The narrative is the story people are telling themselves to justify investing in something.

A narrative doesn’t have to be true. “Stonks always go up” is a form of narrative that is obviously not true. But it is still largely driving the market. So you need to pay attention.

Because financial markets are largely driven by investors psychology, you can’t skip on trying to understand what is the dominant narrative...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.

The Bitcoin narrative

So what is the dominant narrative in Bitcoin?

I think the main narrative is that Bitcoin is better at being gold than gold itself.

Investors see Bitcoin as the store of value of the future and that’s driving a lot of the behaviours we see in the market.

When you think of it this way, this narrative can be used to understand why the correlation between Bitcoin and gold has been rising lately.

Pretty much since the liquidity event of February the correlation is on an upward trajectory. And now these two assets are positively correlated at 60% on a 30 days basis.

But if Bitcoin is better at being gold than gold itself this should not be very surprising.

As more and more traditional investors come to adopt this narrative three things are likely to happen:

Many investors will hold both Bitcoin and gold positions.

The reasons for trading Bitcoin and gold will overlap.

That will drive both assets to have directionally similar price movements.

At the moment the main underlying driver for the rise of both gold and Bitcoin has been the action of central banks (before) and since the start of the coronavirus crisis.

Since the start of the year:

The Fed has expanded its balance sheet by about 70%.

The European Central Bank assets have expanded by about 40%.

The Bank of Japan balance sheet is up 20%.

Looking at this chart you might be fooled into thinking that things will go flat now.

Long term investors know what’s going to happen though, they have seen that already.

I call it the Fed playbook and it follows the same pattern as in the aftermath of the 2008 financial crisis.

Just take a long term view and it becomes obvious.

You have an initial surge in balance sheet expansion that is the Fed trying to address a liquidity crisis. But things aren’t done after that.

The following years of quantitative easing programs are what end up doing the real damage:

In 2008 the Fed balance sheet grew by 150%.

But the following QE programs pushed the total growth to almost 400%!

The consequences are asset price inflation and a distorted financial market.

Both the ECB and the Fed have at times tried to deleverage. But those attempts were not successful. The Bank of Japan never bothered pretending. They have openly been on a smooth path to infinite QE pretty much since 2013.

The expectation that this pattern is going to continue is what’s leading many investors to seek sound money in order to preserve their wealth.

Does that mean we are condemned to see Bitcoin and gold trading hand in hand for the years to come?

Not necessarily.

The logical conclusion of Bitcoin being a better gold than gold is that at some point the market cap of Bitcoin will start eating away at the total market value of gold.

That’s when both markets decouple.

