The End Of Bitcoin ETF Outflows?

Also Beyond Halvings: Bitcoin's New Market Drivers & Fed Maintains Rate Projections, But Questions Linger

Welcome to Ecoinometrics' Friday edition.

Each week, we analyze the three most critical market signals impacting Bitcoin and macro assets, delivering institutional-grade insights through data-driven charts and analysis.

Today we'll cover:

The End Of Bitcoin ETF Outflows?

Beyond Halvings: Bitcoin's New Market Drivers

Fed Maintains Rate Projections, But Questions Linger

In this edition, we examine three key factors influencing Bitcoin's current market. We'll analyze the recent stabilization of ETF flows, explore how Bitcoin's post-halving performance breaks from historical patterns, and assess how the Fed's latest projections impact the broader macro picture. These three elements provide crucial context for understanding Bitcoin's near-term trajectory.

In case you missed it, here are the other topics we covered this week:

Essential Decision-Making Tools

Bitcoin Market Monitor - Key Drivers in Five Charts:

Bitcoin Market Forecast - Probability Scenarios & Risk Metrics:

Get these professional-grade insights delivered to your inbox:

The End Of Bitcoin ETF Outflows?

Bitcoin isn't in the best shape at the moment. Despite its price holding up well, several factors point to downside risk:

The net ETF flows for the past 30 days have been very negative (worst sequence on record)

The NASDAQ is below its 200-day moving average

And that's just three of the major factors that influence Bitcoin's price trend.

The ETF outflows in particular are a big deal.

The chart below tracks the evolution of the cumulative net flows since the launch of the ETFs. Bitcoin's price is overlaid via a color scale.

Every major inflection in the trajectory of the cumulative flows has come together with big price movements for Bitcoin:

The initial bump brought Bitcoin from $40,000 to $70,000.

The second bump at the end of last year brought Bitcoin from $70,000 to $110,000.

The largest sequence of outflows last month came with a -22% dip.

Big moves in one direction or the other are at least correlated to the flows. Since they impact supply and demand, there is also an element of causation.

This is why what the ETF flows do next is important for BTC.

As of this week, the flows are starting to stabilize, and the long sequence of outflows seems to be over. That means there is some hope the situation will stabilize. But it will take much more than that to generate real sustainable growth.

The stabilization of ETF outflows might signal a critical inflection point for institutional sentiment. If flows turn positive in the coming weeks, it could mark the beginning of a new accumulation phase by professional investors. Watch for early signs of momentum shift in daily flow data.

These flows can actually be tracked on our Bitcoin Market Monitor.

