Inflation is melting away the purchasing power your cash savings. Everybody knows that. So how do you go about hedging against it?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great! Now let’s dive in.

Keeping up with inflation

In this third part of our series on inflation (see part 1 and part 2) we want to answer the following question:

What asset do you need to buy in order to keep up with inflation?

Actually this question is a bit too vague. Let’s focus first on hedging against inflation over the midterm i.e. one year to four years.

Say you are getting some regular cash flow. You know that because of inflation the purchasing power of that cash is going to melt over time.

So instead of keeping those bills under your mattress, you decide to invest in something. Your goal is to choose an asset so that if you come back in one year, two years or four years, its value will have appreciated more than the CPI. I.e. you haven’t lost any purchasing power.

If you’ve heard Peter Schiff talk about inflation, your first guess might be to buy gold.

Let’s start with that then.

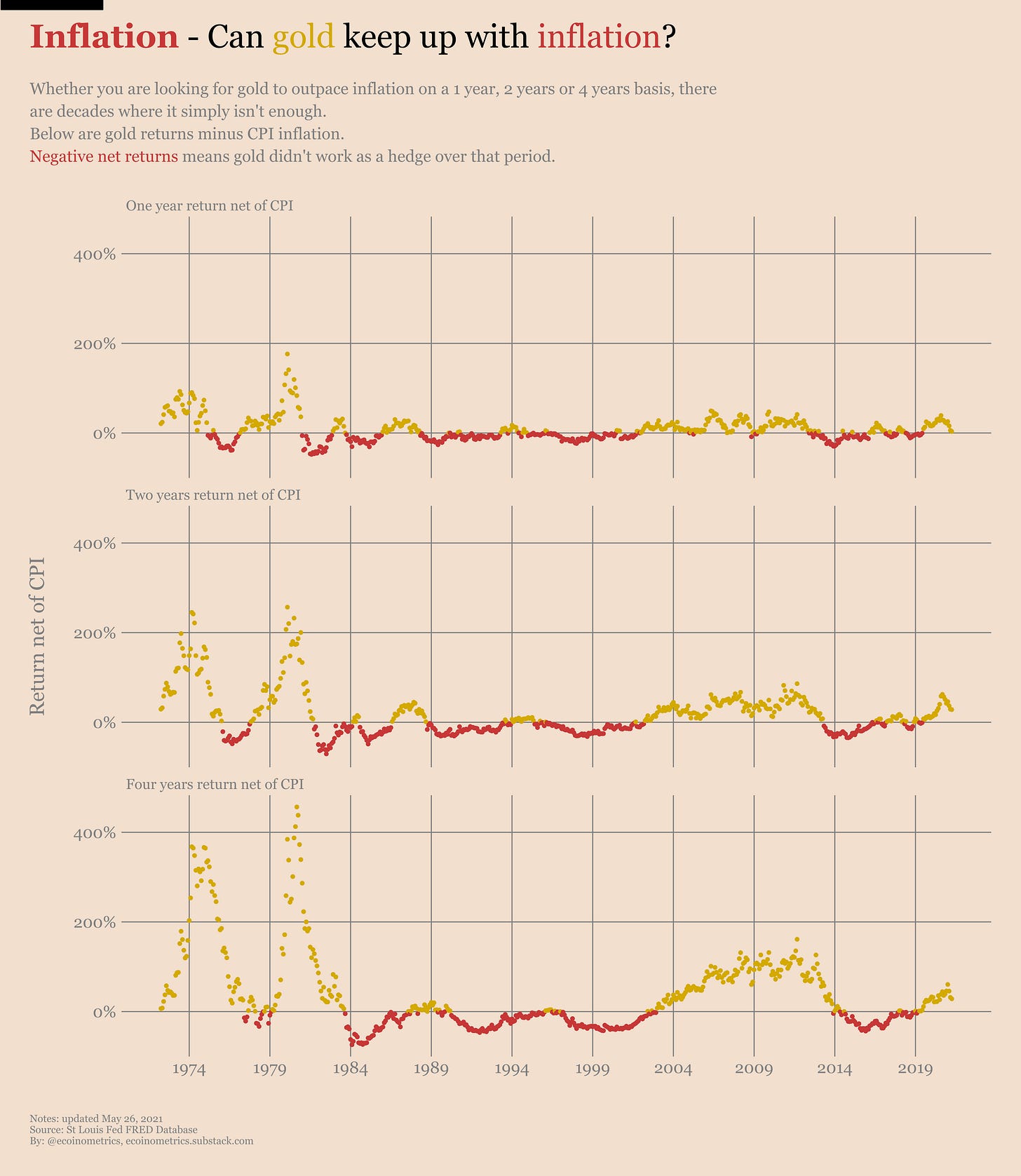

Check out the year-on-year return of gold compared to inflation since the 70s (we are using monthly data).

