In the US the Biden administration is getting to work. It will take a few weeks before we see anything coming out of the US Treasury Department but the picture is pretty clear.

Janet Yellen is now Treasury Secretary. Before she was Fed Chair… you can imagine that this will make cooperation between the central bank and the federal government very easy in the next four years. For better and for worse.

But before we start guessing what’s going to happen we need to know where we are.

So what’s the baseline?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!

Now let’s dive in.

The baseline

Get ready for a lot of charts today. Stick with it, I swear all of this is very relevant for Bitcoin.

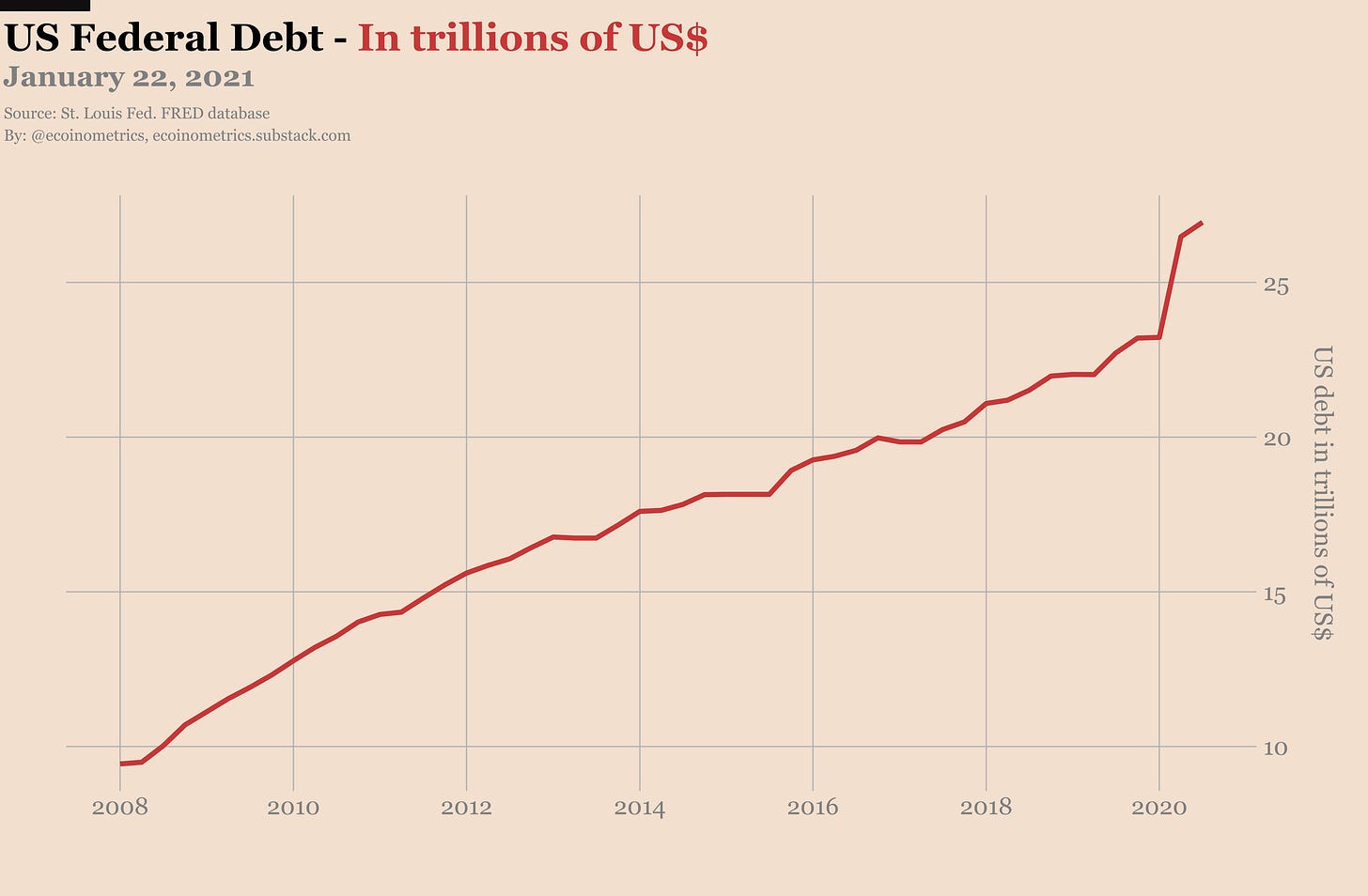

Maybe the easiest place to start is the Federal debt. We are due for another round of stimulus this quarter. But the couple of trillions of US$ from last year’s package are easy to spot on a chart.

