Ecoinometrics - Cryptoization

October 18, 2021

In its latest Global Financial Stability Report the International Monetary Fund dedicates an entire section to the topic of cryptocurrencies. Reading through it gives you a good idea of what central bankers are worried about...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Cryptoization

Here is an easy way to know what the IMF is worried about when it comes to crypto, in their Global Financial Stability Report:

Ethereum is mentioned 7 times.

Bitcoin is mentioned 31 times.

Stablecoin is mentioned 100 times...

Clearly the big brains economists don’t care if you have made some bets on Bitcoin and 10x your stimulus money. And although they do mention it in the report, they also don’t care if you are using unreasonable leverage or making 10,000% APY by doing some yield farming in the latet DeFi ecosystem. They care even less if you are trading jpegs of apes with your spare money...

No, the thing they are really worried about is what they call cryptoization. What’s that? Glad you asked.

Cryptoization is simply the idea that people prefer to use cryptocurrencies rather than their local currencies to conduct financial transactions.

That’s basically the same idea as dollarization (using US$ instead of your local currency) but replaced with Bitcoin or any stablecoin.

You can see why the IMF doesn’t like that. As long as the financial system is built around currencies that are controlled by a small group of central bankers the legacy institutions can run the show.

But if you switch to decentralized finance, suddenly real market forces are shaping the system and it becomes much harder to put arbitrary restrictions on what people can do with their money.

How far are we from full cryptoization? Probably still pretty far. But Bitcoinization has already made some immense progress.

Consider that the current market size of Bitcoin is already larger than the M1 money supply of most of the world’s currencies.

See some comparisons below.

At this point Bitcoin represents a significant portion of the M1 money supply of India and is about the same size as the M1 money supply of Russia or Switzerland. While we are still far from competing with the Euro or the US$ it is good to remember that BTC remains in an early adoption phase.

What’s coming next? Well for sure central banks want to stay in control. And they know that simply spinning up their own version of digital currencies won’t change anything.

People aren’t fools. A digital version of the US$ with the same monetary policy doesn’t change anything. Actually it makes things worse by giving central bankers more control over how you are allowed to spend your money.

So most likely they’ll try to restrict the part that is still mostly centralized i.e. the on-ramping mechanisms to Bitcoin.

That might work for a while, especially if some Bitcoin ETFs are made available in the US. People might choose to buy the ETFs to “own“ some Bitcoin. Of course you only truly own Bitcoin if you control your keys. Buying shares of an ETF don’t give you any access to decentralized finance…

The cat is out of the bag though. We might have already crossed the point of no return that will eventually decentralize the financial system for good.

Glad to be in for the ride.

Unstable equilibrium

Another month, another set of data and still no sign that inflation is coming back down to earth. At this point we are starting to stretch the definition of transitory pretty far from what most people had expected.

All that is placing the Federal Reserve in a precarious situation. Let me tell you, I wouldn’t like to be Jerome Powell these days.

Because if you zoom out from the details of the statistics and consider the current state of affairs:

Inflation is above target and looking stickier by the day. That would call for a tightening of the monetary policy.

The labour market hasn’t yet recovered from the COVID crisis. That would call for continuing to support the economy with a loose monetary policy.

The short term interest rates are pinned at zero. Which means the Fed has very little room to maneuver and would certainly like to see them raised.

The US economy is weak. Which means that higher interest rates are dangerous for both the real economy and the stock market.

You see what I’m talking about… the Fed is cornered. They have no good solution to get out of this.

The most likely scenario is that they will try to taper their purchasing program if inflation continues to be so high above the 2% target. So be ready for some turbulence in the stock market in the next 6 months.

Price predictions

Well, well, well… it looks like the people responding to the first price predictions poll a couple of weeks ago were right to be bullish. Actually maybe they weren’t bullish enough!

There is one more week to go until we hit the date of the first prediction but BTC is already just above the median target price.

See for yourself.

Now if we follow the scenario given by the distribution of price predictions over the coming month, Bitcoin is likely to stall around the level of the all-time high until at least mid November.

That sounds plausible.

