Maybe you are wondering why so many in traditional finance and economics circles have missed on Bitcoin for so long.

It might boil down to one thing: a lack of imagination...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great! Now let’s dive in.

Lack of imagination

This:

A lot of critics come up with theoretical arguments against Bitcoin. That was fine 10 years ago when Bitcoin was just starting and there was little data to work with.

But the fact that in the face of adoption we still get the same objections over and over again shows that a lot of economists are ill equipped to understand real markets.

Crucially what the “fiat brains” lack is imagination.

They think static and assume things will always be as they are right now. Obviously that kind of thinking leads to a mismatch between expectations of stability and the reality of constantly evolving markets.

Take volatility. One common argument from traditional economists is that Bitcoin is too volatile to be a currency. Fair enough. But also totally irrelevant at this point. We are simply too early in the adoption process to compare the volatility of Bitcoin to that of gold or any fiat currency. It does not make sense.

A more apt comparison at this stage is to look at Bitcoin through the lens of a growing network. In the adoption phase the relevant parameters are growth, scale and market value captured by the network.

On those metrics Bitcoin is doing well.

Traditional economists missing out on Bitcoin is akin to Paul Krugman missing out on the internet. We all know his infamous quote from 1998:

“By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.”

Paul Krugman, Nobel Prize-winning economist

When Paul Krugman made this quote arguably very few people had access to the internet but Amazon had just done its IPO.

By 2005 about 17% of the world’s population had access to the internet and this number was already above 50% in developed economies. At that time Amazon’s market cap had risen to $15 billion.

In 2021 more than 50% of the world’s population has access to the internet, Amazon’s market cap has risen to $1.6 trillion and so much of the global economy relies on the internet that it is hard to see how we’d do without it.

For those who remember dial up connections it is pretty clear to see why on the surface, to Paul Krugman, the internet was nothing but a fancy fax machine. Others saw the raw potential and built on it the internet that we know today.

People are making the same mistake with Bitcoin. They are missing on the potential future by lack of imagination. Don’t be like them.

Bitcoin vs home prices

It is hard to keep up with Bitcoin. I mean for other asset classes. We have looked at gold, the stock market, the real estate sector of the stock market… none of them come even close.

So here is another popular category of assets that can’t keep up with Bitcoin: home prices. If you thought that home prices can somehow keep up with Bitcoin’s growth then think again.

The Case-Schiller index is a standardized measure of changes in home prices across the US. When we use that as a reference, houses in the US have been getting 10 times cheaper in BTC after every halving…

Honestly that’s not unexpected. This is the same pattern we see play out when you price anything in BTC.

