Ecoinometrics - Nowhere to hide

December 01, 2021

There is something rotten in the state of the fixed income market.

Almost every country in the world is experiencing an extended period of high inflation.

Yet the only way to preserve the purchasing power of your cash is to invest in always riskier assets. Is it sustainable?

The Ecoinometrics newsletter decrypts the place of Bitcoin and digital assets in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Nowhere to hide

Traditional economists tend to agree on one thing: some inflation is good. That’s debatable but, regardless of what you think of that, policy makers target the annual inflation rate to be around 2%.

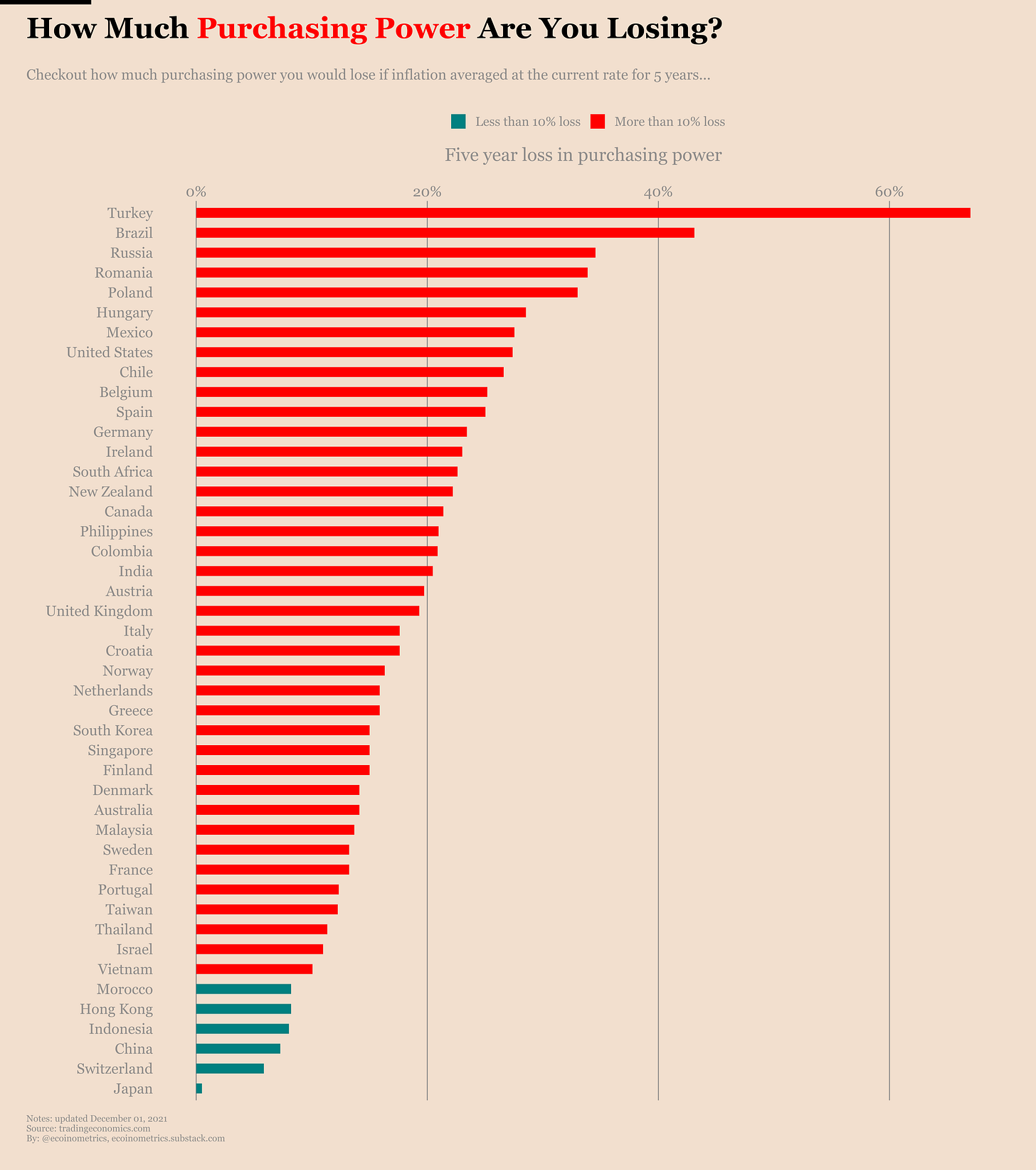

With that number in mind, how many countries still have inflation under control? Apparently not many…

Right. Most of the major countries are running an annual inflation rate above the 2% target. And when I say above I should actually say significantly above. More than a third of the ones on the list are running at 4% and higher.

