There is no such thing as bad publicity. That’s true. Except when Elon Musk is talking down Bitcoin...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great! Now let’s dive in.

The Elon dip

First we got this:

Then we got this:

That escalated quickly…

If you were hoping for Elon Musk to stop tweeting about Bitcoin then you are out of luck.

At this point it is safe for everyone to assume that Tesla is going to offload their coins despite what was announced at first.

To be fair, they made a pretty good short term trade for themselves. We don’t know exactly at what price Tesla bought but we do know they invested $1.5 billion at the beginning of the year.

We also know that they have sold some of it for $272 million during the first quarter. So I would not be surprised to learn that after liquidating everything they have turned a profit of $500 million to $750 million in five months.

That’s a 33% to 50% ROI. Many hedge funds have done worst than that this year.

For comparison, in 2020 Tesla managed to extract $721 million in profit from their regular business…. so maybe Elon should consider creating a crypto hedge fund as his next company.

Jokes aside, traders are anticipating that Tesla is going to put some downward pressure on the price when they liquidate their 43,200 BTC so we are getting another dump.

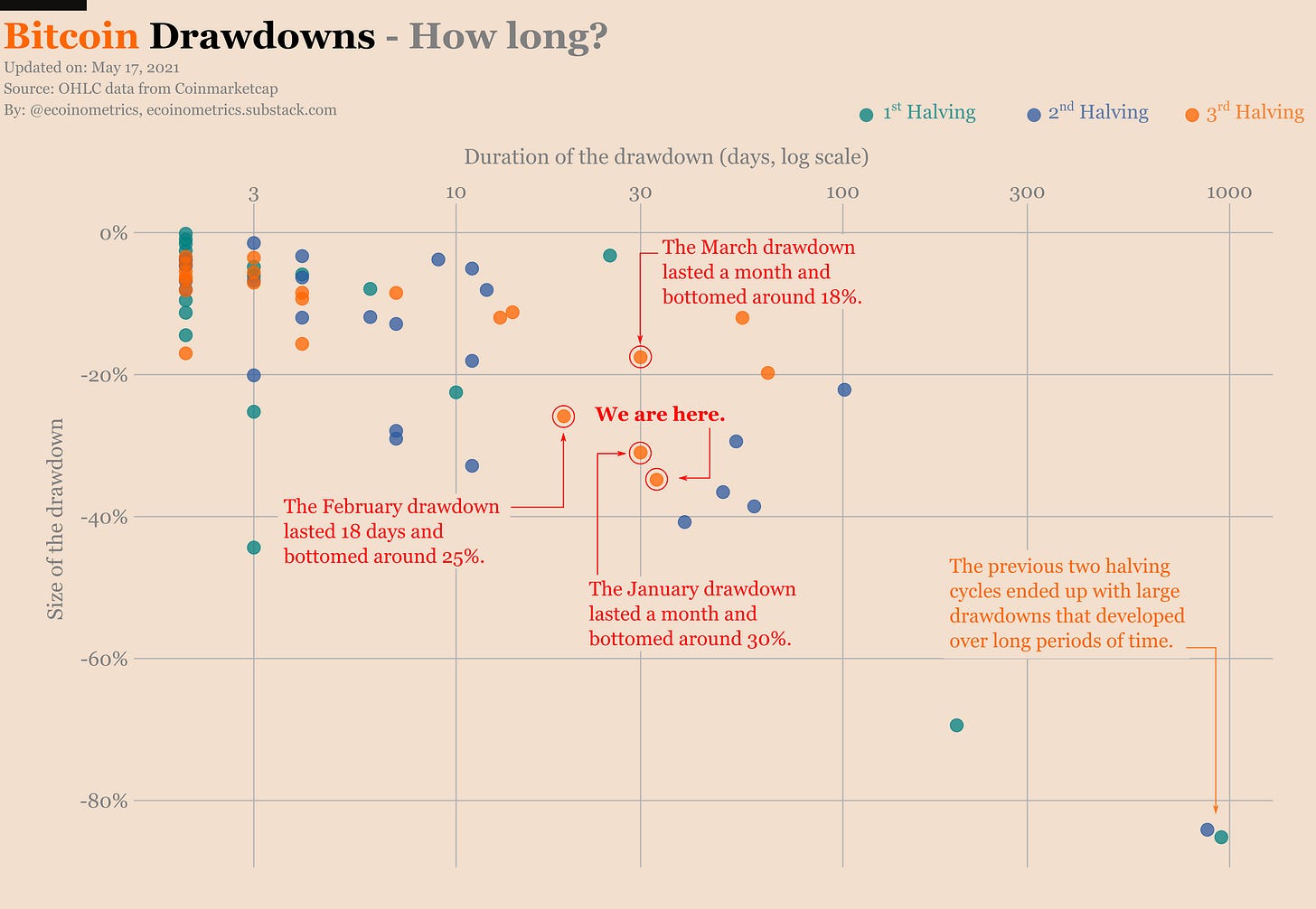

Result, as I write those lines, the current drawdown is making new lows:

After 34 days.

The bottom is at -35%.

Which means this is officially the largest drawdown of this cycle. Actually only a few of the corrections in 2017 were larger than this one.

Check it out.

If you translate those percentages in actual price, only 1 out of 10 of the historical drawdowns would bring BTC below the $42k level. We are getting pretty close.

So what to do?

Well I’ve talked about it here. When something like that happens don’t panic, take a deep breath and examine the situation.

There is a pretty clear root cause for the selloff:

Elon Musk basically drops its support for Bitcoin.

Tesla is most likely going to sell their BTC treasury holdings.

Of these two things Tesla selling some 43,200 BTC is obviously pretty big but it is also a one off event. If they do go through with this, it will tank the price but that won’t last forever.

On the other hand Musk constantly tweeting about Bitcoin is bad for sentiment. And who knows when he will decide to change topic.

Elon Musk has 55 million followers on Twitter. So whatever the validity of his comments regarding Bitcoin, anything he says will have an impact on a large part of the retail crowd.

Debating whether he is wrong or not live on Twitter probably won’t do anything to help with the price action. My guess is that the only thing that can help is to wait for Elon to move on to another topic.