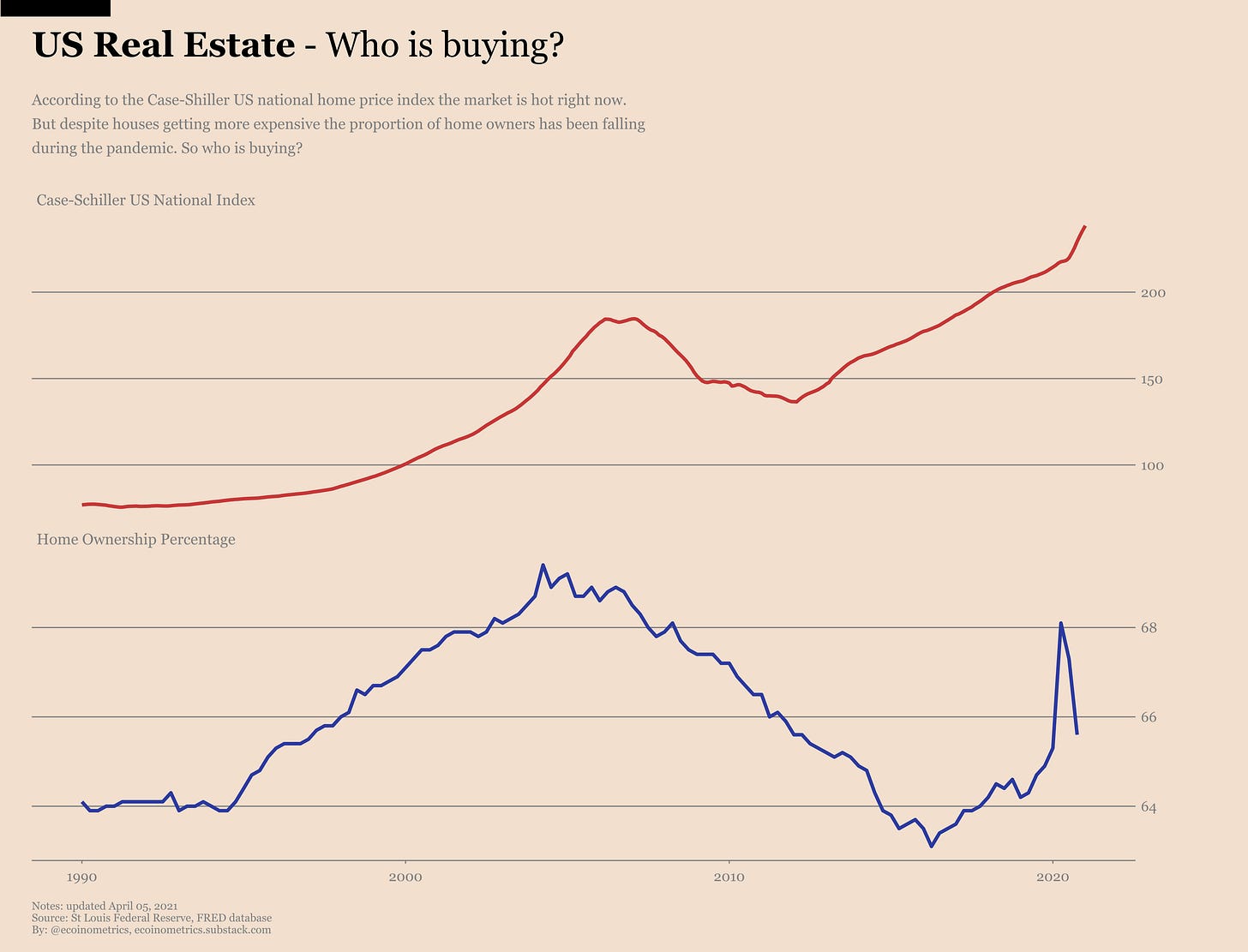

In absolute terms home prices haven’t done particularly bad though. Especially when you see that those have been rising continuously even during the pandemic.

At this point you might think: “Wait what? The US economy is in the trash and so many people have been losing their jobs, how is it possible that houses are getting more expensive.”

True.

The crucial thing is to see who is buying.

Given that home ownership has been on the decline last year we can guess that those buyers putting pressure on prices are very much in the speculation game.

Indeed according to this article from the Wall Street Journal pension funds are on the hunt for real estate to park their cash.

You can thank the Federal Reserve for that.

If you want my opinion that’s one more sign that institutional investors are seriously worried about inflation. By scooping up rental real estate they get a hedge against inflation that is also generating yield in the form of rental income.

Next step for them to diversify would be to buy Bitcoin… maybe… someday. I guess they are all waiting for a Bitcoin ETF in the US.

Still a lot of room to grow.

