Ecoinometrics - You don't need to time the bottom

May 16, 2022

Maybe the market has already bottomed. Maybe it hasn’t. Without the benefit of hindsight nobody knows.

The thing is, you don’t need to time the bottom to get decent returns as long as you have a long enough time horizon. So let’s look at how we could play this one from a strategic perspective.

The Ecoinometrics newsletter decrypts the place of Bitcoin and digital assets in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

You don’t need to time the bottom

Here is the situation:

Bitcoin is down -62%.

Ethereum is down -64%

The SP500 is down -20%

Each point on the chart below represents a drawdown categorized by its low point (the size) and how long it lasted (the duration). Where we are now is circled in red.

As you can see the current situation isn’t very common, even for the stock market.

So naturally everyone is wondering whether or not the bottom is in.

Here are some arguments for why we will go lower:

Inflation remains high which is ultimately bad for the economy and should hurt risk assets.

Real bear markets have been worse than that in the past. We are looking at -40% for the stock market and -80% for major crypto assets. We aren’t there yet. The capitulation hasn’t happened.

The Federal Reserve has barely started raising rates and for the record they haven’t sold anything on their balance sheet either. There is bound to be more downside coming from that.

A lot of economic indicators are pointing at a recession. Recessions aren’t great for risk assets.

Here are some arguments for why the bottom is in:

Inflation is high but it is rolling over. At some point higher prices are the enemy of higher prices.

The sentiment is so bad that things can only get better.

Investors have already priced in the rate hikes and the deleveraging of the Fed. They have reset their positions. They are ready to rotate their portfolio into new positions.

Maybe we’ll get a recession. But surely the central banks will just print their way out of it like they always do. Guess what? That’s good for risk assets.

If you go down to Bitcoin specific metrics to gauge whether or not more downside is possible you can still interpret things both ways.

