Ecoinometrics - Choose your store of value

August 09, 2021

With negative interest rates and inflation fears all over the news you’d have guessed gold must be outperforming.

Well, it isn’t to say the least.

So what’s going on? Is it Bitcoin’s fault?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Choose your store of value

The Federal Reserve doesn’t have too many things to care about. In principle their mandate is to make sure that:

The unemployment rate is as low as possible.

The inflation rate is moderate.

They have some monetary policy tools to achieve those goals. They can set the short term interest rates and they engage in asset purchasing programs.

Until they are gifted a Central Bank Digital Currency version of the US$, this is the whole extent of their powers.

For a little more than a year the Fed has kept the short term rates pegged just above 0% while they injected trillions of dollars into the financial system.

So how did that workout for them?

When it comes to their inflation mandate that worked out particularly well. Maybe too well…

If you remember, the target inflation rate for the Fed is 2%. But we are now way above that. See for yourself.

Not all of this is due to the Federal Reserve for sure. The coronavirus pandemic had a real effect on the supply chain of most industries so you can’t deny that there are physical shortages driving prices higher.

But even if you expect those supply chain constraints will ease up over time, we are still more than 2.5x higher than the 2% target. That’s a lot.

Regardless of the root cause, the Fed wanted inflation and now they have it. That’s 50% of their mandate fulfilled (as long as they can keep it under control).

What about the other half?

Well, Friday showed some pretty good news for US jobs. The unemployment rate continues to drop at a good pace.

The July number came at 5.4% which is a far cry from the 15% rate at the peak of the lockdown.

But 5.4% is still 1.5 times higher than the pre-pandemic reference level. So at some point you’d think that extra gains on the unemployment front will become harder to achieve.

For what it’s worth we can compare 2008 to 2020:

After the great financial crisis it took about 5 years to go from a peak 10% unemployment rate to the 5.4% level.

It then took 4 more years to reach a bottom unemployment rate at 3.5%.

I’m not sure those two situations are really comparable but check it out for reference.

If the unemployment rate decreases at the same pace as in the post-2008 regime we should be back to the pre-pandemic level in 2025.

So we aren’t back at ultra-low unemployment levels but still, things are moving in the right direction.

From the point of view of the Fed, they have been doing a good job:

Inflation, check.

Low unemployment, check.

Which means that from their point of view, the next step should be to start normalizing the monetary policy i.e. raising rates and tapering their asset purchasing programs.

