Bitcoin isn’t dead. We just had a 10 days streak of green candles. If it proves anything, it is that BTC can still build momentum despite the low volatility environment and the negative market sentiment.

10 days of uninterrupted growth, that must be pretty rare right? So does it mean anything?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Candlestick patterns

Full disclosure, I’m not a specialist of technical analysis. So don’t expect me to analyze the price action of the last 10 days as the 5th wave of an ascending inverted ladder… or whatever these things are called. This is above my pay grade.

Personally I like to keep my patterns simple and well defined. So how about we look at the following:

How rare is it to get 10 green (close price above open price) daily candles in a row?

Does that mean anything for the expected return over the next month?

Before we start running the numbers let me point out a big caveat for this analysis.

Bitcoin trades 24/7 on exchanges all over the world. There is no definition of market open or market close. That means the daily price candles are kind of arbitrary.

In particular using different time zones to cutoff the candles will give different results and would have to be interpreted differently.

Clearly some timezones make more sense than others. Maybe the New York time zone would tell you things more specific to the North American market. Or the Tokyo time zone will tell you things about the Asia Pacific region.

Today we are doing a very high level analysis so I’ll be content to use UTC as my reference. But remember that if you run the numbers yourself, you might find some small discrepancies if you use a different time zone even if you use the same dataset.

Ok, let’s dive in.

First question: how rare is it to see Bitcoin go up 10 days in a row?

Answer: very rare.

Since the 1st halving, it has happened only 6 times before last week…

Check out the distribution of consecutive green candles and red candles.

Two or three positive days in a row are quite common. But after that the right tail is getting really thin pretty fast.

The same is actually true for consecutive negative days. The drop off is even faster there though to the point that 5 consecutive red candles is already very unlikely.

Both sides have a very long tail: up to 12 consecutive negative days and 17 consecutive positive days. But both of these are one of events that would probably disappear if we switched to another time zone.

So I wouldn’t focus too much on those freak statistical events. More likely than not they aren’t robust.

But regardless, there is no question that 10 consecutive days of growth is already rare.

That’s good to know. What we really care about are returns though.

So what kind of future does this herald for the expected returns over the next month?

Well we certainly don't know about the future, especially when it comes to rare events. That being said, in the past this kind of bullish move has meant outsized returns over the coming month.

Here is an easy way to visualize that:

On the vertical axis you have the number of consecutive green daily candles. E.g. the 10th row means events of 10 consecutive green candles.

On the horizontal axis you can see the number of days after a given pattern. E.g. the 10th row and the 25th column means what happens 25 days following a pattern of 10 consecutive green candles.

Each square thus defined gives you the average return D days after the N consecutive candles pattern was observed. E.g. the 10th row and the 25th column means the average return after 25 days following a pattern of 10 consecutive green candles. Towards the red you get positive returns, towards the blue you get negative returns.

The size of the bar on the far right represents how often the candlestick pattern is seen.

Take a look.

As you can see with the patches of red colours, typically 6 to 10 consecutive days of growth are a sign that outsized returns are coming over the next month or so.

We might be onto something… but just to be sure let’s switch from the mean returns to the median returns for the colour coding. That’s just to see if there is like one outlier messing up the data.

Ok, let’s have a look.

Right, so the pattern is still there when you use the median although it is a bit more shifted towards the 7 to 11 days range of consecutive green candles.

So for the rare times where we’ve seen these patterns, they do seem to correlate with some upcoming bullish move.

Nice. We can hope this is the way out of this Bitcoin drawdown.

While we are at it, is there any pattern to be observed with consecutive red candles?

Well, we can run the exact same chart as above.

See for yourself.

One thing that’s pretty obvious whether you focus on the average of the median returns is that getting a few consecutive days of negative price action is not a big deal over the long run.

Two to four days of the price going down and you still end up getting positive returns on average as you move away from the event.

Five red candles is another story though. This is the limit where the price really starts to drop off over the following month.

That being said, this is again a very rare event. What this heat map shows is that most of the time you shouldn’t sweat when the price falls down for a few days in a row.

Make what you wish from this data but keep in mind that we are doing statistics on very small samples for these long patterns. So treat these results with caution.

But while those statistics are fun there are some good reasons to be hopeful of the coming months.

First the $30k level has been acting as a strong support for a couple of months already. Traders probably feel more comfortable entering in the current zone as a result.

BTC still hasn’t managed to do a clean breakout over $42k but it isn’t done yet trying to.

Bitcoin just needs a little more momentum for FOMO to kick in once again.