This was not a standard year.

And of course with the economy being shut down for a large part of the year that stimulus money didn’t do much to boost the GDP.

The result is a record high 130% of debt to GDP ratio.

As you can see on the chart the US debt to GDP ratio also climbed after the 2008 financial crisis.

It never went back down… expect the same after 2020.

The government needs money for their stimulus measures. They issue debt to get the cash. And that’s it for the Federal government.

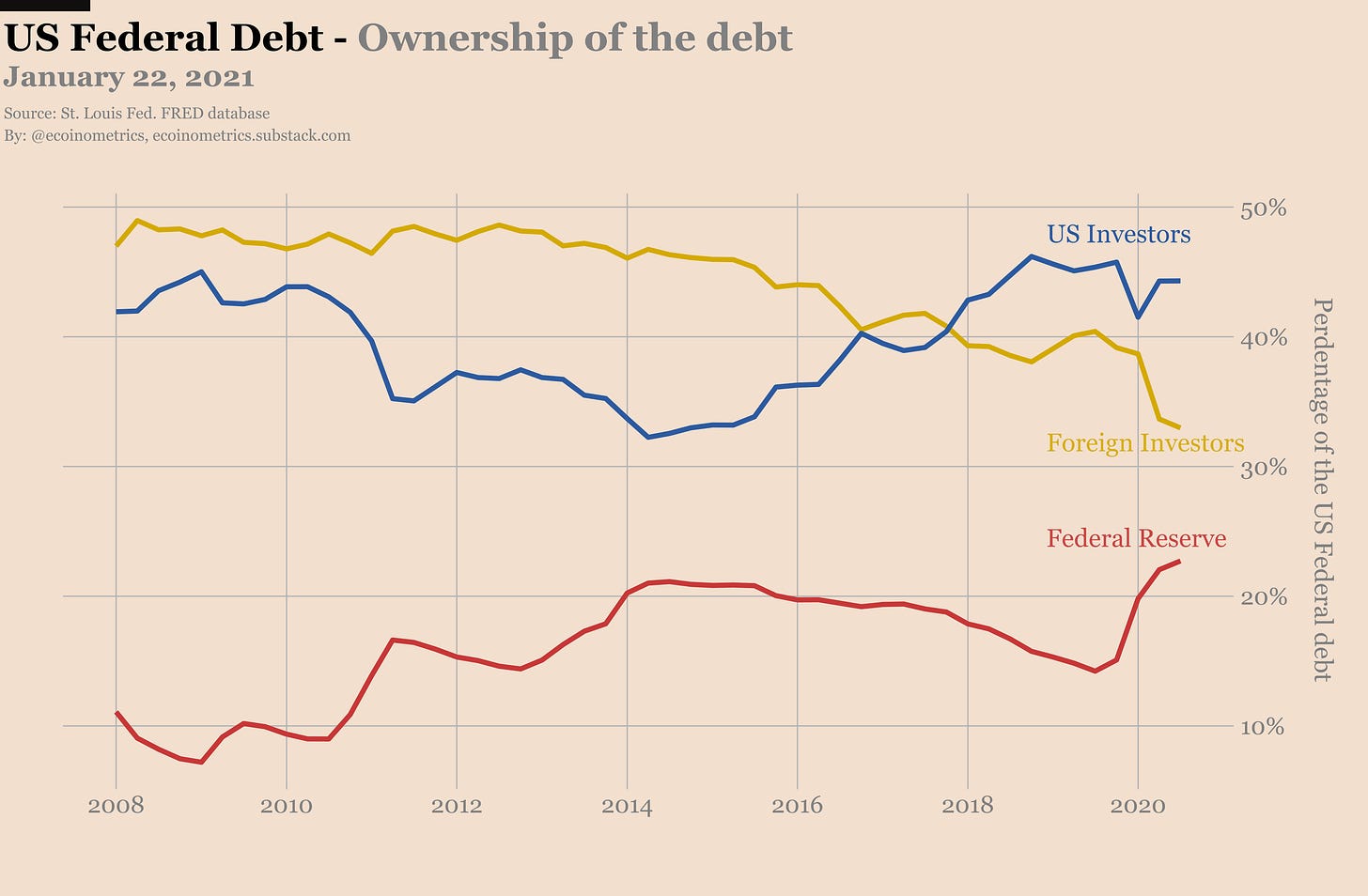

But who is buying that debt exactly?

The Federal Reserve of course. Increasingly so actually.

Check it out.

