Ecoinometrics - The real impact of quantitative tightening

On the surface it looks like the Fed isn’t doing much, apparently it is quite effective

The Federal Reserve works in mysterious ways… actually no, what they are doing is pretty straightforward. And if their goal is to make everyone poorer they are doing a pretty good job at it.

The Ecoinometrics newsletter helps you navigate the landscape of digital assets and macroeconomics with investment strategies backed by data. Subscribe to get an edge on the future of finance.

Done? Thanks! That’s great! Now let’s dive in.

The real impact of quantitative tightening

There is this feeling that what the Federal Reserve is doing impacts the financial markets more than the real economy. And to be fair this is true most of the time.

People see the stock market soaring or falling. They see big moves in the bond market. All that based in big part on the Fed giving and taking away liquidity. All the while thinking "and so what, this ain't the real economy".

But it does have an impact. Quantitative easing has an impact. Quantitative tightening has an impact. Even if the cause and effects mechanism isn’t totally straightforward.

This time around though we have a pretty good example of the Federal Reserve affecting the real economy through the housing market.

Now it is true that when we look at what the Fed is doing for QT it isn’t very impressive.

Remember they have two levers: their balance sheet and the Fed Funds rate.

How much have they managed to reduce their balance sheet by? Not much honestly, take a look at it.

MBSs are flat. US Treasury bonds are down slightly. To put that in perspective if they continue QT at this rate it will take them 6 years to return the balance sheet to pre-COVID levels. These days 6 years is forever. It might as well never happen.

What about rates then? Well relatively speaking, since we are starting from virtually 0%, the Fed Funds rate is up a lot. But the gap with inflation remains massive.

Compare that to how high the Fed Funds rate was in the 70s…

Now as we have been saying time and time again the Federal Reserve has a singular goal. They need to bring inflation down. Their main problem is they have no direct control over prices or the supply chain.

What they can do is manipulate demand by making consumers poorer. Poorer consumers buy less. Prices go down until an equilibrium is reached. Inflation gets under control. Job done.

How they make consumer poorer can be a bit obscure. But here we have a straightforward example.

US consumers have a lot of their net worth tied to housing. So if somehow you can tank the housing market, you are making a lot of consumers poorer. QED.

That's the game the Federal Reserve is playing. Dangerous game for sure. But what else can they do.

Jay Powell might have messed up a lot of things but right now he is playing this game well.