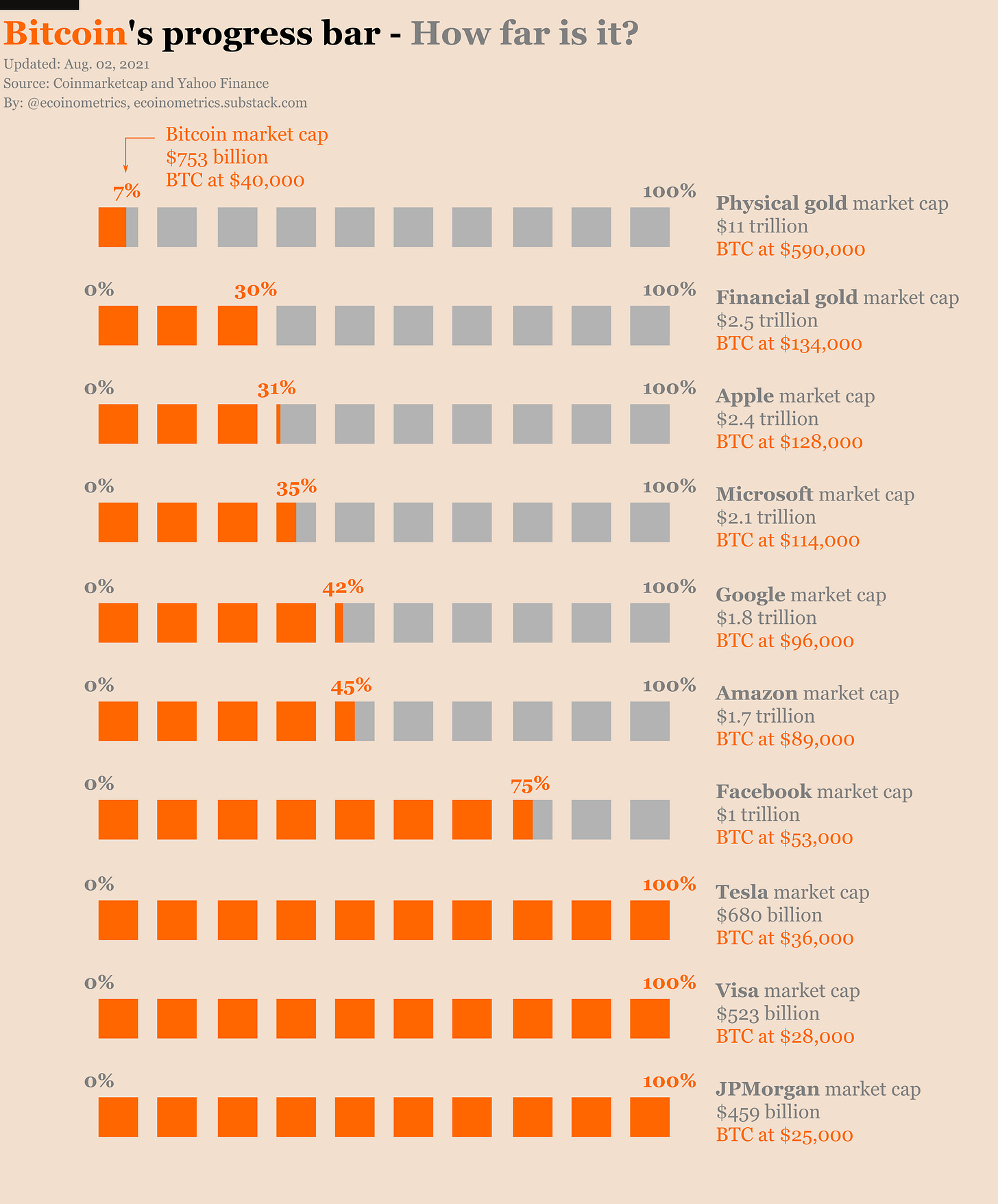

Second, there is plenty of room for Bitcoin to grow by catching up to other financial assets. You might think that, with a market cap of $753 billion, Bitcoin is massive.

But there are plenty of assets larger than that.

We now have two stocks with a market capitalization over $2 trillion: Apple and Microsoft. To catch up with those one BTC would have to be worth 6 figures….

Amazon and Google are also slowly making their way to the $2 trillion club.

So don’t worry about it, the system is flush with money chasing financial assets. Give it some time and it will find its way over to Bitcoin.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

Dope!

I wonder if there has ever been a pattern of 10 green candles followed by 5 red candles before. This "10 green, 5 red" pattern seems relevant now: we just observed 10 green candles between 21-Aug to 30-Aug-2021 and we are now seeing 3 green candles in a row 31-July to 02-Aug. It would be interesting to quantify the frequency or probability of the event "10 green candles followed by 5 red candles", and the expected returns 30 days out. Another interesting query would be if it were possible to compute the probability of another red candle appearing, conditioned on 10 green candles in a row followed by 3 red candles in a row, i.e.,

p(R|[G,...G,R,R,R]).

Your post is very interesting and thought provoking. Thanks!