Ecoinometrics - Is there a weekend effect?

June 09, 2021

Simple question: is Bitcoin more likely to fall on Saturday or Sunday than any other time of the week?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great! Now let’s dive in.

Is there a weekend effect?

I haven’t made any poll, but from what I’ve heard during many discussions there seems to be an idea floating around that Bitcoin tends to perform badly on the weekends.

What do you think?

There is some logic to that line of thinking. Miscellaneous justifications for this phenomenon are:

There is less trading happening on the weekend. As a consequence the market is thinner and thus more prone to violent moves.

Short term traders like to book profits at the end of the week. By closing those positions they would trigger big price movements.

Whales like to shake out weak hands on the weekend (for some unknown reason...).

Large buyers (read institutions) aren’t around on weekends so there is no one to buy the dip.

Honestly I’m not convinced by any of this.

But before trying to look for an explanation we should ask first whether or not there is such a thing as the weekend effect.

Now it turns out that saying Bitcoin price falls on the weekend is not a very well defined quantitative statement… so let’s try to be more specific.

In the following, I’m working on daily data using UTC as a time reference. You’d think it doesn’t matter if we have enough data points, but often where you decide to take your reference price for the daily close does have some effect.

The dataset we are using starts on the day of the 1st halving.

The first thing we can do is look at the daily change (close to close) of BTC and break it down by day of the week.

For each day we plot the distribution of those daily changes:

Each grey point represents the close to close return for one day.

The vertical red line marks the median of each distribution.

The density of the distribution (how many points in a region) is coloured so that the closer you are to the average daily change, the darker the colour.

Now take a look.

Right… where is our weekend effect?

The median and the average return are in the same ballpark for each day of the week.

Moreover there doesn’t seem to be more outliers in the distribution if you look at Saturday and Sunday versus the rest of the week.

Actually it seems to be the opposite. The middle of the week has a wider distribution than the weekend.

Hmmm…

Maybe people mean something else when they talk about Bitcoin being more likely to drop on the weekend.