If you don’t look at the details it doesn’t seem so bad right? Gold did pretty well against inflation in the 70s at least.

But wait, actually starting in the mid 80s things don’t look so good anymore. Very often inflation exceeded the year-on-year return of gold.

That means if you had parked your cash in gold sometime in the 80s and came back one year later, chances are you had lost some purchasing power.

Actually, before we go further, let me change the format of this chart to make things more readable.

Instead of charting both the changes of gold and the CPI let’s just look at gold’s returns minus those of the CPI. That way if the returns net of the CPI are positive we beat inflation, otherwise we are losing some purchasing power.

There we go.

Alright, so the picture should be pretty clear. If you are trying to hedge inflation over a period of one, two or four years gold’s protection is only cyclical.

For some decades gold will be a very good hedge, like in the 70s and 2000s.

But for other decades gold doesn’t make the cut, like in the mid 80s to the end of the 90s.

Actually one way to think about it is that when people are worried about inflation they buy gold. And as a result gold performs well as an inflation hedge.

But when inflation is not the thing people worry about then gold doesn’t perform.

Quite the reflexivity we have here….

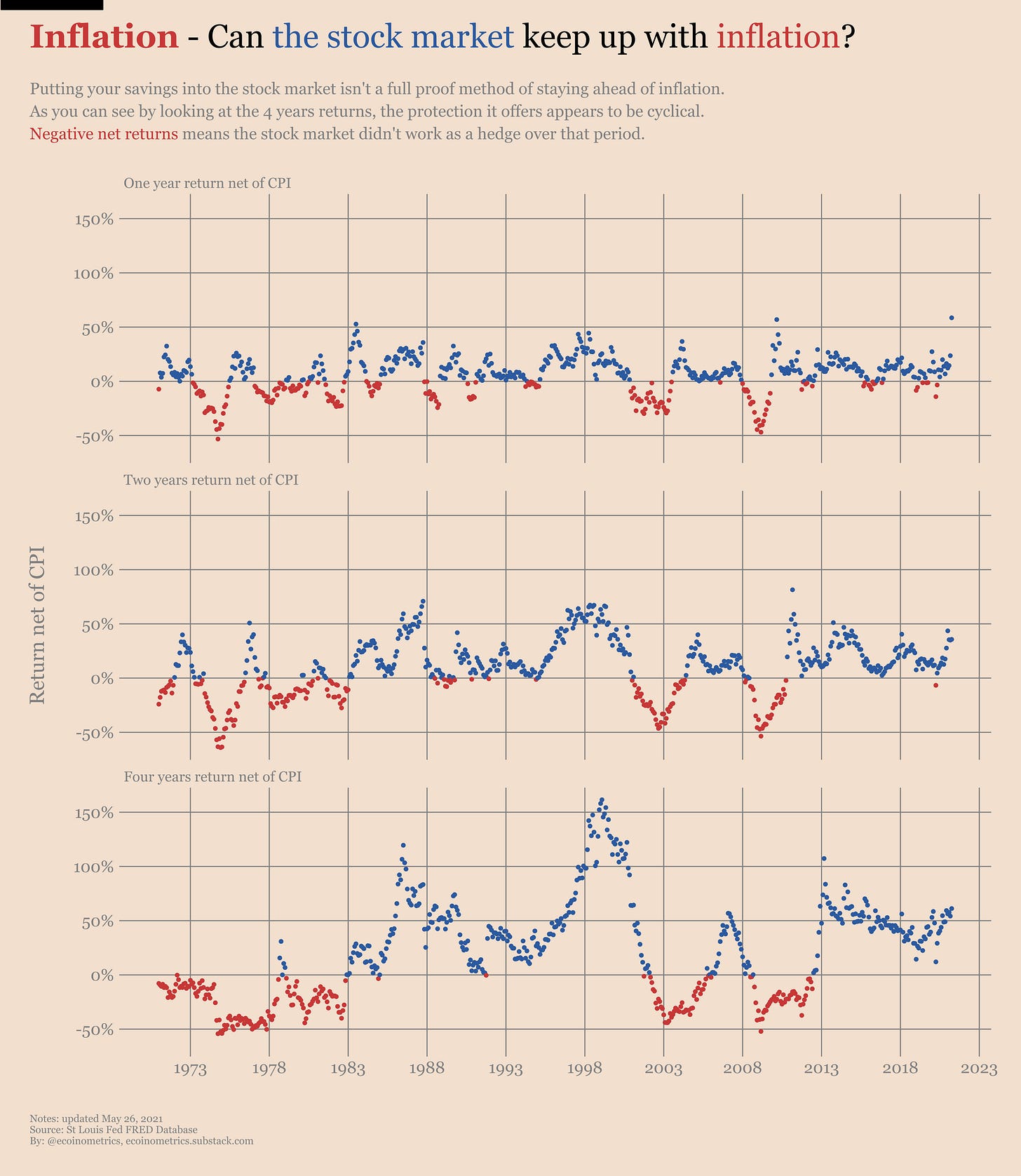

Ok, well maybe if I can’t count on gold for every occasion then I should invest in the stock market. After all, I've been told that stonks only go up.

So what if I park my cash in the stock market.

Let’s see.

Hmmm… this is not that different from gold isn’t it? The similarity is clear if you are trying to hedge against inflation over a four years horizon.

During the 70s putting your money in the stock market did not beat inflation. But from the mid 80s to 2000 the SP500 did great. And after that 2000 to 2011 are a mixed bag… wait.

I bet you noticed that too.

Gold only provides a cyclical protection against inflation. The stock market also provides only a cyclical protection against inflation. But those cycles are kind of opposite to each other!

See.

So something that would have worked pretty well from the 70s until now is to spread your cash between gold and the stock market. With an appropriate mix you’d have been hedged against inflation at one, two or four years over the past 50 years.

At this point you are probably asking yourself “that’s great but what about Bitcoin?”

Unless you are completely new to the space, you might have heard from Peter Schiff or others that Bitcoin cannot be a hedge against inflation because it is too volatile, or because its fundamental value is zero or just… reasons.

