Risk-Off Flows Favoured Gold Over Bitcoin in Early 2025

Also Ethereum Is Still Waiting for a New Narrative & Core Inflation Is Sticky and That Keeps Uncertainty High

Welcome to Ecoinometrics' Friday edition.

Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis.

Today we'll cover:

Risk-Off Flows Favoured Gold Over Bitcoin in Early 2025

Ethereum Is Still Waiting for a New Narrative

Core Inflation Is Sticky and That Keeps Uncertainty High

Together, these signals paint a clear picture of the current landscape: macro uncertainty is still driving capital toward traditional safe havens, Bitcoin is holding its ground with improving flows, and Ethereum continues to lag without a compelling narrative. The big question now is whether softening policy signals and stronger risk appetite can push digital assets into a new phase of growth.

In case you missed it, here are the other topics we covered this week:

Essential Decision-Making Tools

Bitcoin Market Monitor - Key Drivers in Five Charts:

Bitcoin Market Forecast - Probability Scenarios & Risk Metrics:

Get these professional-grade insights delivered to your inbox:

Risk-Off Flows Favoured Gold Over Bitcoin in Early 2025

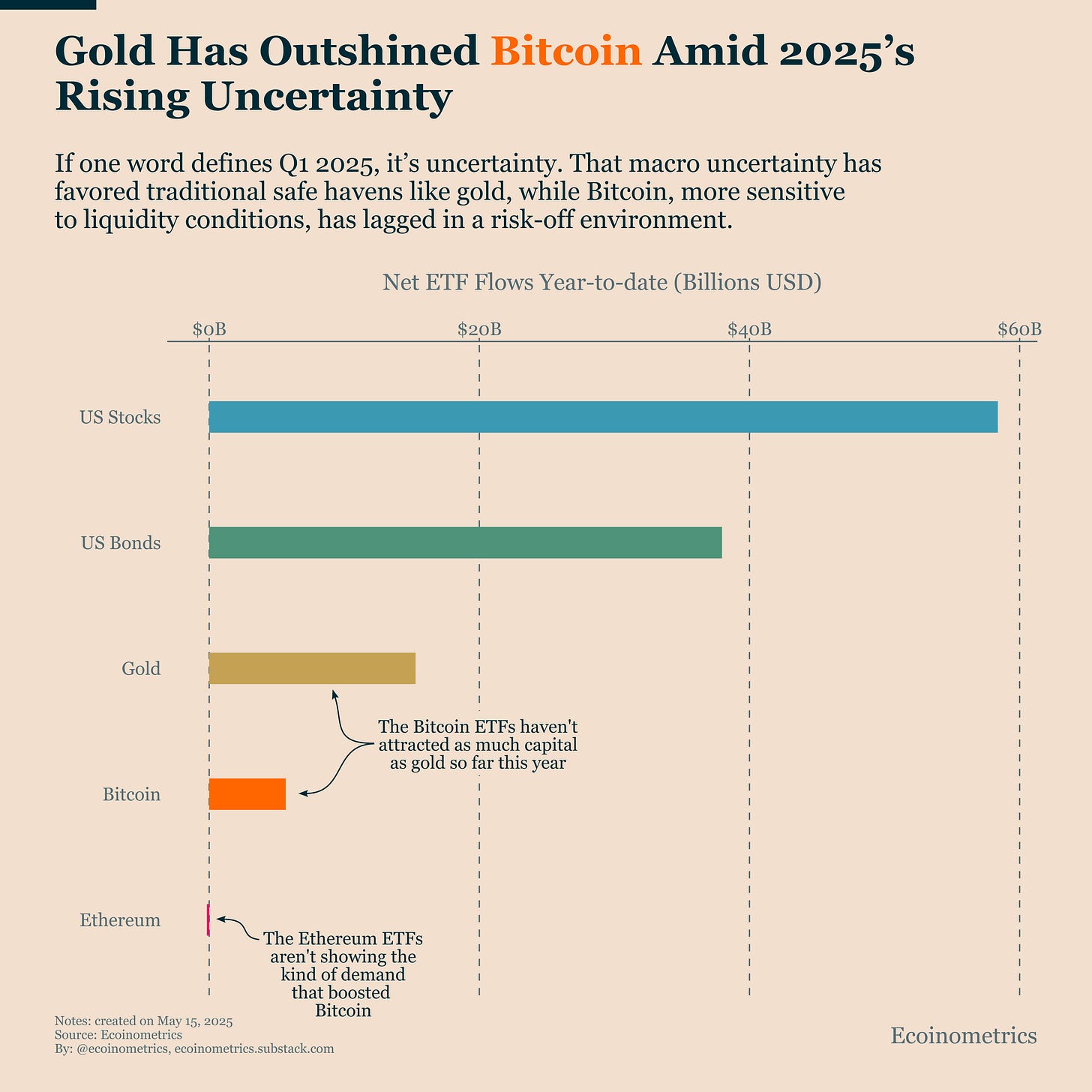

Last year, Bitcoin ETFs saw $35 billion in net inflows and bought 500,000 BTC. That surge in capital helped drive a 120% return.

So far in 2025, things look very different. Four months in, Bitcoin ETF flows are less than a third of what they were last year. Meanwhile, gold ETFs have pulled in more capital.

That shouldn’t come as a surprise. The defining feature of Q1 2025 has been uncertainty, around Fed policy, trade policy, and the broader direction of the US economy.

Between two hard assets, gold and Bitcoin, it’s easy to see why capital went to the one seen as a safe haven.

And Bitcoin is not a safe haven, it’s a high-beta growth asset. It performs best when liquidity is rising and fiat debasement is in the air. So far this year, we’ve had the opposite.

But that may be starting to shift:

US trade policy is becoming more clear and things are not as bad as expected.

The Fed is signalling a softer stance.

And financial conditions, which tightened earlier in the year, appear to be easing again.

That change is starting to show up in the ETF flows. Bitcoin funds are now seeing steady and strong inflows. Over time, that will support price appreciation (you can follow the evolution of the price channel based on our ETF flows model in the Bitcoin Market Monitor).

Are there still risks? Yes. But compared to Ethereum, Bitcoin looks much better positioned.

Ethereum Is Still Waiting for a New Narrative

Since the bottom of the bear market in 2022, Bitcoin has outperformed Ethereum by nearly 400 percentage points.

