Ecoinometrics - This time is different

August 23, 2021

Here we go, as I write those lines Bitcoin is crossing above $50k!

Of course it isn’t the first time. BTC crossed above $50k first in February, then in March, and later April. We know what happened next…

So is it different this time?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

This time is different

I must admit that back in February I wasn’t paying much attention to on-chain data. Hindsight being 20/20 that was a mistake, although not a big one if you are just stacking sats and playing the long game.

But it is true that on-chain data contains valuable information. As an example, already in February, the signs were there showing that Bitcoin’s momentum was slowing down.

To start at a high level we can look at the evolution of the participation score in the accumulation trend.

The participation score takes groups of addresses ranging from small fish (addresses with less than 1 BTC) to whales (addresses with 1k to 10k BTC) and looks at whether or not they have been accumulating coins on average over the past 30 days.

A participation score on the low side (blue below) means that on average over the past 30 days mostly small groups have been accumulating.

By contrast a participation score on the high side (red below) means that almost all groups of addresses, from small fish to whales, are stacking sats.

While addresses accumulating Bitcoins does not immediately predict the price, you can imagine that it is better for both the tightness of the supply as well as the general sentiment when most people accumulate.

Now, with that in mind, take a look at the evolution of the participation score since the beginning of the year.

When Bitcoin crossed $50k for the first time the participation score had already started to weaken. And the subsequent crossings happened with less and less addresses accumulating coins.

Now when you see that, it isn’t surprising to conclude that in this situation as the trend was getting weaker, any kind of FUD or negative event would be more likely to result in some negative price action.

Again I’m not saying this blue zone predicts that the price will drop. But it does hint at some weakness in the market.

This time around we are crossing back above $50k with the participation score on the rise and already in the orange zone! So yes, this time is different. We are moving back towards the all-time high with some positive on-chain momentum.

We can dig a bit deeper though.

The participation score gives an averaged, high level view. But what’s going on if we break it down by address groups and get rid of the averaging?

See for yourself.

In the past couple of weeks, we are starting to see some contrast emerge:

The addresses controlling less than 10 BTC are steadily stacking sats.

The addresses controlling 10 to 1k BTC have turned more neutral.

Whales have been accumulating more slowly.

So to say it differently, we aren’t in a situation where only the small fish are accumulating and everyone else is offloading their coins. This is different from what Bitcoin experienced earlier this year. This time the market is clearly in a more healthy state.

That being said, the big question is whether or not it will stay this way.

After all we don’t want the party to stop at $50k! The real challenge now is to gain enough momentum to see Bitcoin move into the six figures range over the months to come.

For that to happen we probably don’t want to see a big divergence in the accumulation trend between small fish and whales.

So let’s keep an eye on it as the price moves toward its all-time high.

Bitcoin exposure

Last week Forbes reported that BlackRock, the giant asset allocator, has a significant stake in two Bitcoin miners stocks: Marathon and Riot.

To clarify, it isn’t like BlackRock is buying Bitcoin miners for themselves. What they are doing is including those Bitcoin miners into the range of products they offer to their clients (mutual funds, ETF and so on).

But what a lot of investors probably don’t realize is that they already have some indirect exposure to Bitcoin.

The reason is simple, an increasing number of stocks that are part of the big indices have some exposure to Bitcoin.

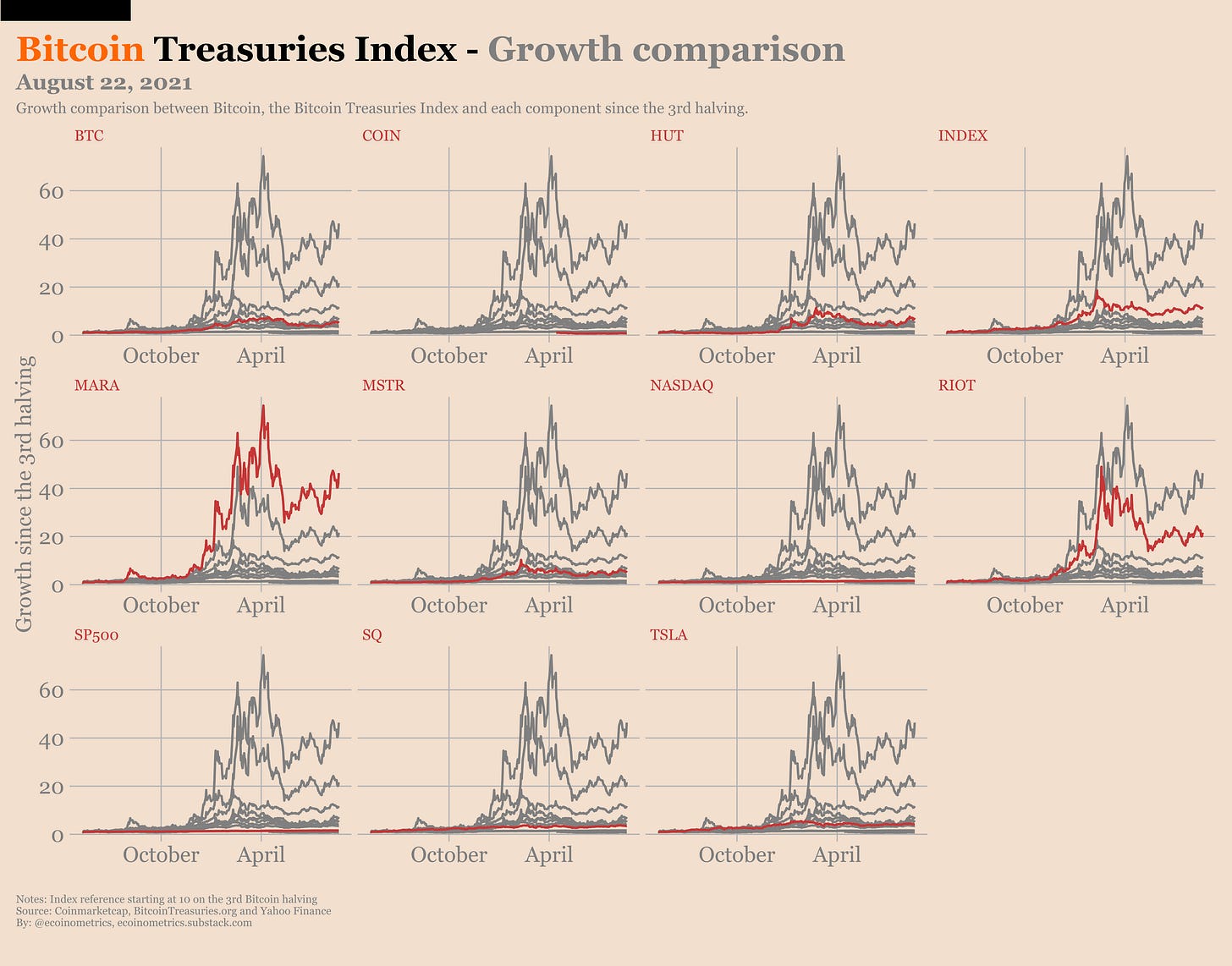

The easiest way to see that is to look at the Bitcoin Treasuries Index. This is a fictitious index I came up with which is composed of public companies trading on big US exchanges and with an exposure to BTC through their treasury.

The current composition of the index includes MicroStrategy, Tesla, Coinbase, but also the miners Marathon, Hut8 and Riot.

All of these are not only part of the Bitcoin Treasuries Index but they are more importantly part of the NASDAQ100… which means that anyone betting on the tech sector through this index has some indirect exposure to Bitcoin.

Of course there is a big different between the NASDAQ and the Bitcoin Treasuries Index, the latter is basically a leveraged bet on Bitcoin!

Check it out.

From up there you’d be forgiven to think that the blue line representing the NASDAQ is the horizontal axis…

So if for some reason you cannot get a direct exposure to BTC or GBTC (maybe while you are waiting for a Bitcoin ETF in the US) betting on a basket of stocks which are correlated to Bitcoin is probably the next best thing you can do.

Give it a try.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

Thanks for your work. Is there a way to see the live chart of the accumulation trends data on the platform you use or on tradingview?

Thanks, Nick. I really like your participation score and its accompanying address breakdown. Those two viz paint a great picture together 👍