In the process of correcting a mistake I’ve made a few weeks ago I came to answer one interesting question.

How long do you need to work to afford one Bitcoin?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!

Now let’s dive in.

Saving for Bitcoin

First my mistake.

A few weeks ago we looked at the evolution of the Big Mac price in the US. What we found out is that in 30 years the price of a Big Mac grew 2.6x.

My reaction to that was to comment:

“Has your salary gone up 2.4 times since 1990? I guess not.”

That was a bad guess on my part. At the time I did not do any research to verify whether that was true or not.

It turns out I was wrong.

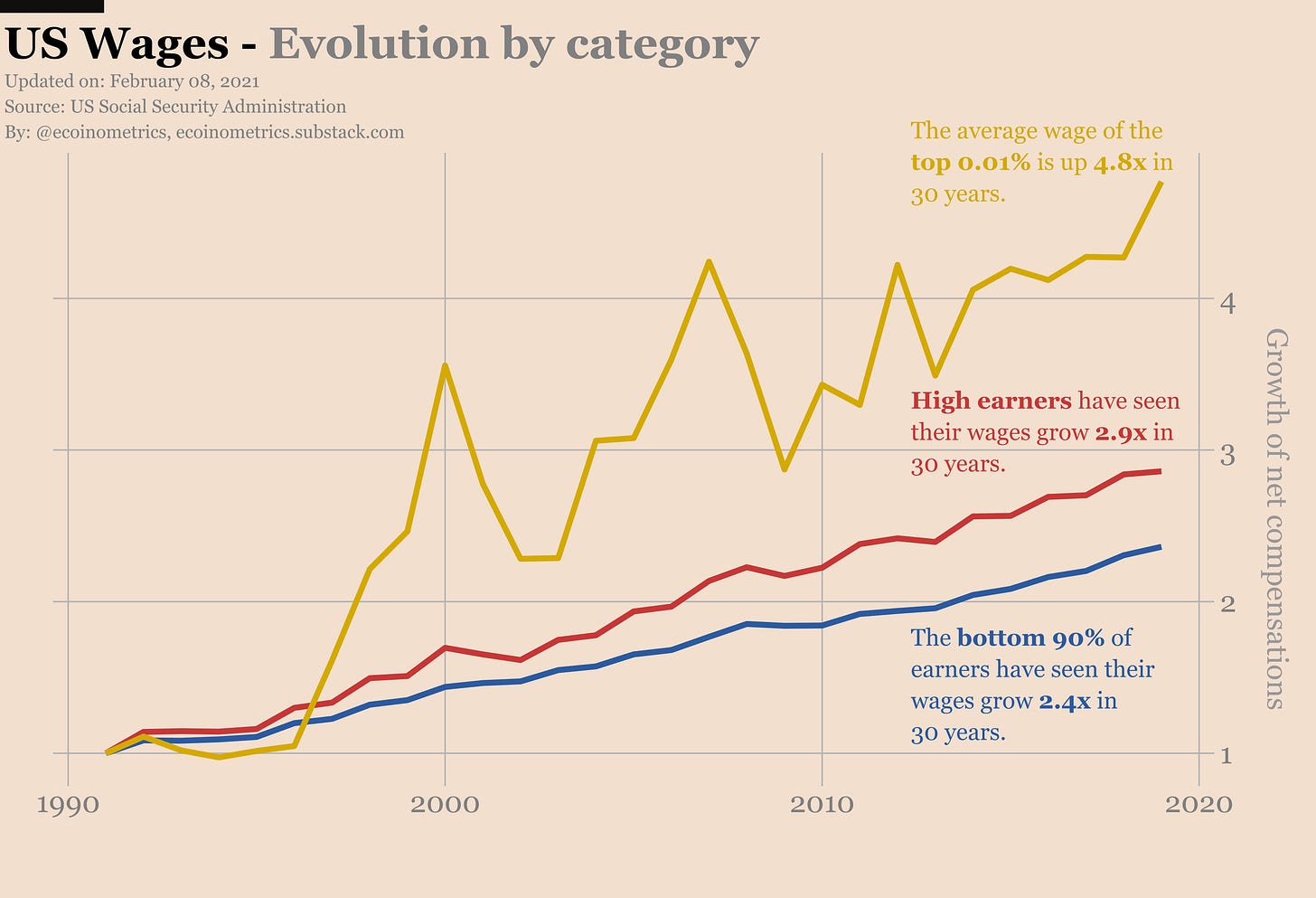

You can break down the US citizens net annual compensations (think total salary before taxes) into three categories:

The top 0.01% of earners (average compensation $1 million per year).

The bottom 90% of earners (average compensation $34k per year).

Whatever is in the middle that I will call high earners (average compensation $190k per year).

Looking at how the average net annual compensation has evolved for each of these categories over the past 30 years you get the following graph:

My mistake, the bottom 90% did see their average salary grow by 2.4x over the same period.

Maybe Mac Donald is actually using this data to decide how much to increase the price of the Big Mac every year… who knows...

But now that we have more data we can do more things. Like for each of these categories how many hours must you work to be able to afford one Bitcoin.

Using some standard statistics on the average amount of working hours per year in the US you get something like that (assuming BTC around $39k):

The top 0.01% only need to work 8 hours to afford one Bitcoin. Their average annual compensation is 237 BTC.

The high earners need to work 388 hours to afford one Bitcoin. Their annual compensation is 4.67 BTC.

The bottom 90% need to work 2,160 hours to afford one Bitcoin. That’s more than the average number of hours worked in a year. Their annual compensation is 0.84 BTC.

Hold on and stack sats.

Bitcoin = Copper

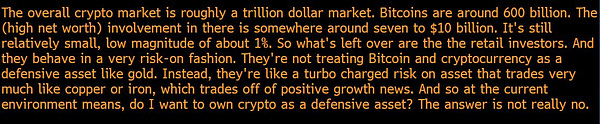

Once more people are missing the big picture. This time the problem seems to be that: Bitcoin isn’t digital gold, it is digital copper.

Check it out:

First of all, the chart. What are we supposed to conclude from this graph?

That both Bitcoin and copper are up since the crash of March 2020? Ok, almost everything is up since then so that doesn’t tell me anything specific.

This is especially useless given that Bitcoin and copper are plotted on different price scales… for a proper perspective since the low of March:

Bitcoin is up 700%.

Copper is up 76%.

Now for the meat of the argument, Jeff Currie (Global Head of Commodities Research at Goldman Sachs) thinks that Bitcoin cannot be digital gold because it isn’t a “defensive asset”.

Maybe by that Jeff means that gold is there to protect you in case of a market crash while Bitcoin won’t be able to do so.

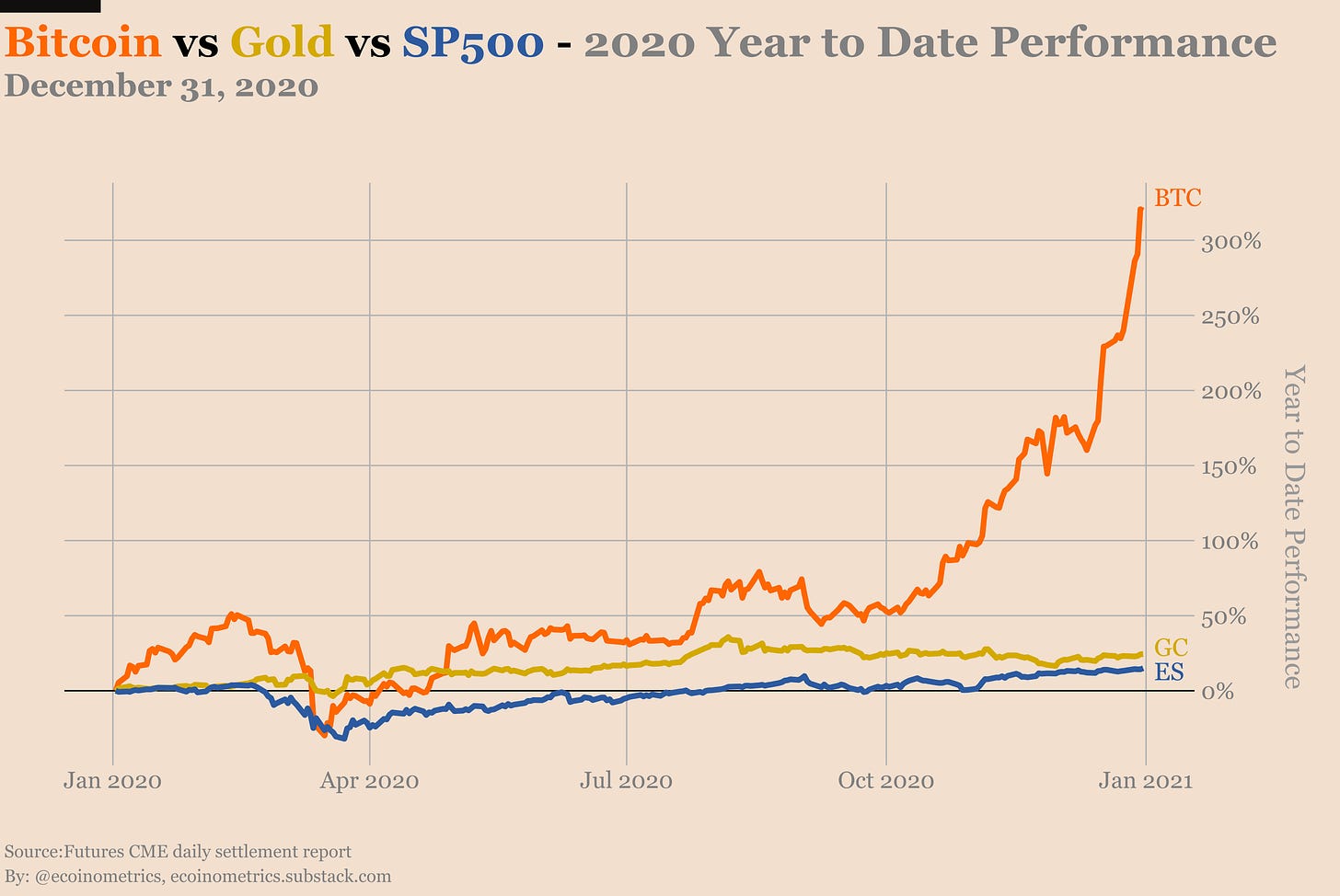

For reference let’s look at what happened in 2020:

In March 2020 Bitcoin went down 65%.

In March 2020 Gold went down 15%.

From that perspective, yes during the crash gold was better than Bitcoin at protecting your portfolio.

But can you conclude from this event that Bitcoin cannot be digital gold?

The answer is no.

The key mistake here is the comparison with copper. Bitcoin is designed to be a store of value. Copper isn’t. Bitcoin’s growth is following the S shaped adoption curve. Copper is just following its natural commodity cycle.

I’ve noticed that a lot of people coming from traditional finance first approach Bitcoin as something that they think should already be a store of value on par with gold. When they see that it’s not behaving exactly the same way they conclude that Bitcoin is just a bubble.

What they fail to factor in is that Bitcoin has all the technical characteristics of a good store of value. It only needs time to be adopted as such.

If you are missing the big picture you’ll mistake the S shaped adoption curve for a bubble. Don’t make that mistake. Adopt a long term investment horizon and wait for everybody else to catch up.

The bubble

So the Financial Times seems to be worried that central banks QE policies are fuels for the growth of Bitcoin.

That’s rich isn’t it? Somehow it is fine for all the other assets but when it comes to Bitcoin easy money from the Fed is a major risk.

But it turns out this article is correct in more ways than one.

There is a double effect when it comes to quantitative easing:

By definition there is more liquidity in the financial system. That means more cash for more or less the same number of investment opportunities. By default this is going to pump the value of all financial assets.

At the same time investors realize that there is more cash in the system and that this is causing at least asset price inflation. As a result they do not want to keep cash reserves and see their purchasing power disappear. So instead they invest.

The beauty of this is the reinforcing dynamic of these two points.

Some investors expect central banks will print more money so they chase every investment opportunity. But that means if you don’t do the same your risk being left behind. As a result everyone is buying everything which is pushing prices even higher making asset price inflation a reality.

But it isn’t true that easy monetary policies all over the world are the only reason for the rise of Bitcoin.

As I’ve commented above many people with a traditional financial background fail to recognize the effect of the adoption curve on the exponential growth of Bitcoin.

This is kinda summarized by this quote that concludes the article:

“Changes in the way assets are perceived can also mean that bubbles may never fully deflate, and this could hold true for cryptocurrencies, too,” Mr Bolliger said.

Right… a bubble that never fully deflates… is it really a bubble then? Or is it simply some asset that went through its adoption curve with an exponential growth pattern?

Bitcoin has been running for more than 10 years now. We have stopped counting how many times it has been called a bubble or simply dead. Yet it is still around. And for those who held all the way the reward was very much worth the risk.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!