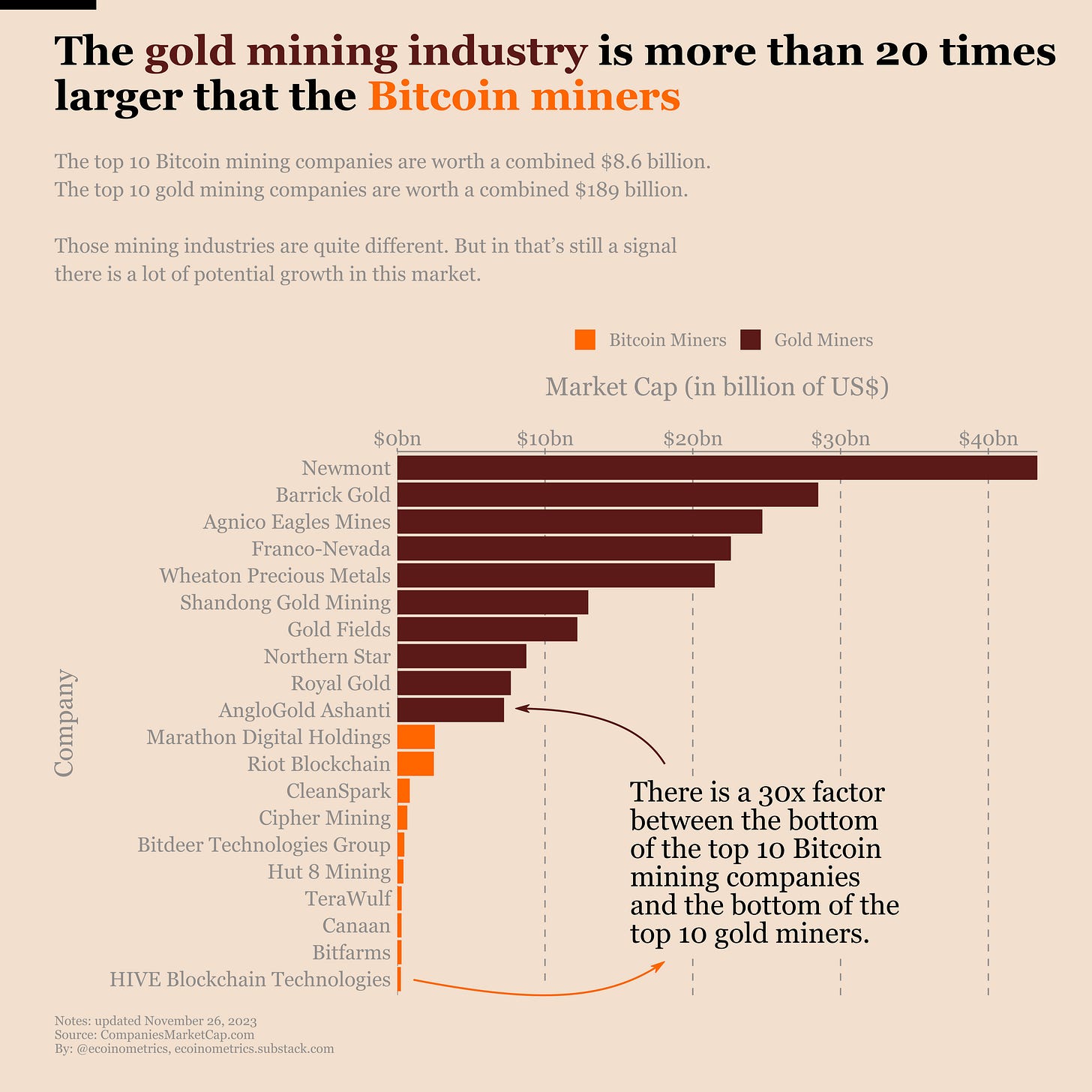

The top 10 Bitcoin mining companies are worth a combined $8.6 billion. Meanwhile the top 10 gold mining companies are worth a combined $189 billion. That’s a 20x difference.

Now I’m not saying to argue that the economics of the gold miners are comparable to that of the Bitcoin miners.

What I want to illustrate is that the “Bitcoin space” and more largely crypto is still a young industry. If you are investing in this space now your best bet is to take the long term view. We are still in the early part of the adoption phase.

If you can make bold bets now and sit on them for 5 to 10 years then the odds are on your side.

That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts.

Cheers,

Nick

P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

Armed with those insights you can make better investment decisions.

Are you a serious investor? Do you want to get the big picture to get on the big trades? Then click on the button below.

I completely agree with your thesis. Do you know why $BTBT reduced so much its mining capacity in the last few months?