Macroecoinomics

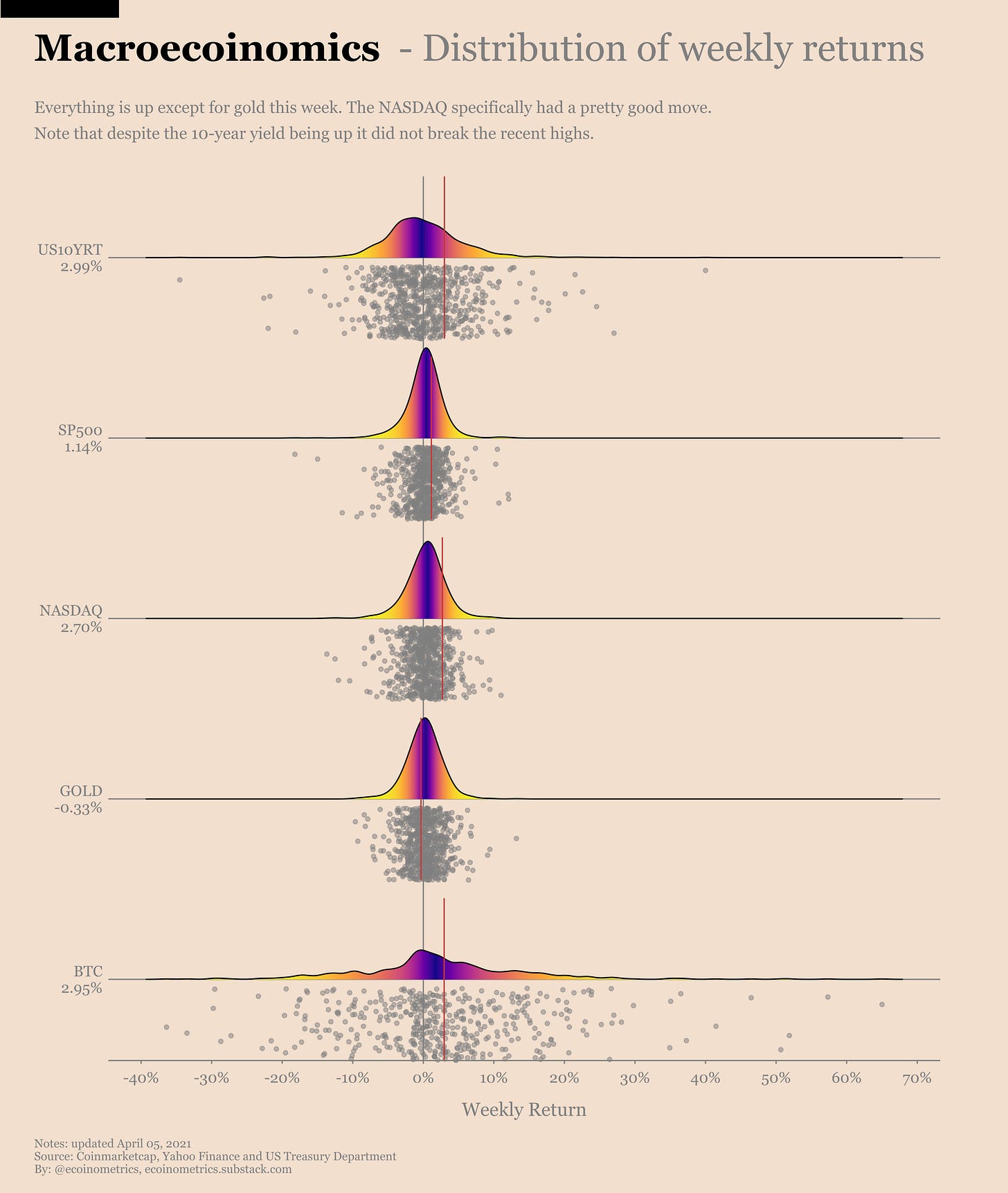

Let’s finish with a quick look at the situation at the end of last week.

One more week of consolidation below $60k. I guess the larger the base the bigger the move. But we’ll see how that plays out.

Still, Bitcoin is up this week even though it’s a pretty average move. The 10-year is up again too and that’s obviously not very good for gold.

Right now the 10-year yield is consolidating below 1.8% but since the Fed is decided in doing nothing I can see it rise past 2% in the months to come. Everybody is waiting for something to break... 🔥so far everything is fine🔥.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!

How can I check to my account my name is Juanita R.Bosquez

You talk about 'fiat brains', yet you say: 'In absolute terms home prices haven’t done particularly bad though'. I presume you mean 'In USD terms ...'.