You have roughly three groups of people who are buying US debt:

Foreign investors including foreign governments and institutions.

US investors, that is US based banks, funds and so on.

The Federal Reserve.

Those groups act with different sets of constraints.

Among US investors banks have to buy US Treasury bonds. It is part of their regulatory constraints as those bonds are deemed to be the safest collateral assets by financial regulators.

That means a large portion of US investors don’t really hold the US Federal debt because they like it. They do because they have to as part of running their business.

So the fact that this group owns 45% of the debt is more about compliance than anything else.

Meanwhile foreign investors who do have the choice are seeing their share of the ownership decline steadily since the 2008 financial crisis. They simply have less use for it.

Finally we come to the Federal Reserve. The Fed is independent from the Federal government. In theory they do not have to buy the bonds issued by the US Treasury.

In practice though they are soaking up a lot of that debt. And that’s important because to buy those bonds the Fed just has to run the money printer. They print money out of thin air to finance the Federal government while you are left paying for it when your purchasing power goes down as your currency gets debased.

How much of the debt is the Fed buying these days? A lot. Really.

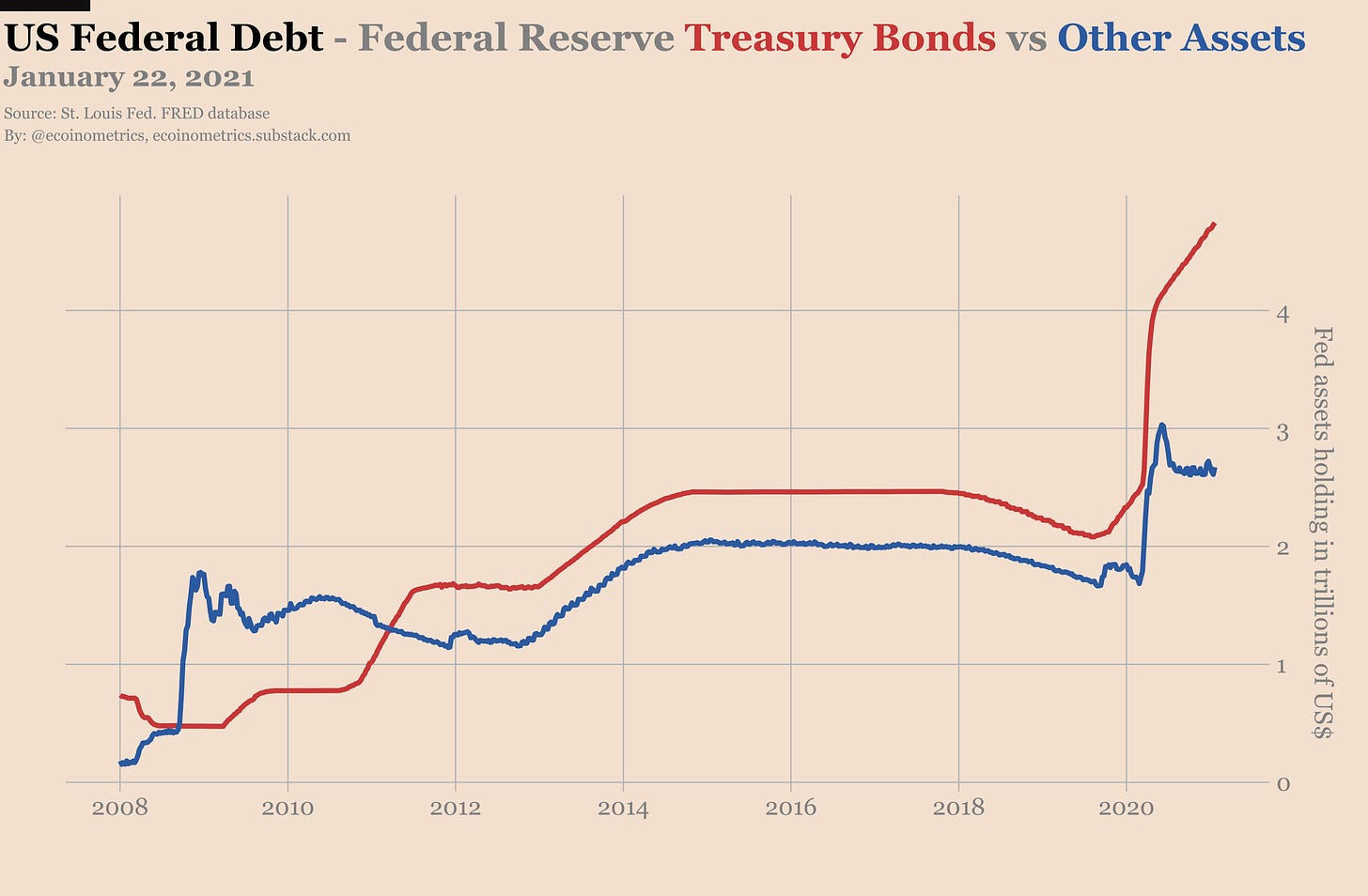

You can break down the balance sheet of the Federal Reserve between US Treasury bonds and the rest of the assets.

