There is one reason Bitcoin is likely to continue growing for decades: demographics

Plus the danger of high interest rates and China as the new Japan…

Welcome to the Friday edition of the Ecoinometrics newsletter.

Every week we bring you the three most important charts on the topics of macroeconomics, Bitcoin and digital assets.

Today we'll cover:

Why Bitcoin will benefit from an unstoppable demographic boost.

How the record high mortgage rates are putting the US economy at risk.

Why China vs the US could be a replay of Japan vs US in the 1990s.

Each topic comes with a small explanation and one big chart. So let’s dive in.

In case you missed it, here are the other topics we covered this week:

If you aren’t subscribed yet, hit the subscribe button, to receive this email every week directly in your inbox:

Why Bitcoin will benefit from an unstoppable demographic boost

The fun thing about demographics is that it is like a Tsunami you can spot from miles away with absolutely no way of stopping it.

That’s why if you are a macro investor and you are investing over the long term, keeping track of the big demographics trend is a must.And at the moment demographics is telling us that money is about to play an epic game of hot potato. Check this out.

Over the next 30 years a large amount of $142 trillion (yes, with a “t”) worth of assets is getting passed around between generations.

Here is the breakdown:

Silent Generation: They've got about $18 tn. Not too shabby.

Baby Boomers: Ah, the champions with a whopping $78 tn.

Generation X: Sitting pretty at $46 tn.

And who's eagerly waiting on the other side of this wealth toss? The Millennials. They currently hold a modest $13 tn, but that's about to change.

Now, here's the plot twist: Millennials aren't just waiting with open bank accounts. They are digital natives. They grew up with the internet. They are familiar with Bitcoin and digital assets. They are ready to invest in the space like no generation before.

The implication? As this massive wealth shift takes place, we might not just see traditional transfers. We're potentially looking at an evolution of where the money goes, especially into digital pockets.

Unless for some reason Bitcoin and crypto become wildly unpopular among Millennials the only conclusion is that if your investment strategy for the next 30 years revolves around digital assets then you have the wind at your back.

