The year is coming to an end and honestly it was a pretty good one for Bitcoin. From $4,000 in March to almost $30,000 today, hodlers have nothing to complain about.

But believe it or not, there are other assets that performed better than Bitcoin in 2020...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great! Now let’s dive in.

Performance review

Last week, I saw this tweet from Peter Schiff:

Apparently it isn’t fair to compare gold to Bitcoin. I mean… yea… I feel bad for Peter. Gold isn’t doing very well against Bitcoin over the last year… and over the last 4 years… and over the last 8 years...

Just look at it.

In the last 8 years gold has barely moved while Bitcoin is now up more than 200,000%.

And it is not like gold is competing with Bitcoin when it comes to risk adjusted returns either.

A quick reminder, the Sortino ratio is a measure of risk adjusted returns which compares the average return to the variation of the negative returns over a given period.

The larger the Sortino ratio the better the risk adjusted returns of an asset.

See this issue of the newsletter for why I prefer to use the Sortino ratio over the Sharpe ratio.

I’ve calculated the Sortino ratio of gold and Bitcoin based on the monthly returns over a period of 1 year, 4 years and 8 years. As you can see over a long period of time Bitcoin is giving you 20 times better risk adjusted returns than gold…

So maybe Peter Schiff is right. You can’t compare those two assets directly.

Actually I tend to agree on that point.

Gold has a $9 trillion to $12 trillion market cap. It is already widely used as a store of value by investors all over the world. As a consequence you can’t expect to see it grow as fast as Bitcoin which is still in the early part of its adoption curve.

Alright. What about comparing Bitcoin to some stocks then. After all this is what Peter Schiff is suggesting.

Once more Peter is correct in saying that there are stocks that have outperformed Bitcoin over the past year.

Example.

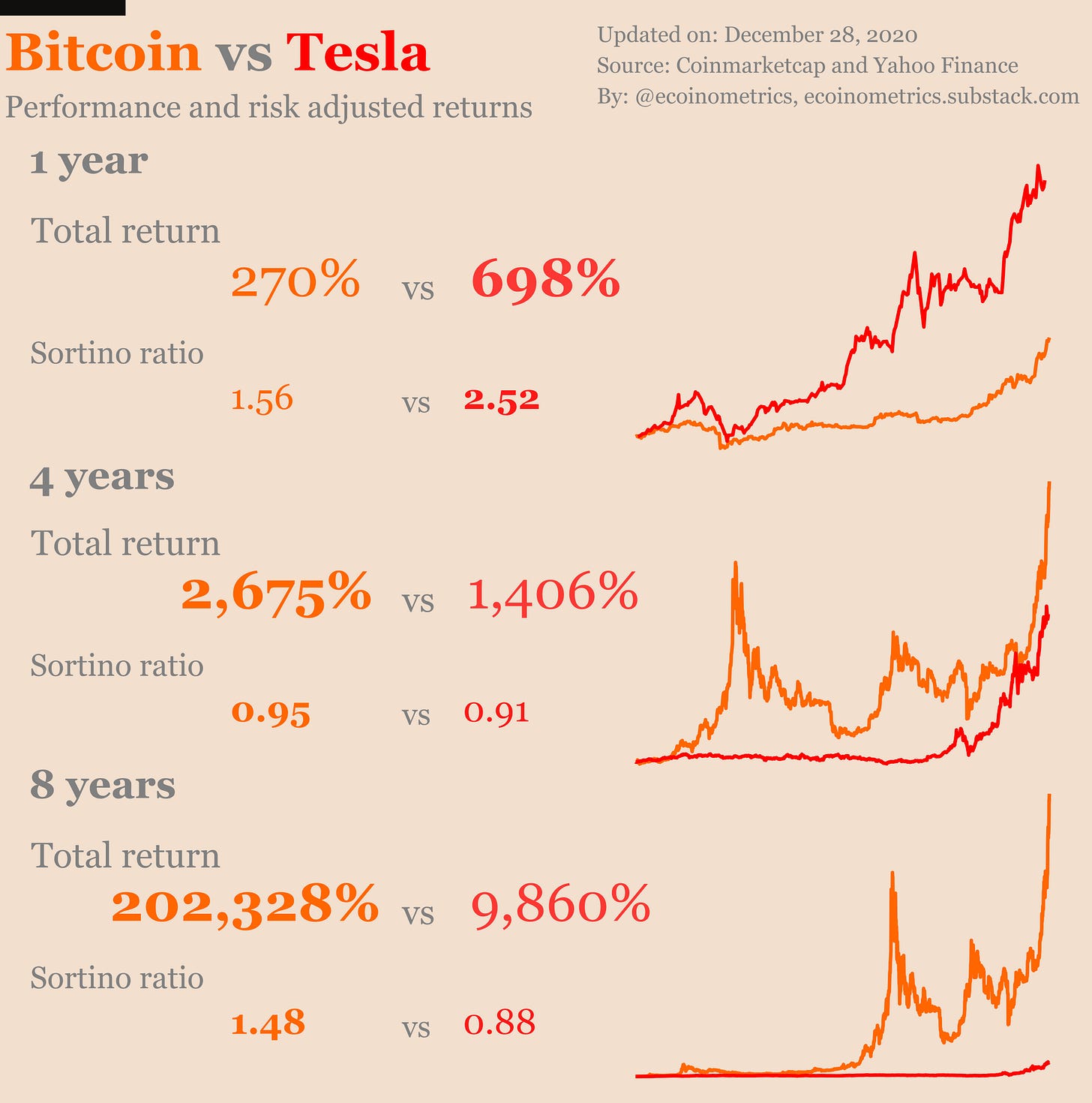

Tesla has been growing faster than Bitcoin this year:

Bitcoin +270%

Tesla +698%

More than that, Tesla also has a better risk adjusted return this year:

Bitcoin’s Sortino ratio 1.56

Tesla’s Sortino ratio 2.52

Ok. Now zoom out. What about the last 4 years? What about the last 8 years?

See for yourself.

Over 4 years Bitcoin and Tesla have similar risk adjusted returns although overall Bitcoin grew faster.

Over 8 years Bitcoin totally blows Tesla out of the water.

Another example.

Nvidia, the designer of graphics processing units, does not beat Bitcoin when it comes to returns this year but it isn’t doing so bad:

Bitcoin +270%

Nvidia +124%

In terms of risk adjusted returns it is the clear winner though:

Bitcoin’s Sortino ratio 1.56

Nvidia’s Sortino ratio 2.98

But as for Tesla, things look different when you take a longer term horizon.

Check it out.

A 4,000% growth in 8 years is good for sure. But Bitcoin is achieving more will a better risk adjusted return.

Do you start to see a pattern?

Yes, that’s right. Over a long enough period of time, as the halving cycles are playing out and adoption is climbing, Bitcoin performs better.

I haven’t done a full search over all stocks / indices that have at least 8 years of history but from a small sample I’ve taken the pattern holds.

Over one year you can find some stocks outperforming Bitcoin either in terms of total returns (Tesla) or risk adjusted returns (Nvidia, AMD).

Over 4 years some stocks are equivalent to Bitcoin in terms of risk adjusted returns (Tesla) but Bitcoin is the fastest growing asset.

Over a period of 8 years everything looks flat against Bitcoin.

So while Peter Schiff is right when he says that some stocks are outperforming Bitcoin over short periods of time the picture is completely different when you have longer time horizons.

What’s driving this phenomenon?

Each halving by creating a supply shock drives 4 year cycles of exponential growth. That means the longer your time frame, the more halving events you capture, the more you benefit from the exponential upside.

There is nothing similar in the stock market.

Do we expect this phenomenon to still hold in the future?

Yes.

Adoption is just starting. The market size of Bitcoin is small. To reach its natural market size as a store of value Bitcoin needs to grow from a $0.5 trillion asset to something like $10 trillion.

There is a long road to get there so you can expect that if you keep a long enough investment horizon Bitcoin will continue to outperform.

Moral of the story: don’t get distracted by the noise, keep your eyes on the horizon and continue to stack sats.

CME Bitcoin Derivatives

The December contract expired last week and after the initial spike in traded volume on Monday (due to the massive gap over the Christmas weekend) we are back to a pretty slow activity.

Looking at the latest data from the Commitment of Traders report we can see that retail traders were back at a record amount of long positions before Christmas.

Good for them.

At the same time the smart money continues to milk the basis trade by being record short the CME futures while maintaining long positions in the spot market to pocket the premium.