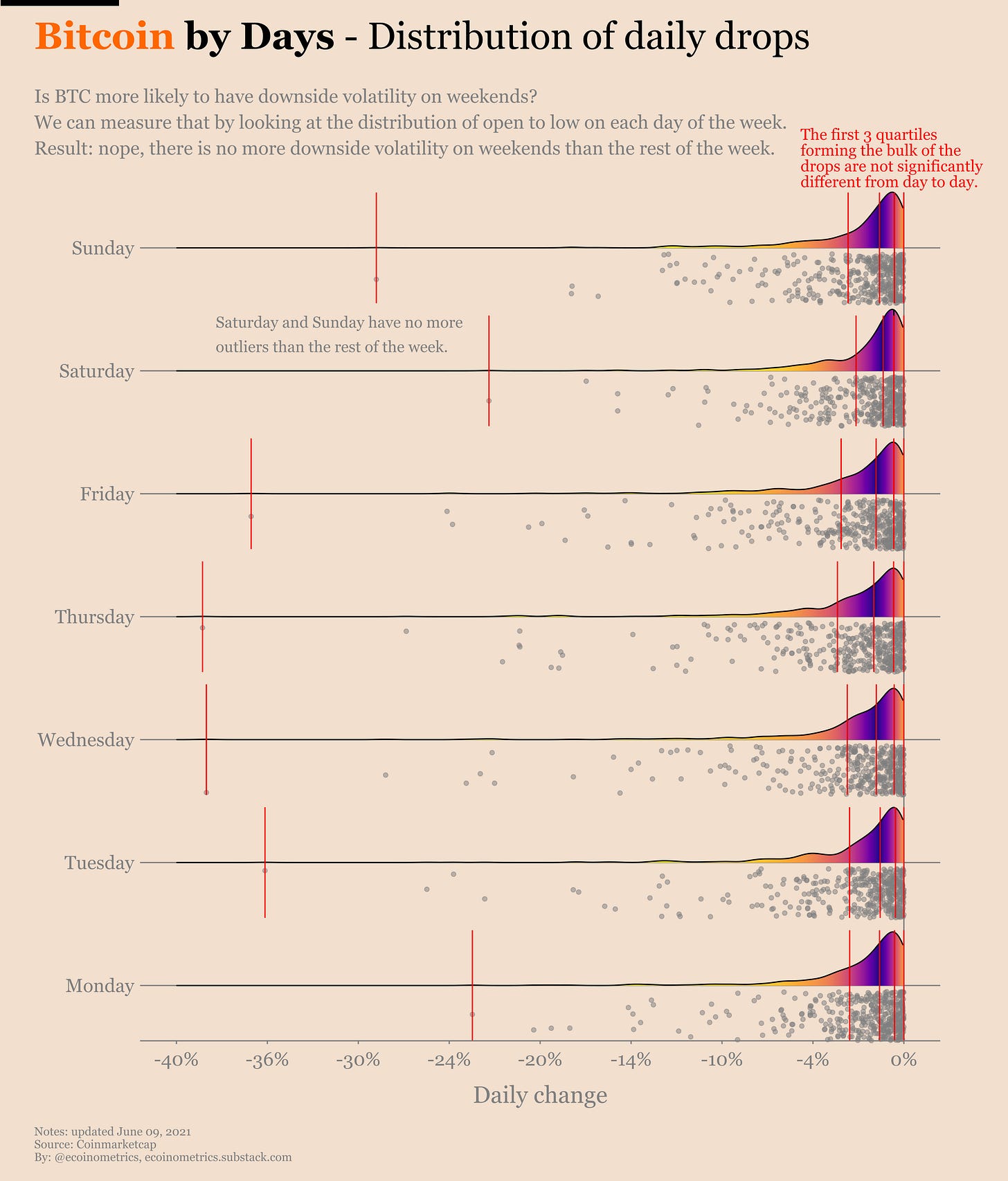

Well, the only other possibility that comes to my mind is to use another metric. Let’s call it the daily drop. It measures the distance in percentage between the daily open and the low point.

After all that’s a reasonable way of looking at it. Even if the price recovers at the close it could be that on the weekend we have lower lows.

Ok, so now let’s take the same chart as before but measure the daily change as the daily drop.

I've added markers for the quartiles of the distributions to help with the comparison between each day.

Alright.

…actually this is the same story here. If you focus on the fourth quartile (largest moves, to the left) once more Saturday and Sunday (Monday too it turns out) have a more compact distribution of daily drops.

If anything, Wednesday, Thursday and Friday have a longer left tail.

Conclusion: as far as those metrics are concerned there is no weekend effect on the value of Bitcoin.

If you have other ideas of metrics you think we should analyze then let me know in the comments.

CME Bitcoin Derivatives

You won’t be surprised to learn that the mood isn’t bullish in the derivatives market.

Let’s start with the positions of traders.

Last week it might have seemed like the retail crowd was buying the dip. Turns out it isn’t that simple.

For now the long positions are hanging around 2,000 contracts (equivalent of 10,000 BTC). It isn’t very clear what it will take for the sentiment to change. BTC stuck between $30k and $35k seems to be an easy target for FUD.

The story is very similar for the smart money. If you focused only on the net positions (red line below) you’d think that the smart money is getting less short. But the thing is, if you dig into the details it doesn’t mean that they are bullish either.

The long positions are stagnating i.e. there is no surge of traders buying the dip.

The short positions are falling, but this is actually a deleveraging of the basis trade. As Bitcoin is sliding the premium of the futures over spot BTC has tightened which can explain why we see a bit less of those positions.

But this has nothing to do with any directional bet. So really there are no bullish signs when looking at the futures.

