Decentralized exchanges are catching up in the bear market

Plus the cost of the federal debt and the vanishing of personal savings

Welcome to the Friday edition of the Ecoinometrics newsletter.

Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets.

Today we'll cover:

Uniswap getting ahead of Coinbase.

The amount of money the US government pays to service its debt.

The vanishing of personal savings in the US.

Each topic comes with a small explanation and one big chart. So let’s dive in.

In case you missed it, here are the other topics we covered this week:

If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox:

Decentralized exchanges are catching up: in 2023 Uniswap processed more volume than Coinbase

Ok, maybe catching up is a bit of a stretch given that both centralized and decentralized exchanges have seen the traded volume trending down and down and down since the top of last bull market.

But something important is happening here.

In 2023 Uniswap processed more volume than Coinbase for 6 consecutive months. That had never happened before. And that could be a glimpse at the future.

Decentralized exchanges have some inherent advantages over centralized ones:

Transparency: exchanges run by smart contracts that can be audited, transactions stored on-chain.

Decentralization: less regulatory and compliance risks.

No middleman: less counter party risk, lower fees

There is a lot to like in that at the fundamental level.

Now that’s not saying that the existing decentralized exchanges are perfect solutions. In many cases the control over those exchanges is not as decentralized as you’d want. And there is a lot of progress having to do with UX.

But if you have used Uniswap recently there has been a lot of progress in terms of user interface.

Blockchain solutions don’t always make sense for all problems. But you have to recognize that when it comes to finance there are clearly a lot of potential applications.

Time will tell if they can really go mainstream.

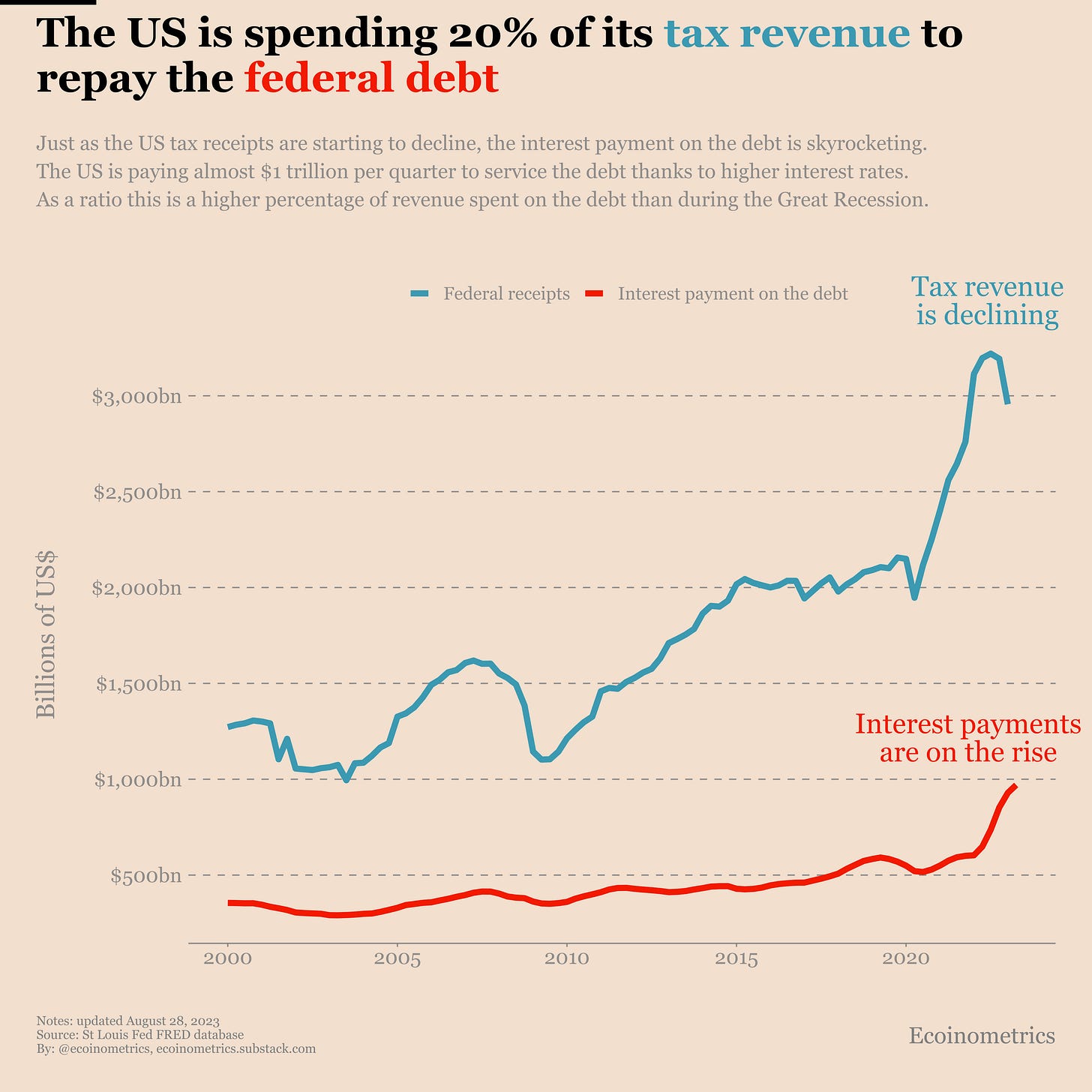

The US is spending 20% of its tax revenue to repay the federal debt

Last week we have seen that this historic rise in the interest rates is putting home owners (and home buyers) in a very tough situation. Turns out they aren’t the only one to feel the pinch.

Who else? The federal government of course.

As the US Treasury is raising more debt, they also have to pay higher interest rates on it. This increase is noticeable. In 2020 the interest payment on the debt was about $500 billion per quarter. That number has now jumped to $1 trillion.

Now you might say this is no big deal as long as the federal tax revenue is also growing right?

Well about that… the tax revenue did increase by about $1 trillion per quarter post-COVID. But it has also started to roll over. And now the interest payment on the debt amount to 20% of the tax revenue in the same quarter.

That’s $1 spent on the debt for every $5 of tax collected.

This ratio is already higher than during the Great Recession and climbing.

Not a very sustainable situation.

Personal savings have melted away in the US

The COVID lockdowns and subsequent stimulus cheques have created the largest ever bump in total personal savings.

At some point in 2020 US citizens had accumulated $6 trillion in personal savings.

But a spike in inflation and the reopening of the economy made quick work of that pile of cash.

As of now the total personal savings are back down the $862 billion. That’s 43% below the pre-pandemic level.

Said differently, US citizens don’t have much cushion money at the same time as inflation is still high and the economy could enter a recession.

That’s not a very good situation to be in.

That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts.

Cheers,

Nick

P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

So if you liked this, please refer Ecoinometrics to your friends to help us grow.

Bonus: referrals give you access to the premium content of the newsletter normally only accessible to paid subscribers.

3 referrals give you one month access for free

10 referrals give you 3 months access for free

25 referrals give you 6 months access for free

.

Wow those US debt interest payments are eye watering