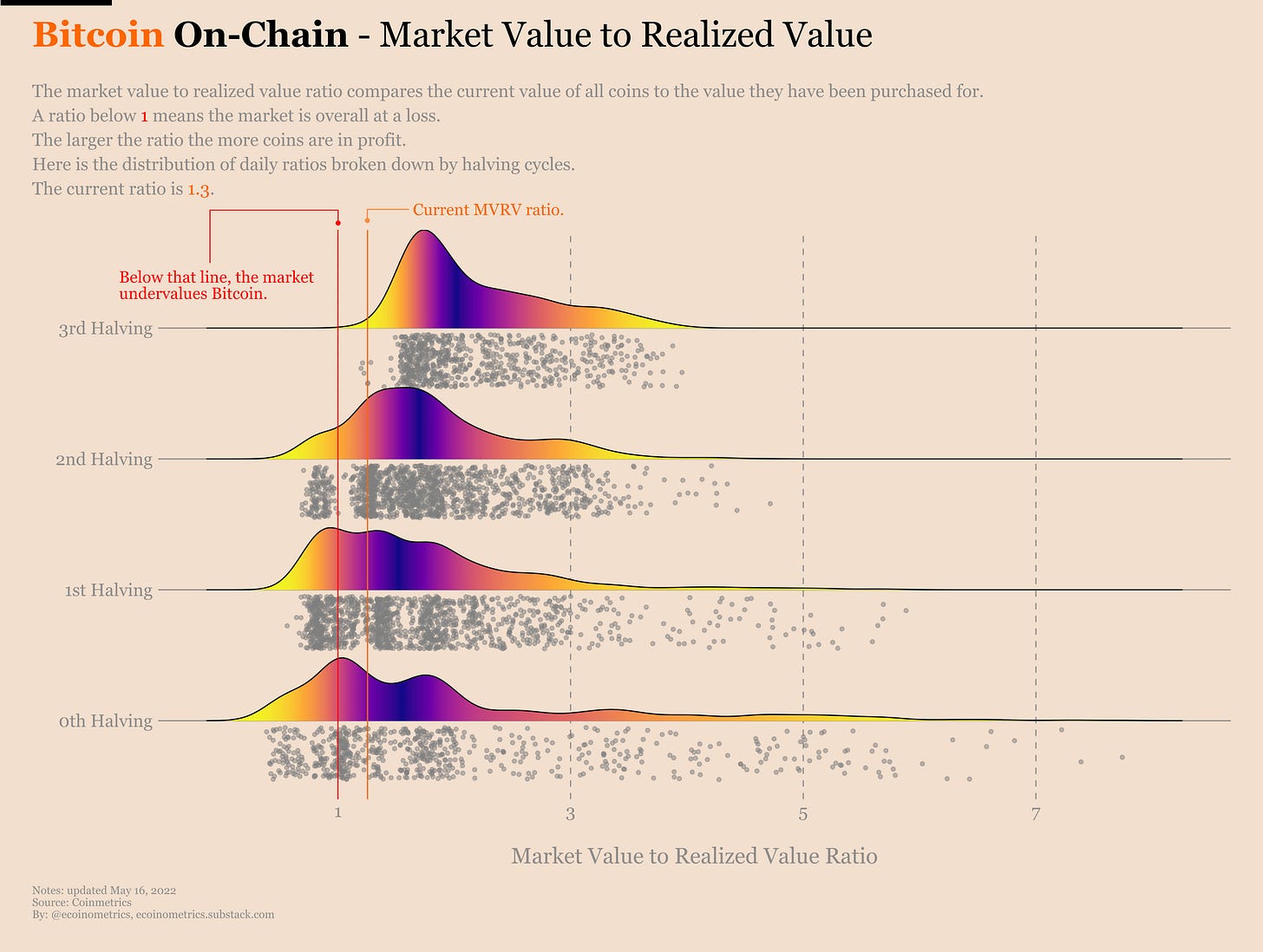

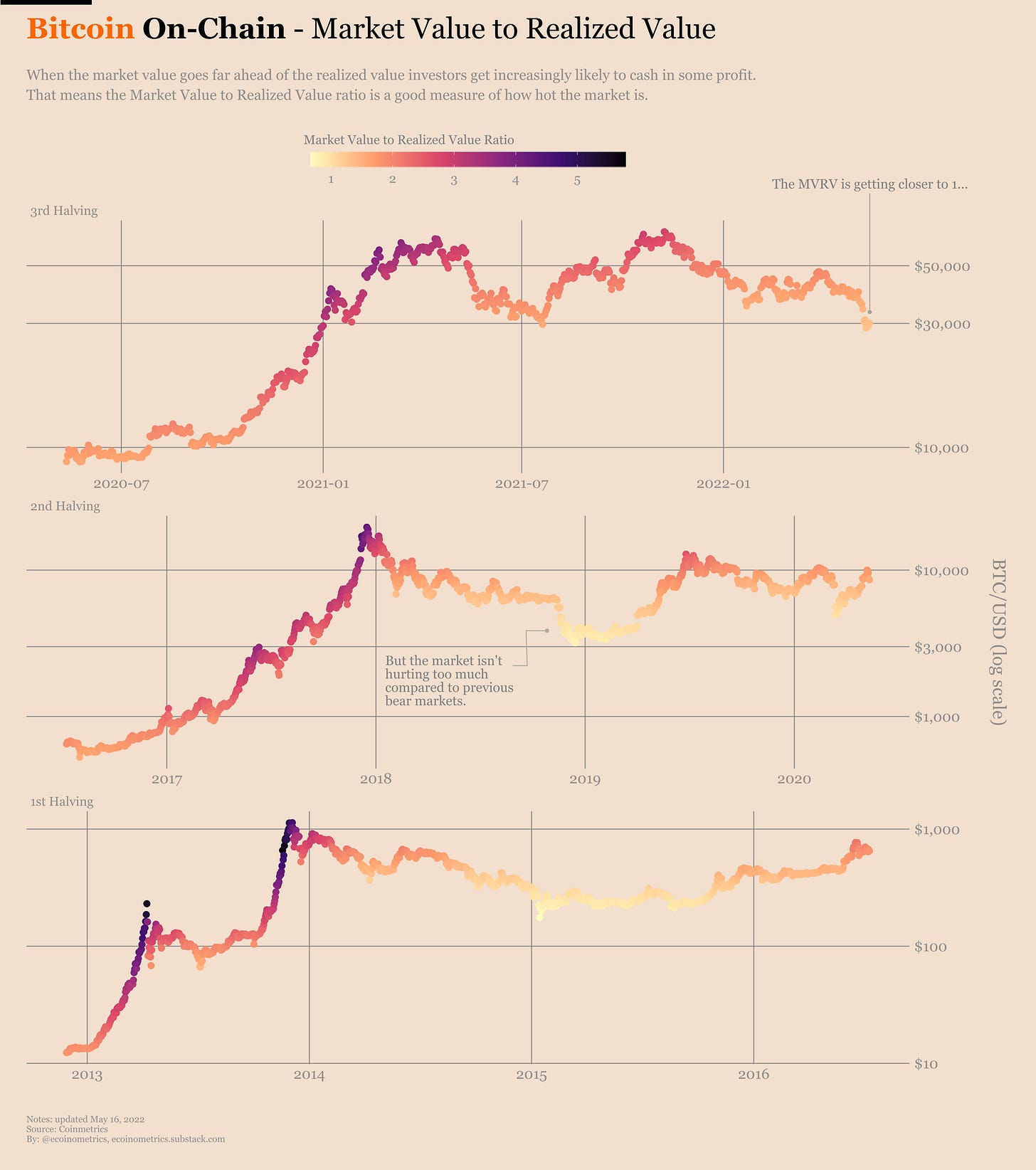

Take the Market Value to Realized Value ratio which measures in aggregate whether coins are in profit or loss based on on-chain movements.