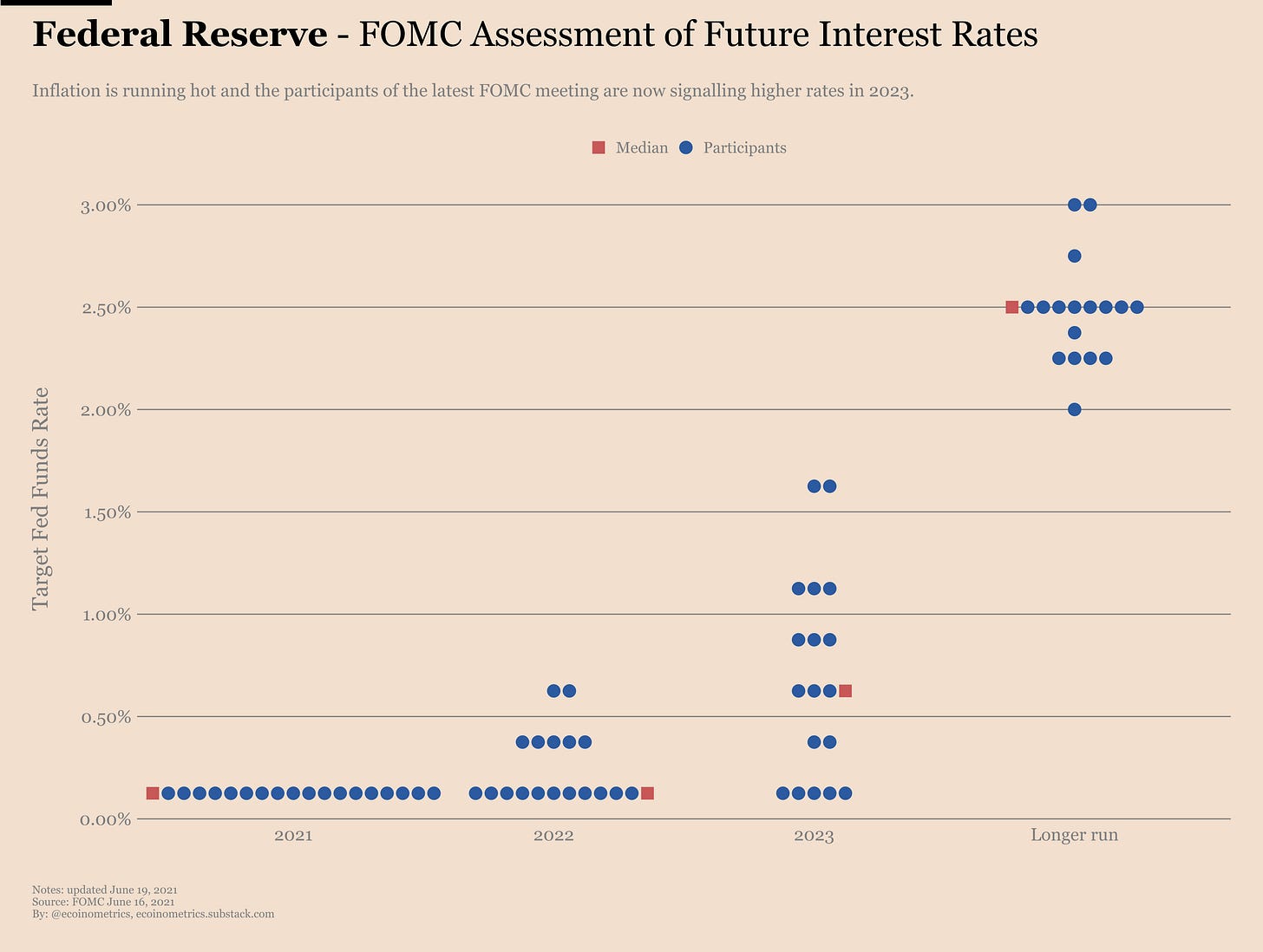

In fact the dot plot signals exactly that.

The FOMC is forecasting to raise rates (from 0.25%) in 2023 to go back towards a long term level at 2.5%... good luck with that target.

I don’t know about you, but I’m a bit skeptical about this timetable, 2023 looks optimistic and I’m not sure the stock market will like that.

But hey, I’m not on the FOMC.

You know who doesn’t like this data though?

Gold.

You’d think that with those very negative real yields gold would do great. But apparently investors aren’t buying it.

At the worst of the pandemic gold managed a push above $2,000. That coincided with the real yield turning negative when inflation started rising faster than the 10-year.

But after that, not much happened right? I mean the 10-year is on a plateau, inflation is climbing, the divergence between those two keeps getting wider… but gold is still below its peak of 2011.

Check it out.

So what’s happening?

Three scenarios:

Gold is about to explode. You just need to give it time. We are going to see a big run similar to what started in 2008.

Gold won’t go anywhere. Investors expect the Fed will normalize the rates and keep inflation in check. So there is no need to buy gold as a hedge.

Gold should explode, but it won’t because Bitcoin is eating its lunch.

What do you think about the third scenario? It is possible right?

I mean the market cap of Bitcoin is now about a third of the market cap of financial gold (i.e. physical gold controlled by financial instruments such as ETFs). So maybe it makes sense that for Bitcoin to continue growing it needs to steal the cash that would otherwise go to gold instruments.

We still don’t have a US based Bitcoin ETF but when that happens I wouldn’t be surprised to see a big chunk of the money parked in the GLD ETF flow to a BTC ETF.

And actually if you think about it there are reasons to bet on Bitcoin instead of gold.

Say you need to choose a store of value:

Gold: has been around for a long time, is low risk, but has a low chance of experiencing an exponential growth.

Bitcoin: is relatively new, hasn’t fully transitioned to a store of value, but because of that it is likely to continue experiencing an exponential growth as adoption gets wider.

So gold is low risk, low return and Bitcoin is high risk, high return…

That’s what you’d think from a high level.

Except that when you run the numbers by calculating the risk adjusted returns of gold and Bitcoin over a period of 1 year, 4 years, 8 years… gold’s returns don’t seem to justify the risk.

See for yourself (if you need a refresher on the Sortino ratio head over here).

In my opinion the choice is pretty clear. If you have to pick one of the two, Bitcoin has a better potential. Period.