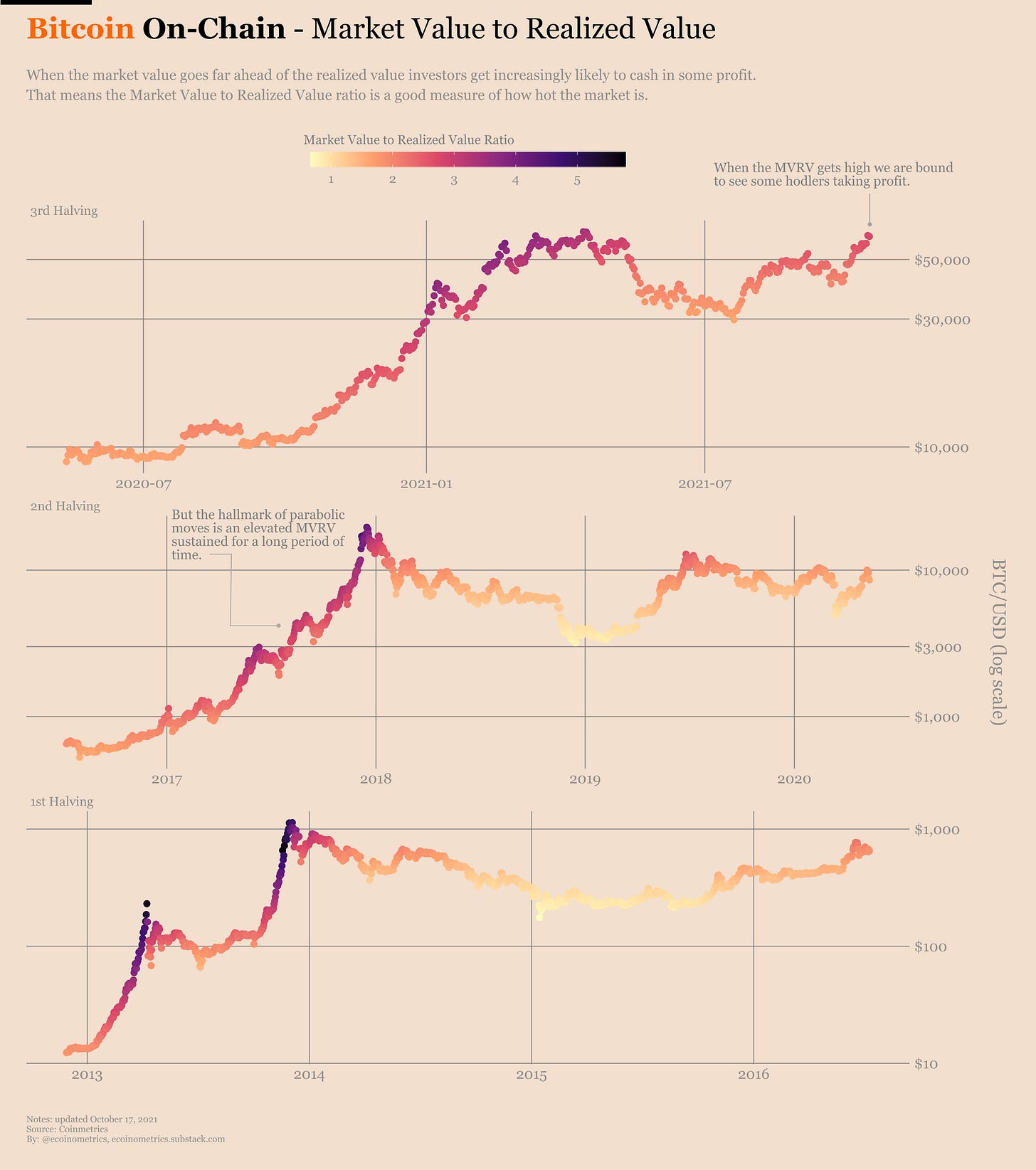

If you look at the market value to realized value ratio you can see that we are getting to levels that call for some amount of distribution.

A fraction of the people that are up 3x are going to take some profit and that could slow down Bitcoin’s growth in the short term.

But that’s likely just a bump in the road to BTC at $100k. If you look at the previous parabolic moves you’ll see that a sustained MVRV ratio is characteristic of those phases where FOMO trumps profit taking.

So far this cycle is no exception.

Check it out.

Same story for Ethereum with the median price prediction slowly moving towards $5k in November. See for yourself.

Now that we are getting close to the all-time high for both Bitcoin and Ethereum it will be interesting to see if the consensus from the polls jumps to higher prices.

When the poll results start to go parabolic I guess we’ll know that we are in the FOMO phase. So go ahead and submit your price predictions for November 19 in the link below:

https://forms.gle/35Jkh7STgTERQ1k3A

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

Great insights as always, thanks

Much appreciated... thank you.