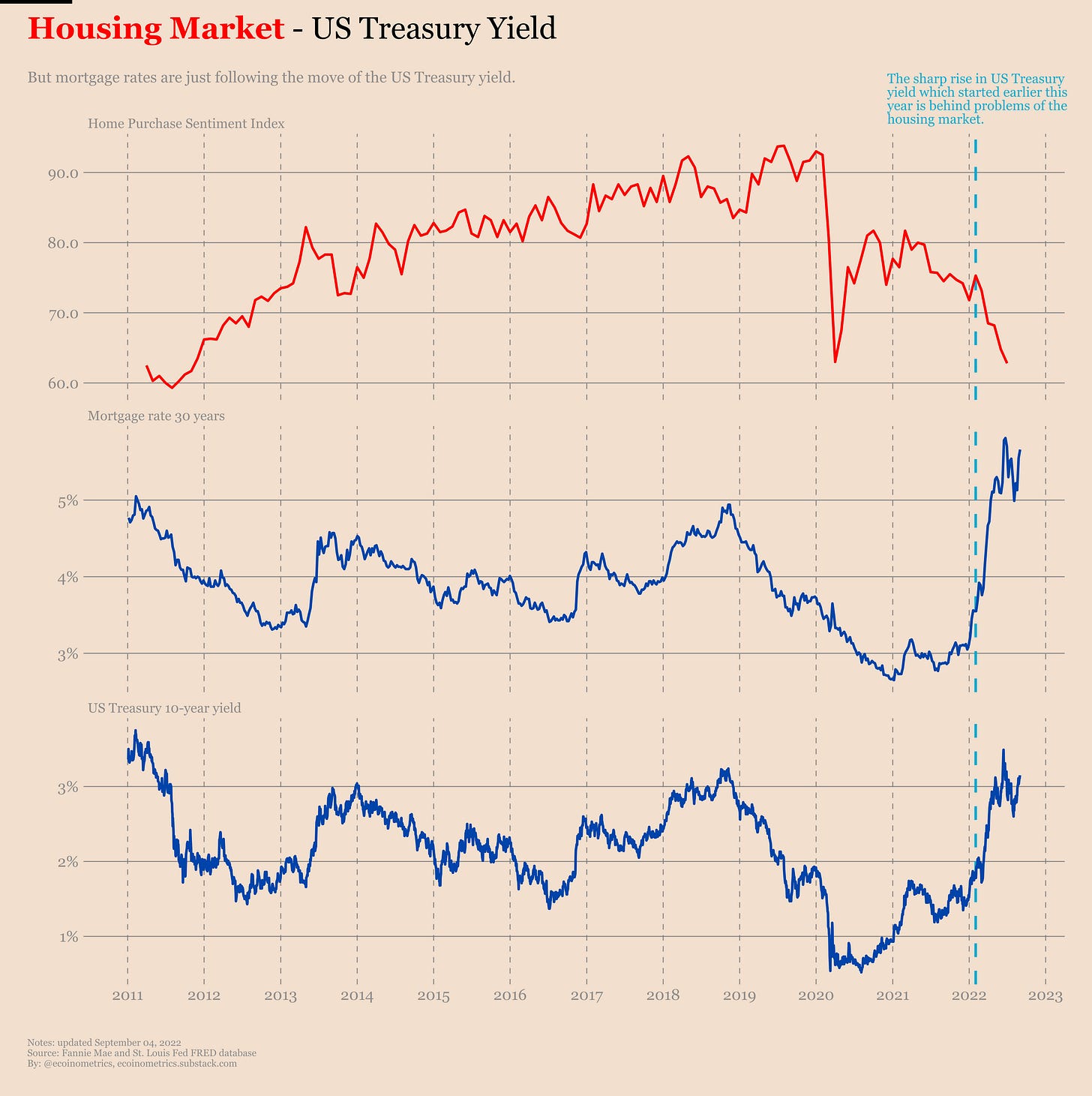

The House Purchase Sentiment Index, compiled by Fannie Mae, is a measure of the health of the housing market. The higher the better. Now checkout the recent trend.

We have three phases:

After the Great Depression the market sentiment slowly recovered.

Everything stopped with COVID but it looked like we were getting a V shaped recovery.

Except that now the HPSI is dipping to its lowest level since 2011.

And you have the Federal Reserve to thank for that.

Hear me out.

Very few house transactions are all cash. Which means that house purchases are tightly related to the mortgage conditions. And it just happens that recently mortgage rates are up massively.

Mortgage rates themselves are just following the bond market. In essence these types of loans are more risky than putting money in US Treasury bonds. That is the Treasury yield acts as a lower bond for the corresponding mortgage rates. And naturally when the US Treasury yields climb across the curve, so do mortgage rates.

But of course US treasury yields are guided by what the bond market expects from the monetary policy. And so the sharp rise in Treasury yield is related to the Fed hiking the Fed Funds rate.

So there you have a chain of events. From monetary policy all the way to the value of your house, the Fed has ways to make you poorer.

On the surface a Fed Funds rate at 2.3% doesn’t look like much. But in an economy heavily reliant on debt this change from 0% actually has a big impact.

The question is, will the Fed know when to stop to nail a softish landing? My guess is no. So be prepared for some bad months ahead.

Regulatory risks

"Governments won't allow decentralized cryptocurrencies to compete with state money. When crypto becomes too big they will step in and crush it with regulations."

Anonymous Twitter user circa 2016

If you have been in the space long enough that is something you have heard before. I've been actively involved in crypto since 2016. Like you I've heard this time and time again.

But fast forward 6 years, Bitcoin reached at some point a trillion US$ market cap, and we have yet to see those crushing regulations arrive.

So it would be easy to dismiss this kind of comment and say that regulations don’t matter. Of course completely dismissing potential issues isn’t the way to go when it comes to risk management.

The field of regulations is vast and I’m definitely not the lawyer type. My approach around thinking about regulations is more centred around what it does to business conditions.