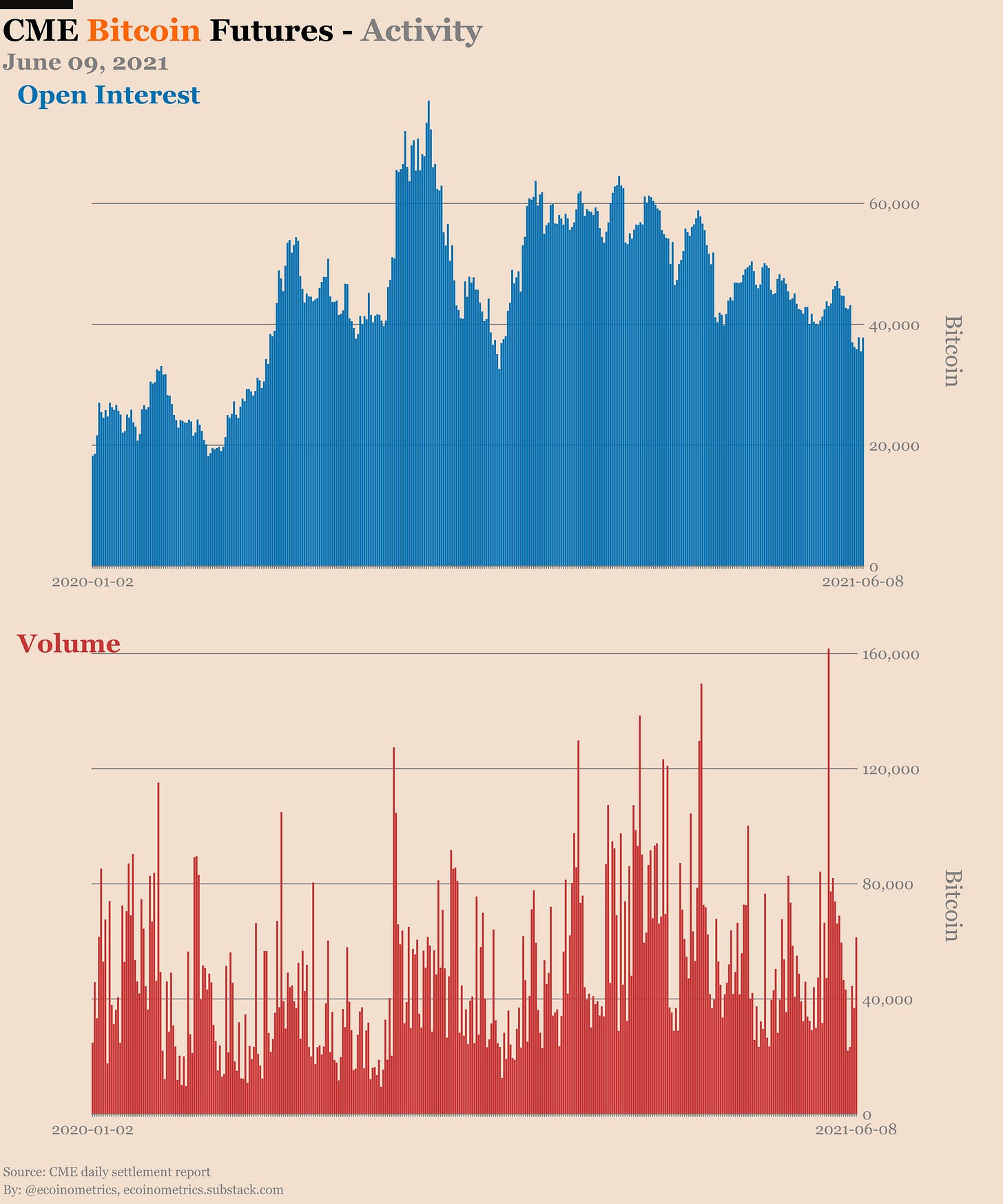

Overall the open interest isn’t moving at all and most of the trading activity is concentrated on the July contract.

