If you have been paying attention this should not be any news. The Federal Reserve in the US and the other major central banks are pumping the markets.

Their stated goal is to trigger a rise in consumer price inflation but they are ill equipped for that.

Thanks to the Cantillon effect all that liquidity is flowing towards financial assets.

But who is benefiting the most?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

We have been through that already. You don’t remember? The year is 2008 and we have a financial crisis on our hands.

What do we do? The only thing we know! That is pumping liquidity into the system.

By we I mean the Federal Reserve (and the other major central banks around the world).

Already back then the result was asset price inflation. But not every asset benefited in the same way.

Check out the growth of gold and silver compared to the NASDAQ and the SP500 since 2008.

Gold managed to keep up against the SP500 over this period. The growth trajectory hasn’t been a straight line but hey it doesn’t look so bad.

The real winners are of course tech stocks. If you want to see how the best performing ones compare to Bitcoin go check out this past issue of the newsletter.

That’s interesting.

But you know what’s even more interesting? Just compare the growth of those assets to the growth of the Fed balance sheet…

Yep! Except for the NASDAQ which comes pretty close over the whole period it is very hard to keep up with what the Federal reserve is doing.

So that’s what happened when we took 2008 as a reference.

Now how about 2020? The scenario is the same: financial crisis, Fed intervention, QE infinity TM... but this time we have a new asset to play with.

Bitcoin was created as a response to 2008. How is it going to fare in this quantitative easing cycle?

Honestly it is too early to know. So far Bitcoin is holding up with the Fed balance sheet. But this is a marathon, not a sprint.

My take though is that Bitcoin will be able to keep up with the amount of money printing for a few reasons.

Bitcoin is in its early adoption phase. Remember that BTC is a store value. It is competing in the same space as gold but with a market cap 50 times smaller. The potential for growth is thus massive.

There is no alternative to Bitcoin. To be more precise, as a store of value, gold is the only alternative to Bitcoin. But investors are starting to realize that Bitcoin has soooo many advantages when compared to gold. It is only a question of time before they end up being markets of equal size. For that reason BTC should continue outpacing gold.

The narrative of Bitcoin as a hedge against inflation is growing. The result is that we are starting to see institutional interest in using Bitcoin as such. The trend is just getting started with MicroStrategy, Square and Stone Ridge using it as a treasury asset. This narrative is only getting reinforced by the actions of the Fed.

That’s my bull case for Bitcoin!

You have noticed that I’ve added Ethereum to the chart above. I’ve done so to discuss something I’m regularly reading Twitter. I’m paraphrasing here but you’ll get the gist of it:

Why are you not including Ethereum on this chart?

Ethereum is the best performing asset this year!

Who are you working for? What kind of agenda are you pushing here?

Chill out. There is no conspiracy here.

The first reason I don’t always include Ethereum in my charts is simply to try to minimize visual clutter. There are a lot of different assets we might want to keep track of and compare to each other. But unless I have a specific point to make about the comparison I like to keep it simple.

Which brings me to the second more fundamental reason.

Bitcoin and Ethereum are very different beasts. The primary thing that influences Bitcoin is its role as a store of value, a digital gold, the best money out there.

By contrast ETH is influenced by many more factors due to its status as a smart contract platform. What it is used for at any given time dictates how it is valued. Yesterday it was ICOs. Today it is DeFi. Tomorrow it will be something else.

So you cannot analyze Bitcoin and Ethereum through the same lens.

Also Bitcoin and Ethereum are not competing with one another. They do not occupy the same space.

Ethereum is not fundamentally competing to be the hardest money out there.

Bitcoin is not trying to be an all encompassing smart contract platform with all the bells and whistles necessary for that.

My attention is mainly focused on understanding macroeconomics issues. Hence the reason why I’m focused on Bitcoin.

Now that I’ve clarified my thought process here is a year to date performance chart with Ethereum… but also Silver, WTI and the NASDAQ.

I hope I’m not forgetting anything.

Enjoy.