Beyond Halvings: Bitcoin's New Market Drivers

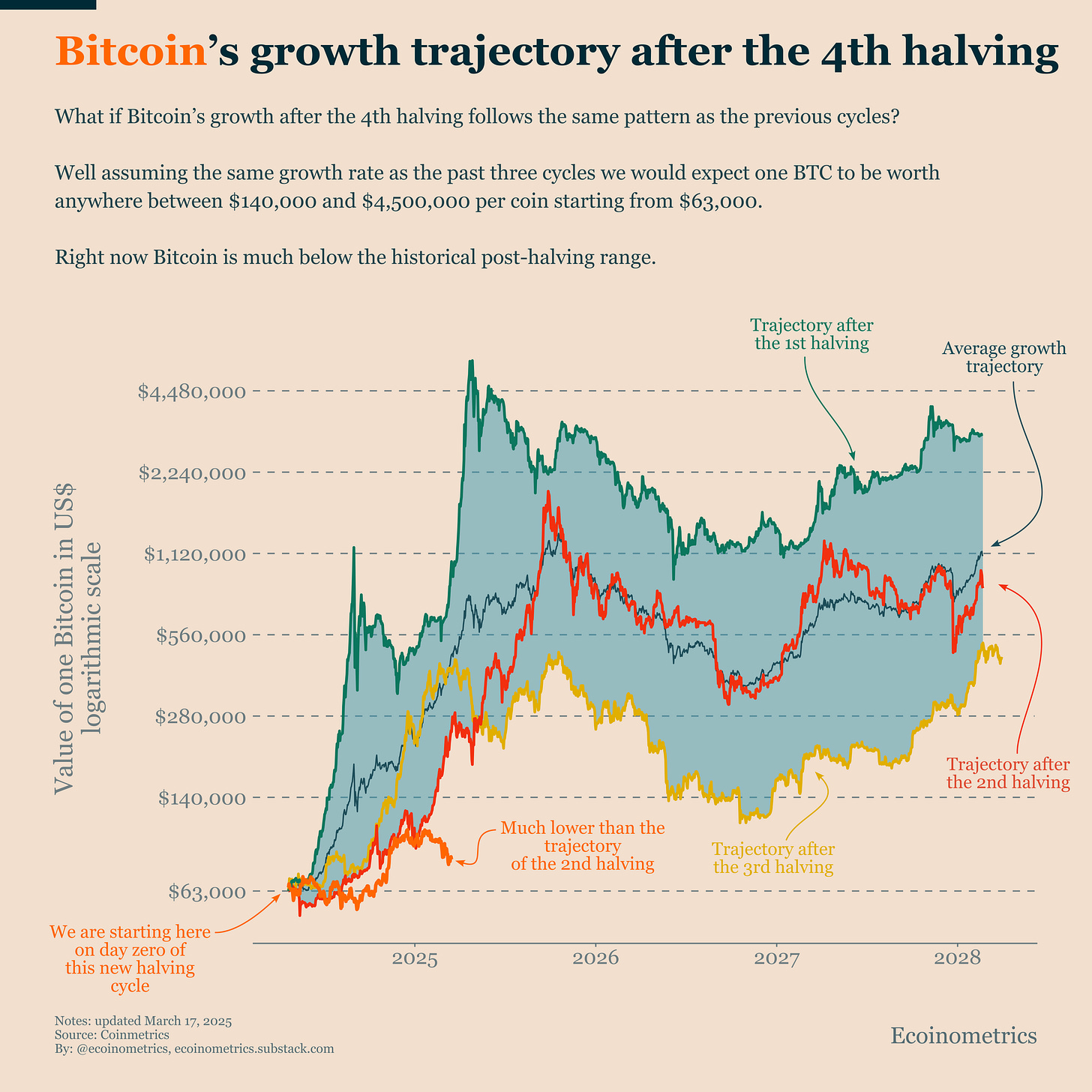

We have just updated our chart which tracks Bitcoin's growth trajectory in this halving cycle against the historical range of growth trajectories in past halving cycles.

Bitcoin is way below its expected price based on those historical projections.

It seems pretty clear that at this point the narrative around the halving itself having a real impact on the market is over.

And that makes perfect sense from a quantitative point of view. Already 94% of all the Bitcoins that will ever exist have been mined.

The difference in supply that comes from mining coins is absolutely negligible compared to all other sources where coins can be bought and sold.

So there is no reason why the halving needs to have an outsized effect on Bitcoin's price trajectory.

What matters much more is how Bitcoin fits in the macro asset cycles. This will only become a stronger influence over time (arguably that has been the case already since 2020). As we flagged months ago, mean reversion of stocks in 2025 could be a negative influence.

This divergence from historical post-halving patterns isn't just a temporary anomaly, it signals a fundamental market evolution. We're witnessing a maturing Bitcoin market where institutional flows and macroeconomic factors now carry more weight than supply-side events like halvings.

Professional investors need to adjust their analytical frameworks accordingly, focusing less on supply mechanics and more on capital flows and correlations with traditional markets.

That's why instead of focusing on a repeat of the previous halving cycles, it is better to focus on what's actually driving the price now, and a big part of it is ETF flows.

Fed Maintains Rate Projections, But Questions Linger

Now this week could have been much worse if the FOMC meeting had turned out differently.

But Jerome Powell chose not to disrupt markets with any hawkish surprises.

As shown in the chart below, the Fed maintained its previous expectations for rate trajectories. Even though Powell thinks trade wars are inflationary. For the Fed Chairman, the key point is that these inflationary pressures will be transitory... if you have a flashback to 2020/2021 and the whole concept of "transitory inflation", raise your hand...

Regardless, the simple fact that the Fed is not planning no rate cuts or worse, raising rates to fight this temporary inflation pressure, gave risk assets a sigh of relief.

Is it just a temporary reprieve? Will financial conditions tighten further from here? There is a lot of uncertainty right now...

We'll analyze the content of the press conference via the Fed Communications Index on Monday to determine what it means for the macro outlook and the likely consequences on Bitcoin's price. For now, what's clear is that this FOMC meeting has not brought any real clarity on the trajectory of US monetary policy.

The market remains in limbo between conflicting signals - stable rate projections versus inflation concerns. Watch for subtle shifts in Fed communications that might signal a more hawkish stance later this year. Until then, markets will continue to react strongly to each new economic data point as participants try to predict the Fed's next move.

That's it for today. Thanks for reading.

Cheers,

Nick

P.S. Every week, our team conducts extensive research analyzing market data, tracking emerging trends, and creating professional-grade charts and analysis.

Our mission: Deliver actionable macro and Bitcoin insights that help institutional investors and financial advisors make better-informed decisions.

Ready for institutional-grade research that puts you ahead of the market? Click below to access our premium insights.

Did you notice that the fed is reducing its balance sheet runoff to only $5b per month starting in April… this means they will be in the market buying securities to the tune of $20b per month. They are not calling it QE of course…

Excellent post today! Thanks.