Right now the MVRV ratio is at a low for this cycle while BTC is hanging around a support level at $30k…

… but we have seen worse during the previous bear markets.

And we could play the same game with a lot of on-chain metrics (such as the accumulation score) or other signals.

So which way is it? Bottom or not bottom?

Well my point is that without knowing the future there is no definitive answer.

But the good thing is that you don’t need to be a trading genius or a time traveler to get good returns over the next 5 to 10 years.

The key here is to expand your time horizon.

In the short term there is too much uncertainty to make any reasonable bet. But look forward a few years and ask yourself what is likely to happen on the other side of this correction.

What’s probably not going to zero even if we get a nasty recession?

Is the SP500 going to be worthless? Is Bitcoin going to die in the next couple of years? Is Ethereum going to get wiped out? Most likely not.

Hence if you have a long time horizon, the kind of discount you get in today’s market is already good enough to start deploying some capital.

Now of course the SP500, Bitcoin and Ethereum aren’t the only ones which have a high probability of making it through a recession. But you gotta make choices. And I like to keep it simple.

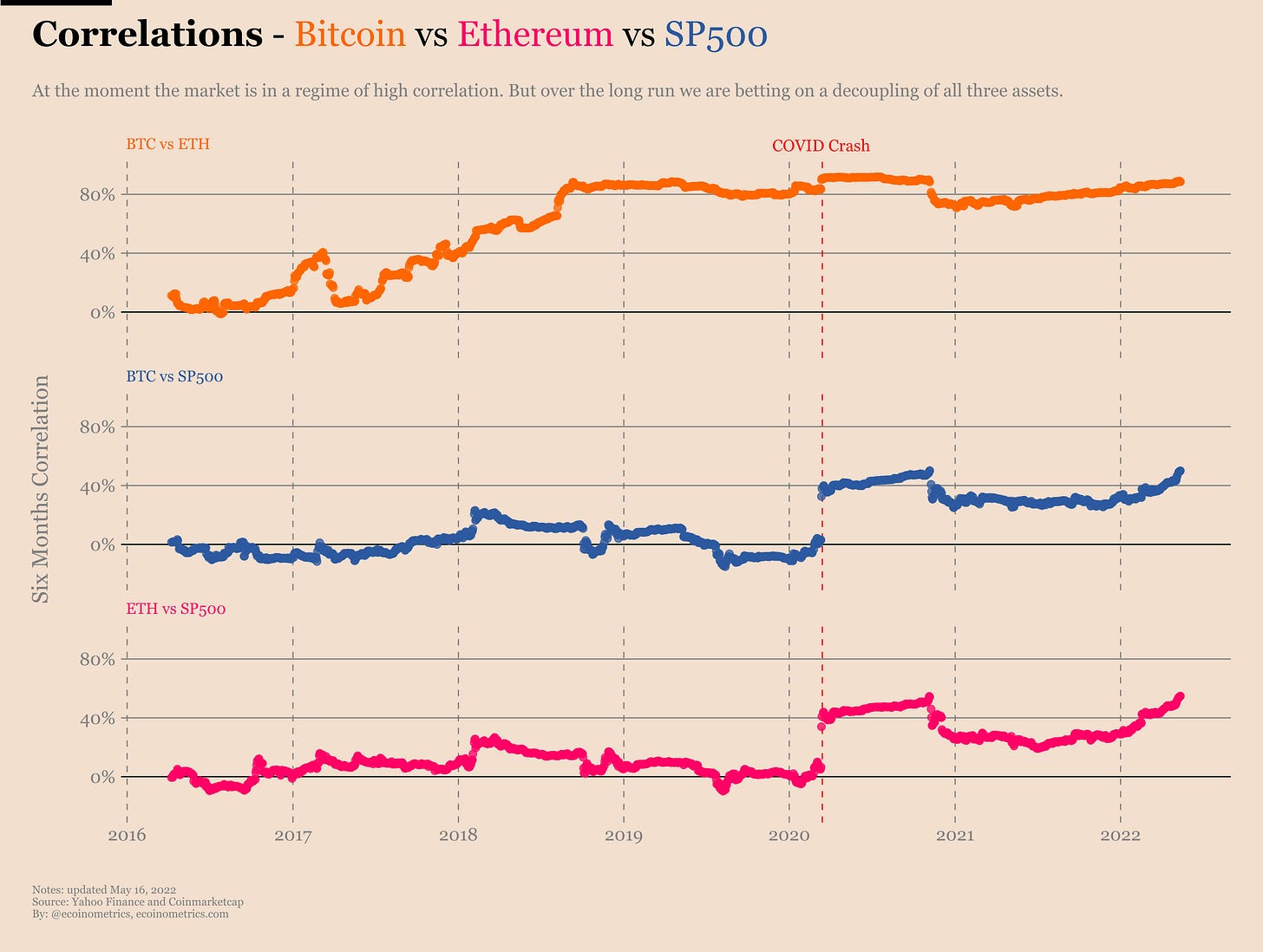

Plus my bet is that over the long run those three will eventually decouple.

For sure right now taking a position in all of them at the same time looks like a highly concentrated bet. I mean look at those correlations…

But those three don’t need to be correlated forever, hear me out:

The SP500 is by force of narrative a magnet for funds. This is where everyone’s money goes by default. As a result unless there was a total destruction of the confidence in capital markets it can’t go down forever.

Bitcoin doesn’t trade as a store of value right now. But it is built to be one. My bet here is that this is the narrative that will dominate in the long run.

Ethereum is highly correlated to Bitcoin. However they serve very different purposes. Ethereum isn’t made to be a store of value. It is meant to ultimately power the decentralized web. Which is why in the long run I’d bet on a decoupling.

Maybe those three will stay correlated forever. If that’s the case then I’m looking at a more volatile portfolio. But since I’d expect all three to have more upside volatility than downside volatility I can live with that.

Now what are the risks?

At 5+ years the SP500 could be worth nothing if the global financial system implodes. If that happens we’ll all have bigger problems to deal with. So the SP500 is the safe bet in your portfolio.

Bitcoin could stay forever a “niche” store of value. By niche I mean with a total market cap much smaller than gold currently is (about $10T for physical gold). If that’s the case there is probably still some upside compared to its current market cap but the risk/reward ratio is less juicy.

Bitcoin has reached a scale at which it is doubtful it will completely disappear from the financial system bar a fault in the code or self-inflicted wounds by way of changes in the protocol. So while less safe than the stock market it is still a solid bet.