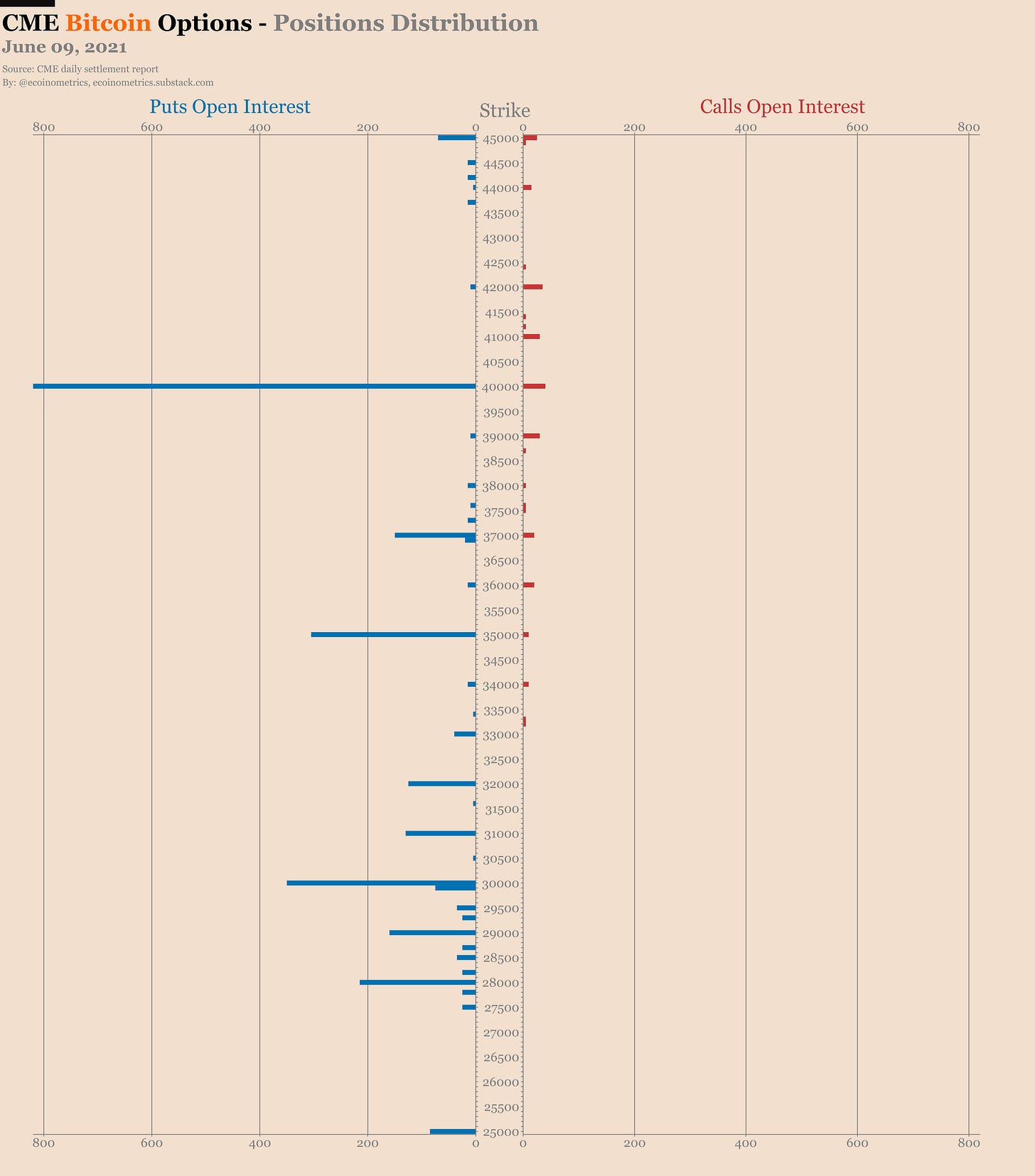

The options market gives the same vibe. We have 2 puts for each call which is historically high.

And the distribution of those puts shows that there are real worries Bitcoin will dip below $30k.

See for yourself.

Clearly that’s not good for the short term. I don’t know what catalyst will come to shake the negative sentiment off BTC.

But if you are betting on Bitcoin with an investment horizon measured in months or years then now is a good time to accumulate.

Dollar cost average into a position while the price is depressed and you will be on a solid base for the next growth phase.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

Thanks, very interesting as ever. My thoughts were that maybe the weekend could be taken as a whole, i.e Friday night to Sunday night; and that this is more likely a recent thing (last two years) since CME has been trading with enough size leading to the professional gap meme (but I see you have addressed that already below).

Thanks for analysis. Santiment did some research on it a couple of years ago. It appeared that Wednesday could probably be the worst day: https://insights.santiment.net/read/1139

Things could change.