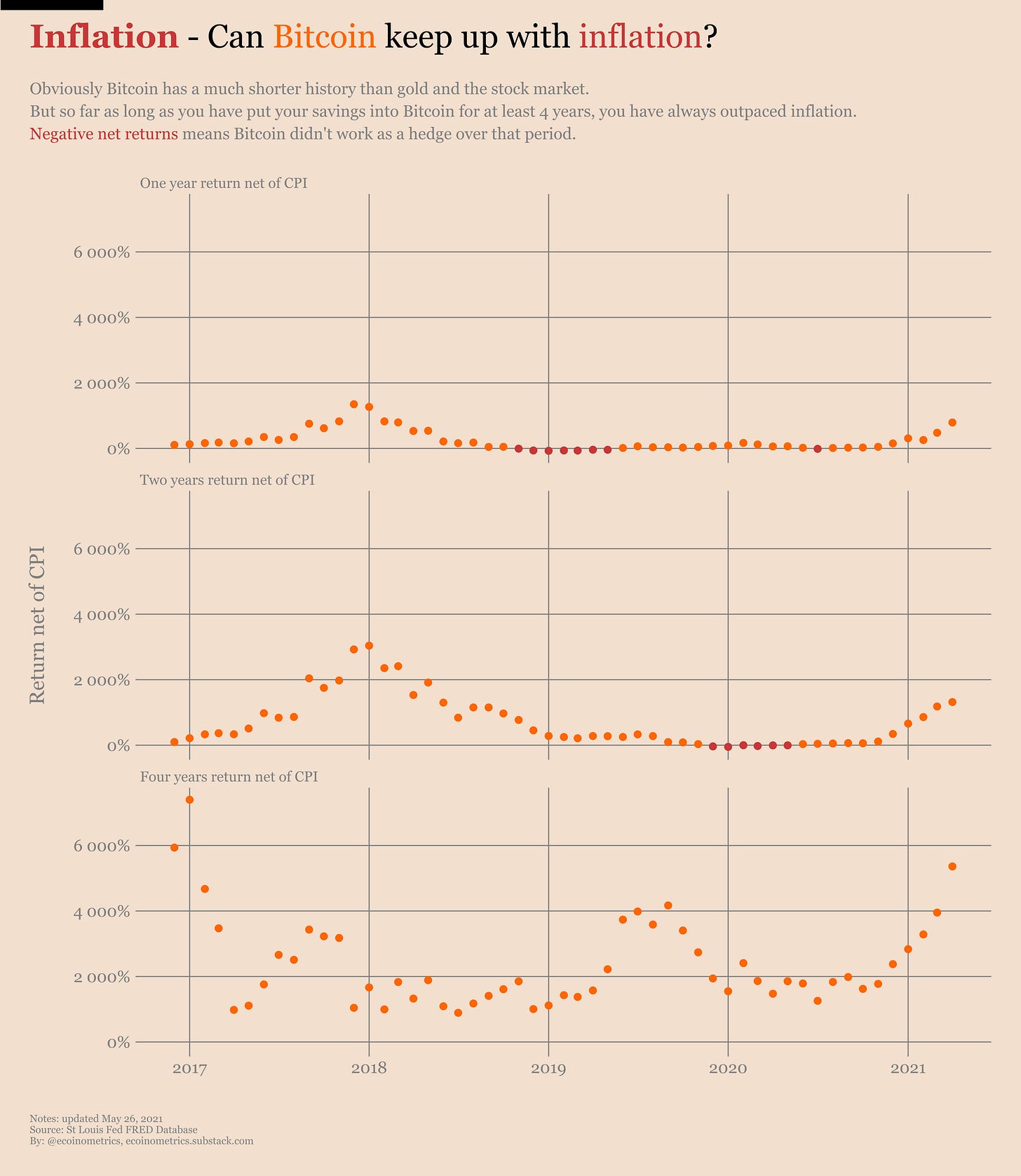

The truth is that Bitcoin is less than 13 years old. So we have only about one tenth of the data to run a comparison against gold.

But when you look at this short history there should be zero doubt that Bitcoin does work as an inflation hedge at least as well as gold.

On a year-over-year basis Bitcoin beats inflation 85% of the time.

On a two years basis Bitcoin beats inflation 89% of the time.

On a four years basis Bitcoin beats inflation 100% of the time.

Of course that’s on a small amount of points. But there is nothing in this data that suggests Bitcoin is not a hedge against inflation in practice.

Now what’s the conclusion?

I’m not saying that Bitcoin is a silver bullet to beat inflation. The truth is, nobody knows yet.

What the data shows is that if you try to keep up with inflation, at least in the midterm (one to four years), then there is no silver bullet. You have to mix things up.

What it also shows is that there is no reason to think Bitcoin doesn’t work as a hedge. In fact over its short life it has done the job pretty well.

Naturally the next question is:

What’s the best way to hedge against inflation over the long term?

But that’s a story for another day.

CME Bitcoin Derivatives

Last week ended on a cliffhanger. Do you remember?

We had data about the positions of traders on CME futures... but only up until May 11… that is one day before the major selloff started!

So there was a big question as to how exactly did the futures traders reacted to that.

Now we have the answer.

As per the Commitment of Traders data for May 18 we have two very different behaviours depending on whether you look at retail traders vs the smart money.

Retail traders first. They have liquidated their long positions heavily. Actually, no, that’s not a strong enough way of saying it. Retail traders puked their long positions!

I mean, look at the chart...

We haven’t seen the net positions so low since the market crash of March 2020.

Meanwhile the smart money is creating new positions. Not only are they adding to their short positions (most likely for the basis trade), they are also buying the dip.

See for yourself.

The result is that in net positions, almost nothing has changed for the smart money after the selloff sequence started.

We’ll have to wait until next week to have a complete picture of where everybody stands now that this drawdown looks to have found a bottom.

But as it goes it is fair to say that the sentiment is widely divergent between the very bearish retail crowd and the “business as usual” hedge funds.

By the way, the retest of the $30,000 level created a new record of futures contracts traded in one day on the CME: 160,000 BTC worth of contract changed hands on May 19.

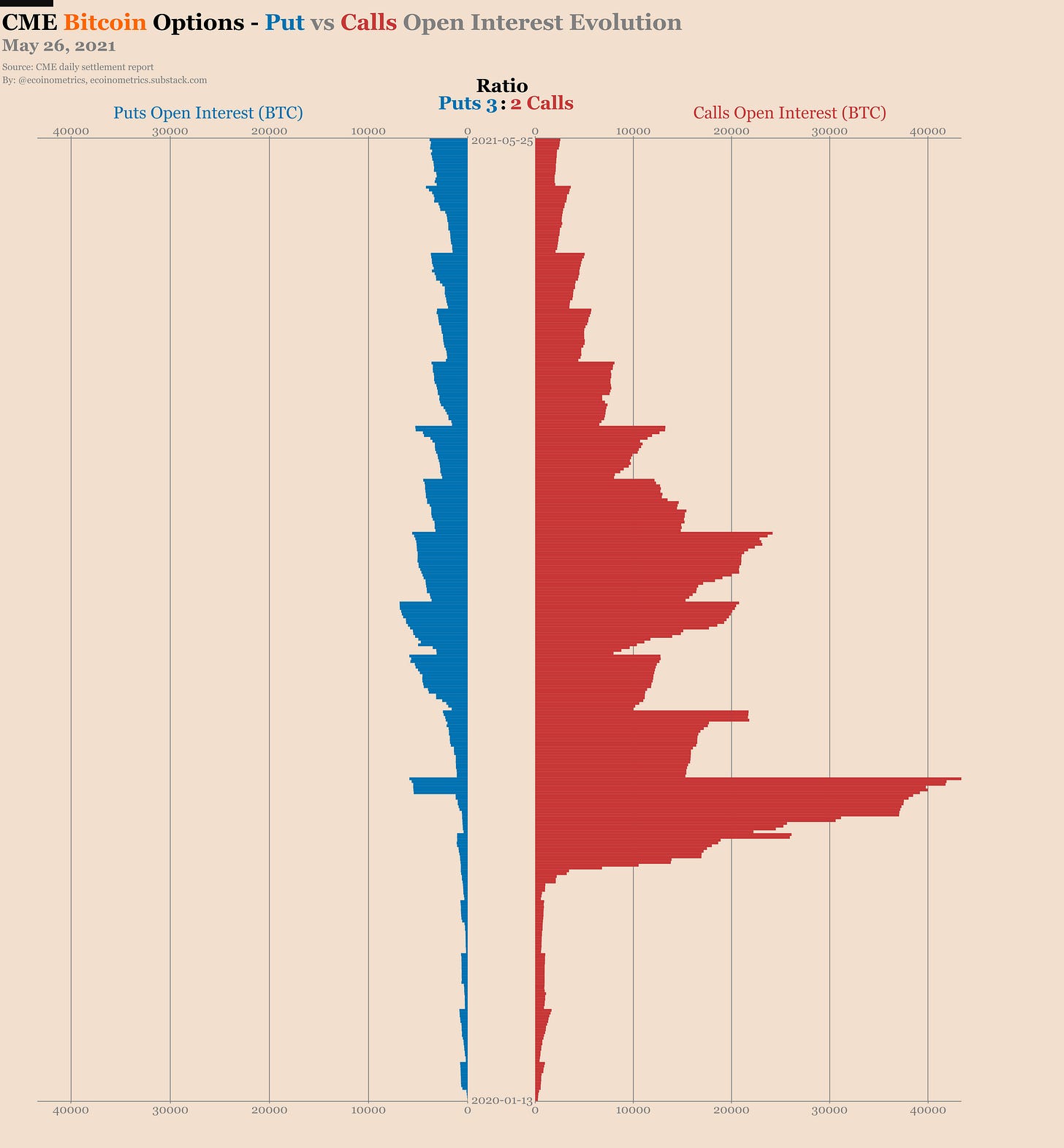

The May contract expires at the end of the week. And given the price action it is no big surprise that the CME Bitcoin options market remains dominated by the puts.

Right now we are set to see:

41% of the contracts expire on Friday.

79% of the puts expire in the money.

3% of the calls expire in the money.

The total activity on the options market is stable. So it looks like we have found some equilibrium for now.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!

can confirm quality - learning evey time

En verdad leo todos sus correos y son de una calidad y análisis increible. Excelente trabajo !!!