Moreover, this didn’t start yesterday. Those data points aren’t outliers for one month. This Temporary Inflation™ started a few months after the financial markets began their recovery from the COVID crash. That was in March 2020… soon we’ll be in 2022.

Not only are prices unlikely to ever come down but it is clear that we need to be prepared to live in a high inflation environment potentially for the years to come.

So how do you preserve the purchasing power of your cash when inflation is so high?

The textbook answer to that is simply: play it safe, park your cash in some safe government bonds and wait for things to settle down.

But how is that working out in practice? If we judge that by the real yields around the world it doesn’t work at all.

See for yourself.

Countries with the “safest” debt do not offer yields attractive enough to compensate for inflation. And most countries with a positive real yield have other kinds of monetary issues.

So you can’t really expect to survive an inflationary period unscathed if you only rely on the fixed income market.

If you think you’ll be fine doing nothing then think again. Compounding is a strong force and under some not so crazy scenario you can see the loss in purchasing power can be material…

If inflation was to average at the current level for five years in most countries you would lose more than 10% of your purchasing power. For many places it will be more than 20%.

And that’s using the official headline CPI. Who knows what’s really going on. I live in Hong Kong and I have kids. Let me tell you that the reported 1.7% inflation rate feels low...

So the choices are:

Spend your cash on government bonds and watch its purchasing power melt away.

Spend your cash on high yield debt and risk losing it all given the weak global economic situation.

Spend your cash on stocks that are at record high valuations by most standard metrics.

Or invest in the new world i.e. Bitcoin and digital assets...

That’s what I wanted to come to. A lot of investors (private and institutional) are going to have the same reasoning and probably conclude that the last option has a lot of upside without being that risky.