Since the end of 2019 they have bought $2.5 trillion worth of US Treasury bonds. During the same period they “only” bought $1 trillion of other assets.

And they are not done with it. Just look at the trend.

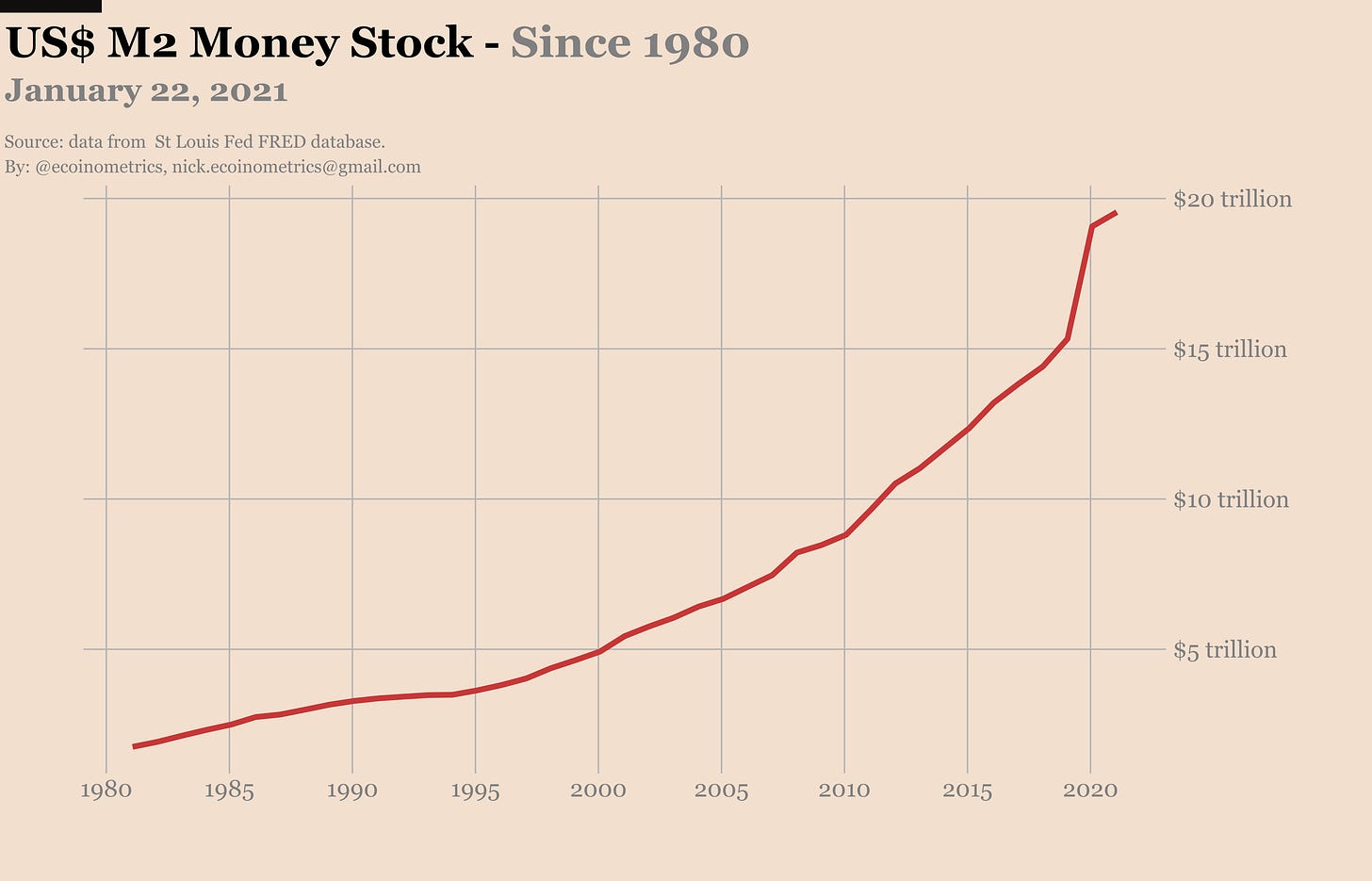

Doing so they have dramatically increased the money supply. Since 1980 the M2 money supply of US$ has been growing at an average rate of 5.85% year over year.