How the record high mortgage rates are putting the US economy at risk

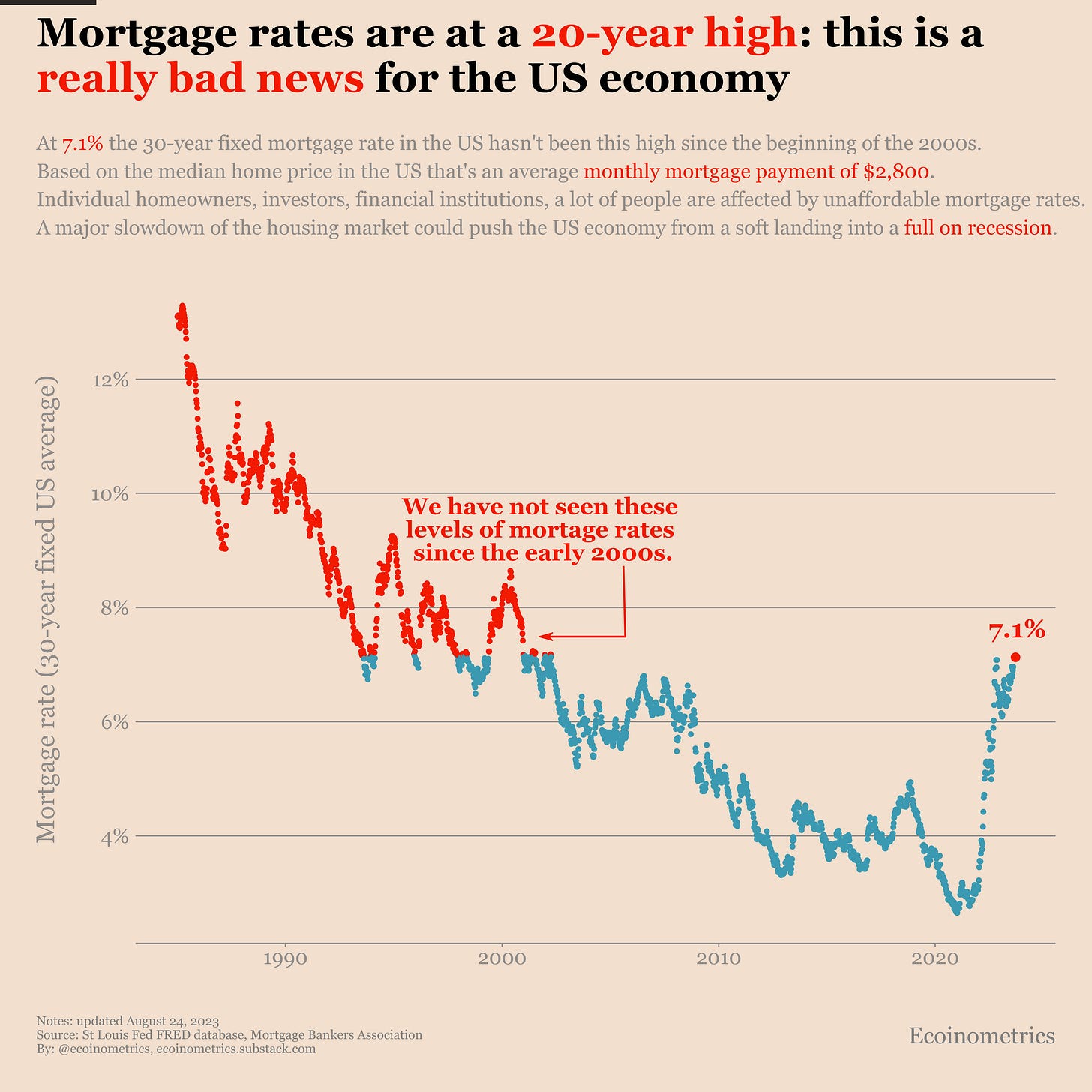

The last time people had to worry about the 30-year fixed mortgage rate lounging at a cool 7.1% was back in the early 2000s. If that period reminds you of the Y2K and MTV then welcome to the club, you too are an old Millennial.

Jokes aside mortgage rates that high are not a good thing for the US economy.

To put things in perspective, if you slap at 7.1% rate onto today’s median home price, you get a jaw-dropping monthly payment of $2800. This is a tough pill to swallow every month. And this is clearly pricing out most people from the real estate market in the United States.

The problem is that the real estate market affects everybody. From dear Aunt Sally who is trying to buy a house, to your cousin who is trying to sell his shed in San Francisco in order to move to Austin, to the big financial institutions who own a lot of real estate.

Remember that the average American has 24% of its net worth tied to real estate, most of the time its home.

If the real estate market collapse and there is a significant repricing of those assets everyone will start to feel much poorer very fast. And you don’t need much more to tilt the US economy into a recession.

How high those rates will go? How long they can stay this high without causing some serious damage to the economy?

This is what I would monitor as one of the factors that could trigger a recession.

Why China vs the US could be a replay of Japan vs the US in the 1990s

China has been the great economic rival of the United States over the past 20 years. For some time it even looked like China could win.

But now things aren’t so clear, China might be in trouble.

And the funny thing is, if you replace China by Japan and the 2020s by the 1990s the (almost) exact same scenario already played out in the past.

For 20 years between the 1970s and 1990s Japan finally recovered from World War II and became an economic power house. Now everything is Made in China, back in those days everything was Made in Japan. During all those years the GDP of Japan was growing as fast as that of the United States and a lot of Americans feared the US would fall behind Japan.

Then suddenly in the 1990s it all stopped:

Deflation gripped the country.

Productivity hit a plateau.

The labor force started to decline due to demography.

Competition started to emerge from China and South East Asia.

And on top of that the asset price bubble collapsed.

It has been 30 years and Japan still hasn’t recovered from that.

Compare that to the turning point China finds itself at right now:

Its productivity growth is trending down.

It has a massive demographic problem as a result of the one-child policy.

Its financial system is fragile.

Competition is starting to emerge from India and South East Asia.

And it is currently experiencing a burst of its real estate bubble.

That is an eerily similar situation which should make you think twice about the future of the Chinese economy and what it means for the global financial system.

That’s definitely something to keep an eye on.

That’s it for today. I hope you enjoyed this. We’ll be back next week with more charts.

Cheers,

Nick

P.S. We spend the entire week, countless hours really, doing research, exploring data, surveying emerging trends, looking at charts and making infographics.

Our objective? Deliver to you the most important insights in macroeconomics, Bitcoin and digital assets.

So if you liked this, please refer Ecoinometrics to your friends to help us grow.

Bonus: referrals give you access to the premium content of the newsletter normally only accessible to paid subscribers.

3 referrals give you one month access for free

10 referrals give you 3 months access for free

25 referrals give you 6 months access for free

Thanks, indeed an very important megatrend. BTW global population is another factor, expected to grow from 8 to 10 B people.

30 years is a long time frame, could you put an approximate BTC price range for in 10 years?