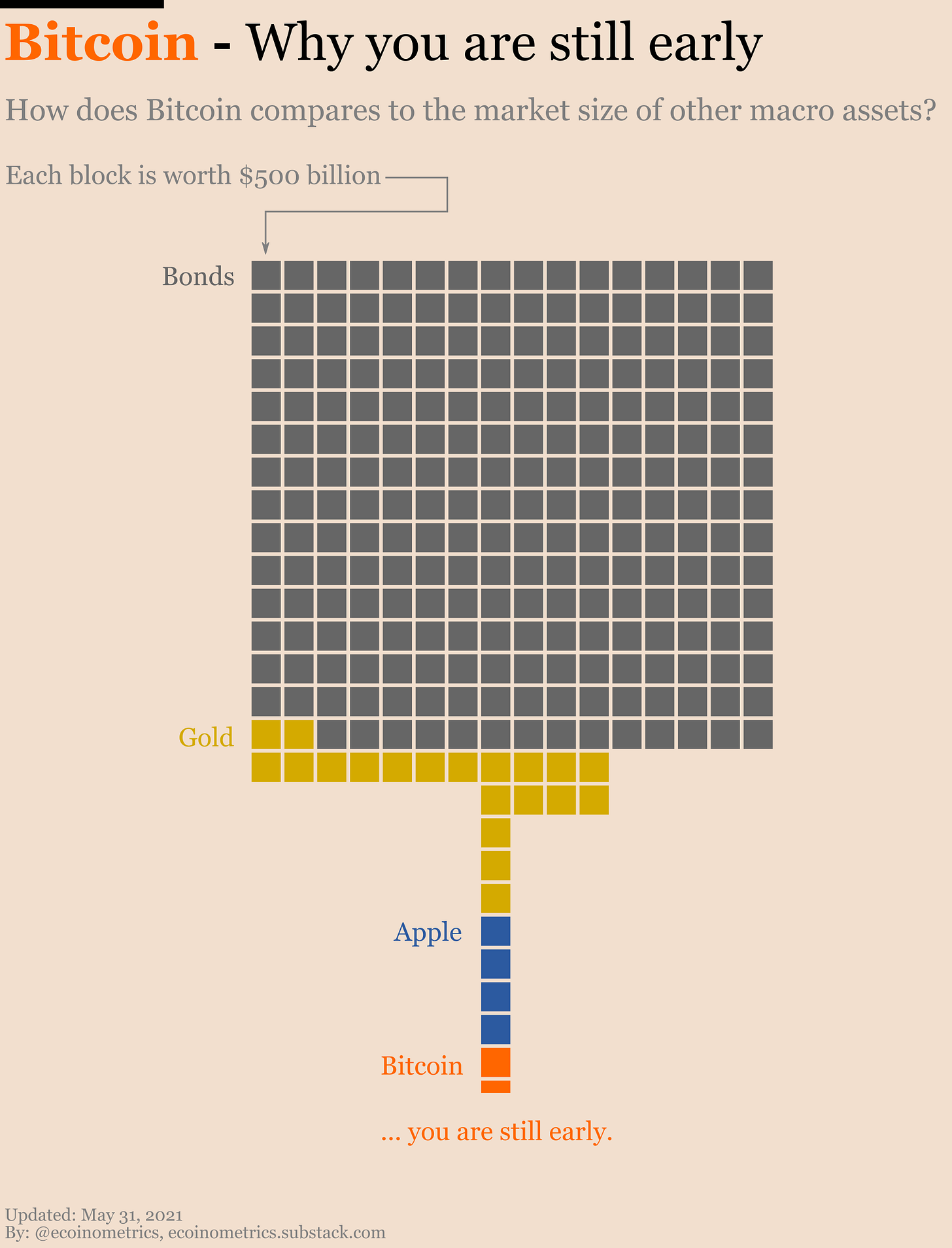

Sometimes people say things like “the crypto market is way too big now, there is no way it can continue to grow so fast”.

I don’t know if Bitcoin will continue to grow as fast as it did in the past. But if some money starts to flow from the fixed income market to digital assets then Bitcoin won’t have any issue going from a $1 trillion to a $10 trillion market cap.

I mean the bond market is massive. Take a look.

How long until that happens? No one knows. But the inflationary environment surely points to earlier rather than later. Let’s see how that plays out.

CME Bitcoin Derivatives

There you go! Finally the smart money is net flat BTC on the CME. For reference this hasn’t happened since 2019.

Of course we have to thank the SEC for that as most of the long positions come for the BITO Bitcoin Futures ETF.

The rollover from the November to December contract as well as the price correction also contributed a little bit by reducing the amount of short positions held by the leveraged funds.

Indeed, on any given day the Bitcoin futures typically trades at a premium over the spot market.

Below you can see the one month average of the estimated premium (at the close) of the futures over the spot market.

For the most part, since 2020 this premium has been positive. Which means on any given day you could have found some opportunity to go short the futures and long the spot market at the same time to pocket some riskless profit.

And as you can see below the net positioning of the leveraged funds more or less follows the variations in the estimated premium:

When the premium gets larger you tend to see more shorts.

When the premium gets smaller you see less of them.

Not an exact science but still.

So yes, the recently approved Bitcoin ETFs do have some impact on the futures market.

Actually those futures based ETFs have other effects. E.g. they could be shifting the pattern of the rollover:

As you can see on the heat map below, the rollover which shifts the position from the front month to the next month seems to start a bit sooner than usual and have a different pace than it used to.

But we’ll have to see if that pattern continues to hold or if there was some Thanksgiving effect specific to this month.

The CME options market remains completely unaffected by all that:

Puts to calls ratio, same.

Distribution of the positions, same.

Trading activity, same.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

If you are already a free subscriber please consider upgrading to a paid tier to get the full access.

Cheers,

Nick

Hello Nick,

I am a new subscriber here. Just want to tell you how I appreciate your work. The charts and analysis are fantastic! I will definitely share your post to more people.

Best regards,

Zack

Hello, il a new subscriber, please can you tell me where I can access to the different charts ?