The year 2021 started pretty well for Bitcoin. But now it has been on a plateau for two months.

Some will see that as a consolidation before the second phase of the bull market. But others will look at Ethereum or the alt coins space and wonder if they should switch…

So BTC or ETH?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great! Now let’s dive in.

BTC or ETH

We are at this point of the cycle where Ethereum continues to perform pretty well while Bitcoin is taking a break.

Naturally now is the time where you start seeing questions like “is Bitcoin dead? Should I sell my BTC for ETH? When the flippening?”… as if BTC and ETH were interchangeable.

My point of view on the subject has not changed. Bitcoin and Ethereum are not comparable. Bitcoin is primarily a store of value. Ethereum is primarily a platform for decentralized applications.

Nobody claims that ETH is digital gold. Nobody claims that Bitcoin is THE network on which you should build general purpose dapps.

In my view it does not make much sense to pit them against each other.

These two networks are of different nature and they have different dynamics.

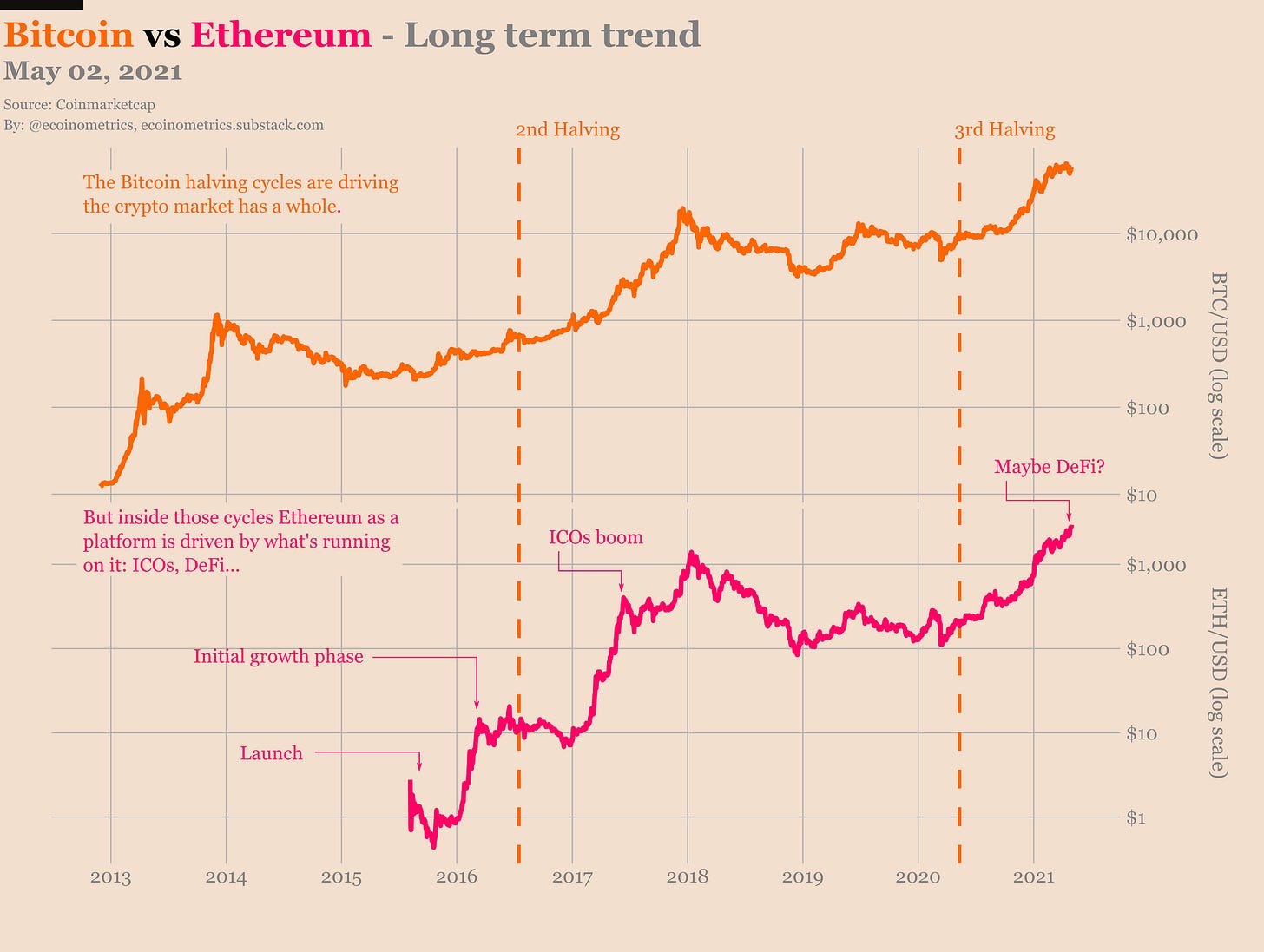

Bitcoin’s growth is driven by its adoption as a store of value.