When I think about regulations through that angle three things come to mind:

Some regulations straight up ban certain activities.

Some regulations slow progress/adoption.

Some regulations create a moat for incumbents.

An outright ban on cryptocurrencies in most part of the worlds is unlikely. The US certainly seem to go in the direction of pushing the space with some initiatives in the congress and things such as the White House Executive Order on digital assets. All this screams incoming regulations but not complete ban.

And to be fair that’s the pragmatic approach. Imposing a straight up ban on a decentralized system is a complicated matter. We have seen that with the example of the ban on Bitcoin mining in China. One year later the net result has been to push the mining industry out of China (thus making it more decentralized) while the hash rate is back to record high levels. If that’s not anti-fragility then I don’t know what it is.

Most likely what we are going to see is waves of regulations that will slow experimentations and potentially put some brakes on adoption.

The sector of digital assets that is the most at risk from that is certainly DeFi. You can’t really run financial services as decentralized apps and hope that governments will just ignore it all. But again the fate of DeFi isn’t that there is going to be a ban on the sector. More likely we’ll see regulations that will make DeFi gravitates more and more towards CeFi. If the move comes too early the amount of experimentations done in the space could slow down dramatically.

I think this is a major risk for the growth of the DeFi sector and that’s why I’m not extremely bullish on it.

The other kind of regulation I’m worried about revolves around Central Banks Digital Currencies. Maybe the term regulation is incorrect for that, but the idea is that if we move towards a cashless society all your transactions will be settled with CBDCs. In that case there is a future where the state puts a lot of friction on the on-ramp/off-ramp mechanisms between CBDCs and non state digital assets. They can do that since they have programmatic control over your money.

We are probably far away from that, but there is nothing like adding a lot of frictions in the system to discourage behaviours you don’t want to see. Long term that’s a big risk to decentralized digital assets.

Finally there is the question of regulations as moat. For some digital assets regulations will be an advantage. At this point it looks very likely that Bitcoin and Ethereum are going to be grandfathered in as legit decentralized commodities.

For every other currency/network that came afterwards this is bad news. Because it means that Bitcoin and Ethereum will have some regulatory moat around them.

For Bitcoin it isn't crucial since it doesn't really have any competitor in the store of value category. But for Ethereum such a moat would be huge. That means the network would not have to worry as much about competitors in the smart contracts platform space.

It is impossible to quantify what impact future regulations will have on digital assets. But qualitatively my guesses are that:

Digital assets with a regulatory moat are likely to be around longer that those without.

Digital assets that are going to be heavily regulated (I’m looking at you DeFi) are more likely to grow slower in the future.

Digital assets that are less likely to be regulated in the near future (NFTs, crypto gaming, everything that’s not obviously a financial product) will experience more growth in the next bull run.

Let’s see how that plays out.

August recap

In case you missed it, here are three things you might want to checkout from last month:

A two part attempt at evaluating what Ethereum will be worth in five years. Here is part 1 and here is part 2.

A look at how different assets have fared as inflation hedges over the past 80 years.

All the most basic questions about the dollar cost averaging strategy answered here.

That’s it for today. If you have learned something please like and share to help the newsletter grow.

If you are already a free subscriber please consider upgrading to a paid tier to get the full access including:

Two newsletters every week.

Suggest research topics and request charts.

Cheers,

Nick

P.S. For hot takes and threads follow Ecoinometrics on Twitter.

Generally love and read most of your writing, esp when it touches on housing, but this piece misses the mark a bit. Just feels like were stretching here — the fed is battling the worst inflation we've seen in decades. The last time this happened, paul volcker pushed us into a recession to break the back of inflation.The Fed will do the best it can to avoid that but they are working within their mandate, using the tools they have at their disposal.

Also, the Fed has a dual mandate, not singular (max employment + stable prices, https://www.investopedia.com/articles/investing/100715/breaking-down-federal-reserves-dual-mandate.asp) as you state: "Now as we have been saying time and time again the Federal Reserve has a singular goal."

Thanks Nick, a great read as usual. It feels like a gloomy outlook, but I'm learning a ton. Keep up the great work 👍