Once more 2020 stands out with a 24% growth of M2...

It really looks like the money supply is going parabolic.

Now do you think things are going to be different with the new administration?

Do you think that when former Fed Chair Janet Yellen will decide to issue new US Treasury bonds to finance upcoming stimulus packages the current Fed Chair Jay Powell will pass on buying them?

Right… it is pretty straightforward to imagine how that will play out:

The US Congress will decide how much stimulus to create.

The US Treasury will issue bonds to finance this stimulus.

The US Federal Reserve will print money to buy those bonds.

This process is called debt monetization and it is bad news for the purchasing power of your US$.

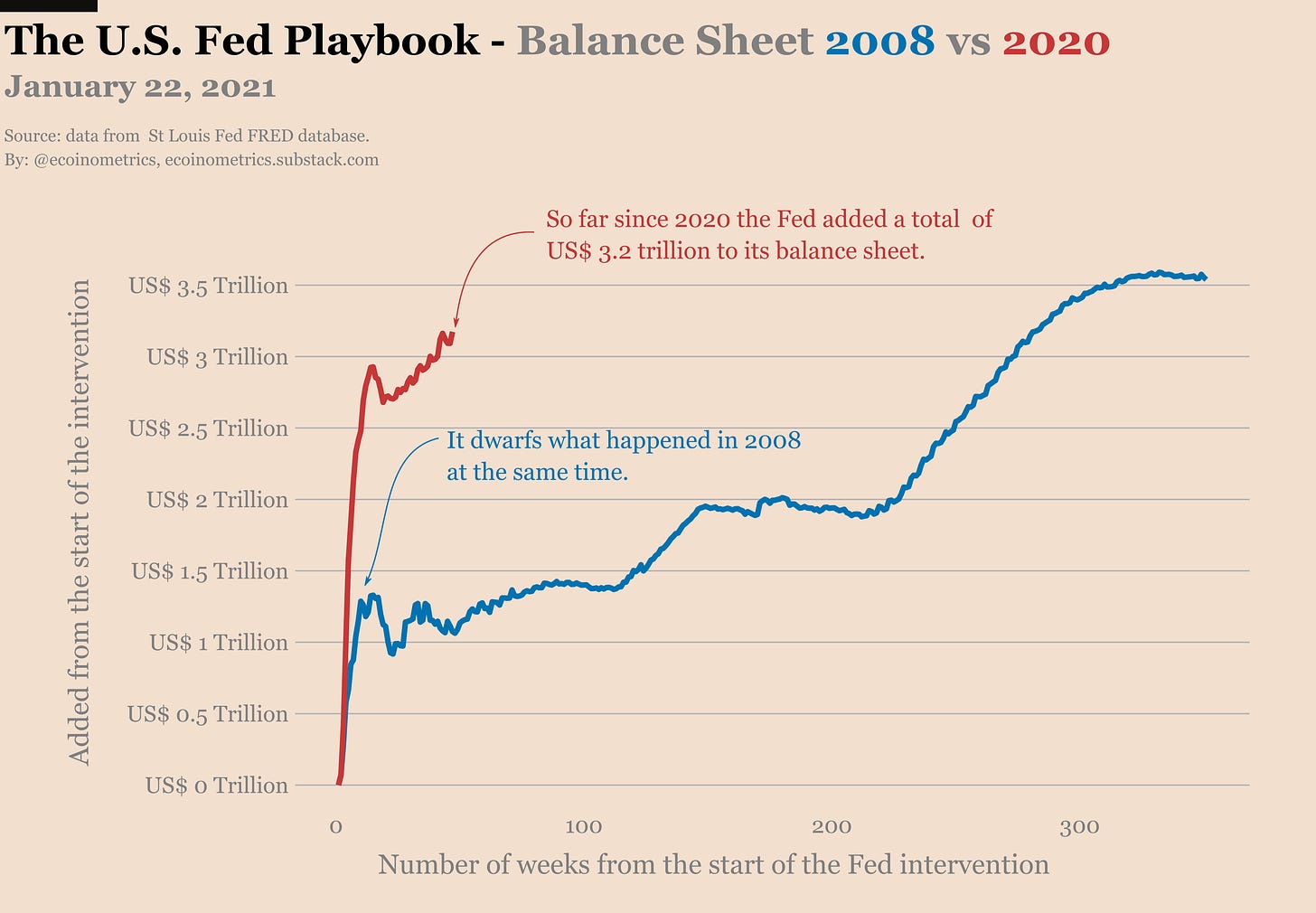

In this scenario the Fed’s balance sheet will expand at about the same rate as the Federal debt in a repeat of the post 2008 playbook.

Remember that in 2008 the initial emergency measures only accounted for a fraction of the total balance sheet expansion. Most of the growth happened in the years that followed with successive QE programs.

How likely is it that things will play out as I just described? Very likely.

The reason is that the Fed doesn’t have any choice. It is all about managing the debt.

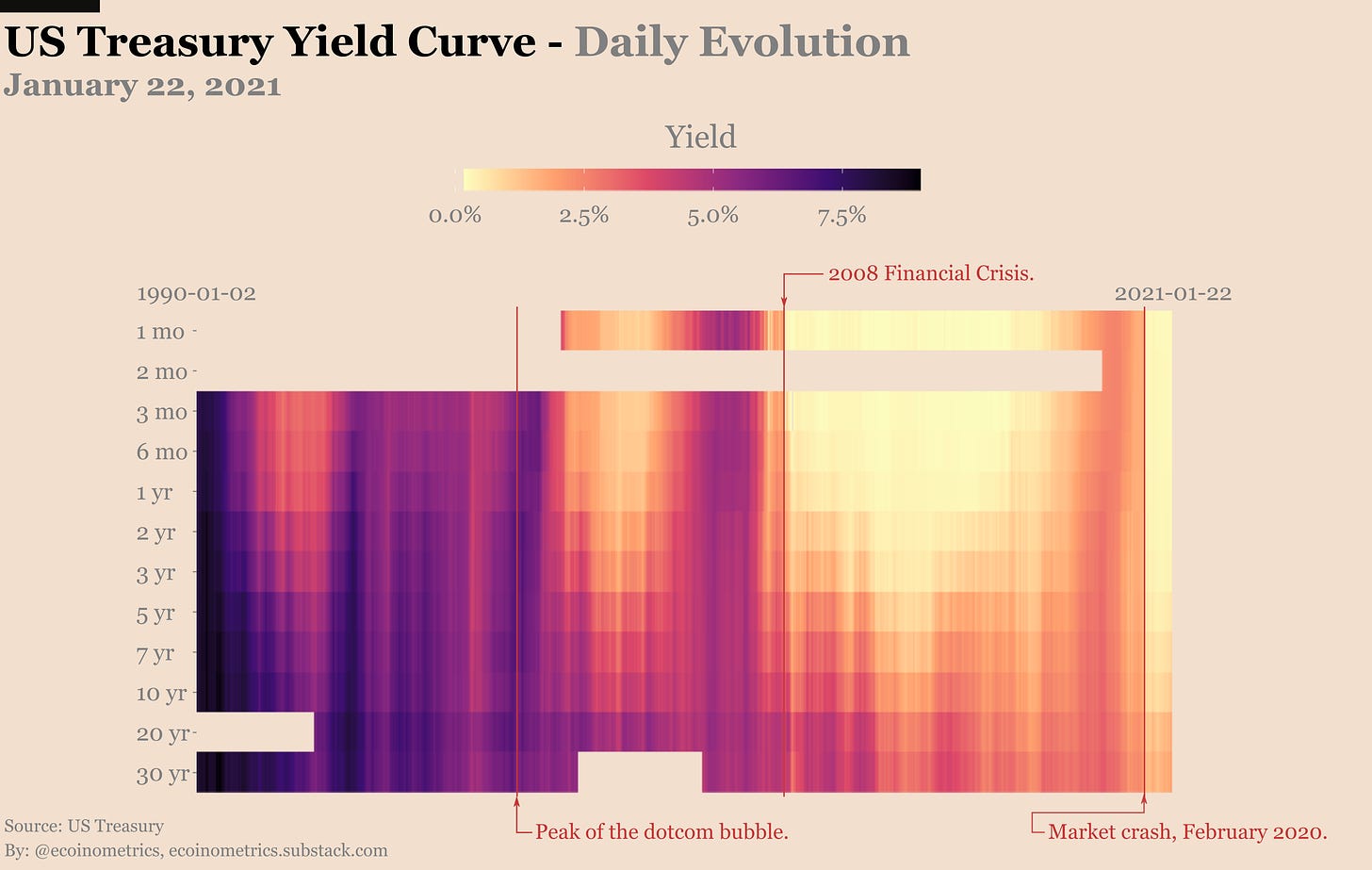

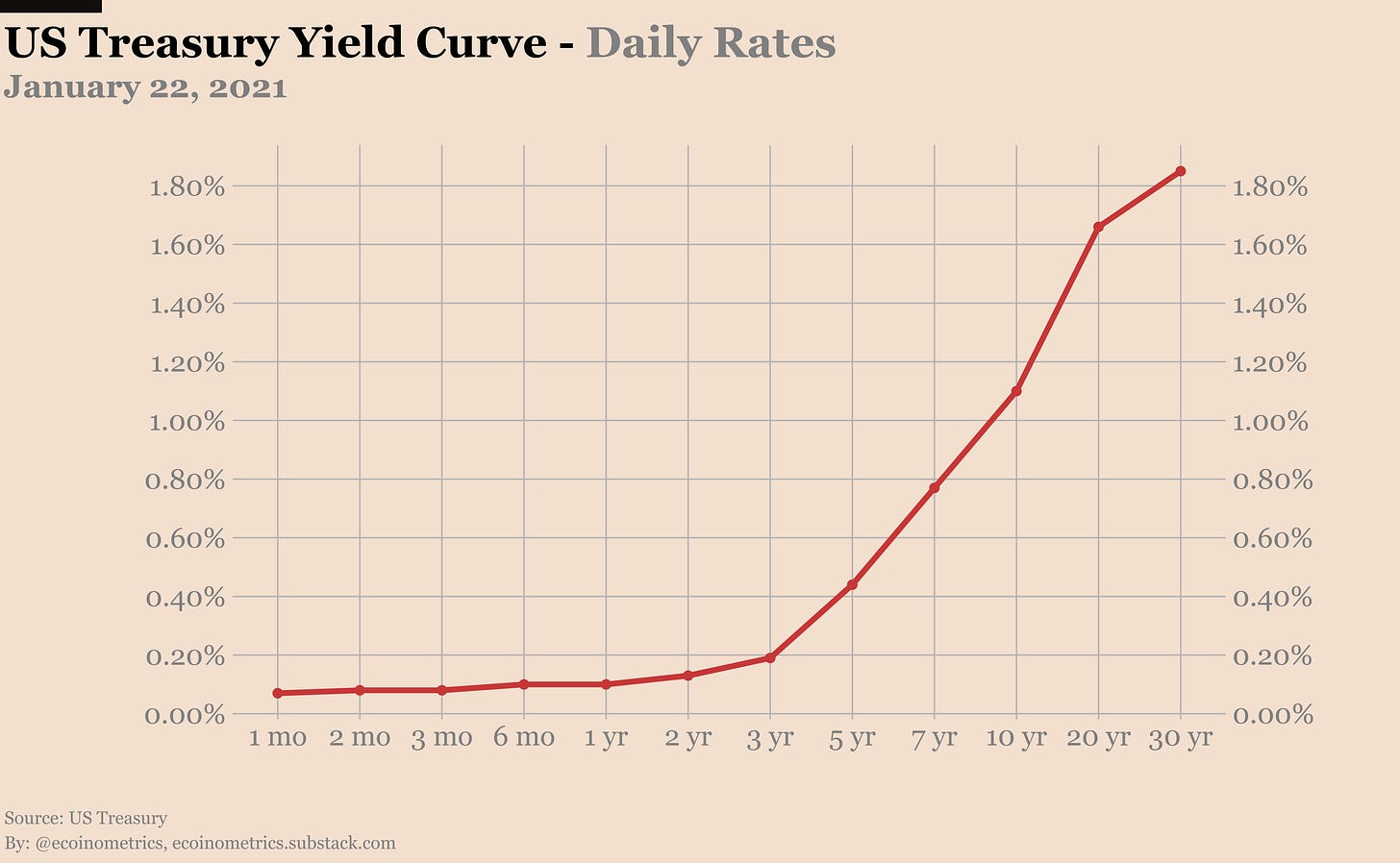

Bond yields have been on a downtrend for the past 40 years. Those yields are now very low all along the curve.