That gap is striking, especially considering that just a few years ago, many were wondering when Ethereum would overtake Bitcoin in market cap, the so-called “flippening.”

But as we’ve seen in this year’s ETF flows, Ethereum is struggling to attract the kind of capital needed to close the gap.

There are two main reasons.

The first is structural: Ethereum ETFs don’t offer staking rewards, which makes them less appealing than alternative ways of holding ETF. But we’ll get into that another time.

The second issue is more fundamental. Most investors today don’t see a compelling reason to allocate to Ethereum other than tagging along with a broader crypto rally led by Bitcoin. Ethereum lacks a clear, standalone narrative.

“Ultrasound money”? That’s faded. NFTs? Still around, but mostly in niche corners of the market. Web3 gaming? Promising but still too early.

In that context, where does serious capital go when looking for digital asset exposure?

Bitcoin. It has a clear story: digital gold, hedge against debasement, institutional adoption. That story continues to resonate.

Ethereum, for now, is still searching for its next big idea.

Core Inflation Is Sticky and That Keeps Uncertainty High

At the last FOMC press conference, Fed Chair Jerome Powell noticeably downplayed the urgency around inflation.

But the data tells a different story, especially when it comes to the core metrics that actually matter for policy decisions.

The latest numbers show:

Core CPI is at 2.8% year-on-year, roughly 30% above the pre-COVID average.

Core PCE is at 2.7%, still 50% above its pre-COVID average.

While the gap between the two is narrowing, overall progress on core inflation has stalled. We’ve been stuck in this range for months.

So we remain in a fog-of-(trade)-war environment where investors are operating without clear signals. Market direction, in the meantime, is driven by sentiment. And right now sentiment is improving:

The Fed is sounding less hawkish.

The US administration is signing trade deals.

And the US economy is holding up.

But the structural problem remains: there won’t be a return to a stable, low-volatility macro environment until core inflation is truly back on target. And we’re not there yet.

For now, ETF and corporate flows into Bitcoin are strong enough to drive growth, as investors continue to bet on longer-term liquidity expansion.

That’s a supportive short-term setup but it’s still built on unstable macro footing.

As usual, for tactical decisions, follow the flows.

That's it for today. Thanks for reading.

Cheers,

Nick

P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis.

Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions.

Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights.