Ecoinometrics - Here we go again

November 22, 2021

All it took was another dip back to prices last seen a month ago and the bears are already waking up from hibernation.

But is the situation really looking that bad for Bitcoin?

The Ecoinometrics newsletter decrypts the place of Bitcoin and digital assets in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Here we go again

Alright, to be honest with you, I didn’t expect to have to whip out those Bitcoin drawdowns charts so soon. But the market being what it is, let's place the current dip in context.

Where are we at:

The current drawdown has lasted 12 days so far.

The bottom has been at -19% from the all-time high at $69,000.

Is it a lot? Is it unusual? How does it compare to the previous corrections?

See for yourself.

No, it isn’t a particularly big drawdown. No, it isn’t a particularly unusual drawdown trajectory. Actually we have had several drawdowns during this cycle that fell in the same range as this one.

Check it out.

Basically this is just business as usual for Bitcoin. Does it suck that we get another drawdown without BTC having set a significantly higher all-time high? Yes, for sure it does.

You don’t get a FOMO inducing parabolic leg simply by doing a small push to $69k.

I’m sure Elon Musk has some buy orders ready when the price touches $69,420… so BTC will need to make a little more effort at least…

Jokes aside, despite the correction, the situation in the market doesn’t look that bad.

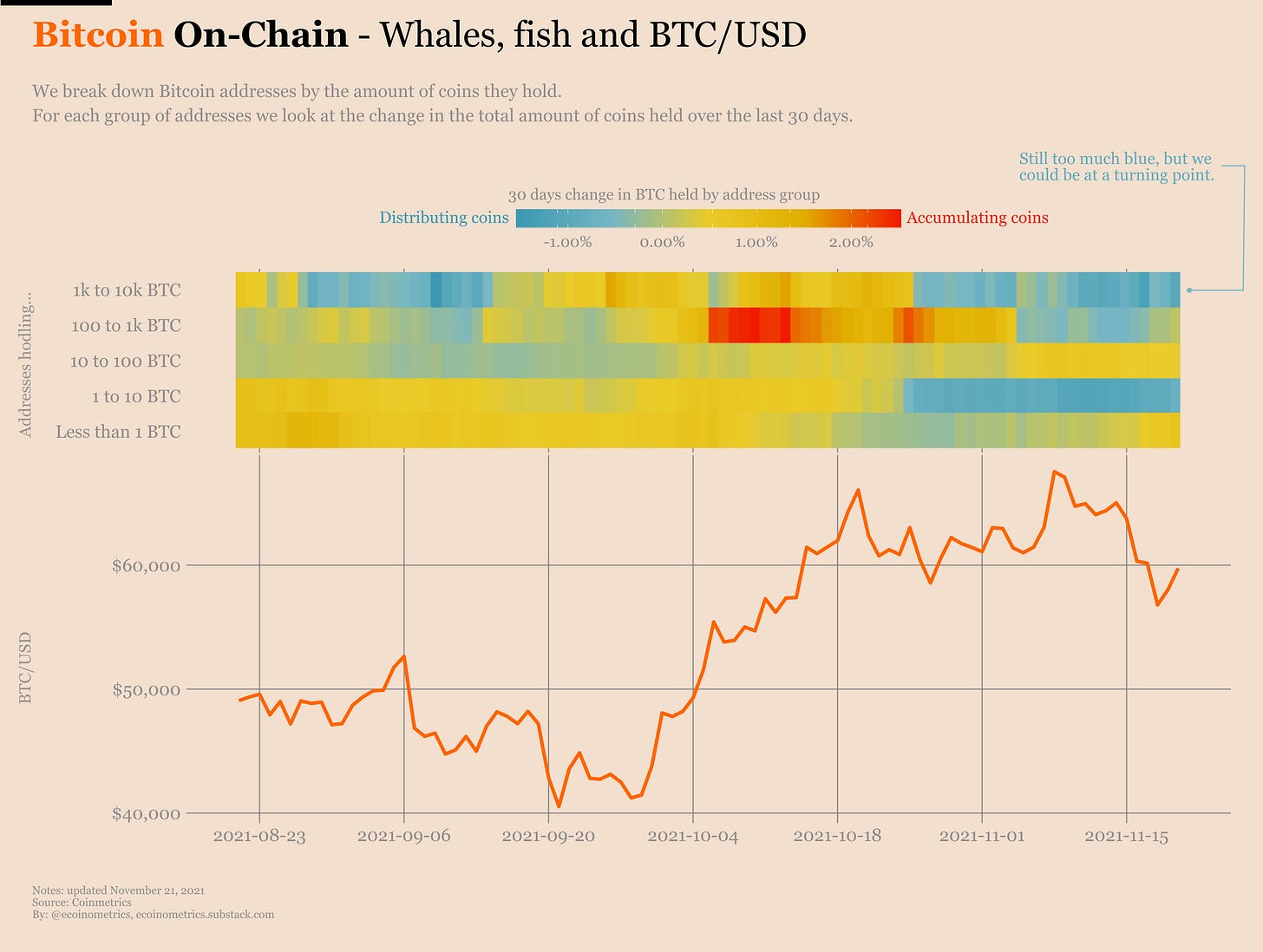

For sure the main issue remains that whales aren’t putting a lot of buying pressure on Bitcoin these days.