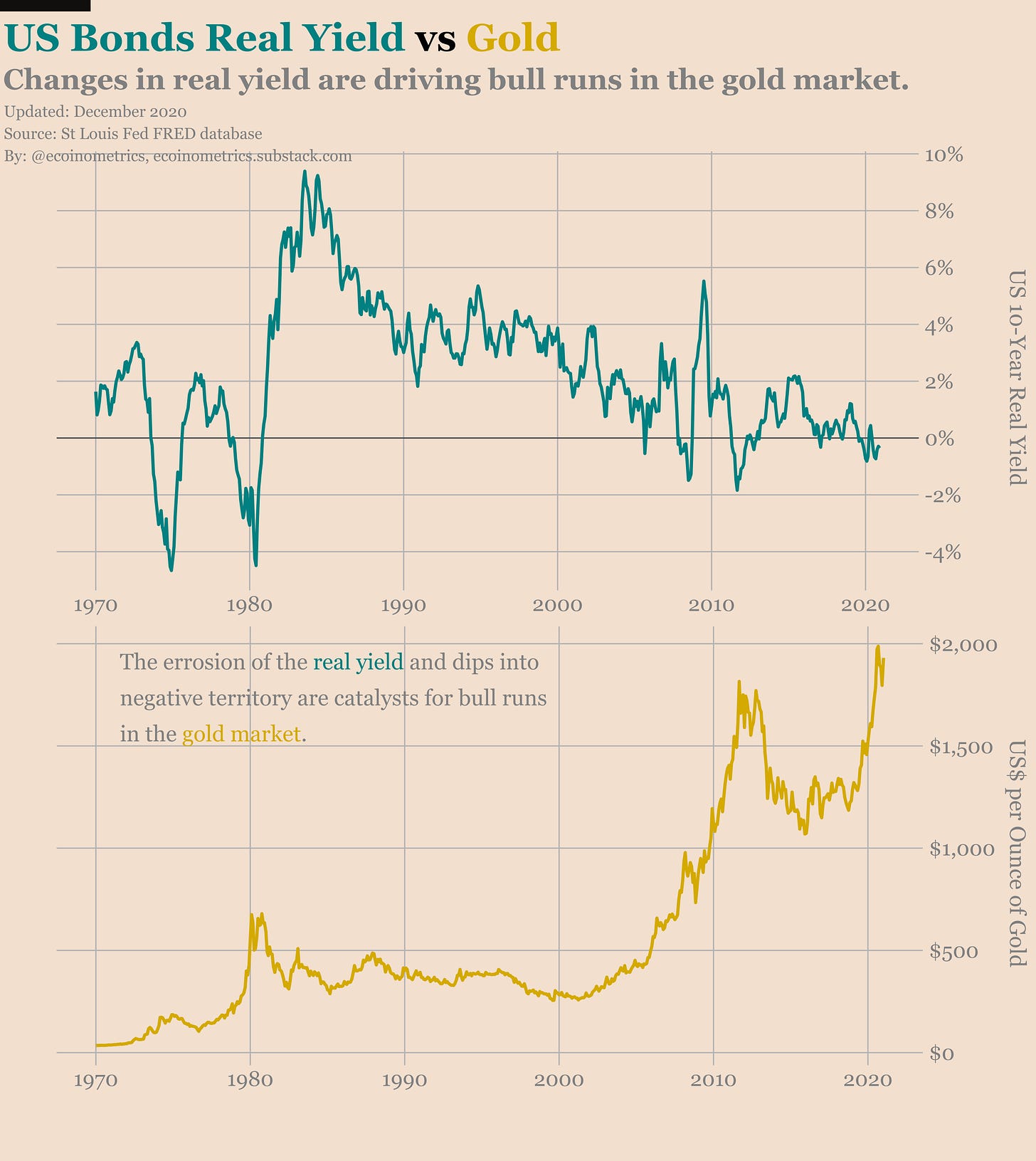

Even the 10-Year is entering negative real yield territory.

A rise in bonds yields will mean that the debt gets more expensive. When you have 130% of your GDP as debt this isn’t really something you can afford.

So the Fed needs to keep that under control.

The short end of the curve is managed by keeping the Fed fund rate at essentially zero.

To keep the rest of the curve under control they just have to let the money printer run and buy as much as the newly issued debt as necessary to cap the rates.

Ok. Those stories about bonds and yield curves are nice but what kind of effects will that have on Bitcoin?

Glad you asked.

Spoiler alert, this is good for Bitcoin.

Several points:

Debt monetization isn’t good for the US$. Technically speaking it is money debasement. So anyone worried about preserving their wealth will want to put their cash in a store of value.

If we see the new money injected into the system via MMT style policies then the risk of getting actual high consumer price inflation is real.

Keeping bond yields low while trying to get some CPI inflation means that we’ll get negative real rates for a while. In the past those conditions have helped create gold bull markets as we covered last week. As Bitcoin is increasingly seen as a store of value by institutional investors it could benefit from the same dynamic.

Tl;dr the monetary policy landscape in the US is very constrained and the most likely scenario is a tailwind for Bitcoin.

That’s the baseline. Now let’s see how things play out.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!