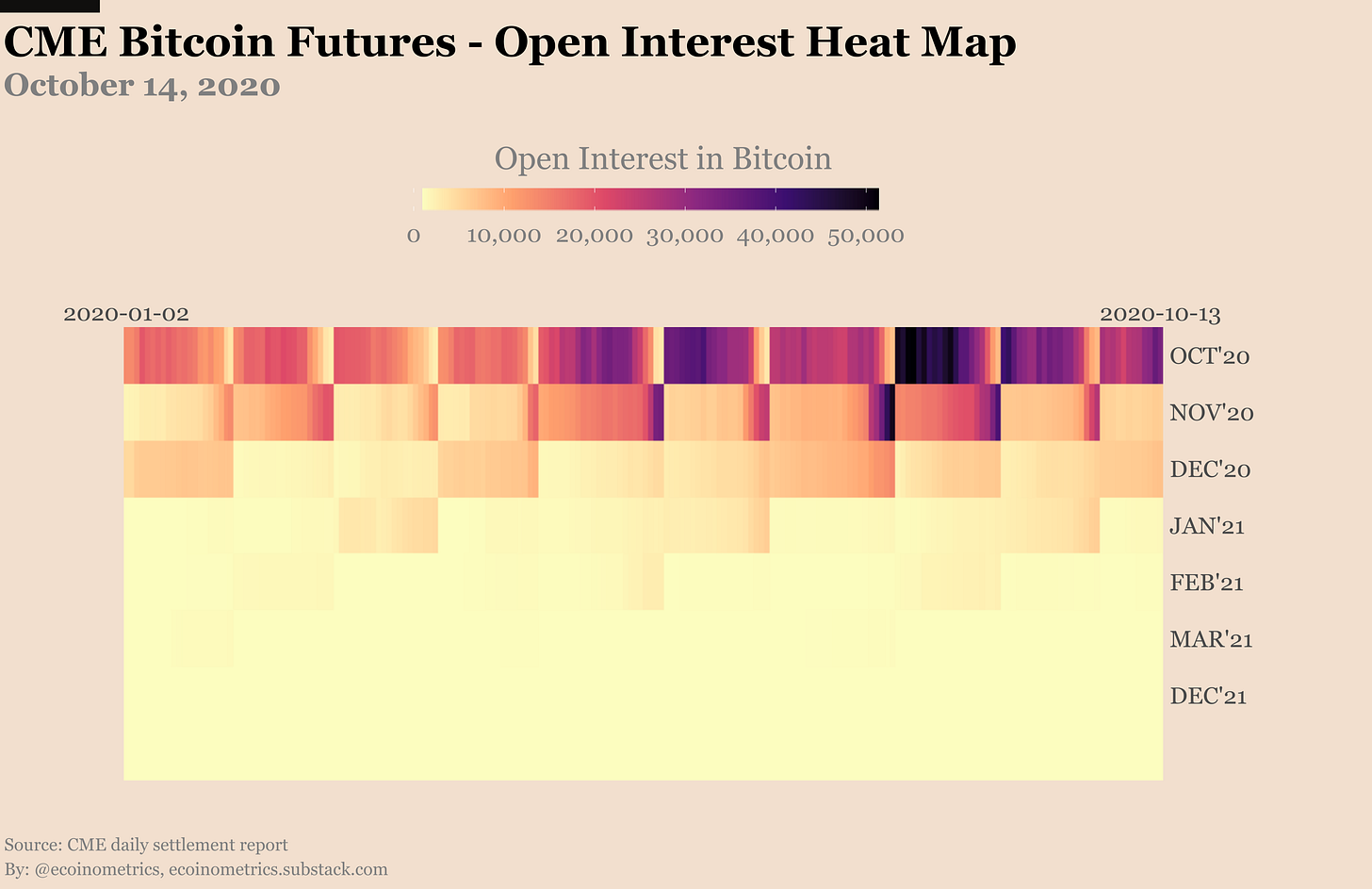

Moving on to the state of the CME Bitcoin derivatives I must say that despite BTC being on the move the trading activity is subdued.

Sure the open interest is rising fast. But the daily traded volume is not following. All that isn’t very convincing.

The latest Commitment of Traders data only covers up to October 06. Up to that date not much has changed.

At some point I’m expecting to see the smart money flip from being dominated by the basis trade (a market neutral strategy) to being driven by the trend-following crowd.

We are not there yet…

Since October 06 the open interest has been climbing at a fast pace on low volume. We’ll need to wait for the next report to understand how these new positions are distributed. As usual there are three main possibilities:

New positions go towards trend following. That would show up as an increase in long positions on the retail and smart money crowd.

New positions go towards the basis trade. That would show up as an increase in short positions for the smart money / leveraged funds.

New positions go towards hedging cases and outright short positions. Honestly that’s just a catch all for patterns that are harder to spot.

My bet is that most of the new positions are going towards harvesting the futures premium over the sport market. There could be some retail trend following chasing a potential breakout too.

I don’t think many traders are playing the game of shorting Bitcoin with leveraged positions on the CME futures. Given the overall market trend that seems like a risky trade, something better handled by buying puts.

But there is no sign of strong activity on the puts. Actually with 9 calls for every 2 puts it is clear that there aren’t many people betting on a dip.

As you can see on the positions distribution chart there are far out of the money puts out there. Just not in large numbers.

We’ll see how that plays out.

That’s it for today! If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.