In other words, more of the same.

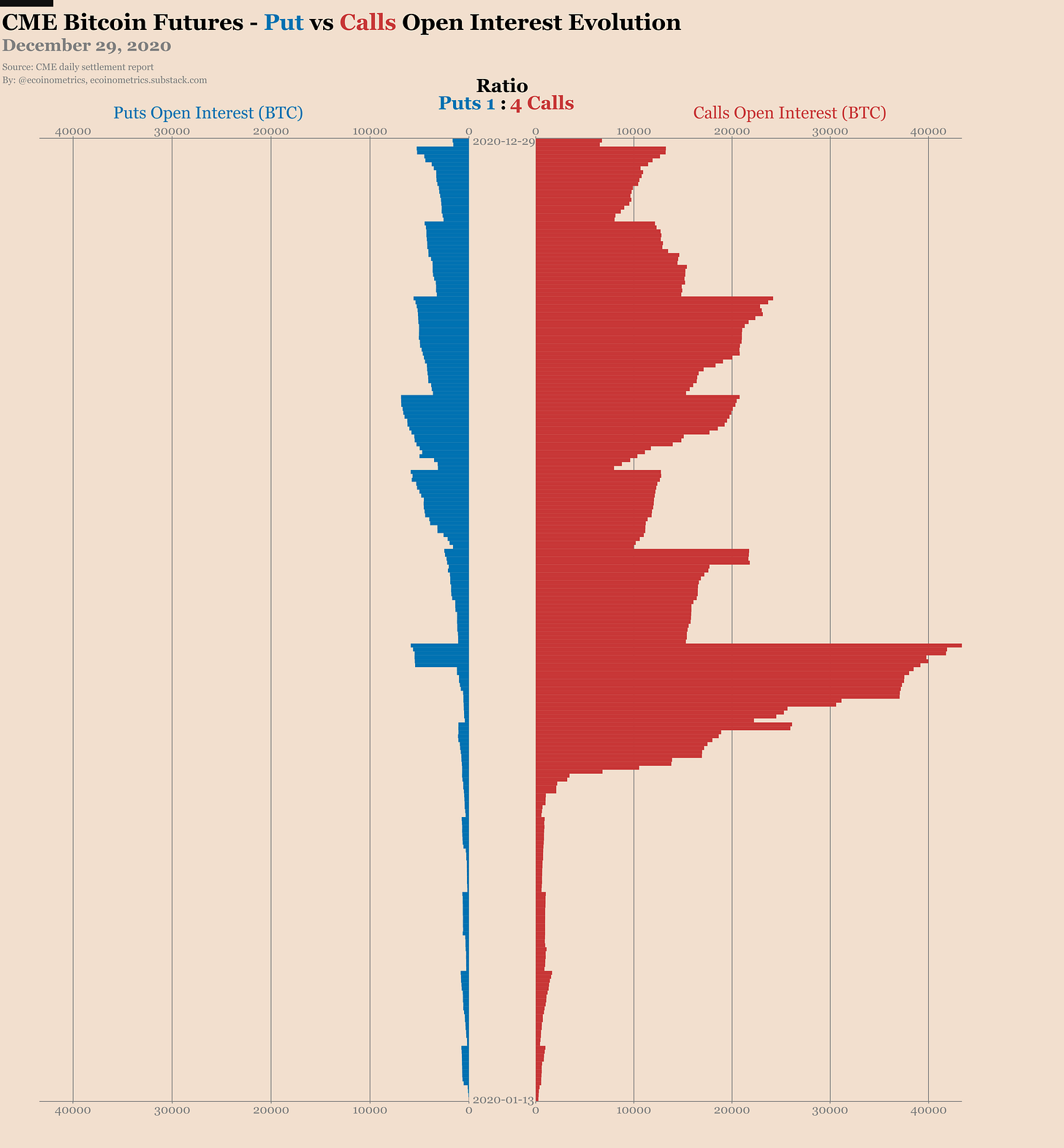

Month on month the options market continues to shrink. It is now only a fraction of what it was at its peak 6 months ago.

It will be interesting to see where this trend goes.

For those who still have open positions, more than half of the calls in January 2021 are already in the money.

We might be heading for a repeat of December when more than 85% of the calls expired in the money.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!