Here is something else that I’m hearing a lot from people who don’t own any Bitcoin:

“You shouldn’t invest in Bitcoin. It is way too volatile. That’s way too risky. And anyway it will go to zero.”

What do you respond to that? Pretty easy.

Bitcoin is an asymmetric bet, the odds are on your side, so you just have to control your risk...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

The main issue with people thinking that Bitcoin is too risky is that they don’t think in terms of portfolio and they don’t think in terms of expected value.

I like to believe that there are three paths for Bitcoin:

Bitcoin becomes worthless.

Bitcoin stays around its current value.

Bitcoin goes on to replace gold as the hardest store of value out there.

For Bitcoin to become worthless there would need to be something like changes made to the software that would significantly alter its properties as hard money. Or maybe a bug that would cause people to lose trust in the network.

I don’t think that’s very likely but it is worth considering.

Bitcoin could also stop growing. Maybe some other cryptocurrency catches on. Or maybe it is made difficult to acquire by governments around the world.

Again I don’t think it is very likely but that could happen.

Finally the most likely scenario in my opinion is that Bitcoin will grow to be a fully fledged store of value at least on par with gold.

But the point is that none of those possible futures will happen with certainty. So thinking in absolute terms won’t help you make a good investment decision.

When there are uncertainties it is best to think in terms of risk and probabilities. Let me make those three scenarios more explicit so that we can do some napkin math.

Bitcoin goes to zero.

Bitcoin value stays exactly the same.

Bitcoin is growing 10x.

Assume that these are the only three possibilities. Since nothing is certain, you have to put a probability on each of them.

At the same time you want to control your risk. So you will invest a fraction of your money in Bitcoin and keep the rest in cash.

That’s your portfolio, y% in Bitcoin and the rest in cash.

For each scenario that means:

You have some probability to lose y% of your portfolio if Bitcoin goes to zero.

You have some probability that your portfolio keeps the exact same value if Bitcoin value does not change.

You have some probability to multiply y% of your portfolio by 10.

If you fix the probability associated with each scenario as well as what percentage of your portfolio you allocate to Bitcoin then you can calculate the expected return of this investment.

If the expected return is greater than 1 then it is more likely than not that you’ll generate some profit on this investment.

If the expected return is smaller than 1 then it is more likely than not that you’ll lose money.

Example, put 10% of your portfolio in Bitcoin. If you think that there is a 50% chance it goes to zero, a 25% chance it grows 10x and thus a 25% it stays the same then your expected return is 1.2x. That’s greater than 1 so you are expecting to make money on this bet.

Now that’s nice, but how do you know which probability to assign on each scenario?

It isn’t like there is a mathematical formula to compute those. It’s all subjective based on your analysis of the situation.

What if instead of having a 50% chance of going to zero it is a 75% chance? Or a 25% chance...

Don’t worry. I got you covered.

Instead of calculating the expected return for a specific set of probability lets calculate them all!

I did that for 5%, 10% and 20% of the portfolio being invested on Bitcoin. In each case you have:

The x axis represents the probability of a 10x growth.

The y axis represents the probability losing it all.

The expected value is represented as a heat map. The very light colours are expected losses. The darker it gets the larger the expected profit.

I’ll give you some time to look at the charts in detail.

Done? Ok good.

What do you see then?

Yep, the vast majority of the combination of probabilities give you an expected profit greater than 1x. That’s the beauty of asymmetric bets!

With a potential 10x growth you don’t need a very high probability or a very high amount of risk allocated to Bitcoin in order to generate profits in your portfolio.

And the higher the potential growth the less likely you are to make a bad choice. As a reminder a 10x growth from now is putting Bitcoin on par with Apple. A 40x growth would put Bitcoin on par with gold…

So what’s your excuse for not taking a chance?