Ethereum is still relatively small and when it comes to smart contract platforms there is a lot of competition. Moreover the protocol itself is much more complex than Bitcoin and constantly evolving. In particular the transition to a Proof of Stake mechanism is a big challenge from a software engineering point of view.

That’s why Ethereum could still fail. While Bitcoin is pretty much a finished product, Ethereum is a work in progress. That’s the major risk. But considering its market size the potential for asymmetric returns is there. So as the riskier part of your portfolio it makes sense to allocate something to it.

Now inflation is still high, the global economy looks weak and the Fed is doing everything they can to bring about a recession.

That means we need to entertain the possibility of more downside in the short term. Because of that it isn’t stupid to keep some cash for opportunistic bets if we move into a recession.

We could decide to do whichever comes first:

Deploy this cash if we see another -20% dip.

Buy the momentum if it turns out we have already seen the bottom.

Or do some other trade with an asymmetric return potential.

Alright, so we are pretty much covered when it comes to the strategy. The last thing is to decide how to break down the allocations in our portfolio.

We could try to do fancy math targeting expected returns and looking at volatility to build a risk profile choose the percentage allocations. But the point of this post is to show that you don’t need to be a genius to get good returns.So let’s keep it simple.

Say we have $1m to deploy:

$400k goes to the SP500 (40%).

$200k goes to Bitcoin (20%).

$200k goes to Ethereum (20%).

$200k goes to cash (20%).

That’s it. That’s the full strategy. We could deploy that cash today and let it run:

More downside? We’ll use the cash to lower our cost basis.

Only up from here? We’ll just pile in on the momentum trade when the time comes.

If it goes very well after a while, we might even do some rebalancing.

Actually, let's do that. Let’s track how this portfolio performs over the long run. We’ll assume that we are deploying our cash today (May 16, 2022) and we’ll update our positions / track the performance on a daily basis over here.

Remember, our goal is not to do the best possible trade by timing the bottom. Our goal is to do well enough consistently over the long run. Over optimization is the enemy of consistency.

Actually let me quote Morgan Housel on this one:

Average returns for an above-average period of time = extreme outperformance.

It is the most obvious secret in investing.

Morgan Housel

Let’s see how that plays out.

That’s it for today. If you have learned something please like and share to help the newsletter grow.

If you are already a free subscriber please consider upgrading to a paid tier to get the full access including:

Two newsletters every week.

Suggest research topics and request charts.

Cheers,

Nick

Good! https://www.ecoinometrics.com/a-simple-portfolio/

great post, thanks!