Ethereum’s growth is driven by the development of decentralized applications on top of the platform.

But they share in common an exponential growth pattern.

Check it out.

Ethereum started much later than Bitcoin so the growth multiplier over the same period of time has been larger for ETH. No surprise there.

Since Ethereum launched in 2015 we only really have one cycle worth of data. So take that with a grain of salt but ETH grew from $10 to $1,000 after the 2nd halving… which is pretty much what BTC did after the 1st halving.

All that came to a stop when BTC reached a top in 2017 and the whole crypto space entered a bear market.

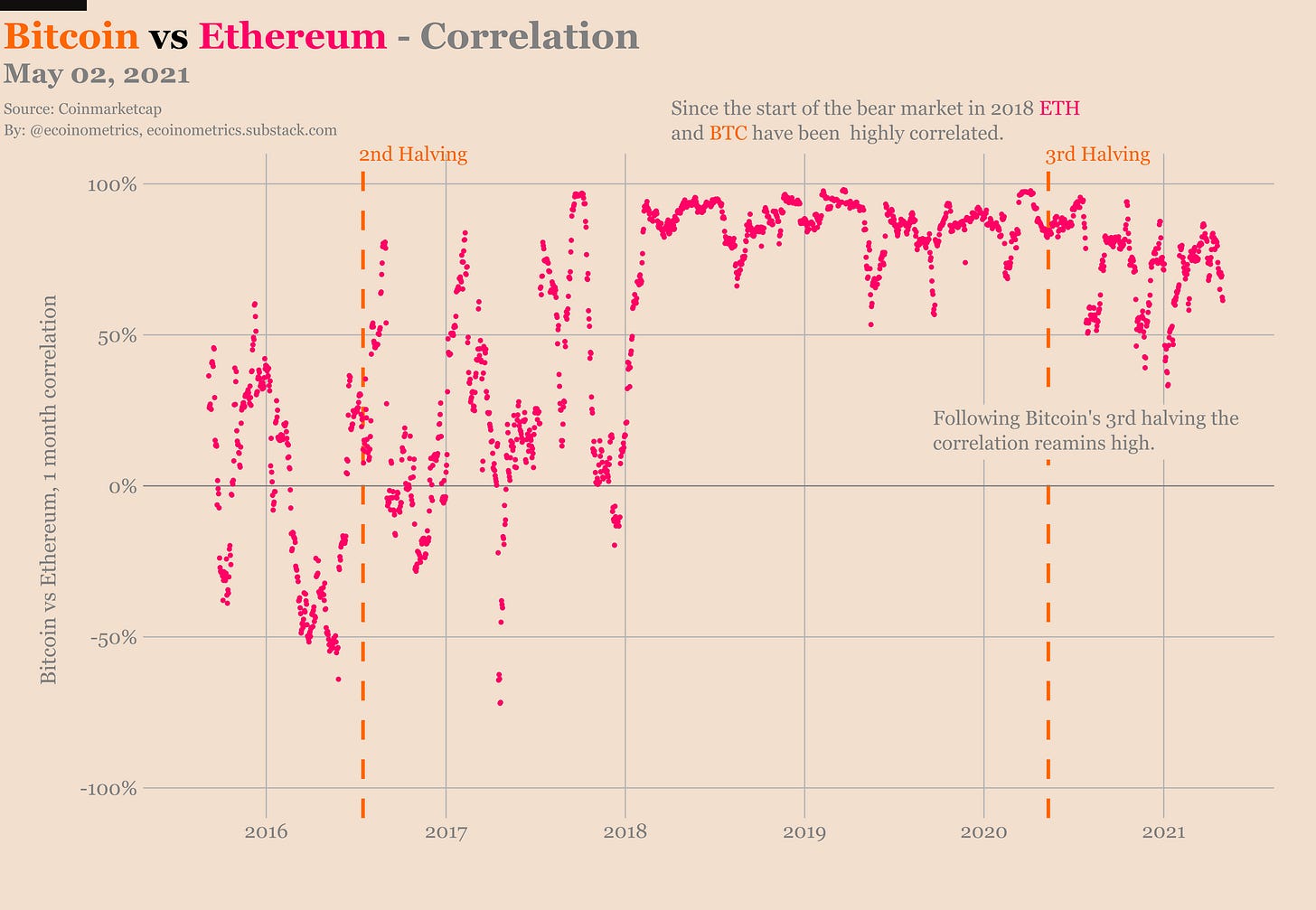

Since then the two have traded with a very high correlation which is still consistently above 50% after the 3rd halving.

That makes me say the Bitcoin market cycle remains the main driver for ETH growth despite the two of them having very different value propositions.

But again high correlation does not mean that they grow at the same rate. So far in this cycle, ETH has been growing faster than BTC.

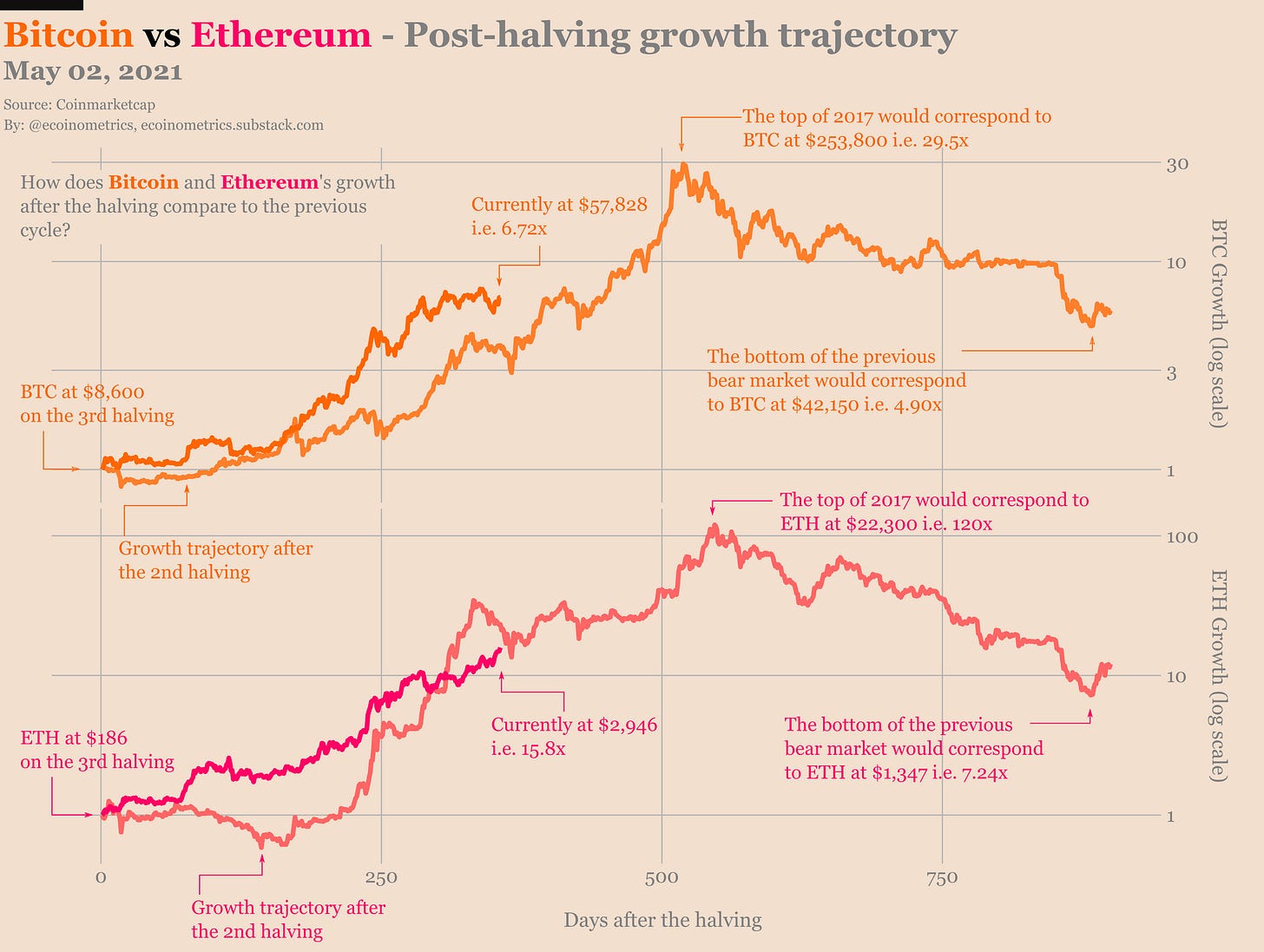

To be more specific, by and large Bitcoin is growing slightly faster than the previous cycle while ETH is pretty much in line with the previous cycle.

For tracking purposes you can compare the two of them against 2017 on the chart below. Obviously these are not predictions, just comparisons, so don’t take that as price targets or anything.

Sometimes people write to me to complain that I don’t cover Ethereum often enough. There is no conspiracy anti-ETH or lack of interest on my part. There is just a finite amount of time in each day to do research...

That being said, those two networks offer very different value propositions:

Bitcoin is a bet on the emergence of a new store of value.

Ethereum is a bet on the emergence of an ecosystem of decentralized applications.

BTC is already a good store of value from a technological point of view. So I consider it to be a safe bet with still a large potential upside vs a very limited amount of risk.

Understanding ETH on the other hand requires to take into account many more parameters. The Ethereum network is still in development. That means the technical execution risk needs to be taken into account. At the same time the real value of the Ethereum network comes from the dapps that run on it. So a fair assessment requires you to consider the whole dapps ecosystem...

Tl;dr don’t look at Bitcoin and Ethereum as opposed to each other. They are both growing exponentially, they both share the same cycle driven by the Bitcoin halvings, but on the long run they are very different kinds of investments. So know what you are getting into.

Slow start for Coinbase

Coinbase went public via direct listing a couple of weeks ago. Choosing to do that in the middle of the post-halving bull market was definitely a smart move.

If they had gone public during a bear market this would have attracted much less attention. Not great for price.

If they had gone public later in the post-halving bull market they would have run the risk of getting bad publicity if there was a big crash. Not great for price either.

But doing it now gives at the same time:

Maximum exposure in the media.

People might decide to invest solely based on the hope that the bull market will continue to be good for their business.

So yes, when it comes to timing they probably nailed it.

However the first couple of weeks of trading have been pretty slow… since its direct listing COIN is down -9%.

That being said, they aren’t the only one. Just compare them to the other components of the Bitcoin Treasuries Index:

Except for Tesla and Square whose price is not highly correlated to Bitcoin, you can easily guess that the culprit is the short term price action of BTC.

Indeed, Coinbase got listed and right after that Bitcoin started taking a dive. Naturally COIN followed.

Due to the small amount of data there is no statistically significant info on correlations for now, but visually the sequence makes sense.

What we’ll probably observe is that when Bitcoin has its next leg higher COIN will follow suit.

So let’s see how that plays out.

Where are we now?

We are almost 3 weeks into the current drawdown. The bottom seems to be in and the recovery process is well on its way.

When you look at the trajectory of each drawdown, it is rare to see the price recover significantly before making a new bottom. Most of the time the bottom comes relatively quickly during the correction (within a week on average) and the recovery takes longer after that.

That’s not a 100% of the cases, but if you play the odds then you should bet that the bottom is already in.

Drawdowns that are between -10% and -80% take on average one month to fully recover so once more there is nothing to be worried about.

At the current rate, it looks like this correction will end within the range of the corrections of January, February and March… yep that’s right, one significant drawdown every month so far this year...

When you see that you are probably thinking something like that:

There is an increasing number of institutional players who have included Bitcoin in their portfolio.

Something that institutional players do is rebalance their portfolio on a periodic basis.

So are these monthly drawdowns triggered by the smart money rebalancing their BTC positions?

Honestly I don’t know. On the one hand the logic kind of makes sense. When you manage a diverse portfolio monthly rebalancing is pretty common.

On the other hand those drawdowns do not align very well with the end of the month or any regular period for that matter. At least not in any obvious way.

So while I think portfolio rebalancing from institutional investors will definitely have some effects, I don’t think this is the main driver in those monthly drawdowns.

But we’ll need to study that in more detail.

For now remember that corrections are part of a healthy bull market. Take them as occasions to stack more sats and always put things in perspective.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!

Thank you for writing about BTC and ETH. I think it’s safe to say >90% of people don’t understand store of value vs. DApps.

Awesome as ever