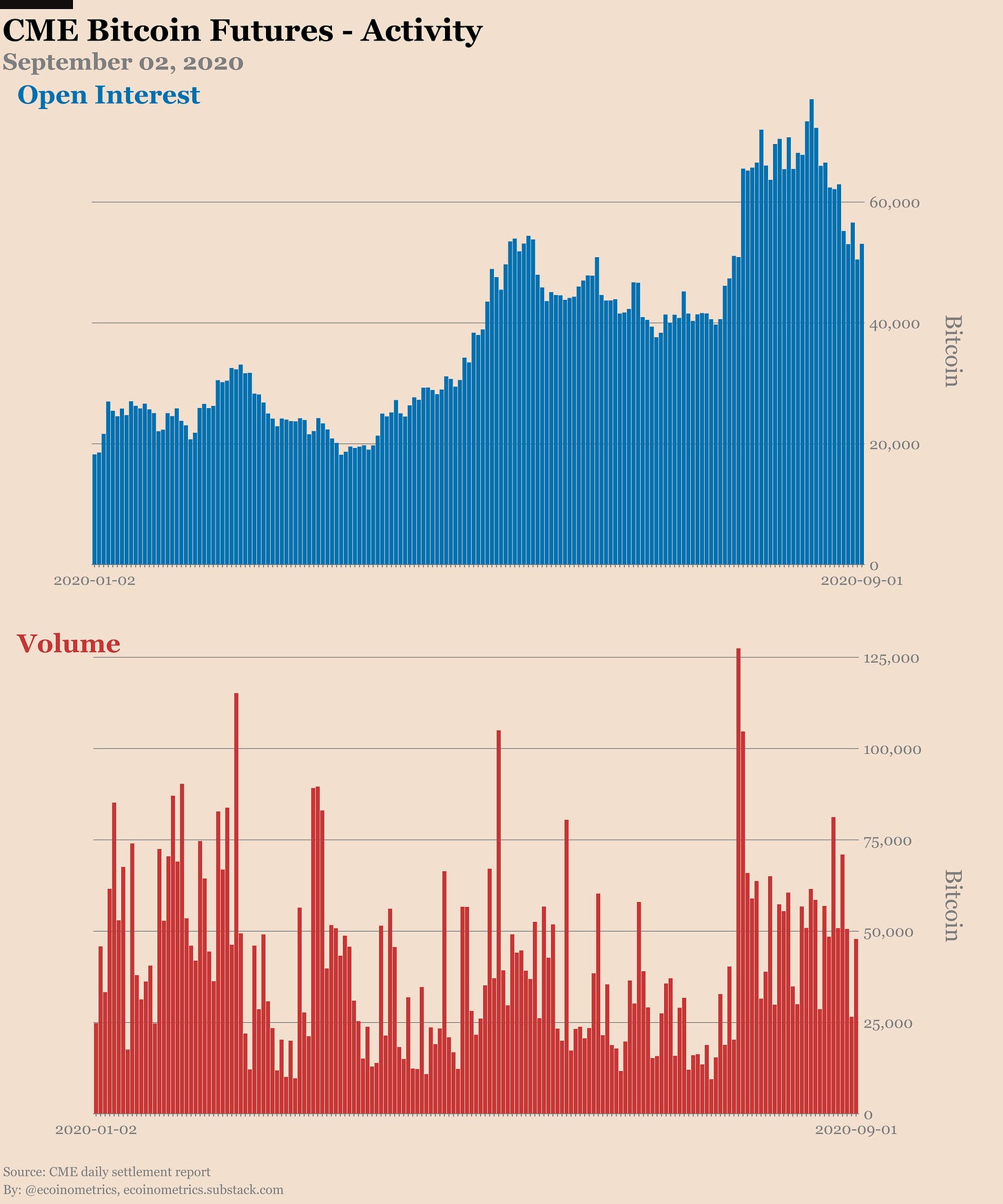

Moving on to the state of the CME Bitcoin derivatives this week there are some interesting things happening.

Take a look at the Commitment of Traders report dated August 25:

The smart money went from 3000 net short positions down to 1000 net short positions!

Retail traders went from 3400 net long positions down to 2000 net long positions!

Check it out.

So what’s going on in there?

Well as usual we need to be a bit cautious in interpreting the data. There are a range of different strategies in play on the CME.

For the leverage funds the big trade of the past few months was cash and carry. You buy spot BTC and sell the futures at the same time. When the Bitcoin futures trade at a premium above spot you are pocketing the difference.

This strategy pushed the smart money to be very much net short the CME futures until recently.

If we isolate the short contracts for the leverage funds we see that a lot of them were liquidated last week. This is most likely unwinding some cash and carry positions.

Now here is something even more interesting. Historically retail traders on the CME have mostly played a straight long Bitcoin strategy. But checkout this jump in short contracts!

At the same time the amount of long positions for the retail traders hasn’t changed much.

It feels like some retail traders decided to play the cash and carry game at the same time as the leverage funds are closing the trade.

I might be missing something there. So let's follow up next week to see if this was just a blip in the data.

Overall the market is still consolidating just below $12,000. The fact that we haven’t seen any significant dip is a sign that Bitcoin is developing another good base to try a push towards $14,000.

After that, the sky's the limit...

We have also seen a return of the bullish option traders on the CME:

1,700 BTC worth of bull call spreads on the October contract at $13.5k/$17k.

More calls being bought at $14k on the September contract.

Traders are still betting on the big breakout coming soon...

That’s it for today. If you have learned something please subscribe and share the newsletter.

And don’t forget to stack sats!

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.