ETH vs BTC

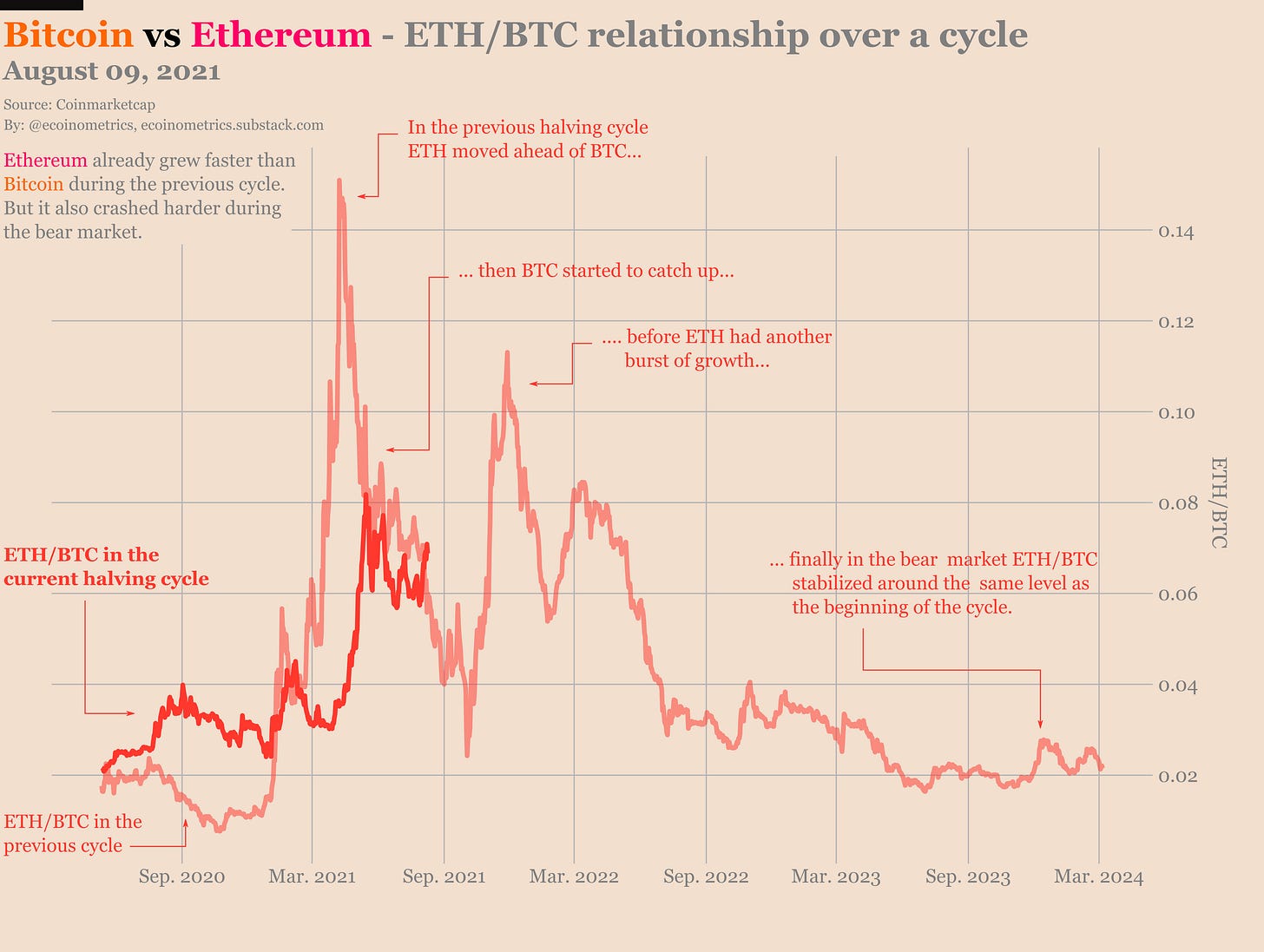

It is that time of the month where we check to see if Ethereum finally managed to decouple from Bitcoin.

Spoiler alert: it hasn’t.

Both of them are in the process of bouncing back from the bottom of this post-halving correction phase:

Bitcoin is up 5.1x since the halving.

Ethereum is up 16.2x since the halving.

But they both remain below the growth trajectory of the previous bull market.

Clearly Ethereum is getting an attention boost with their network upgrade.

Right now the network is in the middle of switching from a Proof of Work to a Proof of Stake model. Will the transition take 6 months, 1 year, more… nobody knows. Honestly this is pretty complex, so as with anything related to technological changes take the projected timeline with a grain of salt.

For now, when you look at the one-month correlation between ETH and BTC there is nothing new under the sun. Those two are extremely correlated.

I’m waiting for two things to decide on whether or not ETH has decoupled from BTC:

The one-month correlation should stop being so high. I wouldn’t expect those two to average at zero but somewhere between 0% and 50% would be reasonable.

ETH/BTC should finish the cycle significantly higher than it started.

It would also be nice if ETH could avoid dropping like a stone every time there is some bearish news that only concerns Bitcoin (see the Chinese miners story for a recent example). But that last one is optional. After all, immediate reactions have more to do with psychology than long term market dynamics.

So far no sign of anything like that. Let’s keep an eye on it.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick