Should you invest in companies that hold Bitcoin on their balance sheet? As usual the answer is: it depends.

So let’s dig deeper into the idea of a Bitcoin Treasuries Index.

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great! Now let’s dive in.

Bitcoin Treasuries Index

Last week we introduced the idea of a Bitcoin Treasuries Index. That’s simply an index tracking public companies that use Bitcoin as a reserve asset.

To ensure that the stocks included in the index are both liquid enough and have a significant position in Bitcoin we need some inclusion rules. So to be included in the Bitcoin Treasuries Index a company must be:

Public and traded on a US exchange.

Own at least 0.005% of the max supply of Bitcoin.

Note that these rules exclude companies such as Hut 8 Mining and Galaxy Digital.

Both companies have more than the minimum amount of BTC required (respectively 0.014% and 0.078% of the supply). But they are traded on the Toronto Stock Exchange so they are out.

That leaves us with the following stocks:

MicroStrategy MSTR (71,079 BTC)

Tesla TSLA (48,000 BTC)

Square SQ (8,027 BTC)

Marathon Patent Group MARA (4,813 BTC)

Riot Blockchain RIOT (1,175 BTC)

Go checkout Bitcoin Treasuries for all the details on these companies.

Just yesterday Square announced that they purchased more BTC raising their reserve from 4,709 to 8,027.

That kind of confirms Square’s strategy where they are probably going to set aside some amount of free cash flow to accumulate more Bitcoins on a quarterly basis. That’s basically stacking sats for business.

Ok.

Now that we have our list of stocks let's discuss how much weight we should give them in the index.

I see mainly four possibilities:

Give them equal weights.

Give them a weight proportional to their market cap.

Give them a weight proportional to the size of their Bitcoin treasury.

Give them a weight proportional to the size of their Bitcoin treasury relative to their market cap.

There is no right or wrong answer in what you choose here. Each choice will give you an index with different properties.

With equal weights you want to invest in companies that own Bitcoin. This is a binary choice. Either a stock owns Bitcoin or it doesn’t. If you build your index using equal weights you are saying that you like stocks that have a stake in BTC but it doesn’t matter if the stake is high or low (as long as it is above a minimum threshold).

With weights proportional to the market capitalizations your are again saying that it doesn’t matter how big is the Bitcoin treasury. But in that case you also give a lot of weight to, well, large companies like Tesla ($671 billion market cap) and Square ($116 billion market cap). At this point this is pretty much the same thing as extracting the stocks that own Bitcoin from the NASDAQ.

With weights proportional to the size of their Bitcoin treasury you are saying that how much Bitcoin they own matters for the performance of the stock. In that case you are saying that the larger the Bitcoin treasury, the better the performance you expect. That’s a reasonable position if you think that either the value of the treasury reserve itself will drive the stock higher or having a large BTC position is a sign that the company is ready for the future.

With weights proportional to the ratio of the value of the Bitcoin treasury divided by the market cap you are going one step further. You’d expect that the larger this ratio the larger the influence of the value of Bitcoin on the stock price. So that’s what you’d choose if you wanted to have an index with a stronger correlation to Bitcoin.

Alright…

My choice for the Bitcoin Treasuries Index is to go with weights proportional the size of their Bitcoin reserve.

Two reasons:

I want the index to be tilted towards being more correlated to Bitcoin.

I don’t want to constantly rebalance the index weights as the market cap and the market value of Bitcoin fluctuate on a daily basis.

With that we rebalance the weights (or add/remove stocks) every time there is a public announcement regarding a change in BTC treasury holdings.

So we end up with the following composition:

MicroStrategy 53% weight.

Tesla 36% weight.

Square 6% weight.

Marathon Patent Group 4% weight.

Riot Blockchain 1%.

We normalize the index value so that it is equal to 10 on the day of the 3rd halving (May 11, 2020) and we obtain something like that:

From 10 to 100 in less than a year. That’s pretty decent.

Yesterday MSTR as well as the miners MARA and RIOT were hammered when Bitcoin dipped. Tesla didn’t do well either so you can see the result.

Which brings us to the question of how correlated is this index to Bitcoin? And how much is this index correlated to the stock market?

Keep in mind that we have less than a year of data to do some statistics. But still when you look at the one month correlation since the halving you get the following picture:

As expected Bitcoin is pretty much uncorrelated to the stock market since the halving. For reference check out the right of the picture. You can see what a strong correlation looks like with the SP500 vs the NASDAQ.

During the same period the Bitcoin Treasuries Index correlation score is averaging 65% with Bitcoin vs 30% for the stock market.

So while the specific values aren’t particularly meaningful, we do get that BTC is a stronger driver of the Bitcoin Treasuries Index than the stock market.

That’s pretty clear too when you look at the long term performance of the index, since the halving:

Bitcoin Treasuries Index +892%

Bitcoin +468%

NASDAQ +41.9%

SP500 +32.5%

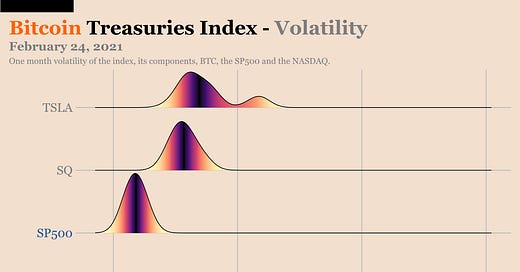

Fun fact, over the same period Bitcoin is not the most volatile asset in this basket. Take a look at the distribution of the one month volatility:

The more you go to the right the higher the volatility.

The distribution represents the number of days at a given volatility level.

The darker the region the closer you are to the average volatility.

So the more a distribution is tilted to the right the more volatile the asset.

Bitcoin is no more volatile than Tesla and in fact the Treasuries Index is significantly more volatile than Bitcoin.

But honestly who cares? Most of that is upside volatility.

So what’s the conclusion here?

From the halving until now tracking the index would have given you a leveraged version of Bitcoin’s bull market.

How it will behave moving forward depends on a few parameters.

For now MicroStrategy is THE heavyweight of the index. And MicroStrategy is mostly a pseudo Bitcoin ETF at this point.

But it is reasonable to think that there is a coming wave of diverse public companies that are going to convert a significant amount of their cash reserve to BTC.

Some of them might meet the requirements to be included in the index which would result in a more diverse composition and thus change its dynamic.

If you want to track the index in your portfolio I’ll do a daily update on Twitter and more deep dives regularly in the newsletter.

So don’t forget to subscribe to keep up to date.

CME Bitcoin Derivatives

There are only a few days left on the February contract.

The dip earlier this week forced some reshuffling and pushed the daily traded volume to a record new high of almost 150k BTC worth of contracts on Tuesday.

But the net result is just an acceleration of the rollover.

Before the dip retail traders timidly increased their long positions while the smart money continued to pile on the basis trade.

Nothing new under the sun.

There is barely any traded volume on the CME options market these days. But the traders who recently bought a bunch of puts at the $50k strike were definitely inspired.

That was probably some kind of hedging but the timing was pretty good.

Even after the dip at the close on Tuesday 62% of the February calls were still in the money. We’ll see how far BTC can recover before those contracts expire on Friday.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!

Specially liked this one. Nice thought about the Bitcoin Treasuries Index.