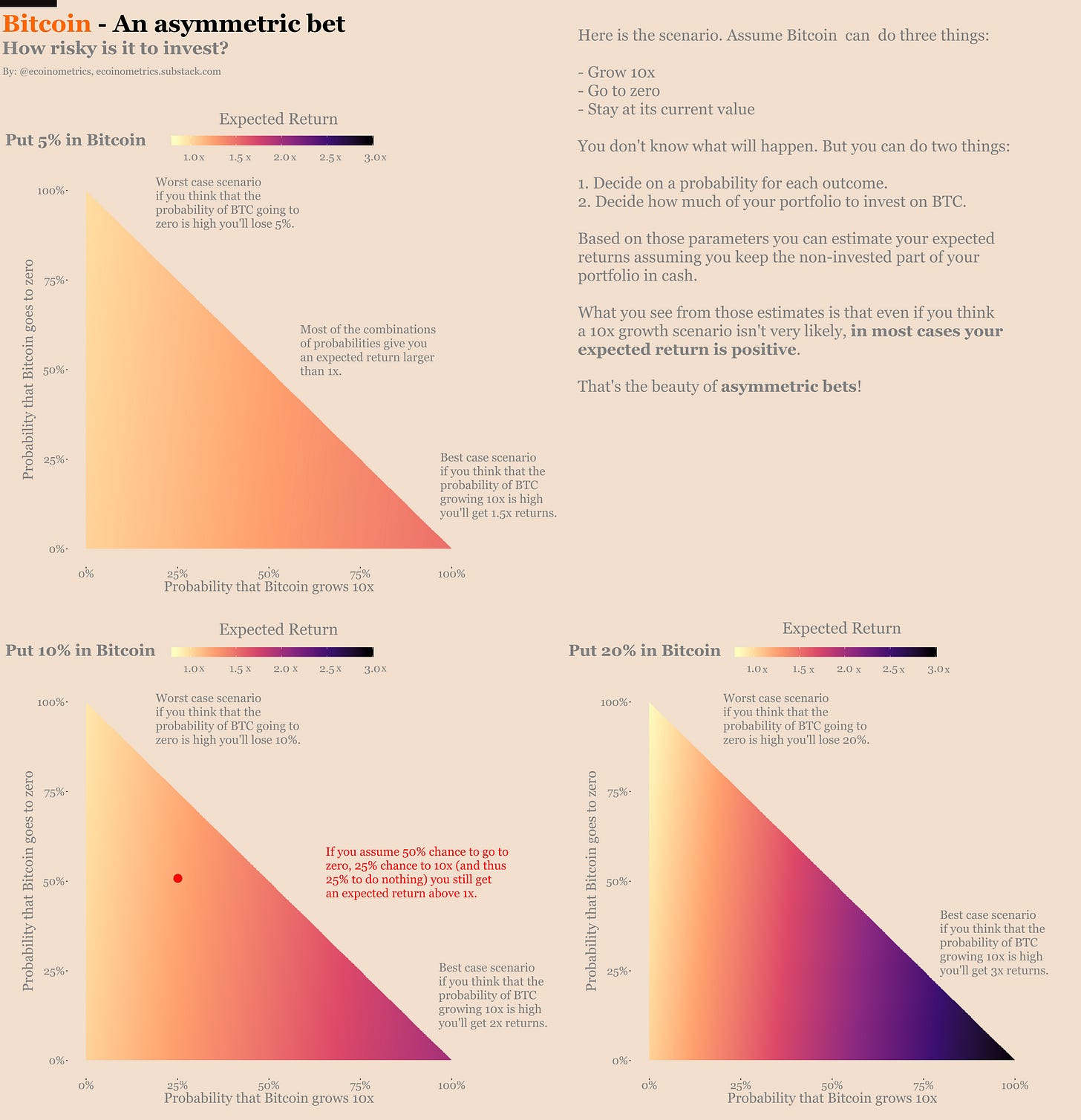

As of now almost 50x separate both assets. That means the potential upside for Bitcoin is massive. Again that is why Bitcoin is an asymmetric bet.

The asymmetric bet part of investing in Bitcoin isn’t yet part of the dominant narrative.

Few understand this.

That’s your edge.

If you understand this then you need to take actions now:

Buy Bitcoin.

Hodl.

Wait for outsized returns.

Volatility

Here is a nice article by Noelle Acheson from Coindesk about what volatility isn’t.

I’ve written about this several times already but it’s important. So here we go again.

Volatility in itself is not a bad thing. The fact that Bitcoin is a relatively volatile asset just means that you can expect to see rapid and sizeable absolute changes in price.

Absolute here means the price change can be to the upside or to the downside.

Bitcoin was created 11 years ago and for a few years was worth less than $1. Fast forward to now and one Bitcoin is worth more than $10,000. So obviously volatility is working in favour of BTC.

If you can put up with the downsides of volatility you’ll be greatly rewarded.

In her article Noelle mentions a survey from Fidelity Digital Assets that reports volatility as one of the main barriers to investment in BTC for institutional investors.

It seems that for some reason those institutional investors are missing the point.

Bitcoin is in its early adoption phase. That is one of the main reasons it is a volatile asset. And that is also why buying Bitcoin now is making an asymmetric bet.

If you are an institution, obviously Bitcoin is not going to be the only asset in your portfolio.

An easy way to control the negative effects of volatility only amounts to limiting the size of your Bitcoin position relative to your portfolio.

Think of it this way. If you have 10% of your portfolio in Bitcoin and its value drops 50% overnight then your portfolio is only down 5%.

If you cannot stomach that when the potential reward for holding this position is a 2x growth on your total portfolio then maybe you should not be in the business of investing.

There is no excuse.

But we are back with the main issue here. For most institutional investors the Bitcoin narrative does not yet include the notion that Bitcoin is an asymmetric bet.

So we still have some work to do in spreading the word!

If you have learned something don’t forget to subscribe to the newsletter to get my insights directly in your inbox.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Follow Ecoinometrics on Twitter at https://twitter.com/ecoinometrics.

Done? That’s great! Thank you and enjoy.