If you check out the chart below you can see that over the past 30 days addresses controlling 1k to 10k BTC as well as those controlling 1 to 10 BTC have been distributing coins.

Now we have to be careful in how we interpret that. Distributing coins doesn’t necessarily mean you are selling.

Say you are a whale with an address that controls 5k BTC. You decide to move some coins from that address to another one that controls only 50 BTC. Well in that case you are distributing coins but of course this transaction had no effect on the price.

That’s why we need to be a bit more subtle when reading the chart above. The only situations that we can interpret with high confidence are:

All (or most) buckets of addresses are accumulating. In that case everyone is actively increasing the amount of coins they control which means there is a strong buying pressure on the market.

All (or most) buckets of addresses are distributing. In that case everyone is actively trying to sell their coins.

Everything in between is harder to interpret.

That’s why I always say what we need is for whales to start buying again. Because if that was the case we’ll end up in the first configuration which is naturally bullish.

Since the dip the small fish have been buying BTC. Actually their aggregate hodling is now at its highest level since the start of the bull market in October last year.

Whales also bought the dip, at least in the last couple of days. But as you can see on the chart below, their accumulation pattern isn’t looking so clear cut.

On one hand that’s good. We kind of have a clear diagnosis of what’s missing. There is no mystery of why we aren’t seeing a new parabolic leg at the moment.

On the other hand, who knows what whales are up to…

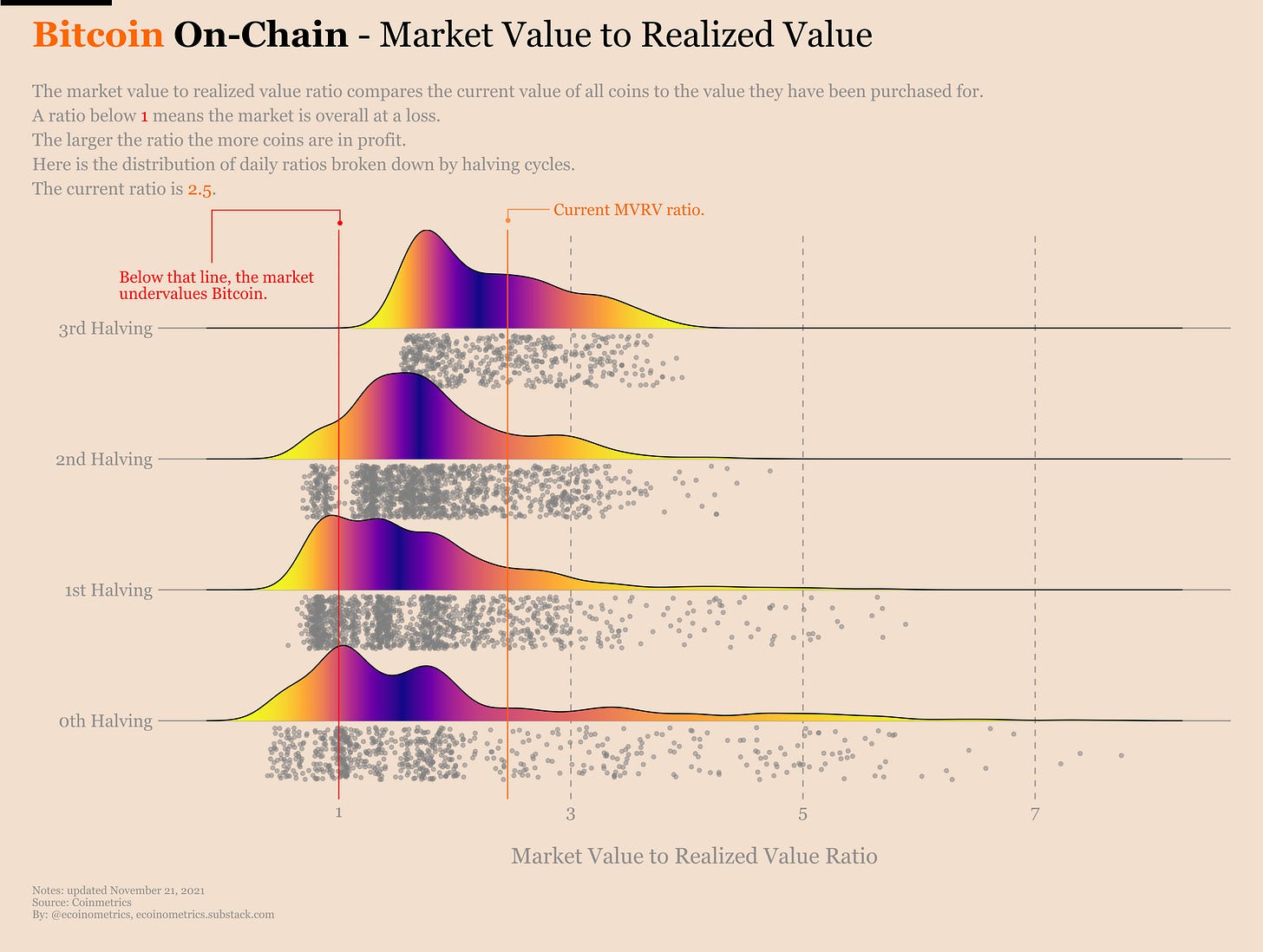

Given that the market as a whole isn’t sitting on very large unrealized profits it isn’t likely that whales would want the price to go much lower in the short term. And so if I had to guess, I’d say they might find the current price level attractive enough to start buying again.

Now I don’t have a crystal ball. When you add the normal uncertainty of financial markets together with the amount of leverage that can be placed on crypto bets it is very hard to make any kind of predictions in the short term.

Long term trends are a different matter. One thing hasn’t changed for months now. There is less and less Bitcoins available to buy on the exchanges. That means the logic of the supply shock still applies which is why we are still likely to see a parabolic move when the demand side of the equation comes back in force.

So nobody knows how long it will take to see Bitcoin make another push towards $100,000. But the ingredients for that to happen are there.

If we can use some historical comparisons to evaluate where we are in this cycle it looks more like Bitcoin is in a second phase prior to making new highs rather than in a declining phase following a blowoff top.

The part that is more concerning is what is going to happen outside of the Bitcoin market. You can refer to this post for more details on the topic, but the Federal Reserve is in the process of unwinding its assets purchasing program.

Historically when the Federal Reserve slows down the expansion of its balance sheet (or worst contracts it) the stock market is seeing lower returns.

For now we are still good. But when we move towards 0% on the horizontal axis the risk of a stock market correction becomes significantly higher.

This is not good for Bitcoin.

According to our weekly price prediction poll nobody is worried about that at the moment. Despite the dip and a pretty big miss from the median prediction last week, people still see Bitcoin and Ethereum moving higher in December.

Let me know what you think about that by submitting your own prediction at the link below:

https://forms.gle/7zSMpmLCUZa5B8Ap7

We didn’t see that coming

Lol.

I mean what else do you want me to say?

We have spent countless editions of this newsletter talking about the risk of persistent high inflation following the central banks reactions to the COVID crisis.

Did most economists get blindsided by inflation? Maybe.

Did central bankers get blindsided by inflation? Probably not.

The thing is whatever they were going to do central bankers were going to have to deal with negative consequences:

Print a ton of money and get high inflation.

Don’t print money and let the economy crash.

Call me cynical, but I’m pretty sure moderately high inflation is what makes the Federal Reserve happy. Ultimately that’s what they need to deal with the debt.

Devalue the dollar and inflate away the debt that’s the choice they’ve made. Let’s see if they are successful at keeping that under control.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

Thanks as always for this. The voice of reason! Always look forward to your newsletter and find it to be consistently on point. Ty for all the hard work, it is appreciated.

Excellent article as usual.