Things will fade away, people will forget and the sentiment will be reset. So if you have dry powder this is a good occasion to accumulate more coins.

Meanwhile it looks like we are going to deal with more drama…

Bitcoin vs Ethereum

A couple of weeks ago we looked at how Bitcoin and Ethereum are basically on a similar growth trajectory when compared to the previous cycle.

Despite Elon Musk’s drama, a little over a year after Bitcoin’s 3rd halving:

Bitcoin is up 5.2x

Ethereum is up 19x

Basically still on the same track as in 2017.

But today I want to focus on the relationship between Bitcoin and Ethereum over a full cycle.

Facts:

Ethereum is growing faster than Bitcoin.

Ethereum was growing faster than Bitcoin in 2017.

Ethereum also crashed faster and harder than Bitcoin when we entered the bear market in 2018.

The result is that if ETH was ahead of BTC for part of the cycle, at the end of the day their total growth was about the same.

You don’t believe me? Check this out.

In light colour you can see ETH/BTC over the previous cycle starting at the time of Bitcoin’s 2nd halving. In dark colour you have the current cycle.

Yep, four years ago the dynamic was something like:

BTC starts its bull market.

BTC slows down and ETH, the “cheaper” and newer thing, is catching up.

Then ETH stalls and it is time for BTC to catch up again.

Rinse, repeat....

At the end of the cycle ETH/BTC is back where it started.

At the end of the cycle, with ICOs dead and Bitcoin no longer there to drive the whole market higher, ETH/BTC comes back down to its original balance.

So actually if you are into short term trading it looks like there is some value that you can extract from betting on the mean reversion of ETH/BTC.

But I don’t know if things will repeat this time. The big question is: can Ethereum decouple from BTC over the long run?

As I’ve said last time my perspective is that Bitcoin and Ethereum, at a fundamental level, offer two different value propositions.

Bitcoin derives its value from being digital gold.

Ethereum derives its value from the decentralized applications that are running on it.

In 2017 it looked like ICOs were going to be the big differentiator between BTC and ETH. But that didn’t last.

In 2021 the DeFi movement and NFTs are two potential differentiators for ETH. But it is still early to tell if these things will really take off.

One thing is sure, DeFi and NFT projects in 2021 are more robust than your average ICO of 2017. But the market is still niche and riddled with execution risk.

So all bets are off to see if at the scale of a full halving cycle BTC and ETH can really decouple.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!

Great article 👌

Awesome work as always! BTC is worth fighting for…